Depreciation Excel Template

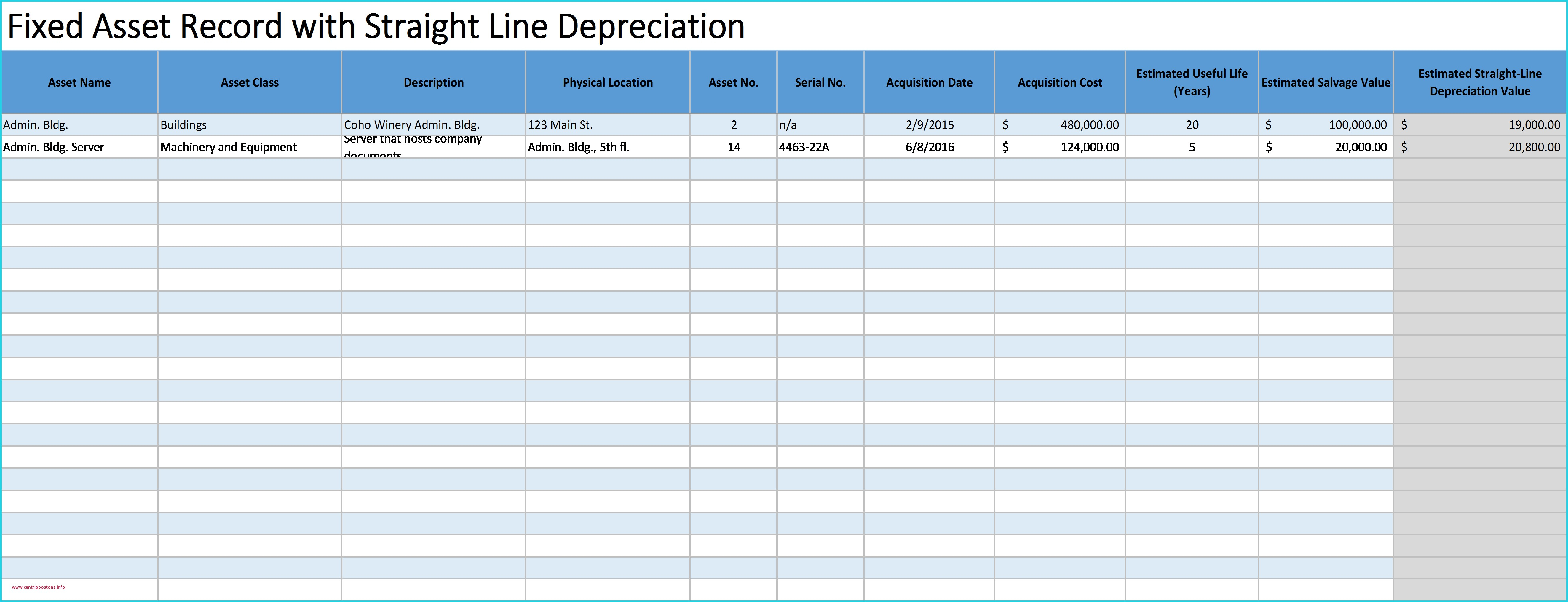

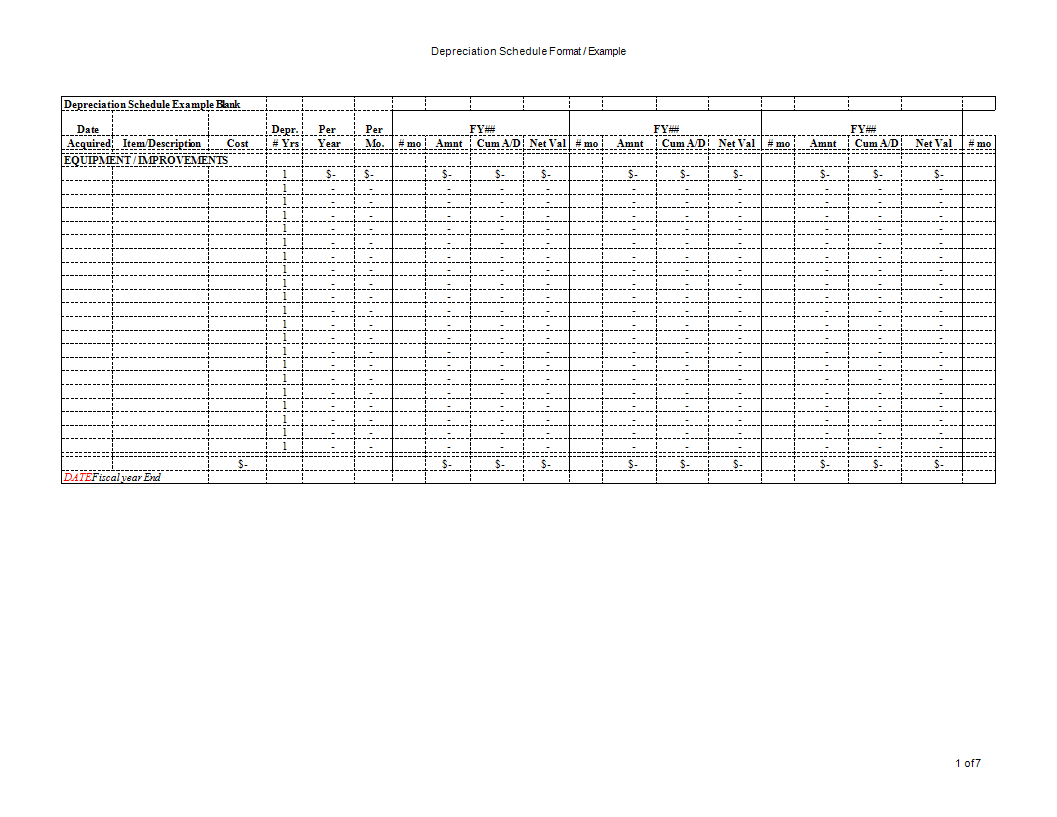

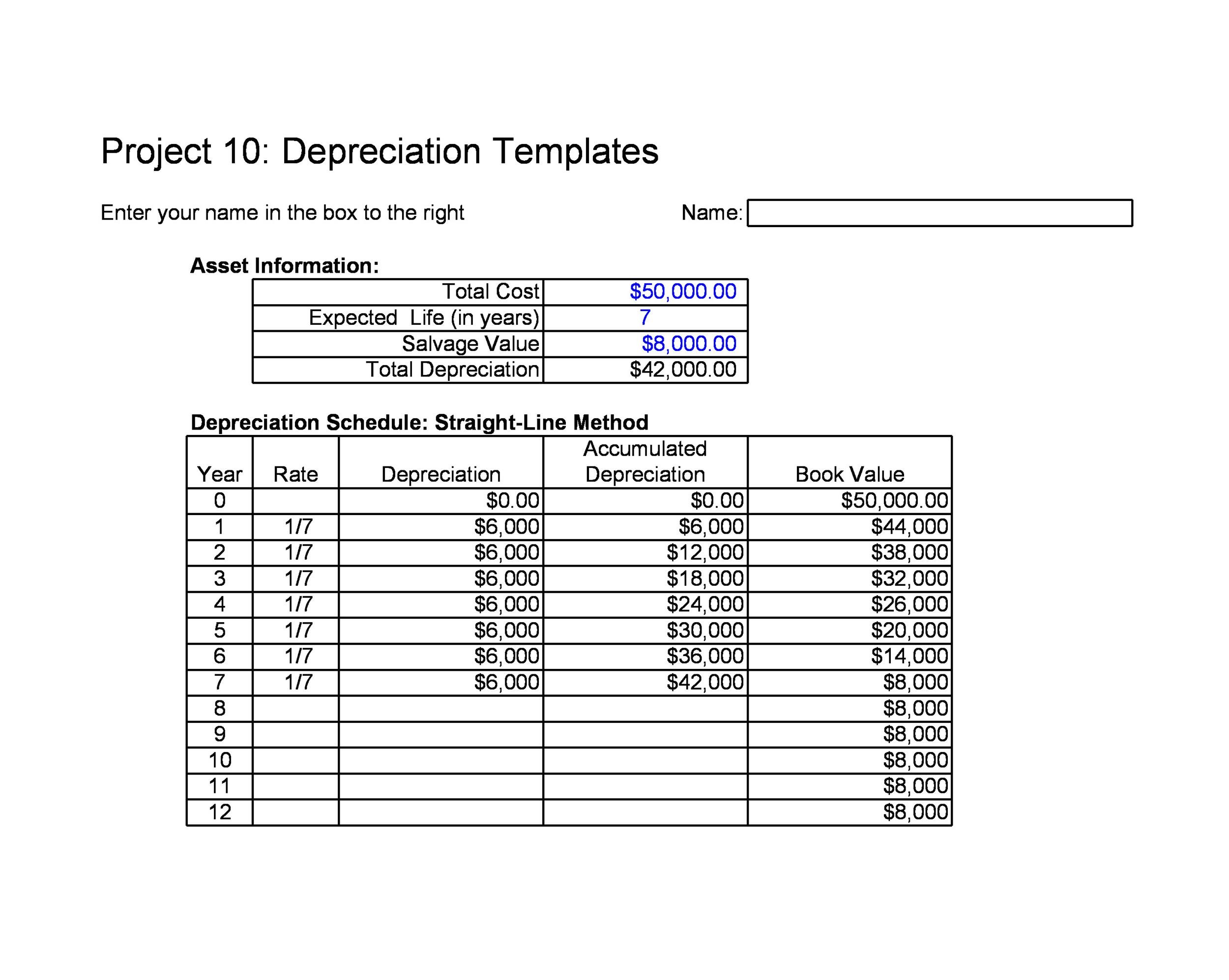

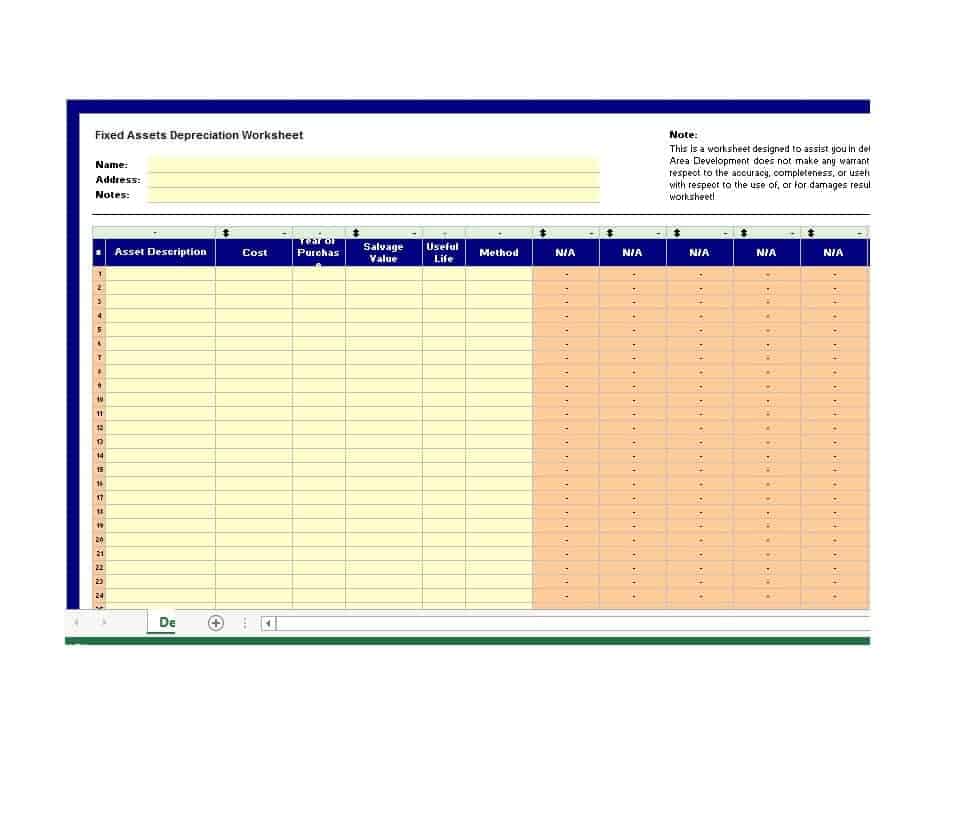

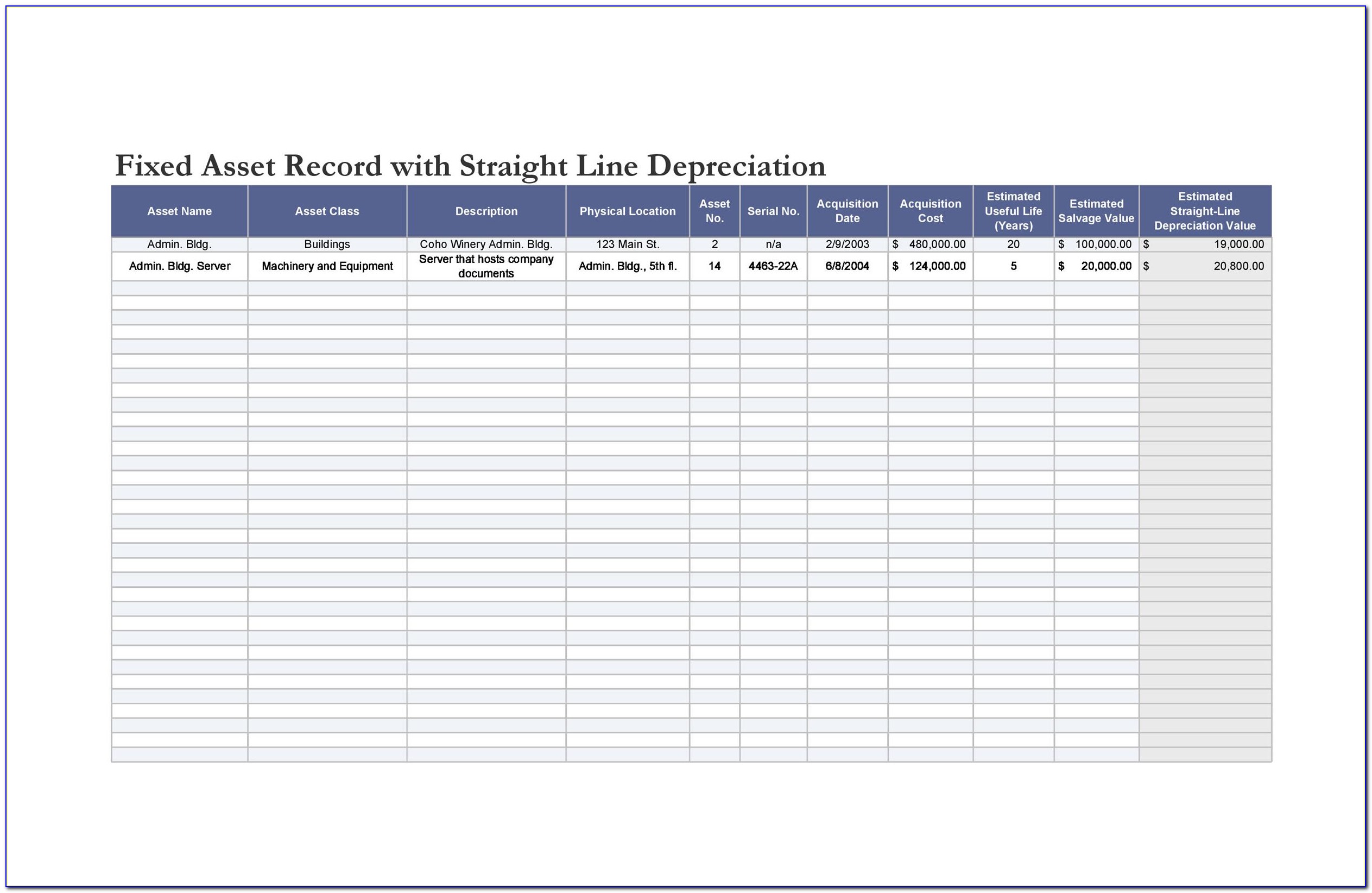

Depreciation Excel Template - Web double declining balance depreciation template. Web this video helps you to understand that how to make a spread sheet of depreciation & accumulated depreciation calculation and also how many factors. Web sln the sln (straight line) function is easy. Web download this template for free. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web download these 20+ free depreciation schedule templates in ms excel and ms word format. Web depreciation is highest in the first period and decreases in successive periods. All these schedule templates are available for download. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Web download depreciation calculator excel template. Web to calculate depreciation, the ddb function uses the following formula: Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. This accumulated depreciation calculator will. Web accumulated depreciation calculator. Depreciation is the reduction in the value of an asset due to usage, passage of time,. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated,.. The sln function performs the following calculation. Web this video helps you to understand that how to make a spread sheet of depreciation & accumulated depreciation calculation and also how many factors. Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. Given that it is used for tangible assets, examples of the assets. Web. Web download depreciation calculator excel template. Given that it is used for tangible assets, examples of the assets. The sln function performs the following calculation. Web double declining balance depreciation template. Web download this template for free. The sln function performs the following calculation. Each year the depreciation value is the same. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web this video helps you to understand that how to make a spread sheet of depreciation & accumulated depreciation calculation and also how many factors. Web download this template for free. Web download this template for free. Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated,. Web depreciation is used to match the. Ddb uses the following formula to calculate depreciation for a period: Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web download these 20+ free depreciation schedule templates in ms excel and ms word format. Web to calculate depreciation, the. This double declining balance depreciation template will help you find depreciation expense using one of the. Web accumulated depreciation calculator. Web sln the sln (straight line) function is easy. Web depreciation is highest in the first period and decreases in successive periods. Each year the depreciation value is the same. The sln function performs the following calculation. Web depreciation is highest in the first period and decreases in successive periods. All these schedule templates are available for download. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web these templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and. Web download depreciation calculator excel template. Given that it is used for tangible assets, examples of the assets. Web to calculate depreciation, the ddb function uses the following formula: Web these templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and formats to make calculation automatic. Web accumulated depreciation calculator. Web double declining balance depreciation template. Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. Depreciation is the reduction in the value of an asset due to usage, passage of time,. Get support for this template. Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Given that it is used for tangible assets, examples of the assets. Web download this template for free. This double declining balance depreciation template will help you find depreciation expense using one of the. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web these templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and formats to make calculation automatic. Web depreciation is highest in the first period and decreases in successive periods. Web sln the sln (straight line) function is easy. Web accumulated depreciation calculator. Web download depreciation calculator excel template. Each year the depreciation value is the same. The sln function performs the following calculation. Web download these 20+ free depreciation schedule templates in ms excel and ms word format. Ddb uses the following formula to calculate depreciation for a period: Web to calculate depreciation, the ddb function uses the following formula: All these schedule templates are available for download. All these schedule templates are available for download. Web depreciation is used to match the cost of obtaining an asset to the income a company will earn due to acquiring it. Web these templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and formats to make calculation automatic. Web download this template for free. Ddb uses the following formula to calculate depreciation for a period: Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. This double declining balance depreciation template will help you find depreciation expense using one of the. Web depreciation is highest in the first period and decreases in successive periods. Web to calculate depreciation, the ddb function uses the following formula: Web download these 20+ free depreciation schedule templates in ms excel and ms word format. This accumulated depreciation calculator will help you compute the period accumulated depreciation, given the. Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Web download depreciation calculator excel template. Get support for this template. Web double declining balance depreciation template. Each year the depreciation value is the same.Fixed Asset Depreciation Excel Spreadsheet —

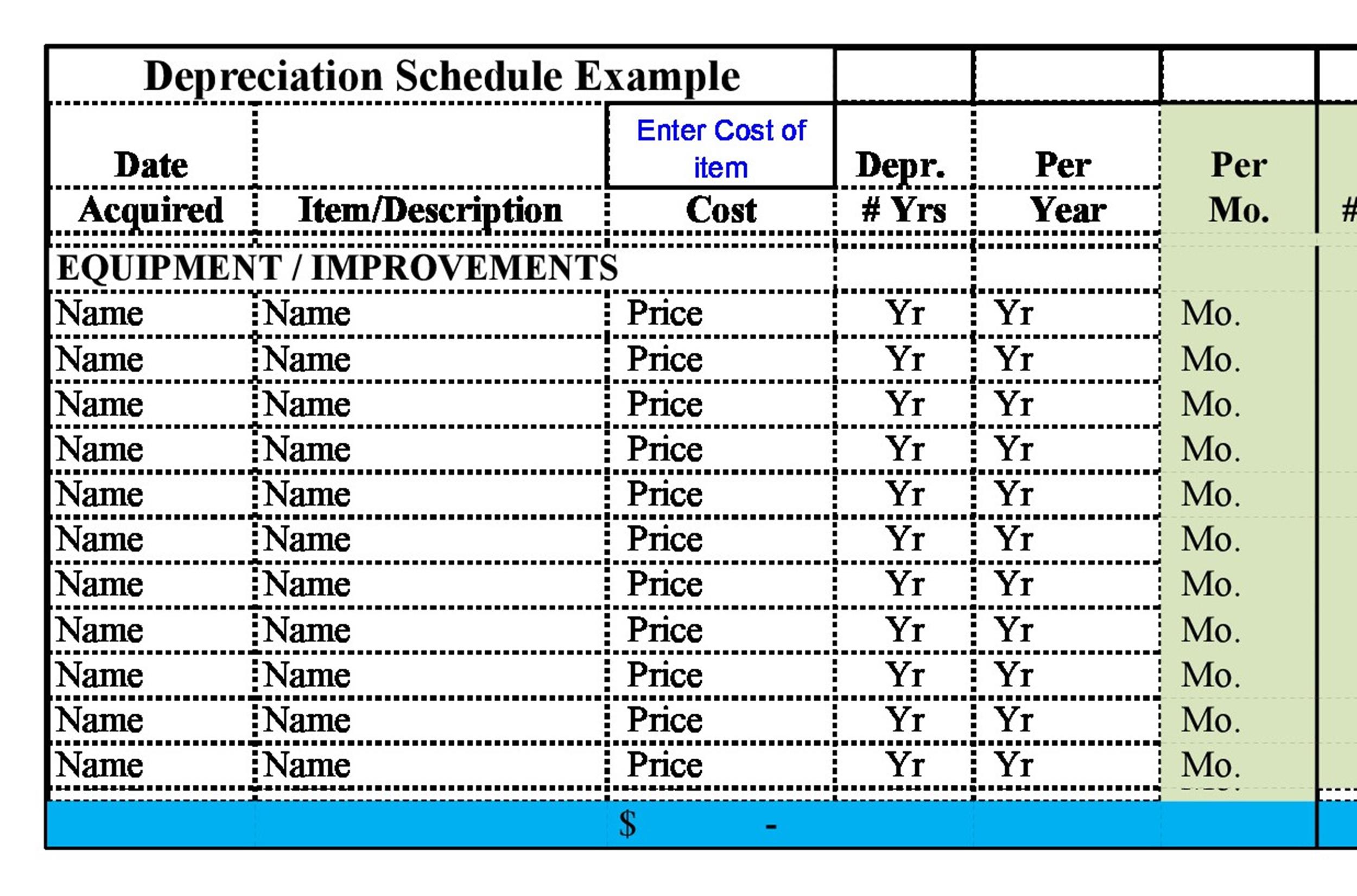

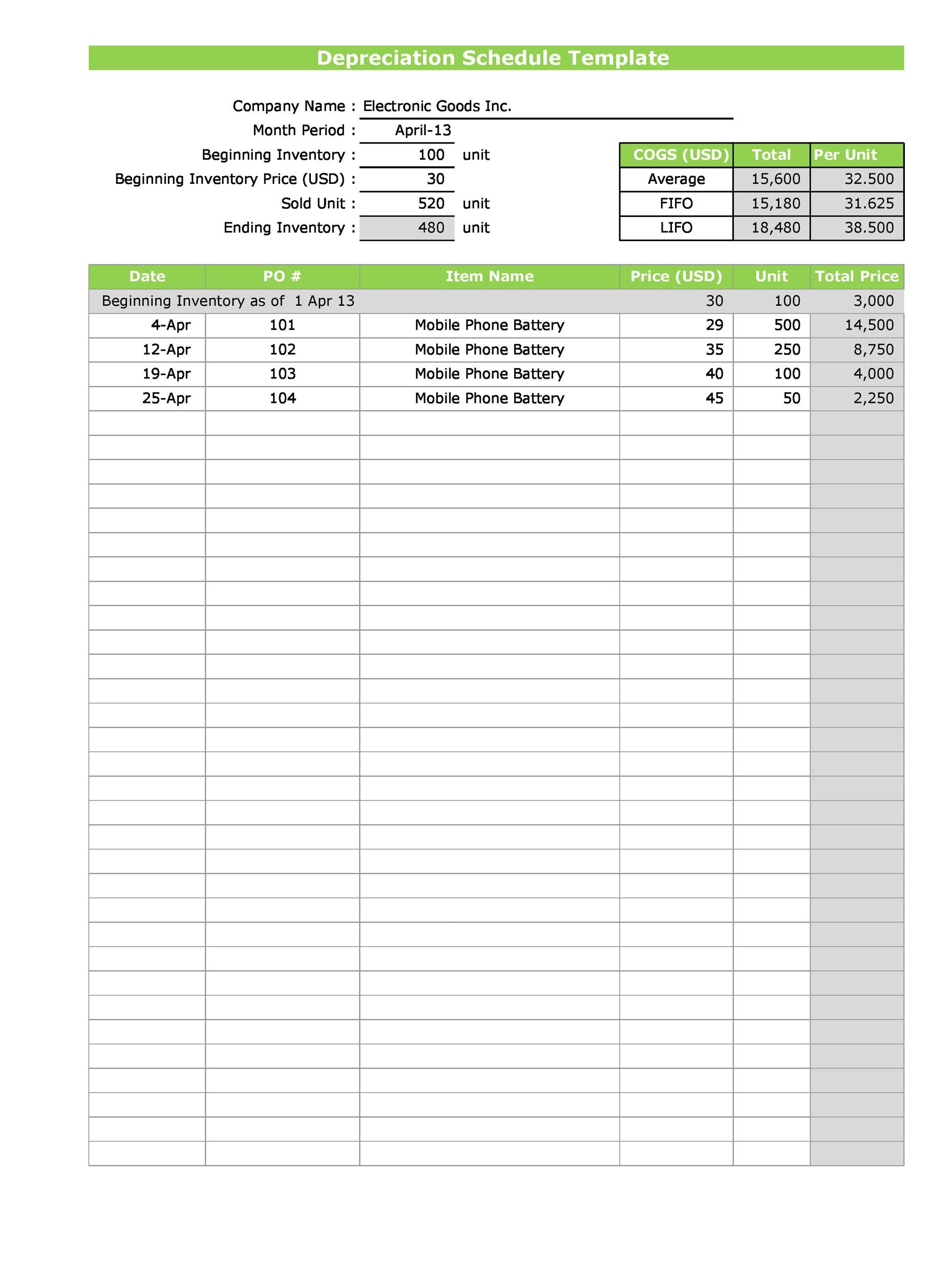

Depreciation schedule Excel format Templates at

How To Calculate Depreciation Schedule In Excel Haiper

Straight Line Depreciation Schedule Excel Template For Your Needs

Juli 2021 Excel Templates

Straight Line Depreciation Schedule Excel Template For Your Needs

Depreciation Excel Template Database

7 Excel Depreciation Template Excel Templates

Depreciation Schedule Template Excel Free Printable Templates

Depreciation Schedule Template Excel Free Printable Templates

The Sln Function Performs The Following Calculation.

Given That It Is Used For Tangible Assets, Examples Of The Assets.

Web To Calculate The Depreciation Using The Sum Of The Years' Digits (Syd) Method, Excel Calculates A Fraction By Which The Fixed Asset Should Be Depreciated,.

Depreciation Is The Reduction In The Value Of An Asset Due To Usage, Passage Of Time,.

Related Post: