Cost Segregation Study Template

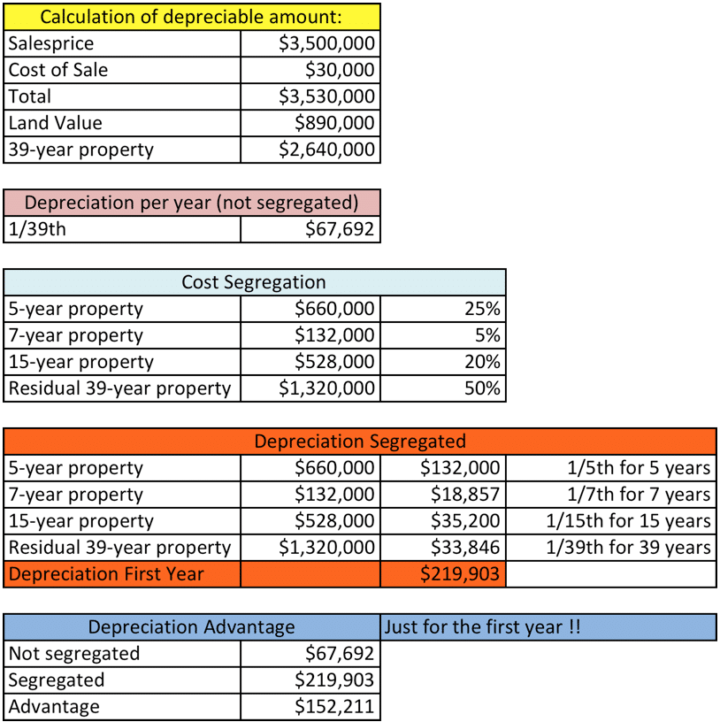

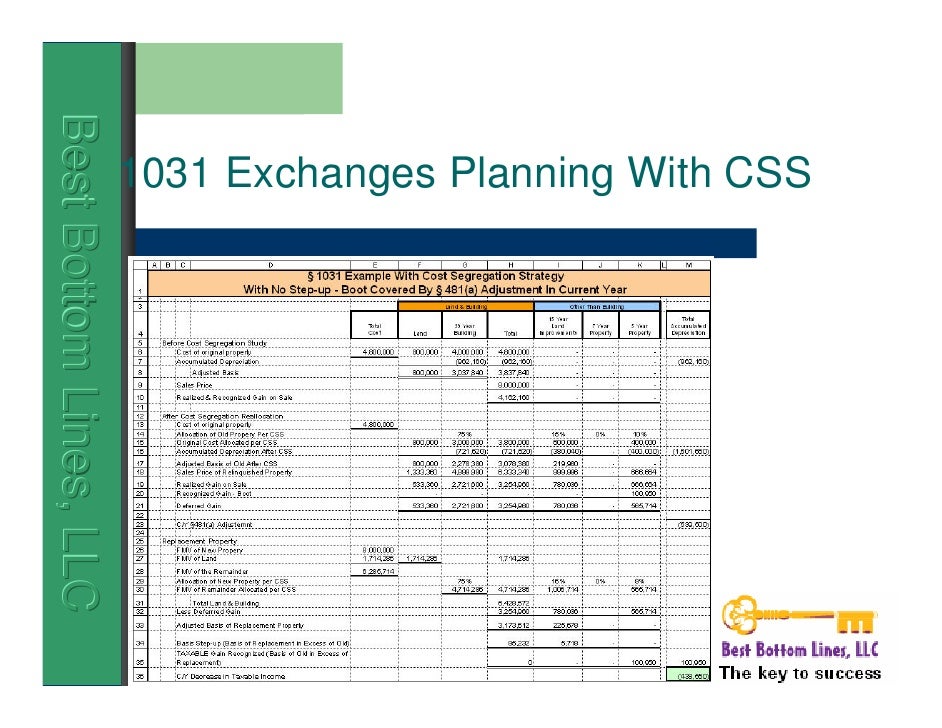

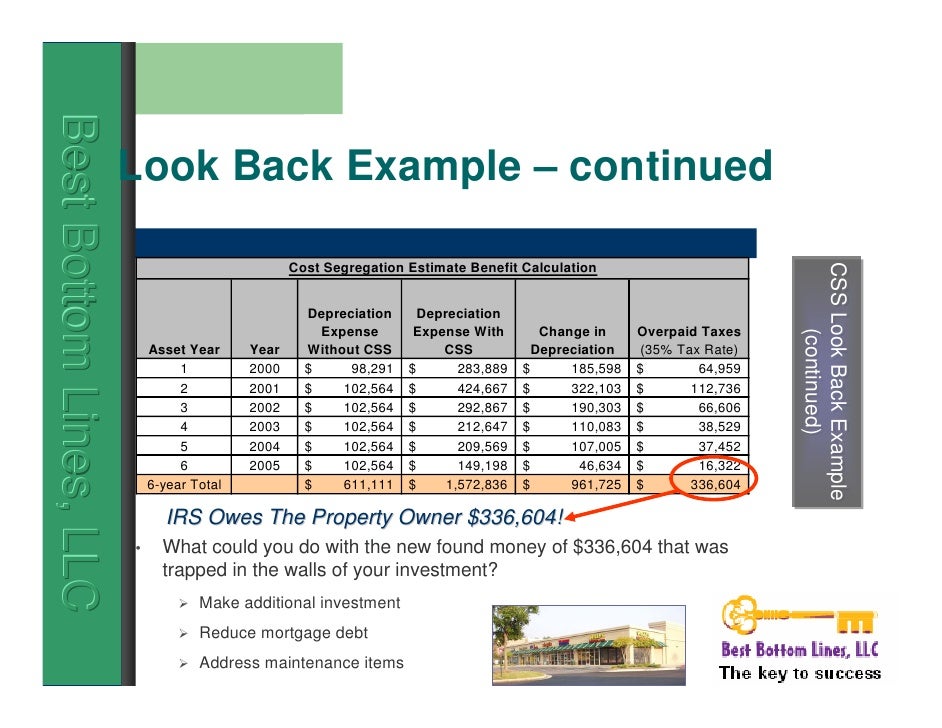

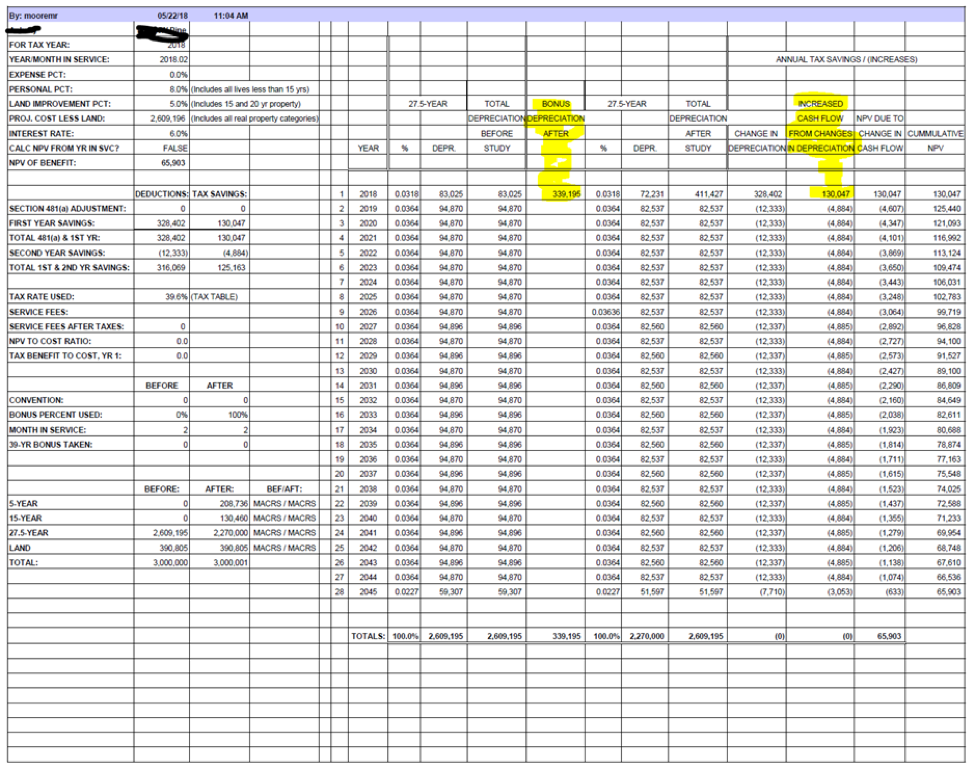

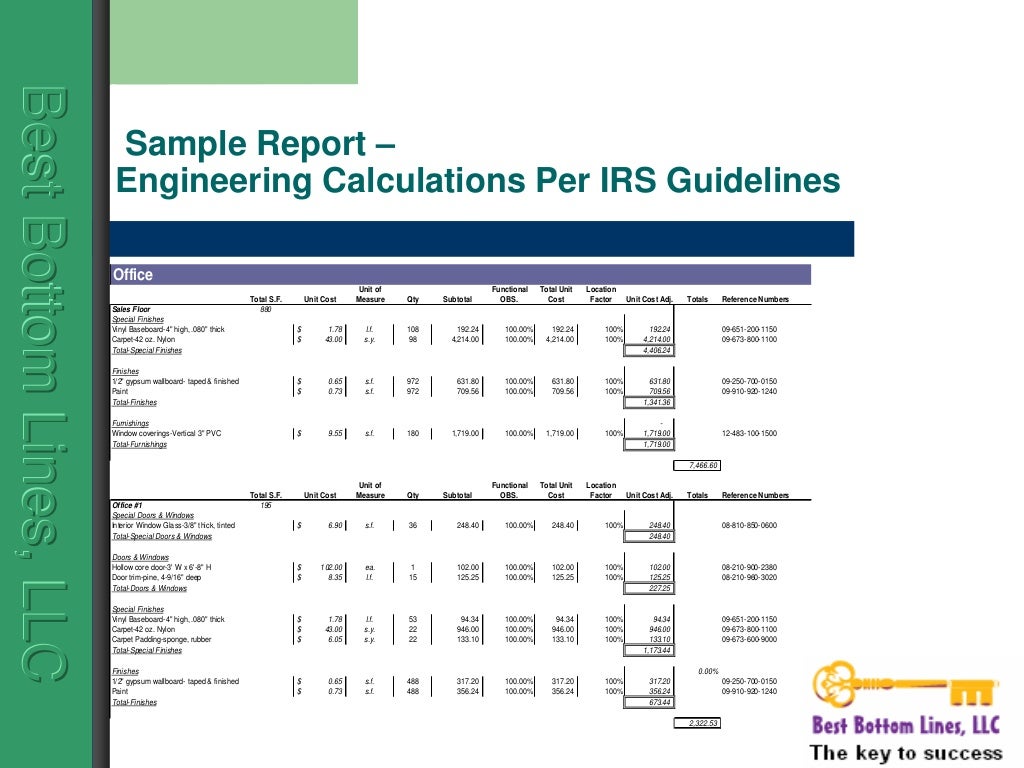

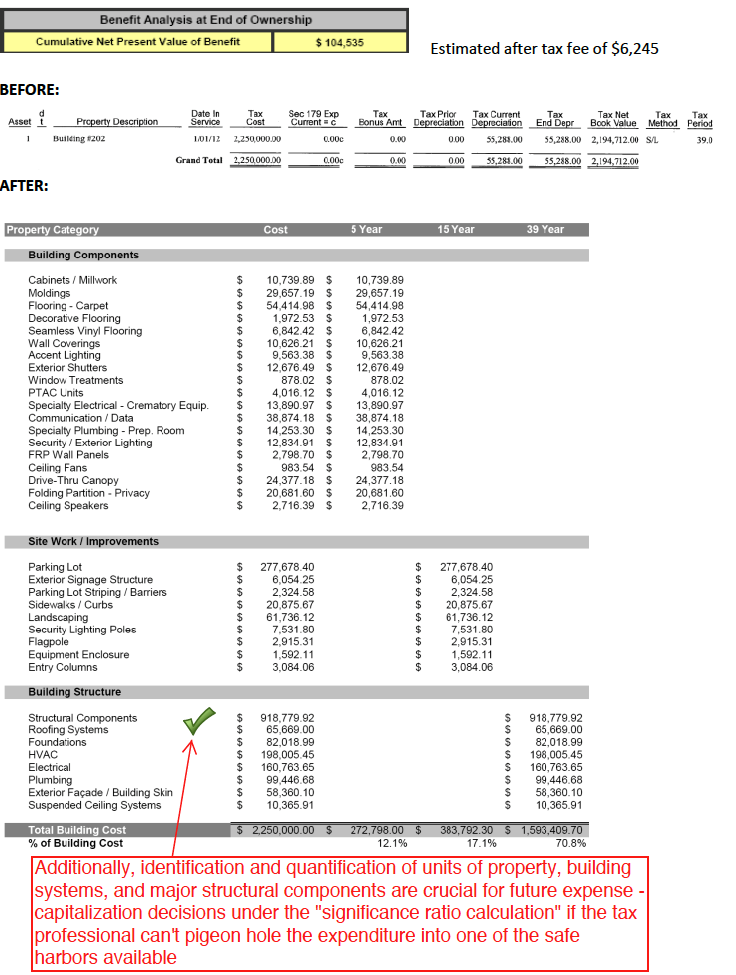

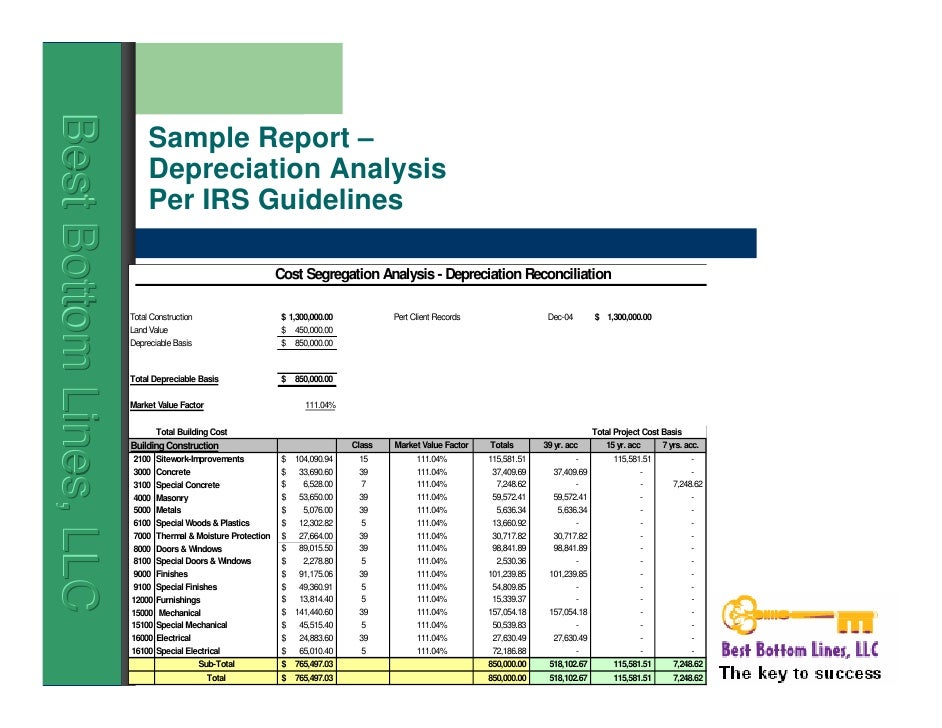

Cost Segregation Study Template - While there is no prescribed qualifications for who conducts a cost segregation study. Web what does a cost segregation study entail? I reduced my taxable income considerably in 2022 with. A cost segregation study is performed to separate which pieces of property are real property and which are personal property. Office building cost segregation example. Keep your hard earned money. Web cost segregation form in excel. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes, which reduces current income tax obligations. Web cost segregation studies are performed for federal income tax purposes; Web what is a cost segregation study? Web cost segregation study (css) template overview. Web would you like a cost segregation analysis customized for your unique situation? Experience in all 50 states & all property types. The css template offers a comprehensive suite for conducting a detailed cost segregation study, allowing. Web a cost segregation study is a process that looks at each element of a property,. • what to look for in the review and examination of. Web cost segregation studies are performed for federal income tax purposes; I reduced my taxable income considerably in 2022 with. Web cost segregation study 123 davis drive, st. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes, which reduces. A cost segregation study is performed to separate which pieces of property are real property and which are personal property. Web a cost segregation study properly classifies and assigns accurate depreciable lives to components of your real estate assets. Web the residential cost segregator® is an online software program that allows cpa’s to generate custom reports in just minutes, providing. Buildings constructed or acquired in prior years. While there is no prescribed qualifications for who conducts a cost segregation study. Web cost segregation study (css) template overview. Web a cost segregation study properly classifies and assigns accurate depreciable lives to components of your real estate assets. Web cost segregation form in excel. Web by michael bowman updated october 5, 2021 cost segregation the practice of segmenting different components of a property’s depreciation. Office building cost segregation example. The irs suggests that it be. Web the residential cost segregator® is an online software program that allows cpa’s to generate custom reports in just minutes, providing tax benefits to clients without hiring a. Web. Web the residential cost segregator® is an online software program that allows cpa’s to generate custom reports in just minutes, providing tax benefits to clients without hiring a. With a cost segregation analysis, you could be. • what to look for in the review and examination of. Web what does a cost segregation study entail? The irs suggests that it. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes, which reduces current income tax obligations. Web a cost segregation study is a process that looks at each element of a property, splits them into different categories, and allows you to benefit from an. Keep your hard earned money. Acquisition price(cost. Web cost segregation form in excel. Web would you like a cost segregation analysis customized for your unique situation? Web what does a cost segregation study entail? A cost segregation study is performed to separate which pieces of property are real property and which are personal property. While there is no prescribed qualifications for who conducts a cost segregation study. Web getty here's something i wish i had known about sooner, and i bet a lot of you will, too: Web i am planning to perform a cost segregation study on the str 's i have purchased to take advantage of the bonus depreciation rules currently in effect to offset the tax. Office building cost segregation example. I reduced my. A cost segregation study is performed to separate which pieces of property are real property and which are personal property. Web getty here's something i wish i had known about sooner, and i bet a lot of you will, too: Experience in all 50 states & all property types. Keep your hard earned money. I reduced my taxable income considerably. Web getty here's something i wish i had known about sooner, and i bet a lot of you will, too: Web a cost segregation study is a process that looks at each element of a property, splits them into different categories, and allows you to benefit from an. Web cost segregation study 123 davis drive, st. Significant remodel, renovation, or expansion activities. The irs suggests that it be. Keep your hard earned money. Acquisition price(cost to owner) acquisition costs (additional costs related to purchase). I reduced my taxable income considerably in 2022 with. Web what does a cost segregation study entail? • what to look for in the review and examination of. Web cost segregation studies are performed for federal income tax purposes; Ad accelerate depreciation and lower your tax liability. Web newly constructed or acquired buildings. Our free cost segregation savings calculator. Web what is a cost segregation study? While there is no prescribed qualifications for who conducts a cost segregation study. • how cost segregation studies are prepared; Web cost segregation is the systematic and comprehensive analysis of all costs associated with real estate assets, whether they are purchased, newly constructed,. Web by michael bowman updated october 5, 2021 cost segregation the practice of segmenting different components of a property’s depreciation. Web cost segregation form in excel. Web a cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes, which reduces current income tax obligations. Web a cost segregation study is a process that looks at each element of a property, splits them into different categories, and allows you to benefit from an. I reduced my taxable income considerably in 2022 with. Web what does a cost segregation study entail? • what to look for in the review and examination of. Experience in all 50 states & all property types. Our free cost segregation savings calculator. Louis, mo page 1 1.0 introduction mr. With a cost segregation analysis, you could be. Acquisition price(cost to owner) acquisition costs (additional costs related to purchase). Web cost segregation study (css) template overview. Web newly constructed or acquired buildings. A cost segregation study is performed to separate which pieces of property are real property and which are personal property. Web cost segregation is the systematic and comprehensive analysis of all costs associated with real estate assets, whether they are purchased, newly constructed,. The irs suggests that it be. Web a cost segregation study properly classifies and assigns accurate depreciable lives to components of your real estate assets.Cost Segregation Analysis Seals the Deal Staebler Real Estate

Cost Segregation Study

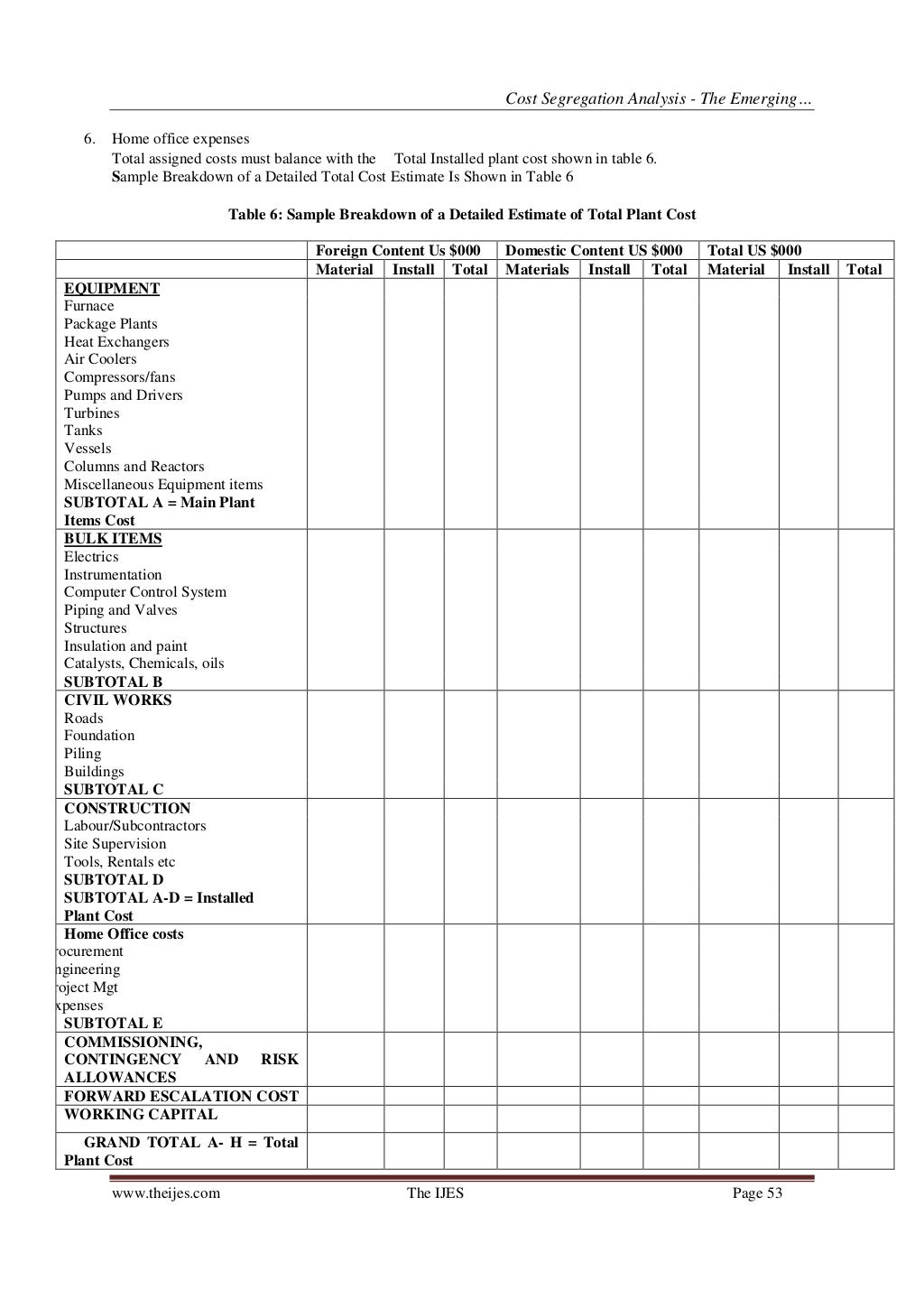

Cost Segregation Analysis The Emerging Practice Of Quantity Survey…

Cost Segregation Study

How Much Does A Cost Segregation Study Cost Study Poster

Cost Segregation Study

Costsegregationstudy Advanced Tax Advisors

Cost Segregation Explained CostControlTeam

Simple Example of Cost Segregation Specializing in cost segregation

Cost Segregation Study

Keep Your Hard Earned Money.

• How Cost Segregation Studies Are Prepared;

While There Is No Prescribed Qualifications For Who Conducts A Cost Segregation Study.

Web Cost Segregation Study 123 Davis Drive, St.

Related Post: