Charitable Contributions Template

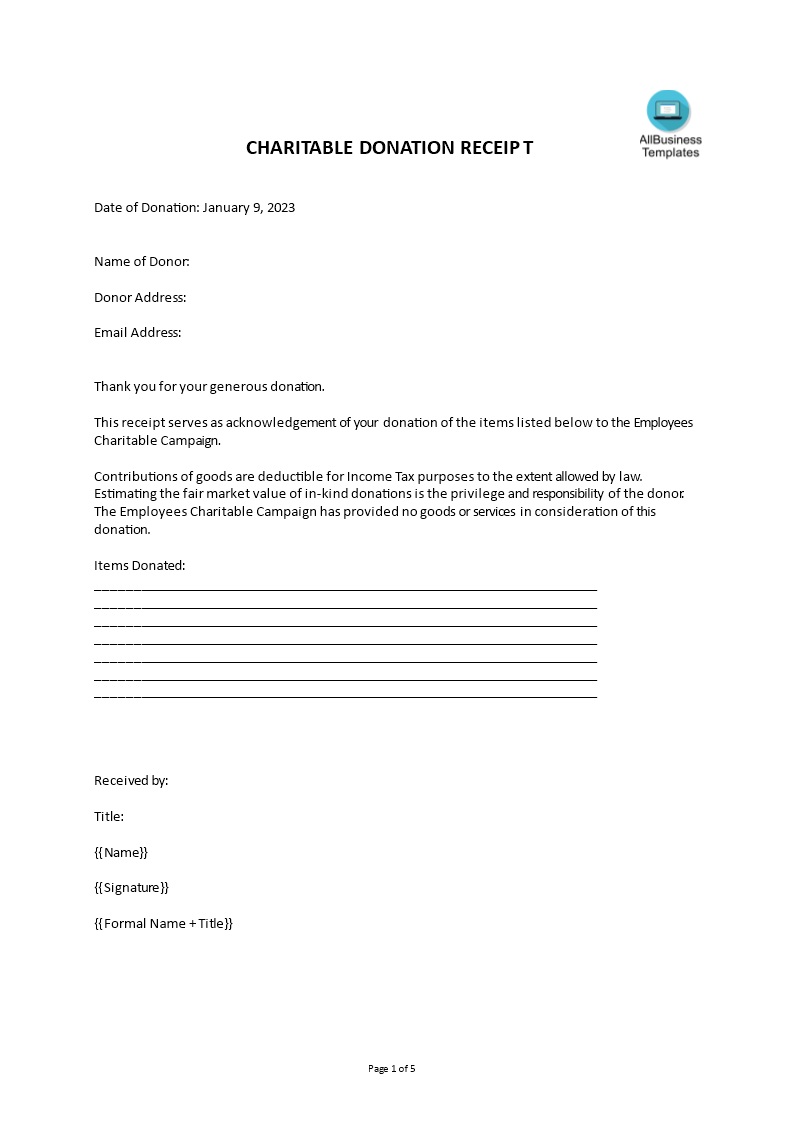

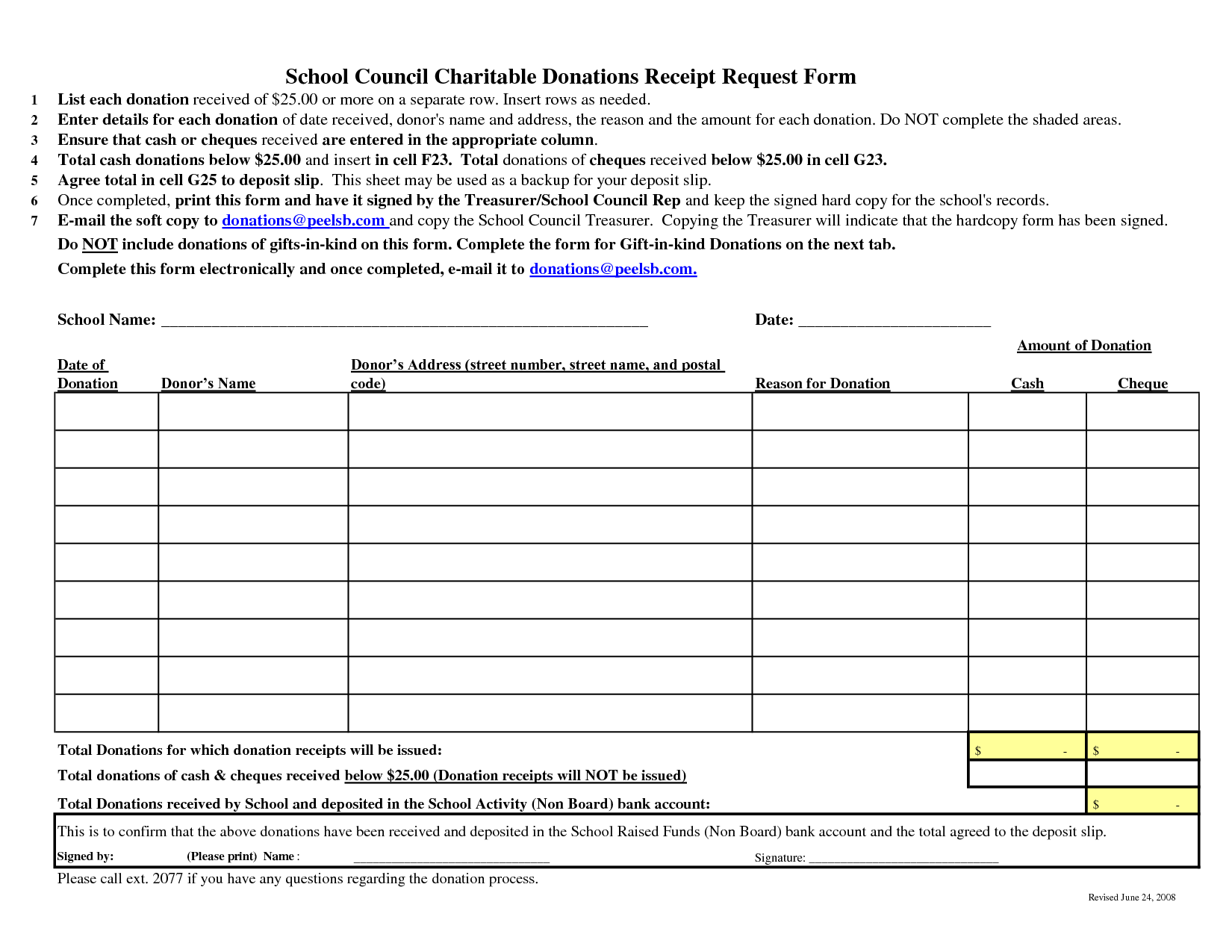

Charitable Contributions Template - Web what should a donation receipt template include? Your donation formis the gateway to your giving experience. Web these templates will help you build your donation receipts. You can choose from our diverse collection of templates like. Written & researched by emily baxley. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. According to a report on the philanthropy round table’s website, local. Your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50%. Whether your nonprofit is large or small,. Information used is from a salvation army. Collect donations, send receipts, and more with wpforms. Information used is from a salvation army. A donation receipt is a. If you’re just getting started,. Web these templates will help you build your donation receipts. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Web a brief description of the disclosure and substantiation requirements for contributions to charitable organizations. Web below are free charitable donation spreadsheets. Web what should a donation receipt template include? Information used is from a salvation army. Many charitable organizations described in section 501(c)(3),. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Web 100+ free nonprofit templates to save you time & money last updated 11/2/21. In its guideline on charitable contributions the irs states that donation tax receipts should include the. Web a brief description of the. Web see contributions of property, later. Many charitable organizations described in section 501(c)(3),. Written & researched by emily baxley. Ad maximize your charitable giving so more goes to the causes you care about. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. Written & researched by emily baxley. Web see contributions of property, later. Web what should a donation receipt template include? Web below are free charitable donation spreadsheets. Let’s take a look at the. A donation receipt is a. Information used is from a salvation army. Written & researched by emily baxley. Web these templates will help you build your donation receipts. It’s your first impression, your welcome mat, your maître d'—so you want it to be clean, clear, and welcoming. Ad maximize your charitable giving so more goes to the causes you care about. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Written & researched by emily baxley. It’s utilized by an individual. Web a brief description of the disclosure and substantiation requirements for contributions. Writing a donation receipt from scratch is a big task, but these templates will get you started. Web find forms and check if the group you contributed to qualifies as a charitable organization for the deduction. Form 8283 is used to claim a. Web see contributions of property, later. A donation receipt is a. Charitable contributions to qualified organizations may be deductible. Ad maximize your charitable giving so more goes to the causes you care about. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. Free 10+ charity report samples & templates in ms word | ms excel | pdf. It’s utilized by an individual. Simple charity donation policy template; Your donation formis the gateway to your giving experience. Web elevate your charitable efforts with the customizable charitable donation form template. Charitable contributions to qualified organizations may be deductible. Web create stunning non profit posters and flyers with template.net's free printable donation templates! Web create stunning non profit posters and flyers with template.net's free printable donation templates! Writing a donation receipt from scratch is a big task, but these templates will get you started. Web elevate your charitable efforts with the customizable charitable donation form template. Web sample donation acknowledgment letter template we’ve created a sample donation acknowledgment letter to guide you in writing your own. Written & researched by emily baxley. Whether your nonprofit is large or small,. Web these templates will help you build your donation receipts. Form 8283 is used to claim a. Web 100+ free nonprofit templates to save you time & money last updated 11/2/21. You can choose from our diverse collection of templates like. And while every nonprofit organization is unique, there are a number of items that most donation forms should include. If you’re just getting started,. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Ad maximize your charitable giving so more goes to the causes you care about. Your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50%. Information used is from a salvation army. Web a brief description of the disclosure and substantiation requirements for contributions to charitable organizations. According to a report on the philanthropy round table’s website, local. Simple charity donation policy template; These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. Attach one or more forms 8283 to your tax return if you claimed a total deduction of over $500 for all contributed property. Collect donations, send receipts, and more with wpforms. Web below are free charitable donation spreadsheets. If you’re just getting started,. Information used is from a salvation army. It’s utilized by an individual. Many charitable organizations described in section 501(c)(3),. Ad maximize your charitable giving so more goes to the causes you care about. Written & researched by emily baxley. You can choose from our diverse collection of templates like. It makes the design and setup a very quick process!. What is a donation receipt? Web a brief description of the disclosure and substantiation requirements for contributions to charitable organizations. Web elevate your charitable efforts with the customizable charitable donation form template. Your donation formis the gateway to your giving experience. Your deduction for charitable contributions generally can't be more than 60% of your agi, but in some cases 20%, 30%, or 50%.8 Charitable Donation Receipt Template Template Guru

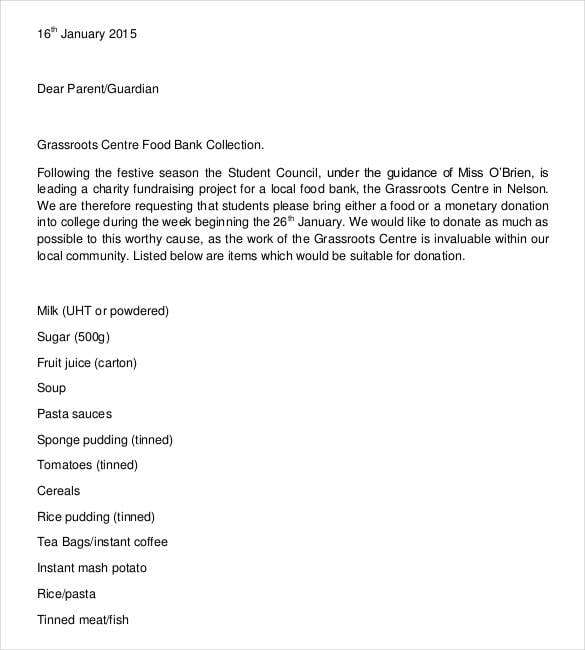

30+ Donation Letter Templates PDF, DOC

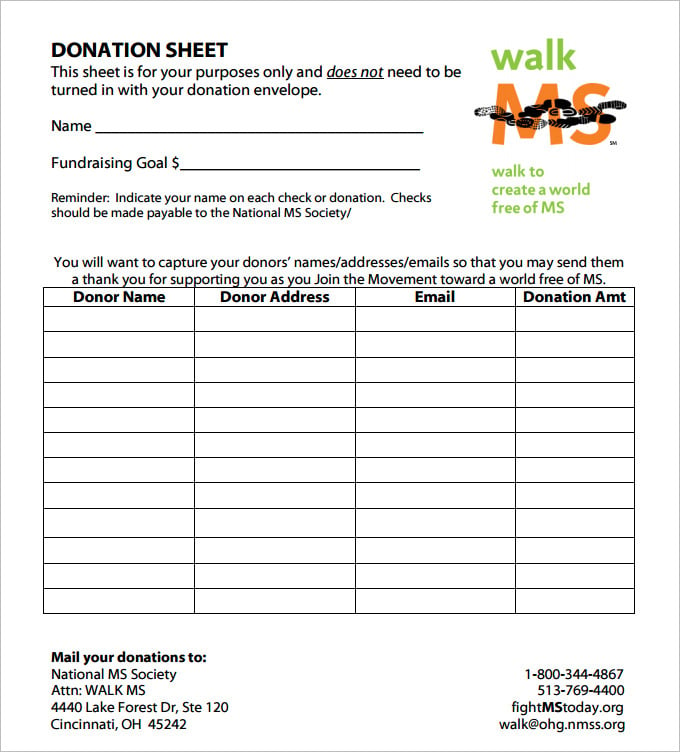

Donation Sheet Template 9+Free PDF Documents Download Free

Charity Donation Form Template Free Printable Documents

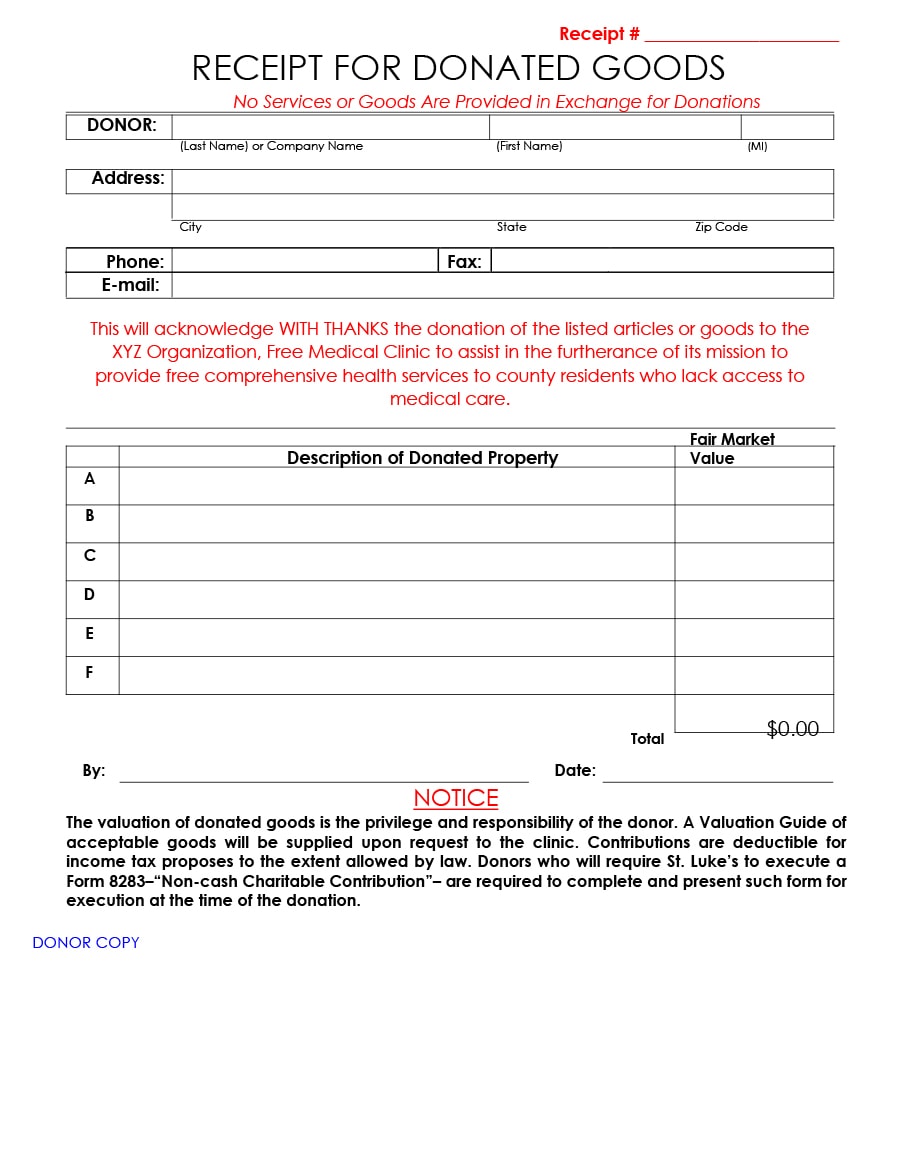

Donation Receipt 10+ Examples, Format, Pdf Examples

Charity Donation Letter Template Free Printable Templates

FREE 8+ Sample Donation Forms in PDF MS Word

34 Professional Donation & Fundraiser Tracker Templates ᐅ TemplateLab

Donation Sheet Template Download Free & Premium Templates, Forms

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

A Donation Receipt Is A.

Group Charitable Donation Policy Template;

This Worksheet Is Provided As A Convenience And Aide In Calculating Most Common Non Cash Charitable Donations.

Let’s Take A Look At The.

Related Post: