Ebitda Excel Template

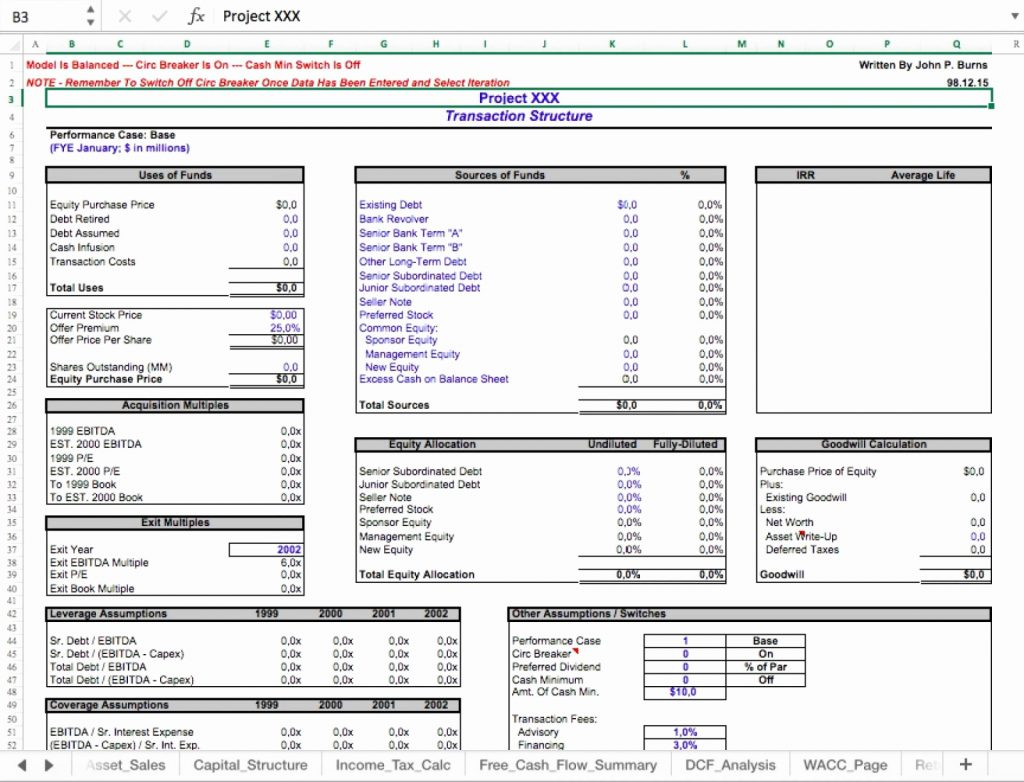

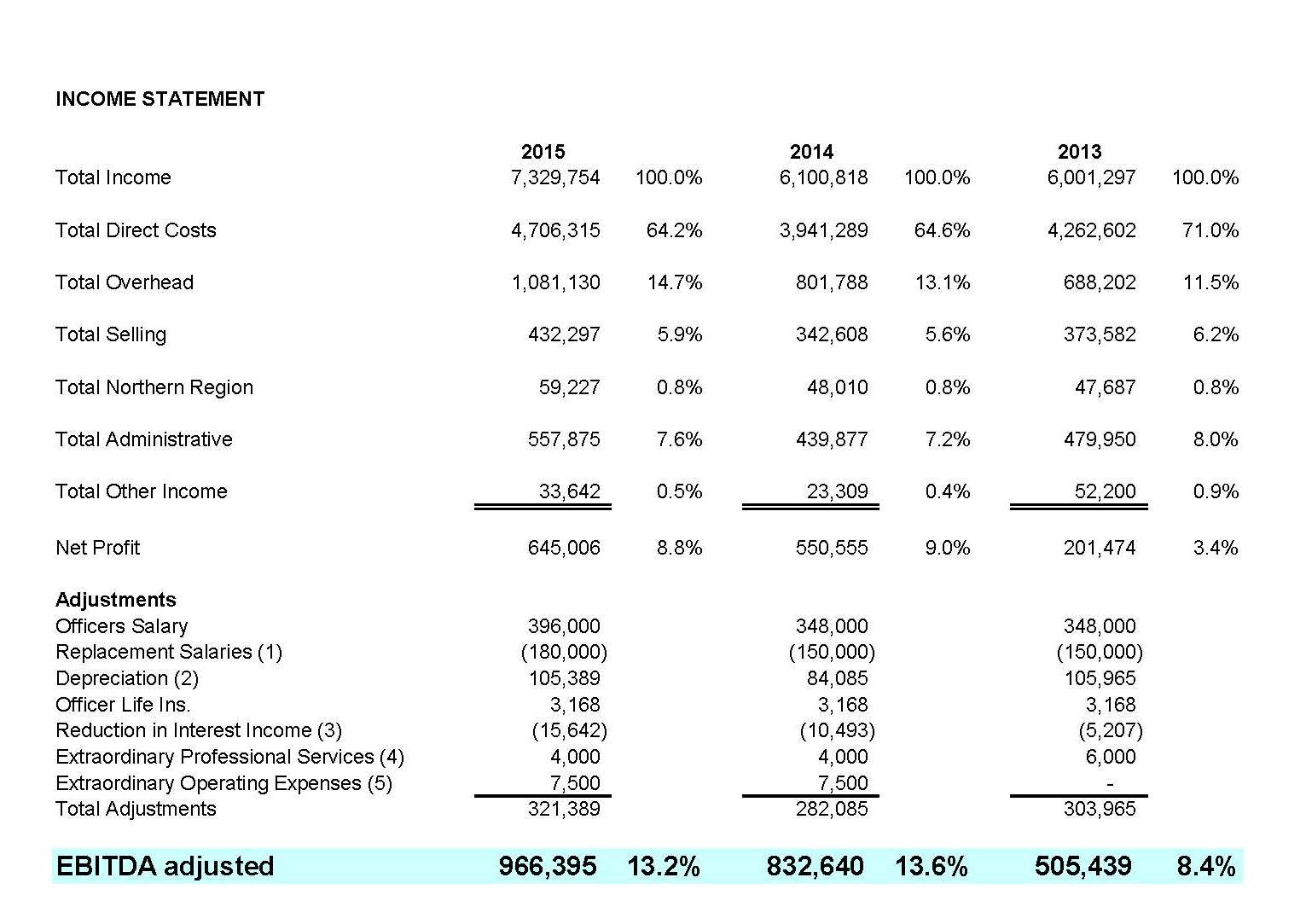

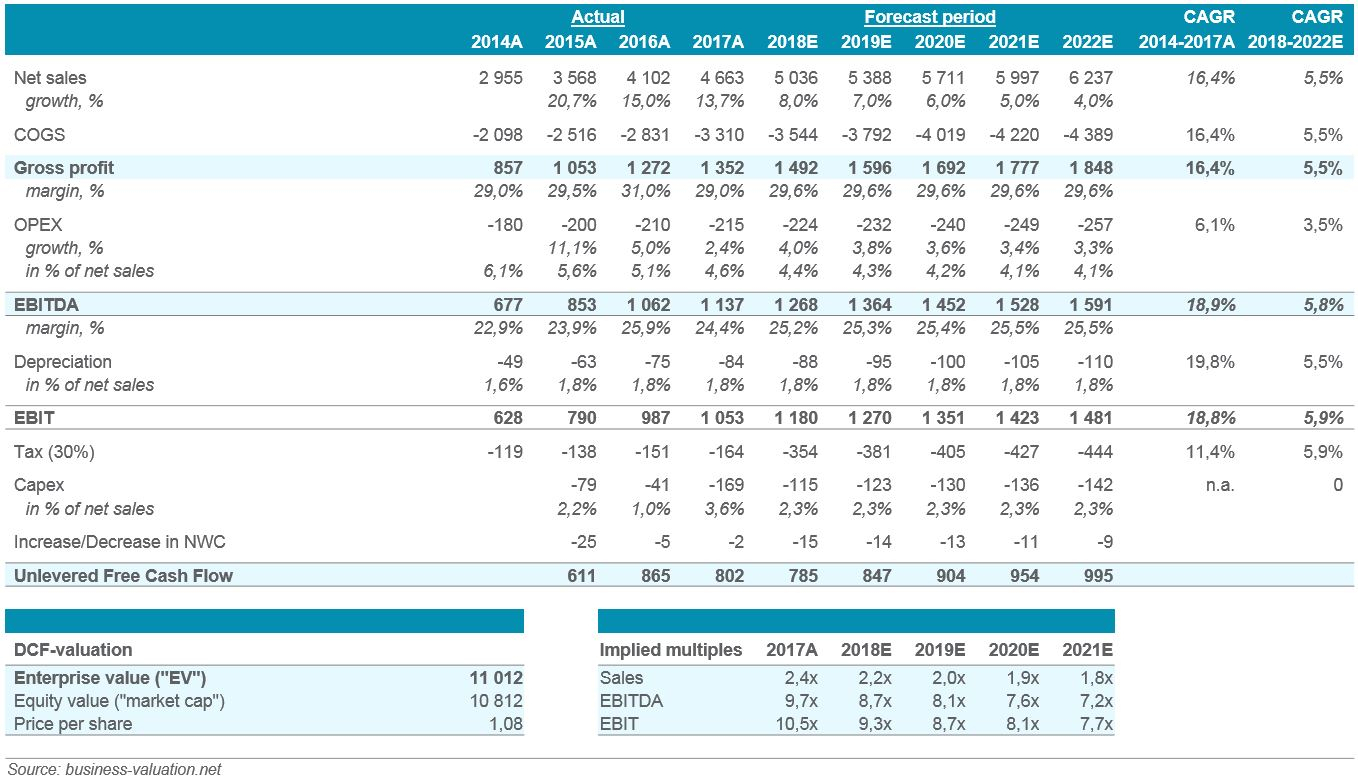

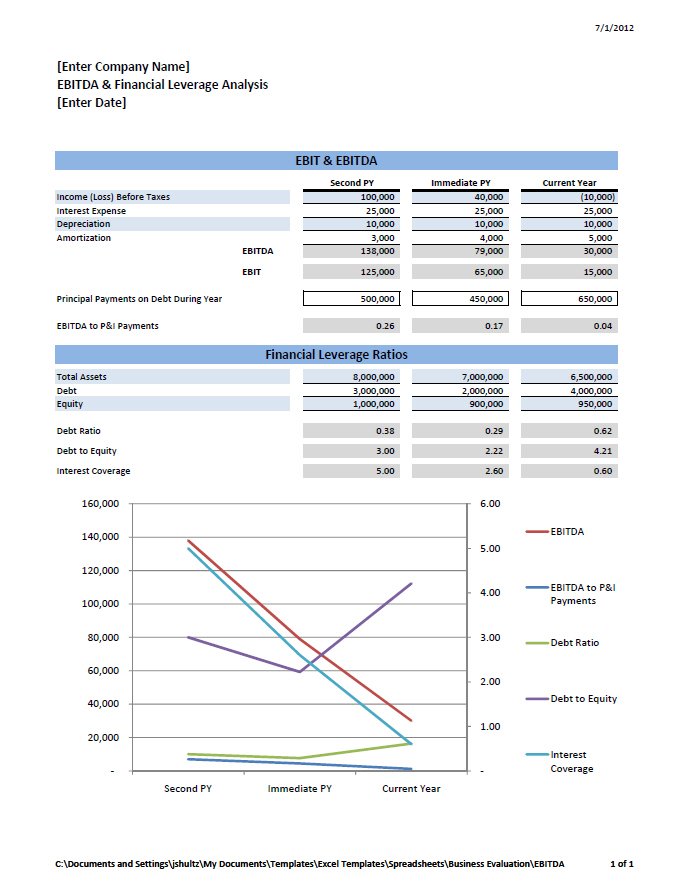

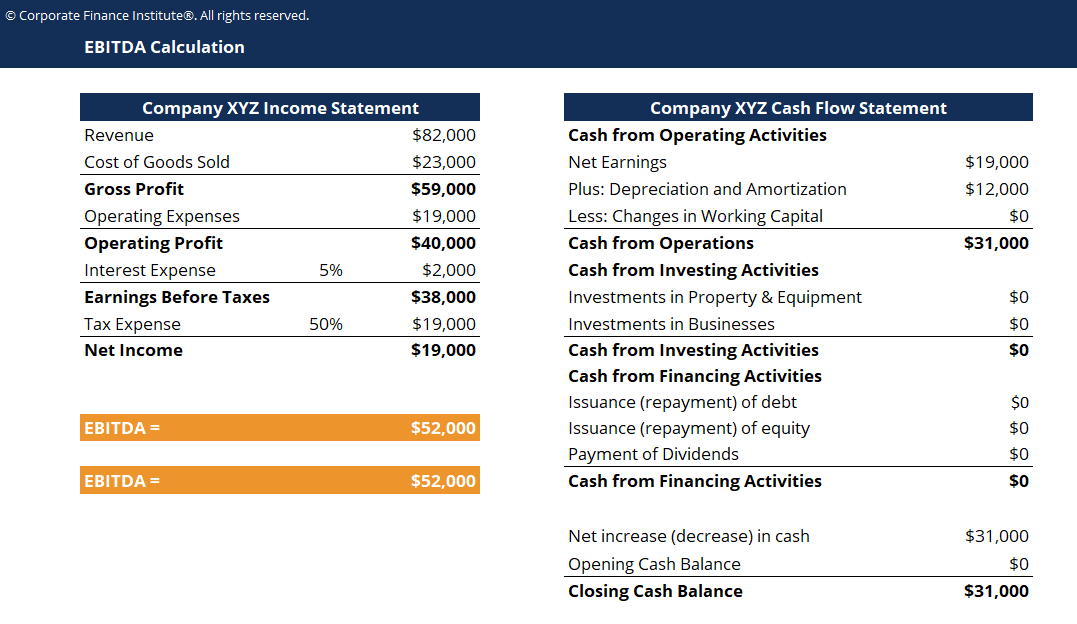

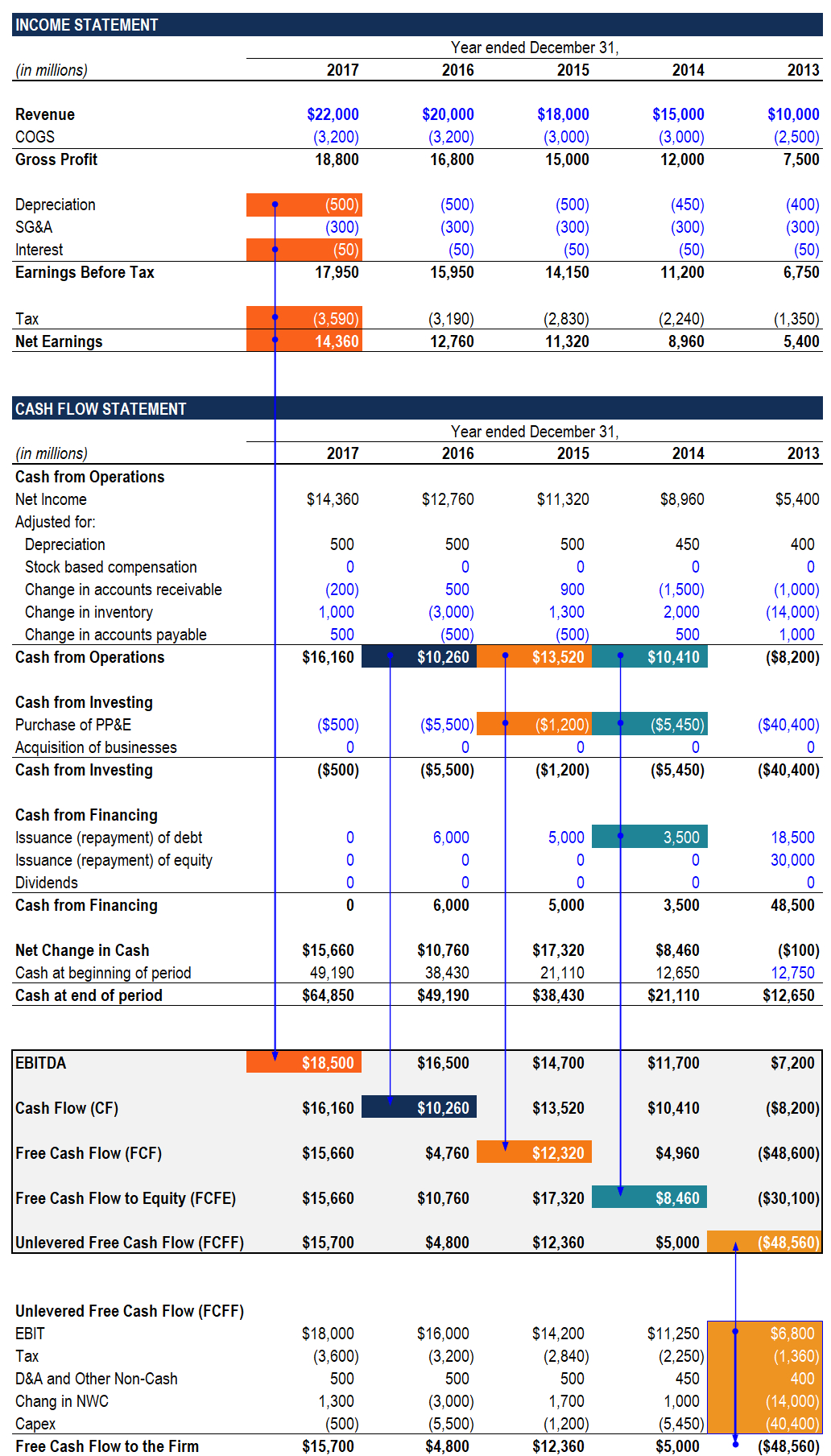

Ebitda Excel Template - Ebitda = $44b + $2b + $8b + $12b = $66 billion; The ebitda multiple is a financial. 1 min read in this article what is ebitda? This net debt/ebitda ratio template will show how to calculate the interest coverage ratio using the formula: When you’re ready to take a more detailed look at your. The first thing you need to do is to download the budget template. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. This ev/ebitda template guides you through the calculation of ev/ebitda using figures from an income statement. Below is a preview of. Web how to get started. When you’re ready to take a more detailed look at your. This ebitda multiple template helps you: This ev/ebitda template guides you through the calculation of ev/ebitda using figures from an income statement. The ebitda multiple is a financial. Web excel templates the excel templates on this page will help you in preparing your business for a sale. 1 min read in this article what is ebitda? This ebitda multiple template helps you: Compare your company valuation with other comparable businesses. Here is a preview of the ebitda margin template:. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. 1 min read in this article what is ebitda? E arnings b efore i nterest and t. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. Web download template ev/ebitda template key features the multiple is independent of the capital structure (i.e. Definition, formula, and examples [+ excel. This ev/ebitda template guides you through the calculation of ev/ebitda using figures from an income statement. Definition, formula, and examples [+ excel template] 30.apr.2020. It includes the key documents required for a financial due diligence (e.g., a. Compare your company valuation with other comparable businesses. Calculate the value of your business. With the template, you analyze and compare budgets and performance across. I like this free personal budget template from. Web our free adjusted ebitda template and adjusted income statement example are designed to help you visualize and present your financial adjustments. Web download template ev/ebitda template key features the multiple is independent of the capital structure (i.e. Definition, formula, and. Web this ebitda excel template helps you quickly and easily calculate earnings before interest, taxes, depreciation, and amortization (ebitda) for your company. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. 1 min read in this article what is ebitda? Calculate the value of your business. Web how. Web download the free template enter your name and email in the form below and download the free template now! I like this free personal budget template from. The ebitda multiple is a financial. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. Below is a preview of. The ebitda multiple is a financial. Below is a preview of. Here is a preview of the ebitda margin template:. It includes the key documents required for a financial due diligence (e.g., a. Web excel templates the excel templates on this page will help you in preparing your business for a sale. Compare your company valuation with other comparable businesses. This net debt/ebitda ratio template will show how to calculate the interest coverage ratio using the formula: The ebitda multiple is a financial. Calculate the value of your business. Below is a preview of. Web you can use the below adjusted ebitda calculation worksheet to get a rough estimate of your company’s current ebitda. Below is a preview of. The mixture of debt and equity). Ebitda = $44b + $2b + $8b + $12b = $66 billion; Web this ebitda margin template shows you how to calculate ebitda margin using revenue amounts and ebitda. I like this free personal budget template from. Below is a preview of. Web this ebitda multiple template helps you find out the ebitda multiple given the line items for determining the enterprise value. This ebitda multiple template helps you: Web our free adjusted ebitda template and adjusted income statement example are designed to help you visualize and present your financial adjustments. Web this ebitda margin template shows you how to calculate ebitda margin using revenue amounts and ebitda. Web you can use the below adjusted ebitda calculation worksheet to get a rough estimate of your company’s current ebitda. Ebitda = $44b + $2b + $8b + $12b = $66 billion; 1 min read in this article what is ebitda? With the template, you analyze and compare budgets and performance across. Compare your company valuation with other comparable businesses. The ebitda multiple is a financial. This ev/ebitda template guides you through the calculation of ev/ebitda using figures from an income statement. Definition, formula, and examples [+ excel template] 30.apr.2020. Web net debt/ebitda ratio template. The mixture of debt and equity). It includes the key documents required for a financial due diligence (e.g., a. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. Web this ebitda excel template helps you quickly and easily calculate earnings before interest, taxes, depreciation, and amortization (ebitda) for your company. E arnings b efore i nterest and t. When you’re ready to take a more detailed look at your. Web excel templates the excel templates on this page will help you in preparing your business for a sale. Here is a preview of the ebitda margin template:. With the template, you analyze and compare budgets and performance across. Microsoft's 2020 ebitda stands at roughly $66 billion. The ebitda multiple is a financial. The first thing you need to do is to download the budget template. This ebitda multiple template helps you: Below is a preview of. Web how to get started. Web download the free template enter your name and email in the form below and download the free template now! E arnings b efore i nterest and t. This net debt/ebitda ratio template will show how to calculate the interest coverage ratio using the formula: Web download template ev/ebitda template key features the multiple is independent of the capital structure (i.e. Web ebitda = net income + interest expenses + corporate income taxes + depreciation and amortization of fixed and intangible assets. I like this free personal budget template from.EBITDA.xls Earnings Before Interest Debt Free 30day Trial Scribd

Ebitda Valuation Spreadsheet Google Spreadshee ebitda valuation

Ebitda Valuation Spreadsheet —

Ebitda Valuation Spreadsheet Google Spreadshee ebitda valuation

desesperación Misericordioso Permanentemente plantilla excel para

How Do I Calculate an EBITDA Margin Using Excel?

EBITDA Template Download Free Excel Template

The Ebit Excel Dashboard Report Is An Update Of Another Of The Original

Is there a way to format the P&L report to have an EBITDA line and have

How To Find Ebitda On Financial Statements Haiper

Web This Ebitda Excel Template Helps You Quickly And Easily Calculate Earnings Before Interest, Taxes, Depreciation, And Amortization (Ebitda) For Your Company.

Download The Excel Budget Template.

Web Net Debt/Ebitda Ratio Template.

Web This Ebitda Margin Template Shows You How To Calculate Ebitda Margin Using Revenue Amounts And Ebitda.

Related Post: