50-30-20 Budget Template

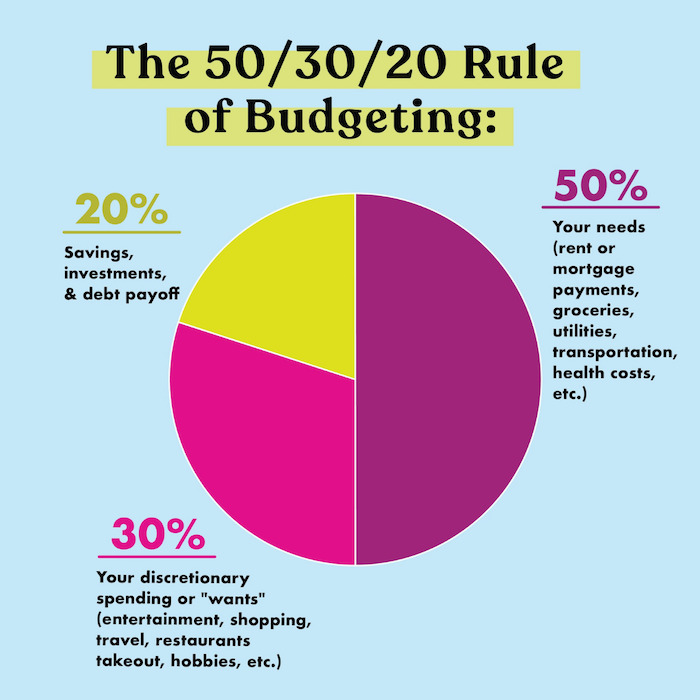

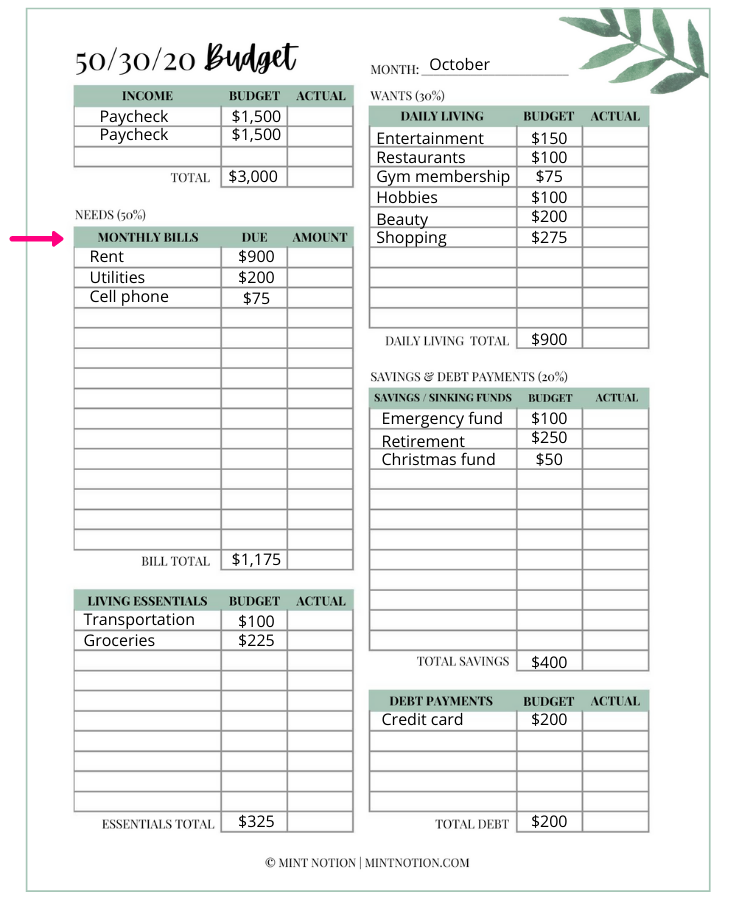

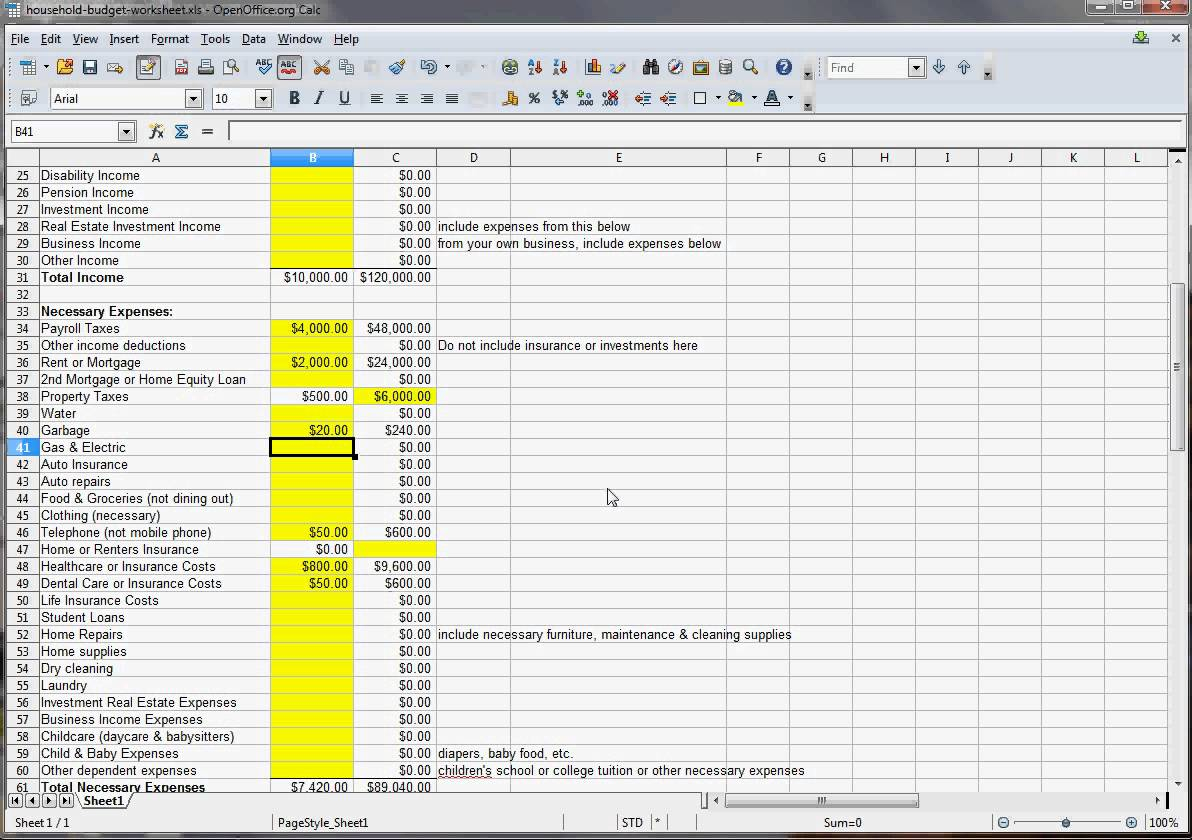

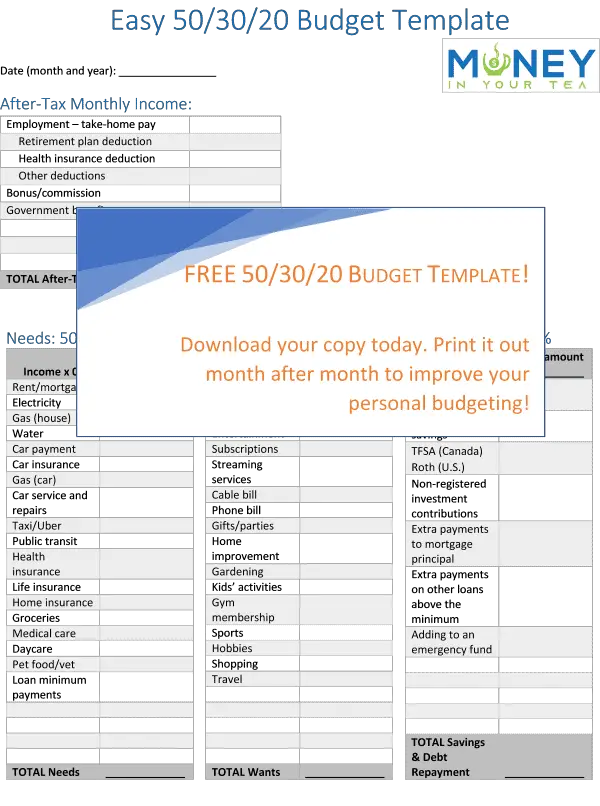

50-30-20 Budget Template - Compute expenses in 3 different categories step 04: Lower bills, manage budgets, and start saving today. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Rocket money helps 3.4+ million members save hundreds. Consider an individual who takes home $5,000 a month. Calculate monthly income step 02: Savings and debts may include: Web 50 30 20 budget template related tags sample budget download this 50 30 20 budget template design in excel, google sheets format. The 50/30/20 budget rule is a fast way to see how much you can afford to spend and save each month. 50% for needs, 30% for wants, 20% for savings and debt. The 50/30/20 budget rule is a fast way to see how much you can afford to spend and save each month. 50% for your needs, 30% for your wants and 20% for your savings. 50% on needs, 30% on wants, and 20% on savings. Keep tabs on your spending on mobile or web. Ad everydollar puts you in control of. Get the app and start saving today. 50% for your needs, 30% for your wants and 20% for your savings. 50% for needs, 30% for wants, 20% for savings and debt. 30% of your income on wants and. 50% of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.). One of the primary attractions of the 50/30/20 budget rule is its simplicity. Consider an individual who takes home $5,000 a month. Savings and debts may include: Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. Web a 50/30/20 budget calculator, specifically,. Rocket money helps 3.4+ million members save hundreds. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. It’s easy to use, enter your monthly income and the sheet. Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. Savings and debts may include: Lower bills, manage budgets, and start saving today. Compute expenses in 3 different categories step 04: Web about this template a straightforward financial planning system for those who. Rocket money helps 3.4+ million members save hundreds. Ad everydollar puts you in control of your money (not the other way around). Web about this template a straightforward financial planning system for those who just want an easy way to plan and keep track of their budget and finances. Web what is the 50/30/20 budget rule? Web crunching the numbers. Compute expenses in 3 different categories step 04: Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Ad everydollar puts you in control of your money (not the other way around). Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans. Get the app and start saving today. Savings and debts may include: Compute expenses in 3 different categories step 04: Consider an individual who takes home $5,000 a month. Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. 30% of your income on wants and. Savings and debts may include: With everydollar, your budget goes with you. Lower bills, manage budgets, and start saving today. Web the 50/30/20 budget in a nutshell. Web crunching the numbers. Web about this template a straightforward financial planning system for those who just want an easy way to plan and keep track of their budget and finances. It’s easy to use, enter your monthly income and the sheet will calculate your outgoing targets for needs, wants and savings. One of the primary attractions of the 50/30/20. Web the 50 30 20 budget template can get you started on the right track. 50% of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.). Web crunching the numbers. Compute expenses in 3 different categories step 04: Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. One of the primary attractions of the 50/30/20 budget rule is its simplicity. Web about this template a straightforward financial planning system for those who just want an easy way to plan and keep track of their budget and finances. Ad everydollar puts you in control of your money (not the other way around). Rocket money helps 3.4+ million members save hundreds. The most difficult part of having a budget is trying to stick to it, but it is possible if you are. The 50/30/20 budget rule is a fast way to see how much you can afford to spend and save each month. Get the app and start saving today. Keep tabs on your spending on mobile or web. Savings and debts may include: Calculate monthly income step 02: 50% for your needs, 30% for your wants and 20% for your savings. With everydollar, your budget goes with you. Consider an individual who takes home $5,000 a month. 50% on needs, 30% on wants, and 20% on savings. 30% of your income on wants and. It’s easy to use, enter your monthly income and the sheet will calculate your outgoing targets for needs, wants and savings. 50% for your needs, 30% for your wants and 20% for your savings. With everydollar, your budget goes with you. Lower bills, manage budgets, and start saving today. Web crunching the numbers. Rocket money helps 3.4+ million members save hundreds. Web the 50 30 20 budget template can get you started on the right track. Ad find hidden costs and cut them. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: 50% on needs, 30% on wants, and 20% on savings. Savings and debts may include: 30% of your income on wants and. Compute expenses in 3 different categories step 04: Web 50 30 20 budget template related tags sample budget download this 50 30 20 budget template design in excel, google sheets format. Web 20% savings and debt the savings and debts category is meant for setting money aside for the future and paying off any loans or debts owed. Calculate monthly income step 02:The 50/30/20 rule to budgeting and saving Locke Digital

50/30/20 Budget Worksheet Fillable PDF Etsy Budgeting worksheets

The 50/30/20 Budget What It Is & Why You Need To Start Using It ASAP

Monthly Budget Planner 50/30/20 Rule & Expense Money Etsy in

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Free 50/30/20 Budget Calculator for Your Foundation Template

Free Printable 50 30 20 Budget Spreadsheet Template Printable Templates

The 50/30/20 Budget Rule A Simple StepbyStep Guide Money In Your Tea

Monthly 50/30/20 Budget Worksheet in 2021 Budgeting, Budgeting

The Most Difficult Part Of Having A Budget Is Trying To Stick To It, But It Is Possible If You Are.

The 50/30/20 Budget Rule Is A Fast Way To See How Much You Can Afford To Spend And Save Each Month.

Web About This Template A Straightforward Financial Planning System For Those Who Just Want An Easy Way To Plan And Keep Track Of Their Budget And Finances.

Get The App And Start Saving Today.

Related Post: