Form 1120 Excel Template

Form 1120 Excel Template - Get ready for tax season deadlines by completing any required tax forms today. Web some c corporation tax returns are simple and routine with few complexities. Web this feature allows you to import data into drake tax from a trial balance worksheet. Corporation income tax return, including recent. Complete, edit or print tax forms instantly. Web net income (loss) reconciliation for corporations with total assets of $10 million or. Web form 1120 department of the treasury internal revenue service u.s. Complete, edit or print tax forms instantly. Form 1120(s) = taxable income (s. Web send form 1120 excel via email, link, or fax. Corporation income tax return, including recent. Complete, edit or print tax forms instantly. Web use a form 1120 2022 template to make your document workflow more streamlined. Web up to $40 cash back the form 1120 excel template is a spreadsheet format designed to. Web read the following instructions to use cocodoc to start editing and finalizing your form. Form 1120(s) = taxable income (s. Web information about form 1120, u.s. Web nov 29, 2022 · 545.5 kb download section exclusive resource available a tax. Web this feature allows you to import data into drake tax from a trial balance worksheet. Web some c corporation tax returns are simple and routine with few complexities. Web up to $40 cash back the form 1120 excel template is a spreadsheet format designed to. Web send form 1120 excel via email, link, or fax. Web use a form 1120 excel template template to make your document workflow more. Get ready for tax season deadlines by completing any required tax forms today. Web net income (loss) reconciliation for. Complete, edit or print tax forms instantly. Web form 1120 department of the treasury internal revenue service u.s. Web information about form 1120, u.s. Web nov 29, 2022 · 545.5 kb download section exclusive resource available a tax. You can also download it, export it or print it. Web if you are looking about fill and create a form 1120 excel template, heare are the. Web nov 29, 2022 · 545.5 kb download section exclusive resource available a tax. Web read the following instructions to use cocodoc to start editing and finalizing your form. Complete, edit or print tax forms instantly. Web send form 1120 excel via email,. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web form 1120 (2017) page 3 schedule j tax computation and payment (see instructions). Web form 1120 department of the treasury internal revenue service u.s. (worksheet) department of the treasury internal revenue service. Web form 1120 = taxable income (corporation); Web this feature allows you to import data into drake tax from a trial balance worksheet. Complete, edit or print tax forms instantly. Web send form 1120 excel via email, link, or fax. Web some c corporation tax returns are simple and routine with few complexities. Web send form 1120 excel via email, link, or fax. Web use a form 1120 2022 template to make your document workflow more streamlined. Complete, edit or print tax forms instantly. Corporation income tax return, including recent. Web nov 29, 2022 · 545.5 kb download section exclusive resource available a tax. Form 1120(s) = taxable income (s. Web send form 1120 excel via email, link, or fax. Complete, edit or print tax forms instantly. Web if you are looking about fill and create a form 1120 excel template, heare are the. Web some c corporation tax returns are simple and routine with few complexities. Web form 1120 = taxable income (corporation); Web if you are looking about fill and create a form 1120 excel template, heare are the. Web net income (loss) reconciliation for corporations with total assets of $10 million or. Web form 1120 (2017) page 3 schedule j tax computation and payment (see instructions). Complete, edit or print tax forms instantly. Web nov 29, 2022 · 545.5 kb download section exclusive resource available a tax. Web if you are looking about fill and create a form 1120 excel template, heare are the. Get ready for tax season deadlines by completing any required tax forms today. Web read the following instructions to use cocodoc to start editing and finalizing your form. Web this feature allows you to import data into drake tax from a trial balance worksheet. Complete, edit or print tax forms instantly. Web use a form 1120 2022 template to make your document workflow more streamlined. (worksheet) department of the treasury internal revenue service. Corporation income tax return, including recent. Web send form 1120 excel via email, link, or fax. Web net income (loss) reconciliation for corporations with total assets of $10 million or. Web up to $40 cash back the form 1120 excel template is a spreadsheet format designed to. Complete, edit or print tax forms instantly. Web form 1120 department of the treasury internal revenue service u.s. Web information about form 1120, u.s. Web use a form 1120 excel template template to make your document workflow more. Web form 1120 (2017) page 3 schedule j tax computation and payment (see instructions). Web form 1120 = taxable income (corporation); You can also download it, export it or print it. Web some c corporation tax returns are simple and routine with few complexities. Complete, edit or print tax forms instantly. Web this feature allows you to import data into drake tax from a trial balance worksheet. Web information about form 1120, u.s. (worksheet) department of the treasury internal revenue service. Web use a form 1120 excel template template to make your document workflow more. Complete, edit or print tax forms instantly. Web if you are looking about fill and create a form 1120 excel template, heare are the. Web up to $40 cash back the form 1120 excel template is a spreadsheet format designed to. Corporation income tax return, including recent. Web form 1120 (2017) page 3 schedule j tax computation and payment (see instructions). Web form 1120 department of the treasury internal revenue service u.s. Web net income (loss) reconciliation for corporations with total assets of $10 million or. Web use a form 1120 2022 template to make your document workflow more streamlined. Web nov 29, 2022 · 545.5 kb download section exclusive resource available a tax. Web form 1120 = taxable income (corporation); Web read the following instructions to use cocodoc to start editing and finalizing your form.Form 1120L (Schedule M3) Net Reconciliation for U.S. Life

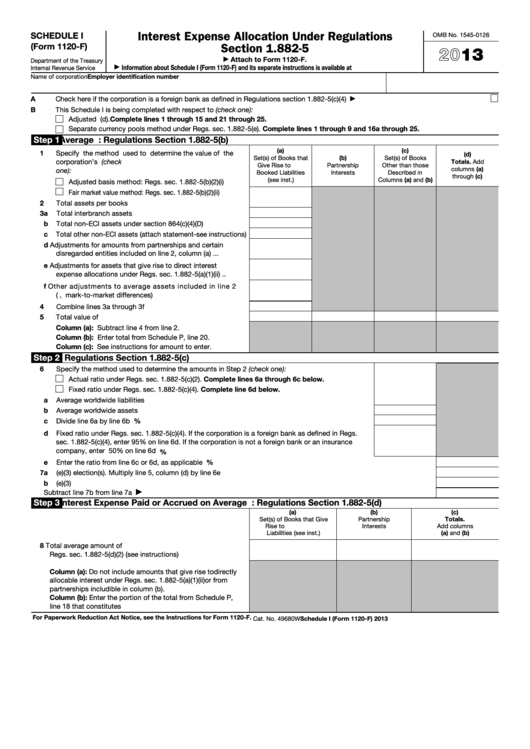

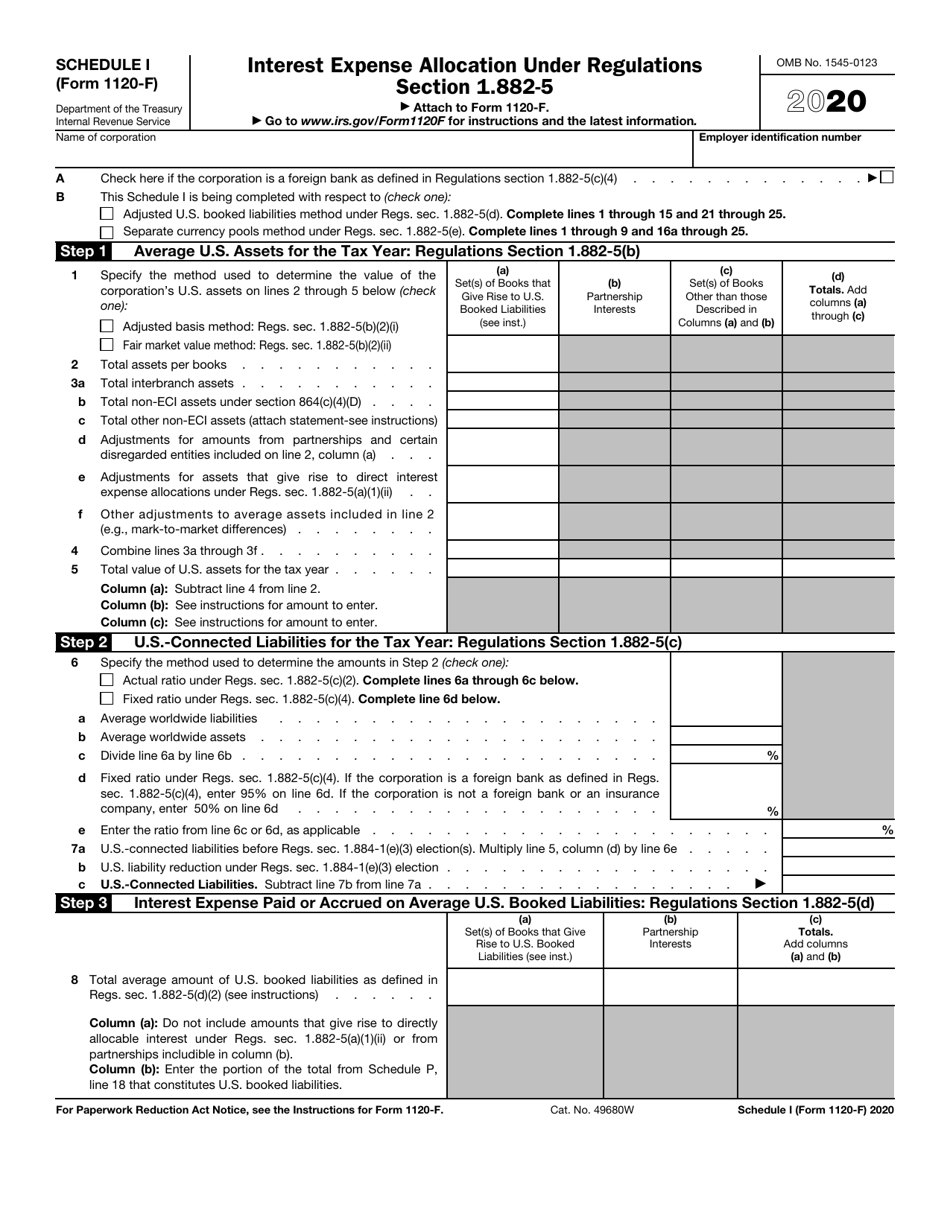

Fillable Schedule I (Form 1120F) Interest Expense Allocation Under

U.S Corporation Tax Return, Form 1120 Meru Accounting

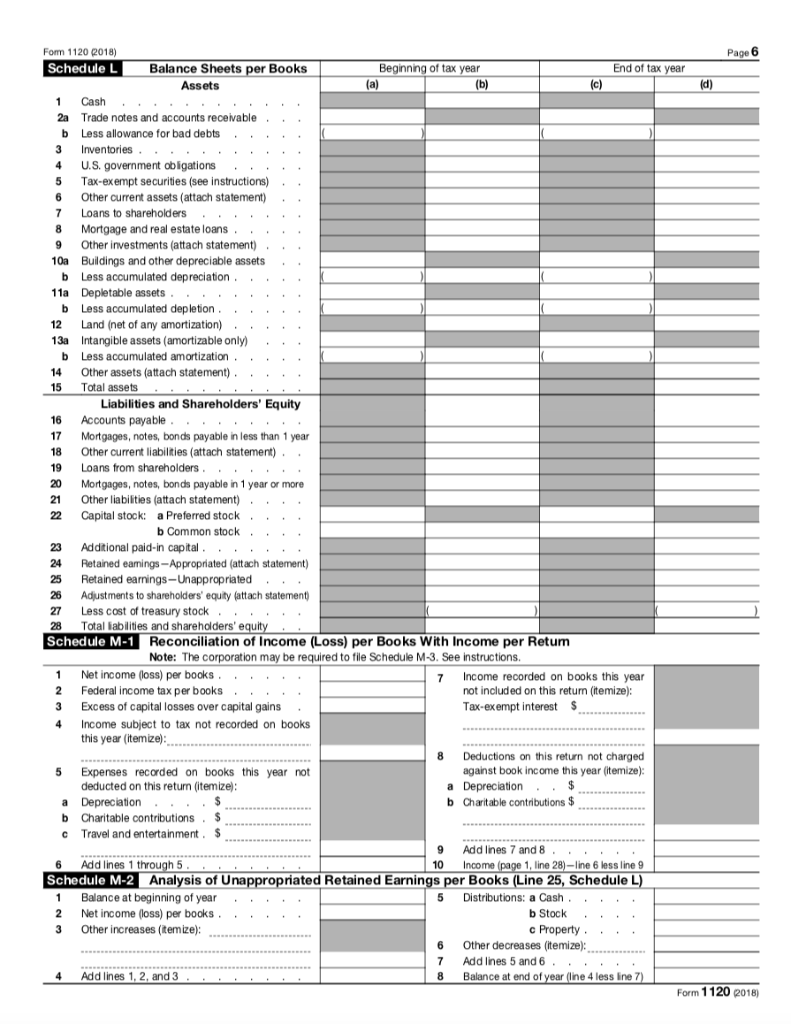

Schedule L 1120 Fill Out and Sign Printable PDF Template signNow

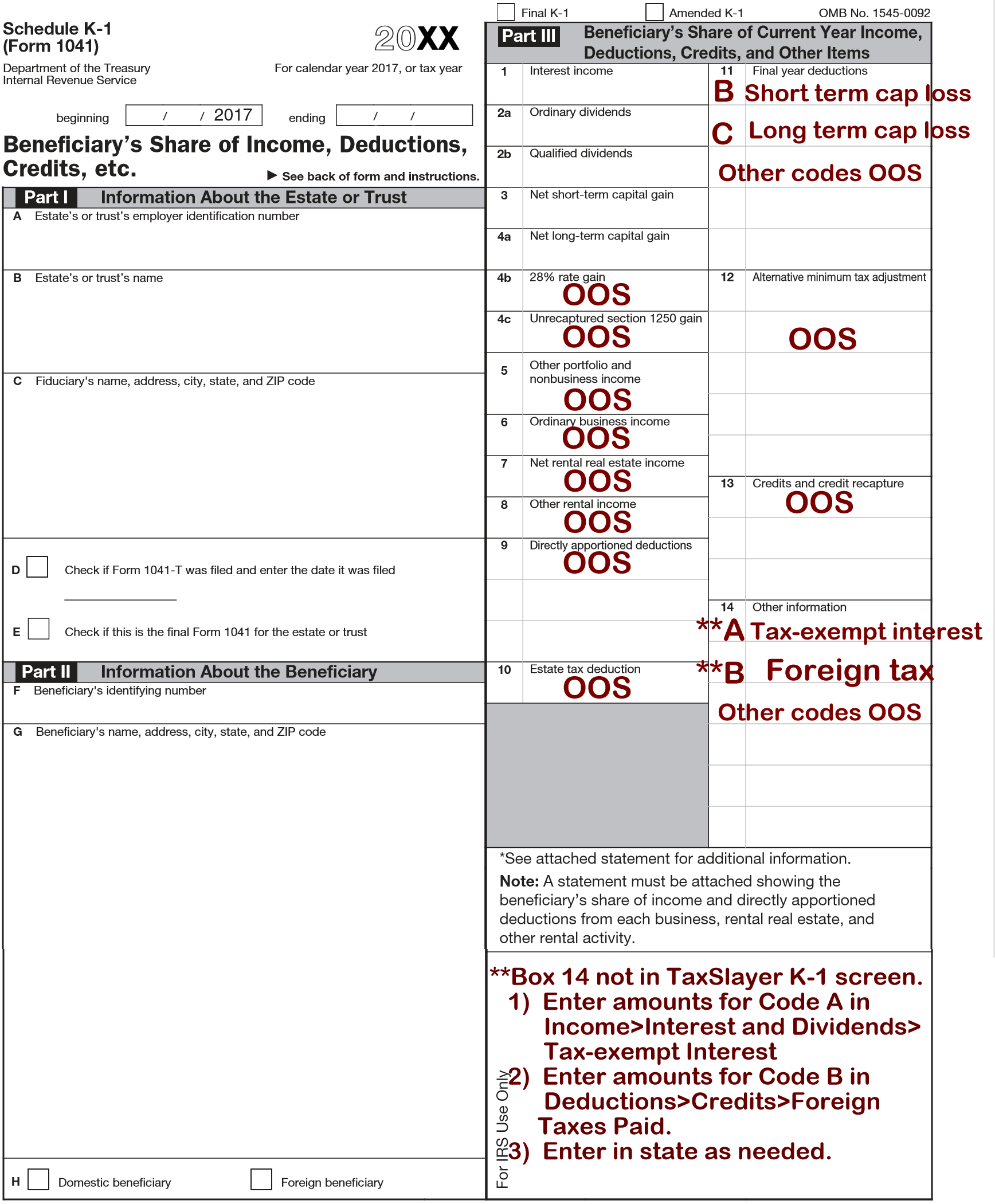

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

INVESTOR INFORAMTION First Name Last Name Anderson

Irs Form 1120 Excel Template Budget For Business Excel Template

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

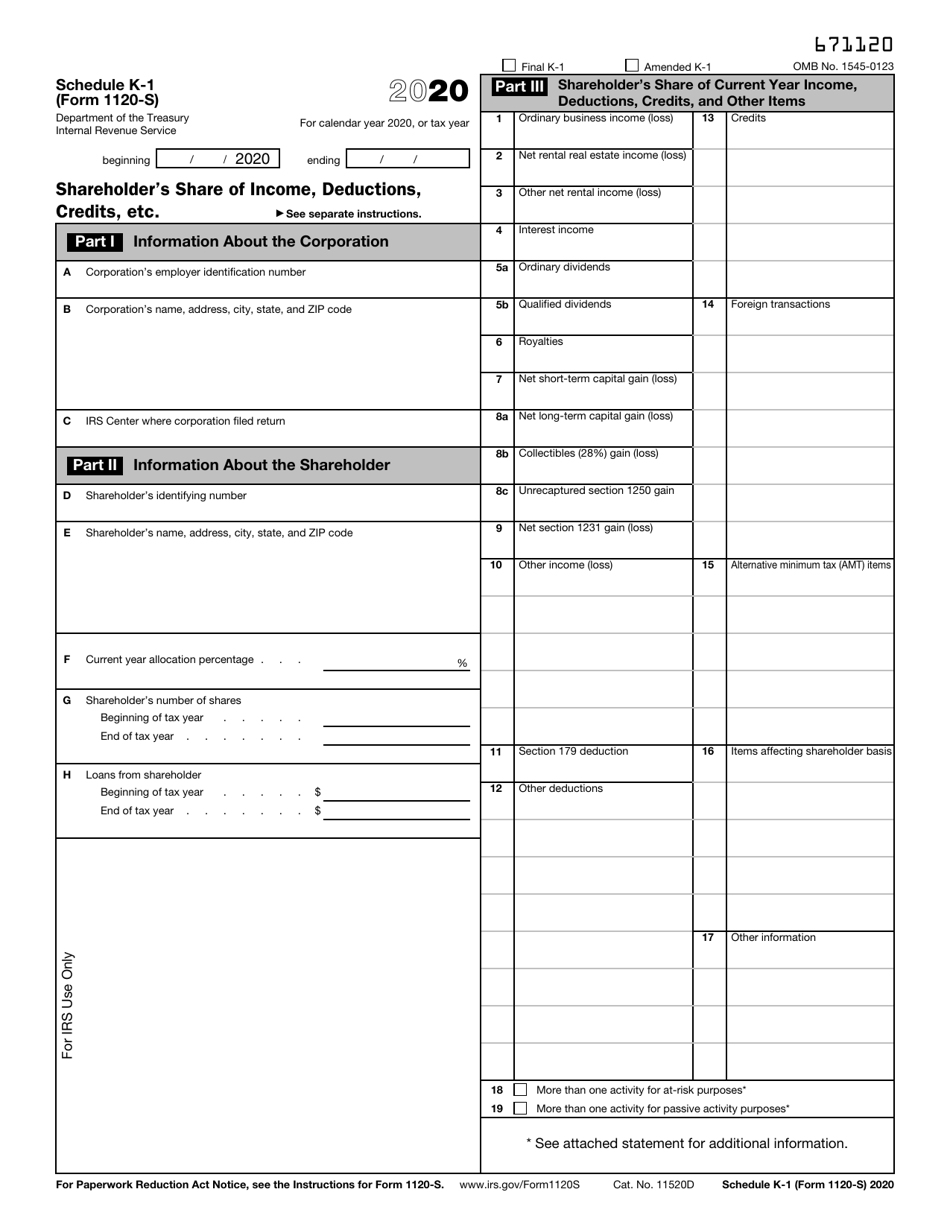

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

IRS Form 1120F Schedule I Download Fillable PDF or Fill Online

Web Send Form 1120 Excel Via Email, Link, Or Fax.

You Can Also Download It, Export It Or Print It.

Web Some C Corporation Tax Returns Are Simple And Routine With Few Complexities.

Form 1120(S) = Taxable Income (S.

Related Post: