Financial Advisor Succession Plan Template

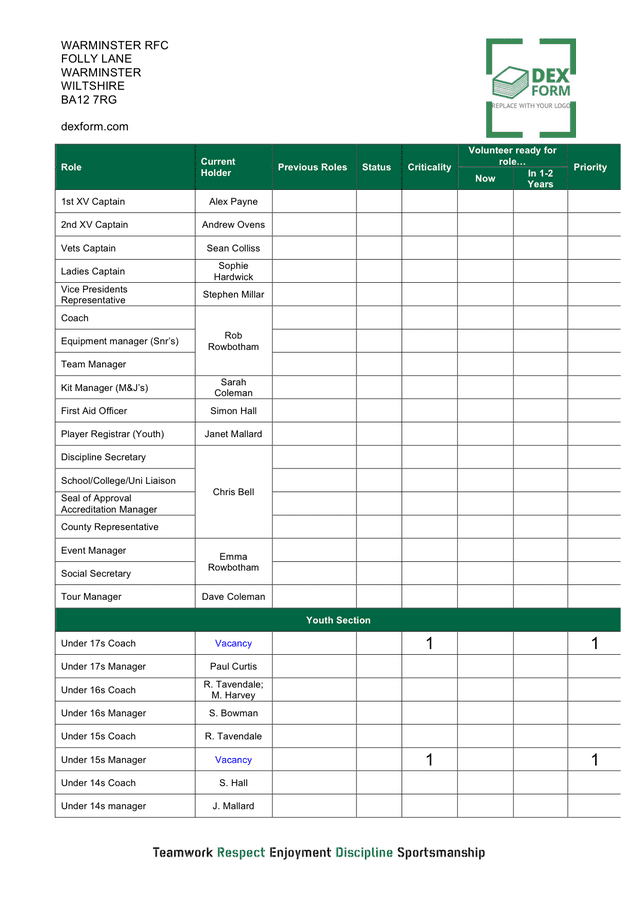

Financial Advisor Succession Plan Template - Here’s what you should consider. Web every financial advisor succession plan is different and the kind of documents that you need will depend heavily on two major factors: | 6 succession planning tips for advisors the best way to achieve a successful outcome is to reduce the risk that unexpected events could derail your plans. Ad browse & discover thousands of book titles, for less. This could be due to retirement, death, or disability. Web a financial advisor succession plan is a document that outlines how your financial advisory business will be passed on to another financial advisor if you’re no longer able to work. 20% of advisors don’t want to deal with succession planning at all, and they So what should you incorporate into your financial advisor. Ad fisher investments tailors your financial plan to your goals with your interests first. A bonus succession planning toolkit, with fillable templates. A bonus succession planning toolkit, with fillable templates. Web given the broad nature of the affiliation models available to financial professionals, advisor growth strategies has provided insight that is specific and intended to be applicable to most investment professionals seeking a framework to develop a strategic succession plan. Web a financial advisor succession plan is a document that outlines how. Ad browse & discover thousands of book titles, for less. Succession planning for financial advisors. Succession planning is an expected, scheduled transition out of. If you are selling parts of your book to multiple advisors, you’ll need to create paperwork for each one of those sales. Building an enduring business (a review) david grau sr. Your succession planning is a part of your estate planning checklist as a financial advisor. Succession planning for financial advisors. Most financial advisors without a succession plan intend on creating one at some point in the future. Ad access tailored resources, optimize your business, learn from industry leaders. It involves identifying and grooming potential successors, addressing client concerns, and ensuring. Most financial advisors without a succession plan intend on creating one at some point in the future. Your succession planning is a part of your estate planning checklist as a financial advisor. Web succession planning is a strategy used to identify then develop future leaders in your company at all levels. 29% of advisors have started their succession planning process,. Ad fisher investments tailors your financial plan to your goals with your interests first. The three succession plans every advisor needs. Web a financial advisor succession plan is a strategy to pass ownership of a practice to another advisor. How to evaluate your succession options. Web every financial advisor succession plan is different and the kind of documents that you. How to evaluate your succession options. Here are the steps in this process: Essential components of a succession plan. Web the time to start figuring out your succession plan is now. Investment advice offered through ak financial group, a registered investment advisor and separate entity from lpl financial. If you are selling parts of your book to multiple advisors, you’ll need to create paperwork for each one of those sales. Here are the steps in this process: This could be due to retirement, death, or disability. Building an enduring business (a review) david grau sr. Tap into objective perspectives from leading business practitioners. Web while advisors are often challenged to make succession planning a priority, getting started on a sound plan is clearly in the best interest of the firm’s owners, its employees and its clients. Web a financial advisor succession plan is a strategy to pass ownership of a practice to another advisor. Ad compare your matched advisors for fees, specialties and. Essential components of a succession plan. Fisher investments clients receive personalized service dedicated to their needs. John wiley & sons, inc. This could be due to retirement, death, or disability. Web succession planning is a strategy used to identify then develop future leaders in your company at all levels. Web the time to start figuring out your succession plan is now. Tap into objective perspectives from leading business practitioners. Web succession planning for financial advisors: Join finra staff and industry panelists as they discuss considerations for developing a succession plan that works for your business. Web succession planning is the process of identifying very important positions in the organization. This could be due to retirement, death, or disability. Web the time to start figuring out your succession plan is now. Web a financial advisor succession plan is a strategy to pass ownership of a practice to another advisor. Six actionable steps to build your succession plan. Here are the steps in this process: If you are selling parts of your book to multiple advisors, you’ll need to create paperwork for each one of those sales. 29% of advisors have started their succession planning process, but are encountering difficulties implementing it. Schedule a call with a vetted & certified financial advisor today. Web we've included the guidance you need, including: Web a financial advisor succession plan is a document that outlines how your financial advisory business will be passed on to another financial advisor if you’re no longer able to work. Web march 5, 2021, at 4:22 p.m. Web succession planning for financial advisors: A good succession plan reduces unhealthy dependencies on key team members, which in Ad access tailored resources, optimize your business, learn from industry leaders. 32% of advisors have put off the task of succession planning, even though they believe it’s important. The three succession plans every advisor needs. Succession planning is an expected, scheduled transition out of. Ad browse & discover thousands of book titles, for less. Building an enduring business (a review) david grau sr. Succession planning for financial advisors. So what should you incorporate into your financial advisor. Building an enduring business (a review) david grau sr. Six actionable steps to build your succession plan. Web march 5, 2021, at 4:22 p.m. The benefits can be far reaching, including: Web succession planning is the process of identifying very important positions in the organization and creating a talent pipeline, by preparing employees to fill vacancies in their organization as others retire or move on. John wiley & sons, inc. Web while advisors are often challenged to make succession planning a priority, getting started on a sound plan is clearly in the best interest of the firm’s owners, its employees and its clients. Here’s what you should consider. Ad compare your matched advisors for fees, specialties and more. Web succession planning is a strategy used to identify then develop future leaders in your company at all levels. A bonus succession planning toolkit, with fillable templates. 32% of advisors have put off the task of succession planning, even though they believe it’s important. Web a succession plan is vital to ensuring the continued success of your firm. How you are selling your business. It involves identifying and grooming potential successors, addressing client concerns, and ensuring regulatory compliance throughout the transition.Succession Planning Ms Excel Template Excel Templates

Business Succession Planning Template Lovely Bank Management Succession

Succession Planning Template download free documents for PDF, Word

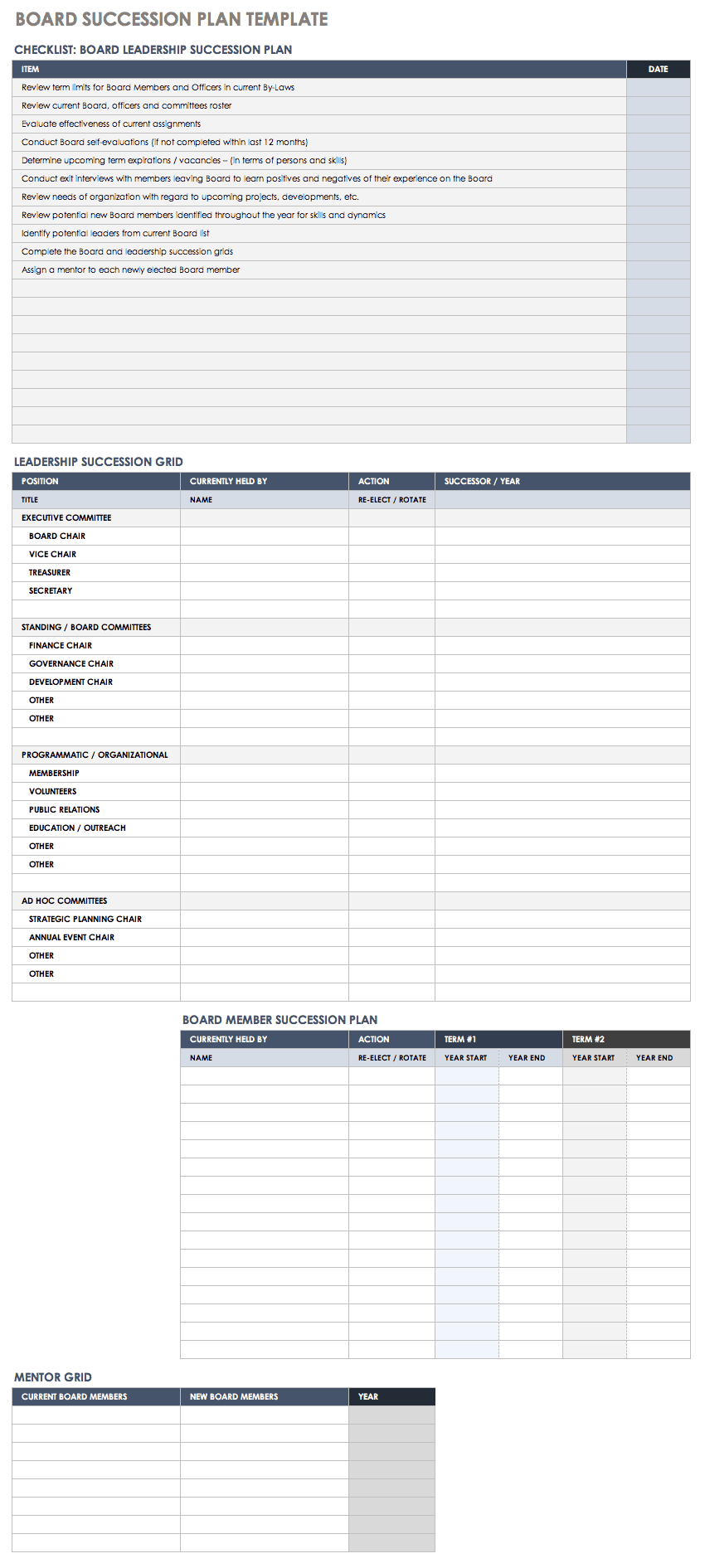

Free Succession Planning Templates Smartsheet intended for Report To

Power Of Attorney Wa Pdf

Free Succession Planning Templates Smartsheet

Simple Succession Plan Template Unique Bank Management Succession Plan

Free Succession Planning Templates Smartsheet (2022)

5+ sample succession planning template Template Business PSD, Excel

Succession Planning For Financial Advisors Pdf Houses For Rent Near Me

Succession Planning For Financial Advisors.

Web The Time To Start Figuring Out Your Succession Plan Is Now.

Fisher Investments Clients Receive Personalized Service Dedicated To Their Needs.

Integrate Book Keeping With All Your Operations To Avoid Double Entry.

Related Post: