1099 Expense Report Template

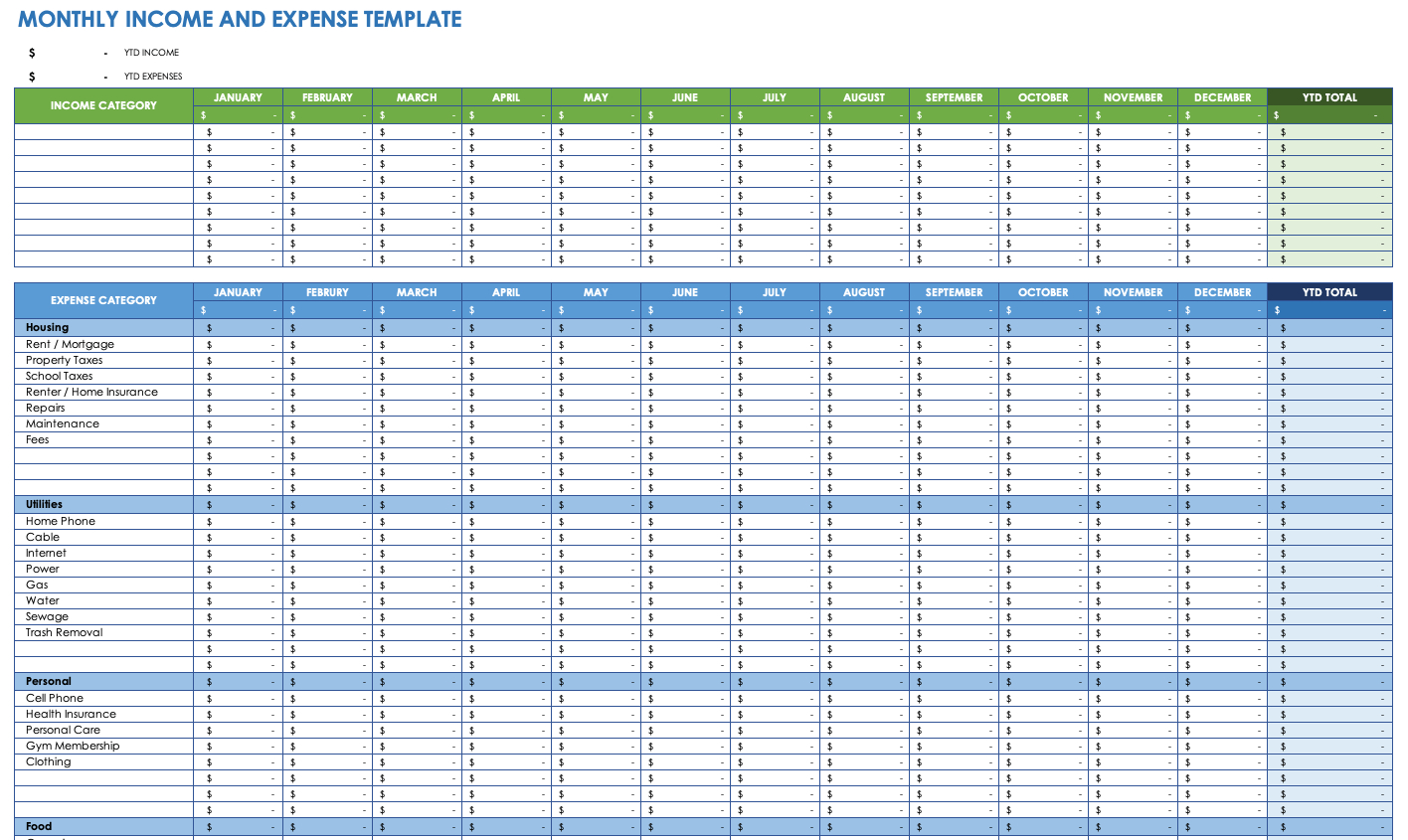

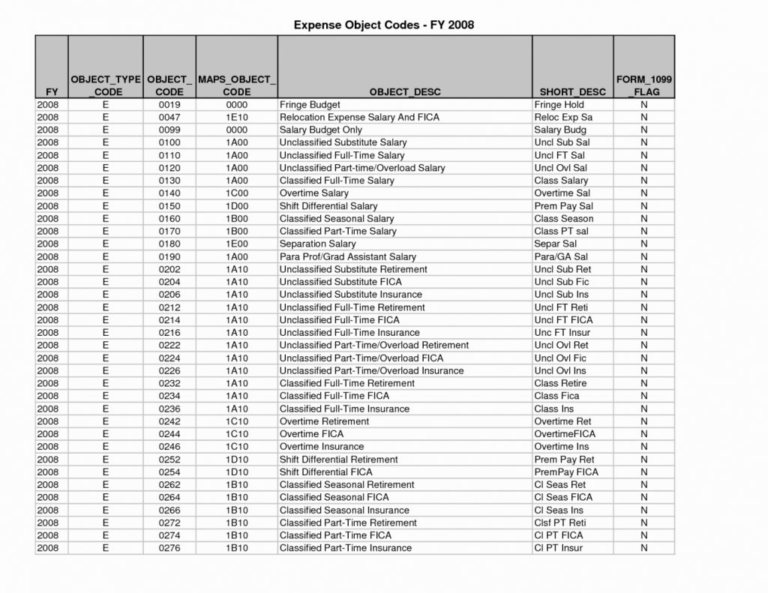

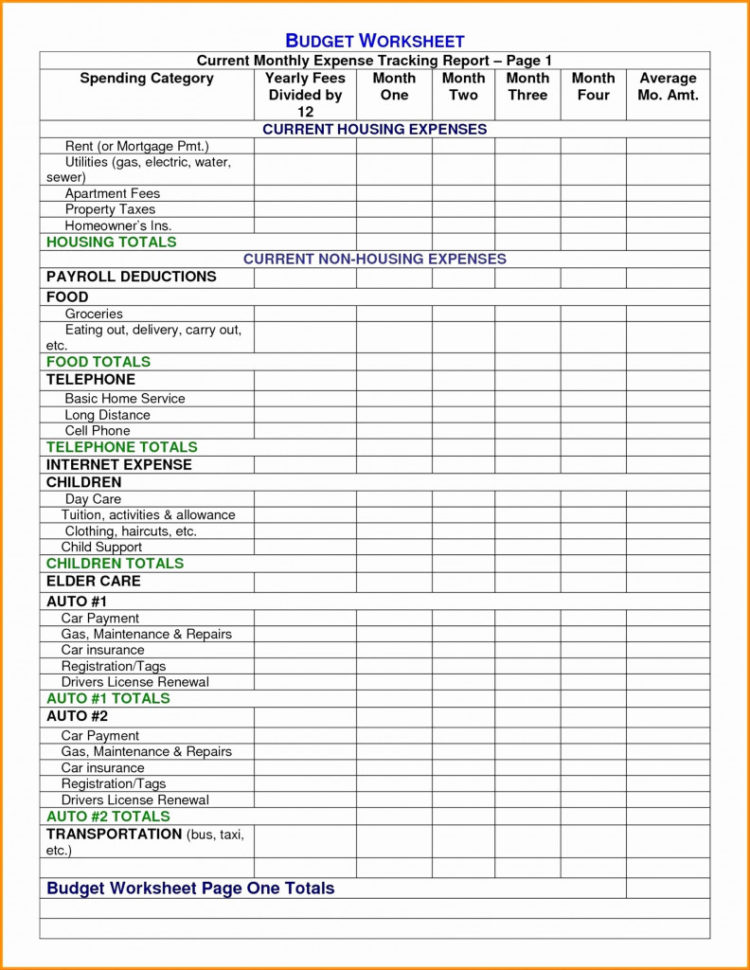

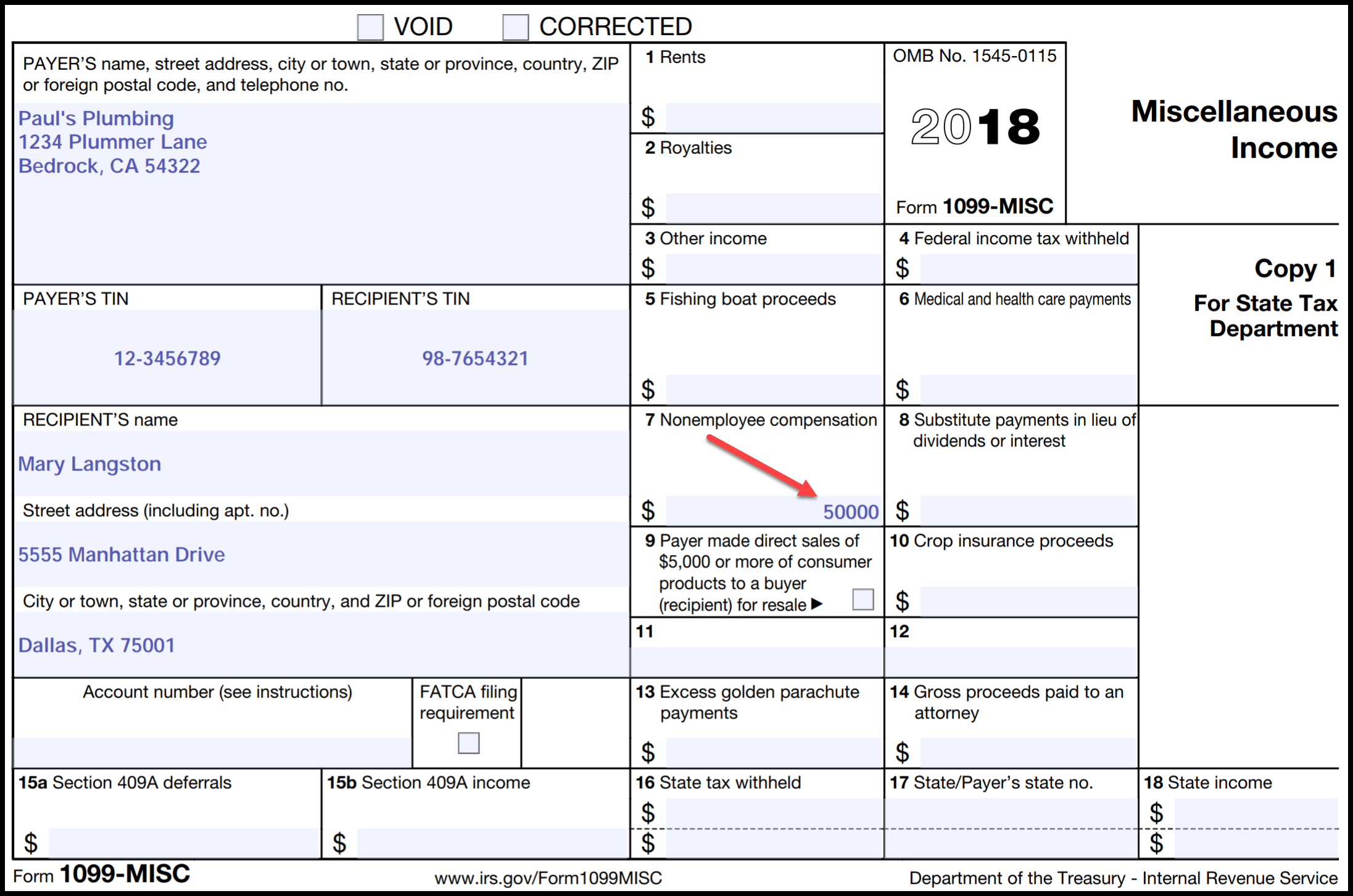

1099 Expense Report Template - Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Whether the payment is made in the year of death or after the year of death, you must also report the. Car expenses use it to lower: Shows income as a nonemployee under an nqdc plan that does not meet the requirements of section 409a. Integrate book keeping with all your operations to avoid double entry. Web download this expense report template design in excel, google sheets format. Free template) march 9th, 2022 | accounting & bookkeeping, contractor. Web independent contractor expenses spreadsheet: Stay financially organized with our expense report. However, report rents on schedule c (form 1040. Web download 1099 misc excel template go to 1099 software details page. Web how to use this 1099 template. This free resource is brought to you by keeper, an app that helps freelancers and small business. Also, it meets irs requirements for expense record keeping. Web easily create expense reports and mileage logs with your expense data for email to. Stay financially organized with our expense report. Ad choose your expense report tools from the premier resource for businesses! Web easily create expense reports and mileage logs with your expense data for email to anyone in pdf or spreadsheet formats, all from your phone. Also, it meets irs requirements for expense record keeping. Ad automate your vendor bills with ai,. Shows income as a nonemployee under an nqdc plan that does not meet the requirements of section 409a. Schedule c, box 9 (“car and truck expenses”) and form 4562 if you ever drive for work, you can. Web how to use this 1099 template. This free resource is brought to you by keeper, an app that helps freelancers and small. Web download this expense report template design in excel, google sheets format. There are 6 basic steps to using this 1099 template. For your protection, this form may show only the last four digits of your social security number. Web quickbooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease. Schedule c,. Enter all expenses on and all business expenses tab of who free template. Web there are 6 basic steps to using this 1099 template. Ad automate your vendor bills with ai, and sync your banks. There are 6 basic steps to using this 1099 template. Web instructions for recipient recipient’s taxpayer identification number (tin). Easily find the reporting tools you're looking for w/ our comparison grid. Enter all expenses on and all business expenses tab of who free template. Ad choose your expense report tools from the premier resource for businesses! Web quickbooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease. Web download 1099 misc. There are 6 basic steps to using this 1099 template. Web independent contractor expenses spreadsheet: Web quickbooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease. For your protection, this form may show only the last four digits of your social security number. Integrate book keeping with all your operations to avoid. There are 6 basic steps to using this 1099 template. Integrate book keeping with all your operations to avoid double entry. Car expenses use it to lower: Web download 1099 misc excel template go to 1099 software details page. Ad choose your expense report tools from the premier resource for businesses! For your protection, this form may show only the last four digits of your social security number. Also, it meets irs requirements for expense record keeping. This spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category. Stay financially organized with our expense report. Web quickbooks tracks your expenses throughout the year,. Enter all expenses on the all business expenses tab of the free template. Schedule c, box 9 (“car and truck expenses”) and form 4562 if you ever drive for work, you can. There are 6 basic steps to using this 1099 template. Integrate book keeping with all your operations to avoid double entry. Shows income as a nonemployee under an. Free template) march 9th, 2022 | accounting & bookkeeping, contractor. Car expenses use it to lower: Ad choose your expense report tools from the premier resource for businesses! Schedule c, box 9 (“car and truck expenses”) and form 4562 if you ever drive for work, you can. However, report rents on schedule c (form 1040. Web independent contractor expenses spreadsheet: Enter all expenses on the all business expenses tab of the free template. Stay financially organized with our expense report. This free resource is brought to you by keeper, an app that helps freelancers and small business. Web see your tax return instructions for where to report. Whether the payment is made in the year of death or after the year of death, you must also report the. Everything you need to know (plus: Enter all expenses on and all business expenses tab of who free template. Easily find the reporting tools you're looking for w/ our comparison grid. Web to your tax return and report your income correctly. Web instructions for recipient recipient’s taxpayer identification number (tin). Web download this expense report template design in excel, google sheets format. Shows income as a nonemployee under an nqdc plan that does not meet the requirements of section 409a. Also, it meets irs requirements for expense record keeping. For your protection, this form may show only the last four digits of your social security number. Web there are 6 basic steps to using this 1099 template. Web instructions for recipient recipient’s taxpayer identification number (tin). Integrate book keeping with all your operations to avoid double entry. Web how to use this 1099 template. Everything you need to know (plus: Whether the payment is made in the year of death or after the year of death, you must also report the. This is a mandatory field. Learn how we can reduce your risk by providing timely insights on irs changes. Web download this expense report template design in excel, google sheets format. Stay financially organized with our expense report. This free resource is brought to you by keeper, an app that helps freelancers and small business. Web quickbooks tracks your expenses throughout the year, so you can predict and manage your cash flow with ease. However, report rents on schedule c (form 1040. Schedule c, box 9 (“car and truck expenses”) and form 4562 if you ever drive for work, you can. Easily find the reporting tools you're looking for w/ our comparison grid. Web see your tax return instructions for where to report.Free 1099 Template Excel 2019

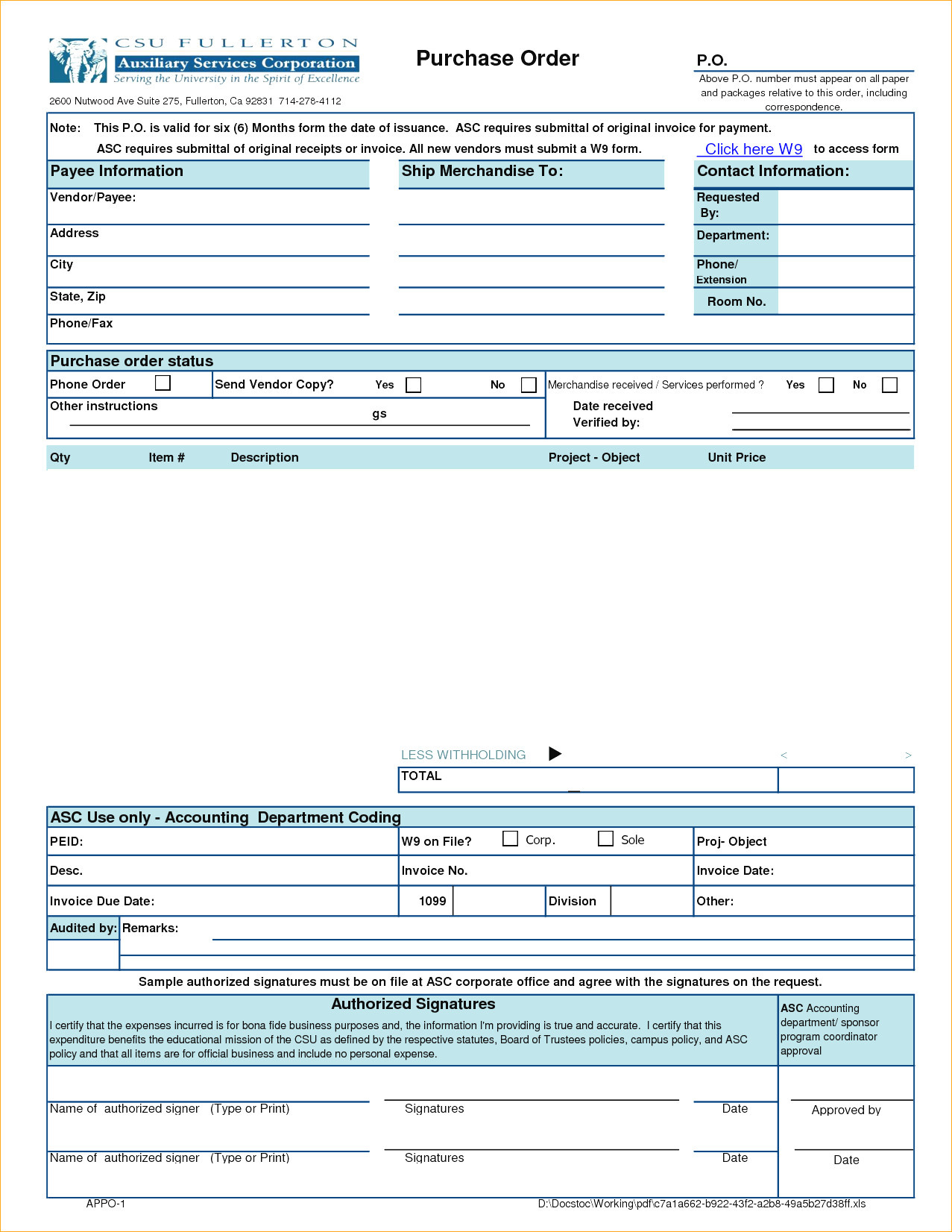

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

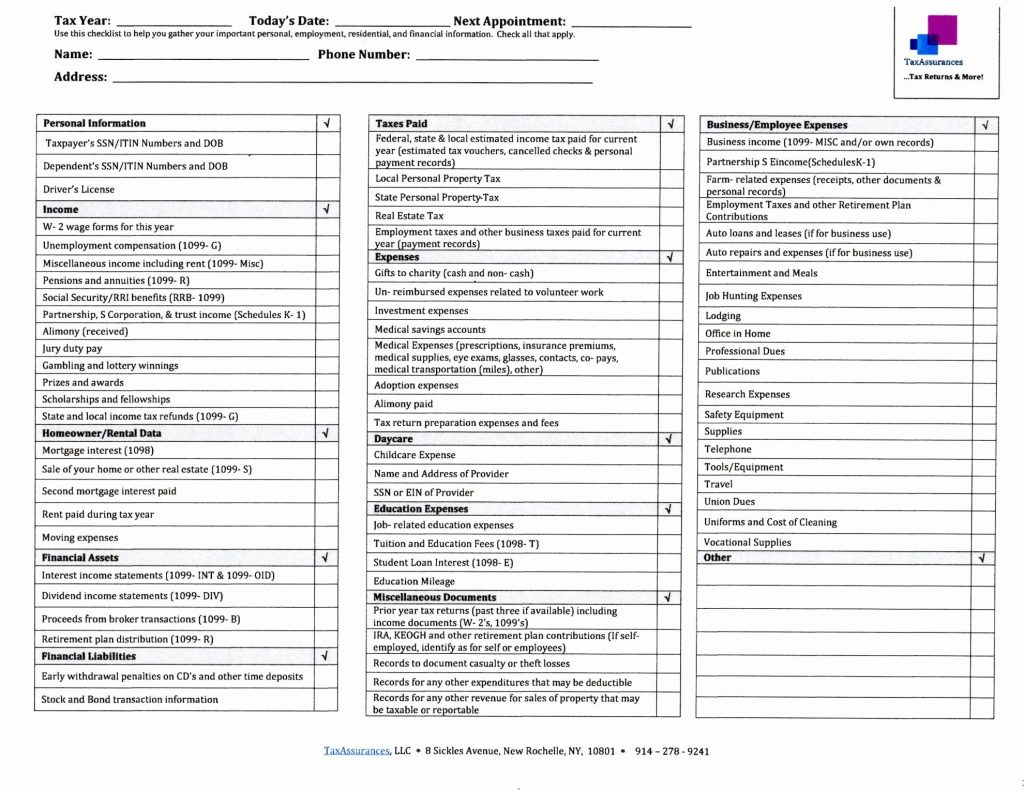

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

Independent Contractor Expenses Spreadsheet [Free Template]

1099 Spreadsheet Google Spreadshee 1099 expense spreadsheet. 1099

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

1099 Expense Spreadsheet in Tax Prep Worksheet With Small Business Plus

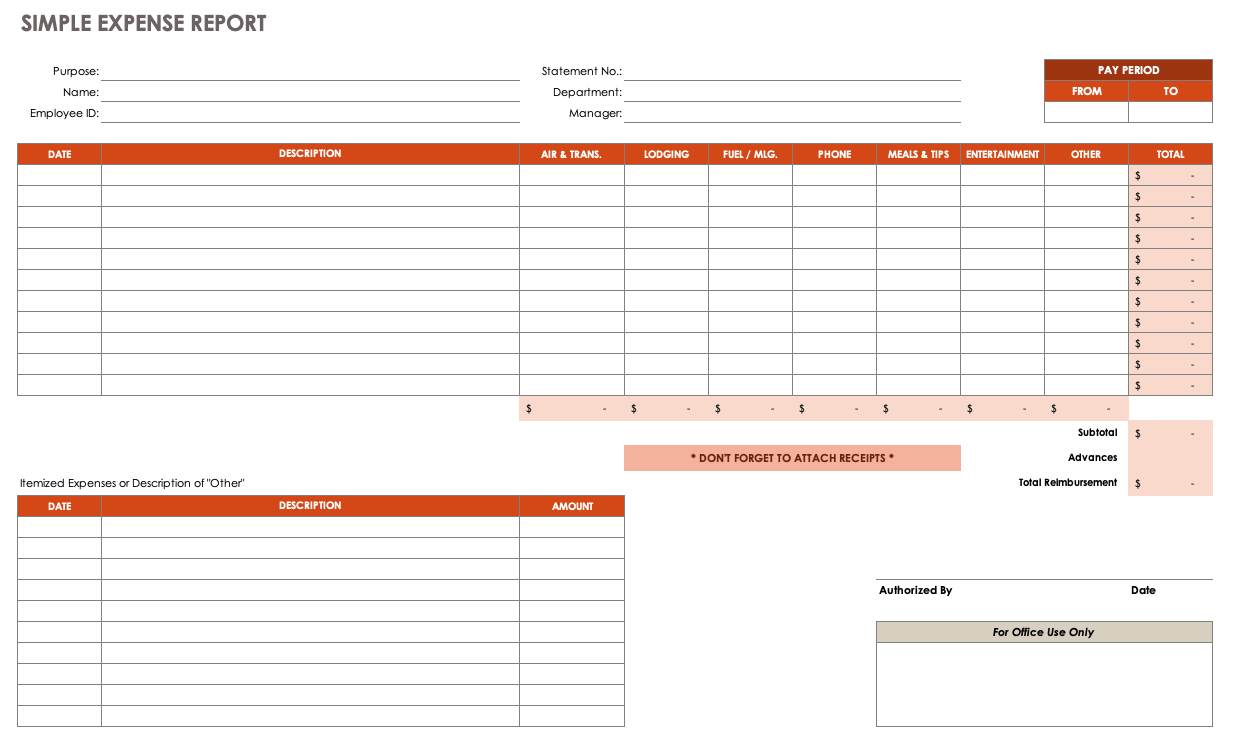

1099 Expense Spreadsheet intended for Free Expense Report Templates

1099 Expense Spreadsheet Spreadsheet Downloa 1099 expense spreadsheet.

1099 Expense Spreadsheet —

Enter All Expenses On The All Business Expenses Tab Of The Free Template.

Enter All Expenses On And All Business Expenses Tab Of Who Free Template.

Also, It Meets Irs Requirements For Expense Record Keeping.

Web Download 1099 Misc Excel Template Go To 1099 Software Details Page.

Related Post:

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png)