Debt Payoff Planner Printable

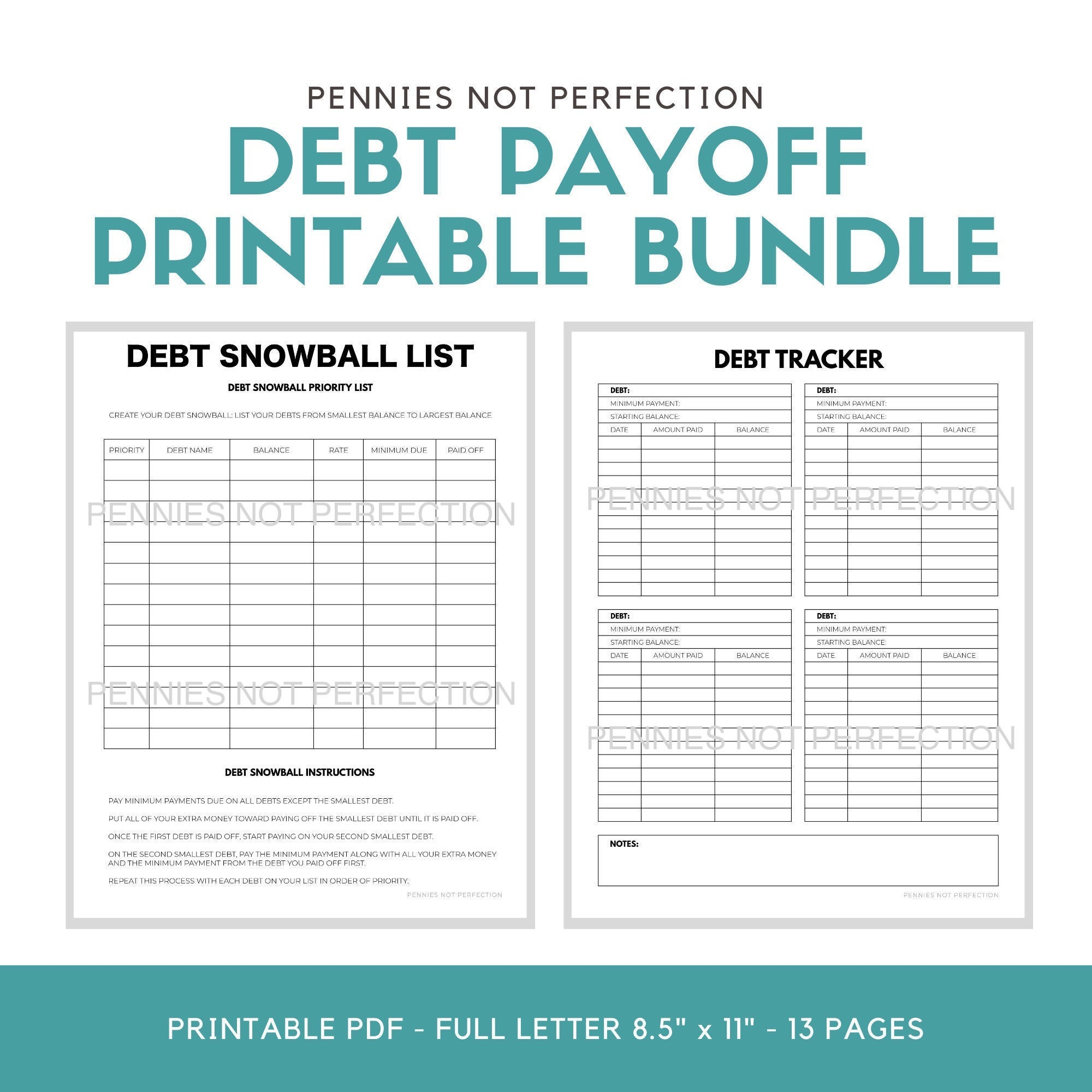

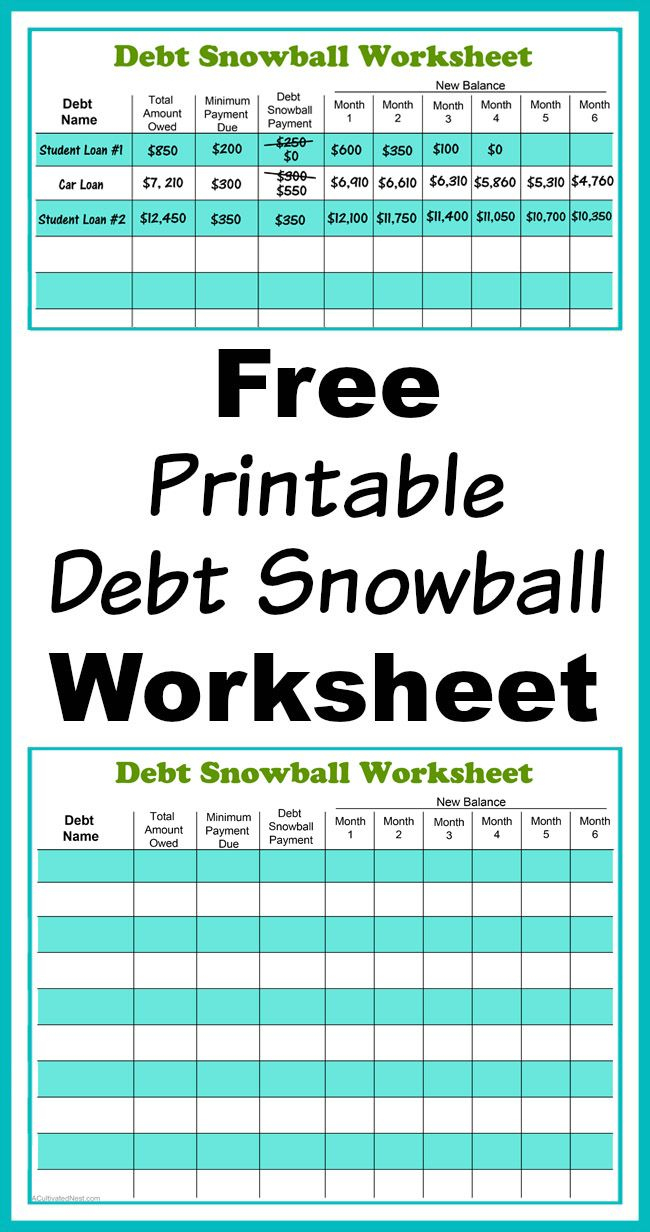

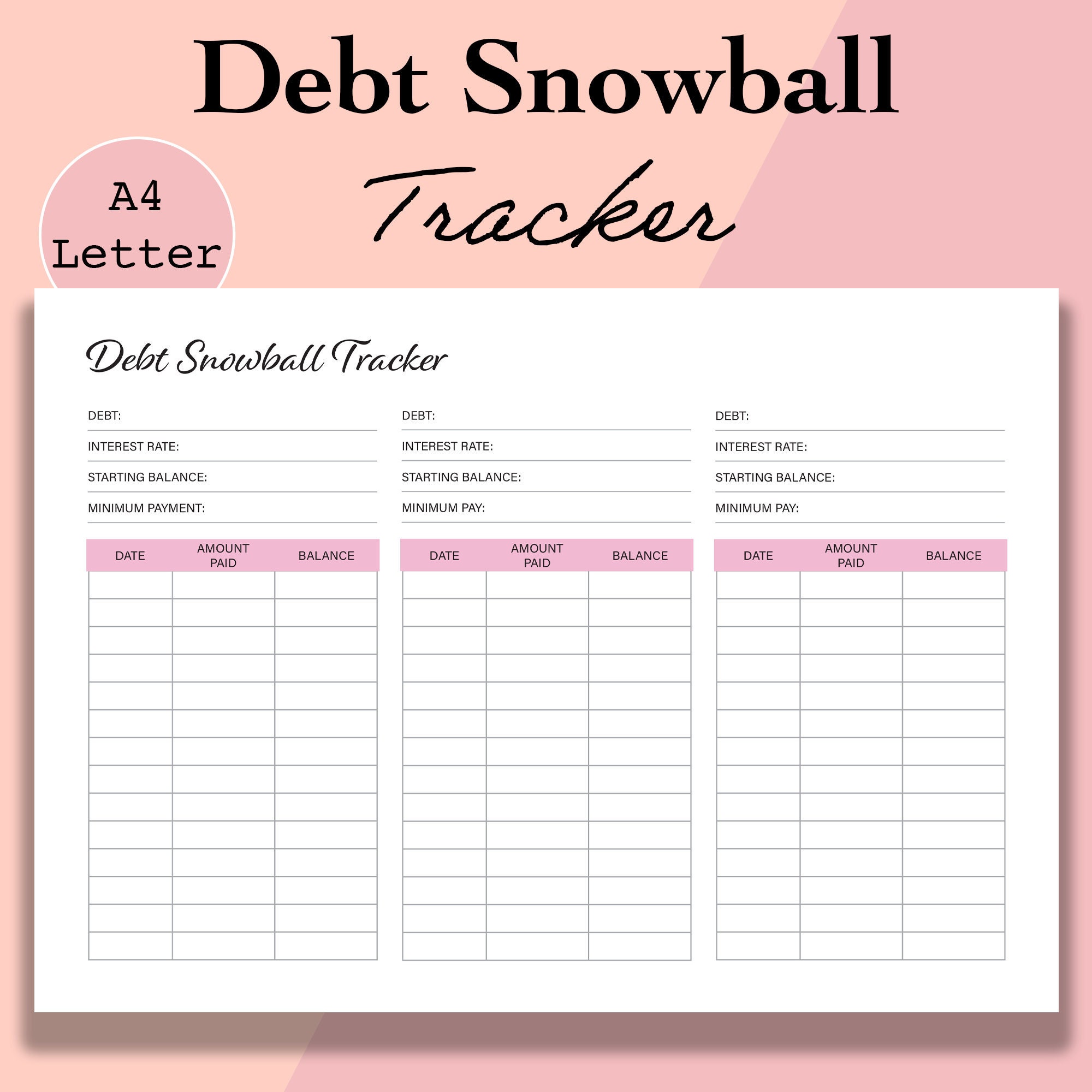

Debt Payoff Planner Printable - Month paid balance january february march april may june july august september october november december creditor: Web debt payoff planner creditor: J f m a m j j a s o n d paid balance creditor: You can also use this worksheet to add additional payments to debt each month. Debt adds to the amount of money we need to come up with each month. These products can help you get started. Web we are kicking off this year with a series of free printables to help you take control of your budget. Once you pay off one debt, move on to the. It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. Web $ minimum payment $ account name (optional) add debt your household income this includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Write in the monthly payment followed by the due date. Web grab the free printable debt payoff worksheet below, fill it out, and start by getting your debts organized. Included is the daily spending log, expense tracker, debt payoff tracker (this one), monthly bill worksheet and as a bonus, you can get the monthly goals and yearly goals trackers !. Two weeks ago we got our account balanced aligned with a personal cash flow statement. Need help repairing your credit? These products can help you get started. Web grab the free printable debt payoff worksheet below, fill it out, and start by getting your debts organized. Web using the debt payoff planner. Web february 3, 2023 grab these free printable debt payoff planner pages to help you track as you pay down your debt so you always know where you stand with your finances. Web this will help you to keep track of your debt and help you to stay organized while paying it off. Web progress markers 1st debt paid off. Web debt payoff planner template simple planner sample planner basic planner printable planner download this debt payoff planner template design in apple pages, word, google docs, pdf format. This variety of debt trackers also includes ones for car loans, credit card debt, mortgages, student loans, and blank ones that allow a variety of debt sources to be. (via moritz fine. Write the debt you are trying to pay off in the “debt column.”. Write in the monthly payment followed by the due date. And it can feel debilitating if we have a lot of it. You can track the interest rate, balances and all payments that you make. Web there are two debt payoff methods in the financial community that. Web this spreadsheet includes a printable payment schedule for easy reference. You can also use this worksheet to add additional payments to debt each month. Web here is how it works: Month paid balance january february march april may june july august september october november december creditor: Web debt payoff planner creditor: It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. Web this will help you to keep track of your debt and help you to stay organized while paying it off. Web progress markers 1st debt paid off halfway mark paid down debts 6+ months debt. Web here is how it works: Web grab the free printable debt payoff worksheet below, fill it out, and start by getting your debts organized. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. Each printable worksheet in this free download can be used with any system. Web debt payoff planner creditor: Web get this free printable debt payoff tracker worksheet to keep up with all of your payments, track your progress, and have a one page glimpse at all of your debt payoff information. Web we are kicking off this year with a series of free printables to help you take control of your budget. With. With just a few details. This is an aggressive way to pay off your debt. You can also use this worksheet to add additional payments to debt each month. Debt adds to the amount of money we need to come up with each month. Web debt paydown calculator advertiser disclosure if you’re looking for ways to get out of debt. Month paid balance january february march april may june july august september october november december creditor: Web grab the free printable debt payoff worksheet below, fill it out, and start by getting your debts organized. Web progress markers 1st debt paid off halfway mark paid down debts 6+ months debt free! Keep track of how much you owe and record the amount of money you're paying back with these handy sheets that you can download in a printable pdf format. Web debt payoff planner template simple planner sample planner basic planner printable planner download this debt payoff planner template design in apple pages, word, google docs, pdf format. Monthly household income (optional) $ additional payment next, to snowball your debt, enter the additional amount you want to pay above the minimum required. This is an aggressive way to pay off your debt. Need help repairing your credit? Web check out a collection of the most popular debt payoff trackers that will help you pay off your debts more quickly and efficiently. J f m a m j j a s o n d paid balance creditor: This variety of debt trackers also includes ones for car loans, credit card debt, mortgages, student loans, and blank ones that allow a variety of debt sources to be. If you prefer to use the debt snowball method, you will be ordering your individual debts beginning with the smallest debt through the largest debt (regardless of how much interest you’re paying). You can track the interest rate, balances and all payments that you make. (via moritz fine designs) debt free charts what’s better one free debt payoff printable? Web debt paydown calculator advertiser disclosure if you’re looking for ways to get out of debt fast, but don’t know where to start, bankrate’s debt calculator can help. Web we are kicking off this year with a series of free printables to help you take control of your budget. Many of us would like to pay down our debt. Debt adds to the amount of money we need to come up with each month. Web there are two debt payoff methods in the financial community that have been proven to work extremely effectively for hundreds of thousands of people. Sometimes, we need to write down every vital information to keep everything organized. How about 39 of them? Monthly household income (optional) $ additional payment next, to snowball your debt, enter the additional amount you want to pay above the minimum required. This is an aggressive way to pay off your debt. Enter the start debt, then print the worksheet. You can track the interest rate, balances and all payments that you make. Included is the daily spending log, expense tracker, debt payoff tracker (this one), monthly bill worksheet and as a bonus, you can get the monthly goals and yearly goals trackers ! Keep track of how much you owe and record the amount of money you're paying back with these handy sheets that you can download in a printable pdf format. Web here is how it works: Web the minimum payment represents the amount of cash flow you will free up by completely paying off the debt. This grid uses 200 cells, so you'll have many opportunities to cross out, scratch out, or joyfully color in the amounts as you reach each goal. It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. Month paid balance january february march april may june july august september october november december creditor: Web we are kicking off this year with a series of free printables to help you take control of your budget. This debt snowball calculator is meant to gather information on all your debts. Web this spreadsheet includes a printable payment schedule for easy reference. These products can help you get started.Budget Binder Printable How To Organize Your Finances Budget

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Pin by Tiffany Bianchi on Organizing Debt payoff plan, Payoff, Debt

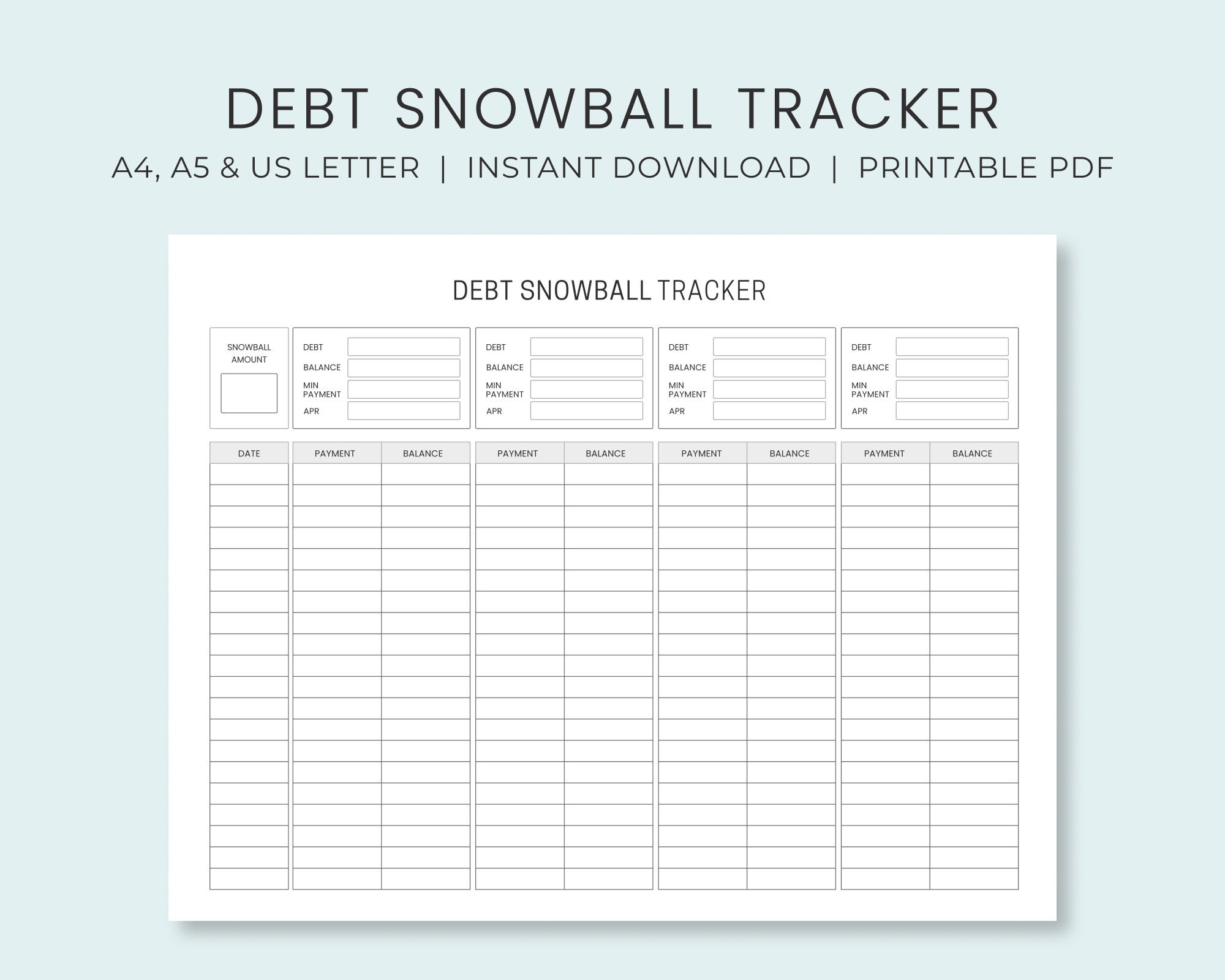

Debt Snowball Tracker Printable Debt Payment Worksheet Etsy

Free Debt Repayment Printable Example Calendar Printable

Debt Payoff Planner Worksheet A Mom's Take

debt repayment planner Paying off credit cards, Spreadsheet template

Debt Payoff Planner Free Printable Debt payoff, Budget planner

Free Printable Debt Payoff Worksheet Free Printable

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy Canada

Once You Pay Off One Debt, Move On To The.

Two Weeks Ago We Got Our Account Balanced Aligned With A Personal Cash Flow Statement.

Web There Are Two Debt Payoff Methods In The Financial Community That Have Been Proven To Work Extremely Effectively For Hundreds Of Thousands Of People.

Web Using The Debt Payoff Planner.

Related Post: