50/30/20 Budget Template Free

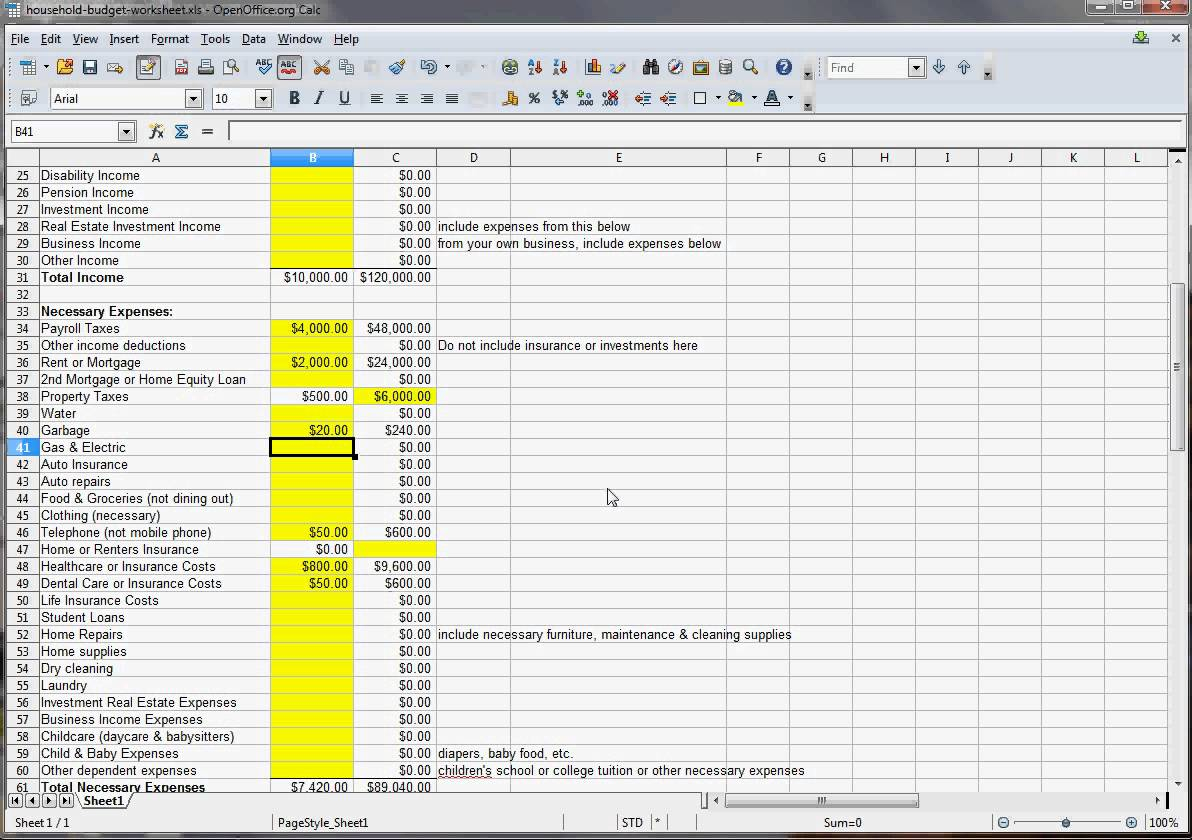

50/30/20 Budget Template Free - Half of your net monthly income should be dedicated. Web this template includes guidance for the 50/30/20 budgeting method. Ad actionable insights about your resources, projects, and teams in one place. You need a better budgeting app. Web it sounds harder than it is. Web you can use the 50 30 20 budgeting calculator to help divide net income into 3 categories.: Web free budget planner worksheet. That's why we made everydollar. Ad take the stress out of budgeting. It’s easy to use, enter your monthly income and the sheet will calculate your outgoing targets for needs, wants and savings. 50% for your needs, 30% for your wants and 20% for your savings. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Web create a 50/30/20 budget calculator in your tiller foundation template extend your foundation template with a free 50/30/20 budget calculator. Ad save time by managing bills & expenses, invoicing &. Follow along for a quick budget example. Web 50% to needs 30% to wants 20% to savings this plan keeps your finances simple and also easy to follow. Generate clear dynamic statements and get your reports, the way you like them. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: You need a better budgeting. Everydollar goes with you anywhere—and it's free! Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Web this template includes guidance for the 50/30/20 budgeting method. Budget & money management sample 50/30/20 worksheet. Web create a 50/30/20 budget calculator in your tiller foundation template extend your foundation template with a free 50/30/20 budget calculator. Web you can use a budgeting app to make a monthly budget for you, or you can make one yourself. This is a widely used strategy that’s easy to apply and remember. Your current spending step 2. Compute expenses. Ad take the stress out of budgeting. Web you can use the 50 30 20 budgeting calculator to help divide net income into 3 categories.: Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Compute expenses in 3 different categories step 04: Web 50/30/20 budget calculator to plan your income and expenses. Budget & money management sample 50/30/20 worksheet home file insert page layout formulas data review view edit view insert. Web this template includes guidance for the 50/30/20 budgeting method. Web 50% to needs 30% to wants 20% to savings this plan keeps your finances simple and also easy to follow. This is a widely used strategy that’s easy to apply. Generate clear dynamic statements and get your reports, the way you like them. You need a better budgeting app. Ad actionable insights about your resources, projects, and teams in one place. Ad take the stress out of budgeting. Web 50/30/20 budget calculator to plan your income and expenses. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Basically, it helps you set. Web you can use a budgeting app to make a monthly budget for you, or you can make one yourself. Generate clear dynamic statements and get your reports, the way you like them. You need a better budgeting app. Your current spending step 2. Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20. Calculate monthly income step 02: Web this template includes guidance for the 50/30/20 budgeting method. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Everydollar goes with you anywhere—and it's free! Web we’re familiar with some of the budgeting tools you can use to create a budget, like with a budgeting app or a free budget template, but in the next chapter in. Budget & money management sample 50/30/20 worksheet home file insert page layout formulas data review view edit view insert. Ad take. Generate clear dynamic statements and get your reports, the way you like them. Follow along for a quick budget example. Generate clear dynamic statements and get your reports, the way you like them. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. It’s easy to use, enter your monthly income and the sheet will calculate your outgoing targets for needs, wants and savings. You need a better budgeting app. Half of your net monthly income should be dedicated. This is a widely used strategy that’s easy to apply and remember. Compute expenses in 3 different categories step 04: Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20. Web you can use the 50 30 20 budgeting calculator to help divide net income into 3 categories.: Web you can use a budgeting app to make a monthly budget for you, or you can make one yourself. Basically, it helps you set. Ad take the stress out of budgeting. Calculate monthly income step 02: Your current spending step 2. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Here’s how to design your own 50/30/20 plan in three simple steps. Everydollar goes with you anywhere—and it's free! Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Generate clear dynamic statements and get your reports, the way you like them. Web 50% to needs 30% to wants 20% to savings this plan keeps your finances simple and also easy to follow. Web this template includes guidance for the 50/30/20 budgeting method. Web create a 50/30/20 budget calculator in your tiller foundation template extend your foundation template with a free 50/30/20 budget calculator. Your current spending step 2. Budget & money management sample 50/30/20 worksheet home file insert page layout formulas data review view edit view insert. Follow along for a quick budget example. Everydollar goes with you anywhere—and it's free! Web you can use the 50 30 20 budgeting calculator to help divide net income into 3 categories.: Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. Calculate monthly income step 02: Compute expenses in 3 different categories step 04: Half of your net monthly income should be dedicated. Web it sounds harder than it is. Web 50/30/20 budget calculator to plan your income and expenses.50/30/20 Budget Worksheet Fillable PDF Etsy Budgeting worksheets

How To Create An Easy Budget In 2020 Fast With The 50/30/20 Rule

50 30 20 Rule (Free Excel Budgeting Template) The Dismantle

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

Free Printable 50 30 20 Budget Spreadsheet Template Printable Templates

Monthly Budget Planner 50/30/20 Rule & Expense Money Etsy in

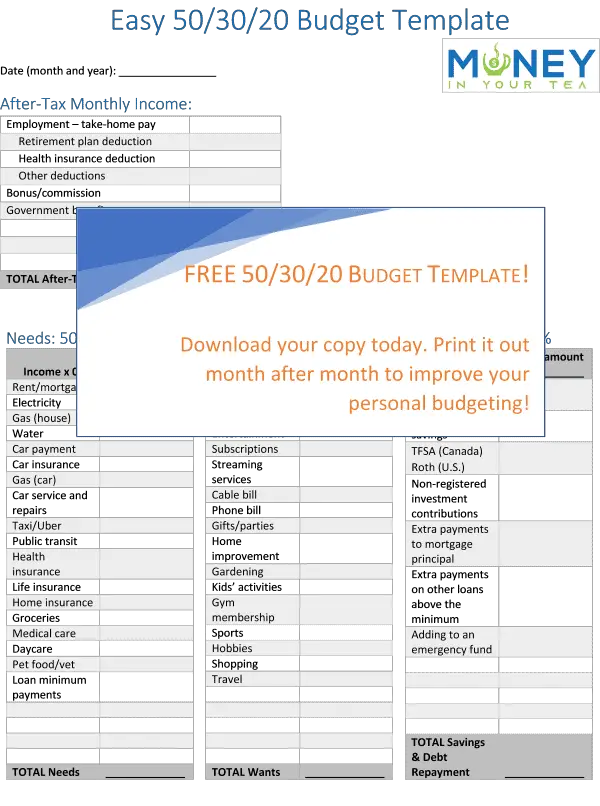

The 50/30/20 Budget Rule A Simple StepbyStep Guide Money In Your Tea

Monthly 50/30/20 Budget Worksheet in 2021 Budgeting, Budgeting

Is the 503020 Budget a Good Budget for You?

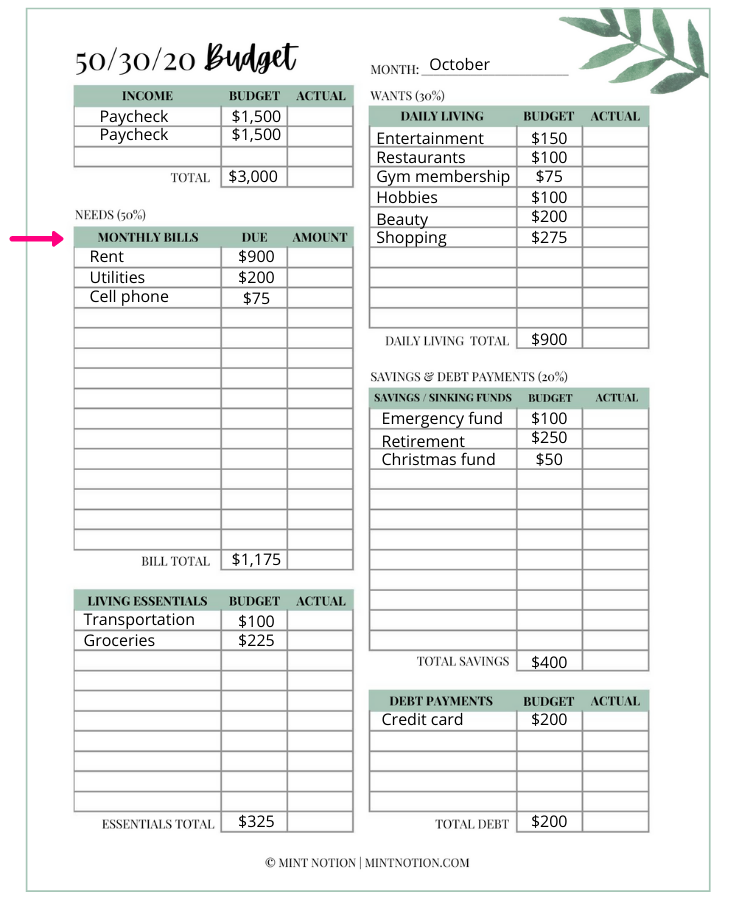

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Web You Can Use A Budgeting App To Make A Monthly Budget For You, Or You Can Make One Yourself.

This Is A Widely Used Strategy That’s Easy To Apply And Remember.

Here’s How To Design Your Own 50/30/20 Plan In Three Simple Steps.

Ad Take The Stress Out Of Budgeting.

Related Post: