Free Blank Promissory Note Template

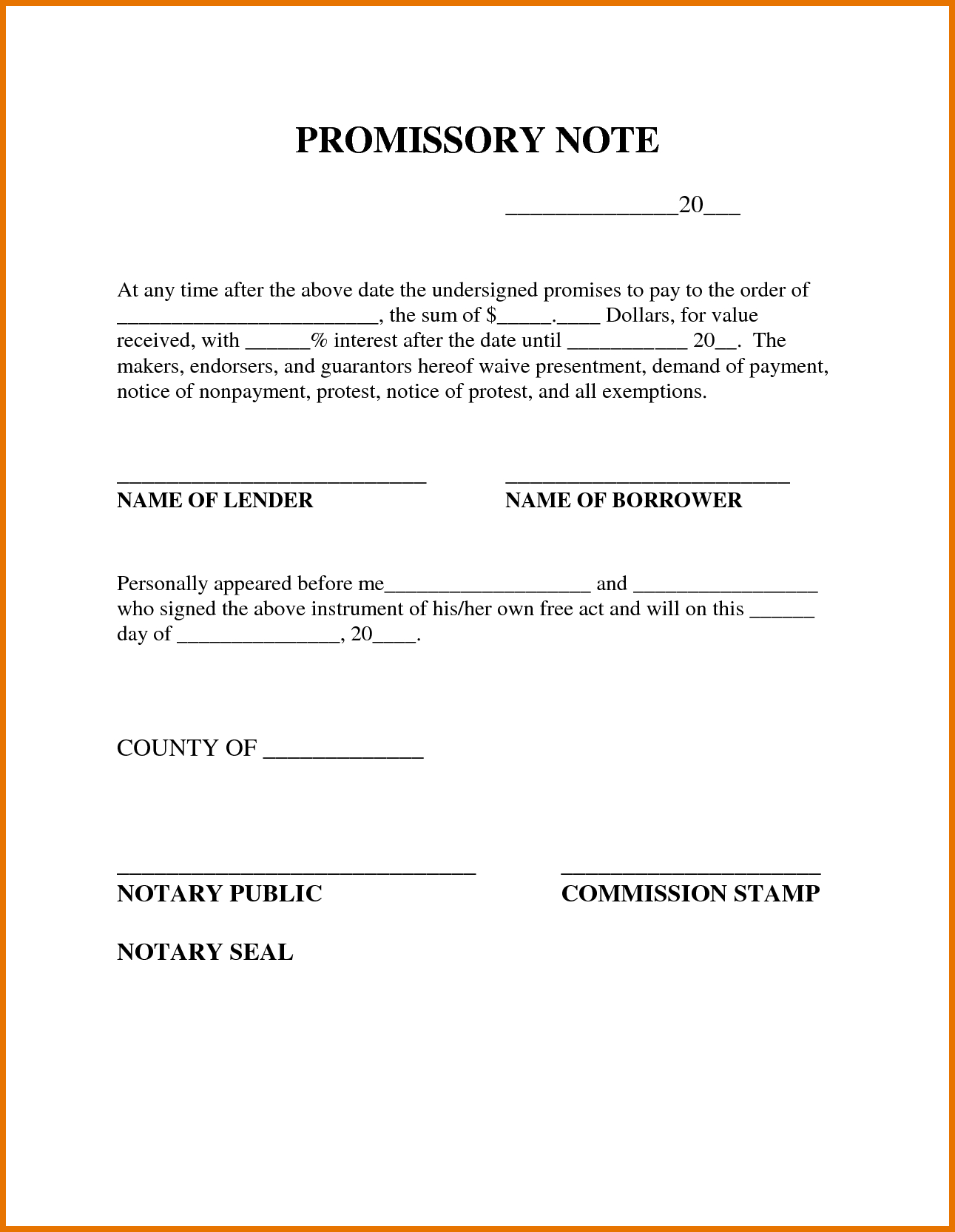

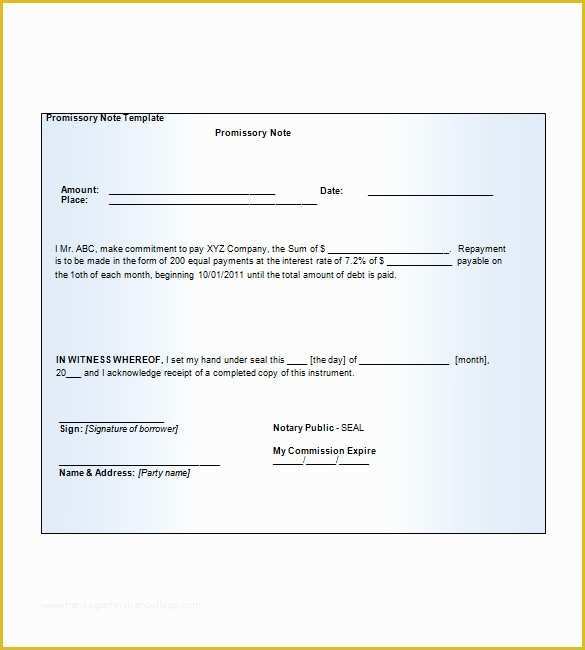

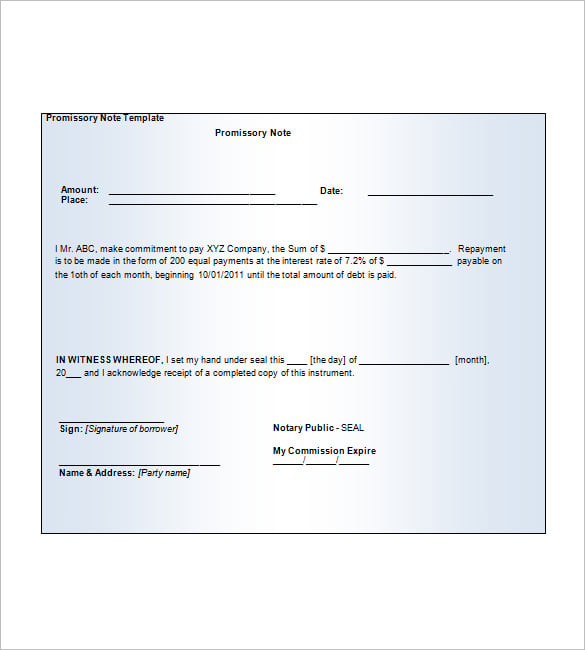

Free Blank Promissory Note Template - If the borrower offers collateral as security for loan repayment, the note is considered “secured”; Web terms of this note. Web a blank promissory note is a written document that gives the borrower’s intention of paying some specified amount of money to the lender at a given indicated time though it does. Web the difference is whether there is collateral. Web select a free printable promissory note in pdf format from the template list. Web get started so, what goes into a promissory note: Web this note shall be: Create a free account and fill out customized templates for free. If no collateral is required, the note is. Use our promissory note template to detail the terms of loan repayment. Web terms of this note. Web select a free printable promissory note in pdf format from the template list. Web this note shall be: If the borrower offers collateral as security for loan repayment, the note is considered “secured”; Web up to $40 cash back finally, add the current date and sign the document. Updated july 3, 2023 | legally reviewed. Web the difference is whether there is collateral. Web free promissory note template. Web get started so, what goes into a promissory note: Use our promissory note template to detail the terms of loan repayment. The borrower executes this note as a principal and not as a surety. Web terms of this note. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). Web promissory note forms and templates | download free legal documents. Create a free account and fill out. Web the difference is whether there is collateral. Web promissory notes are legal documents outlining a promise to pay a specific sum of money by a specific time. Web up to $40 cash back finally, add the current date and sign the document. Web a blank promissory note is a written document that gives the borrower’s intention of paying some. Web select a free printable promissory note in pdf format from the template list. Web the difference is whether there is collateral. Web how to write an unsecured promissory note. Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the.. Ad fill out your form in minutes with our template builder. Enter all the required information in the appropriate fields on the blank form. Web get started so, what goes into a promissory note: If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower.. Web select a free printable promissory note in pdf format from the template list. Web terms of this note. Web up to $40 cash back finally, add the current date and sign the document. Updated july 3, 2023 | legally reviewed. Ad 1) fill out promissory note template 2) print & download, start by 2/15 Write your signature with a mouse or touchpad. There shall be no security provided in this note. Web promissory note templates it's common for students to pay a loan for a school tuition and for professionals to settle a payment for a real estate mortgage. There should be an unconditional and. Web a blank promissory note is a written document. Updated july 3, 2023 | legally reviewed. Who needs to understand and sign know the names and contact info of the borrower, lender, and guarantor (if there is one). It's quick, easy, & 100% free! Lawdepot.com has been visited by 100k+ users in the past month These documents contain terms and conditions related. If no collateral is required, the note is. Use our promissory note template to detail the terms of loan repayment. There should be an unconditional and. Web how to write an unsecured promissory note. Updated july 3, 2023 | legally reviewed. Draft a promissory note to formalize and secure a loan. Web promissory note template. Web select a free printable promissory note in pdf format from the template list. There should be an unconditional and. It's quick, easy, & 100% free! Ad fill out your form in minutes with our template builder. Web how to write an unsecured promissory note. Ad 1) fill out promissory note template 2) print & download, start by 2/15 Write your signature with a mouse or touchpad. You can also type your full name and select a. Who needs to understand and sign know the names and contact info of the borrower, lender, and guarantor (if there is one). Web terms of this note. There shall be property to secure this note described as:. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. If the borrower offers collateral as security for loan repayment, the note is considered “secured”; Use our promissory note template to detail the terms of loan repayment. Web up to $40 cash back finally, add the current date and sign the document. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). If no collateral is required, the note is. These documents contain terms and conditions related. Web get started so, what goes into a promissory note: If the borrower offers collateral as security for loan repayment, the note is considered “secured”; Web a secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the. Web promissory note forms and templates | download free legal documents. Web how to write an unsecured promissory note. Lawdepot.com has been visited by 100k+ users in the past month Web up to $40 cash back finally, add the current date and sign the document. Draft a promissory note to formalize and secure a loan. It's quick, easy, & 100% free! The borrower executes this note as a principal and not as a surety. Ad fill out your form in minutes with our template builder. Web terms of this note. Ad 1) fill out promissory note template 2) print & download, start by 2/15 The note is a written statement by the. Web download free printable promissory note templates that may be written in fillable adobe pdf (.pdf), ms word (.doc), and rich text format (.rtf). Who needs to understand and sign know the names and contact info of the borrower, lender, and guarantor (if there is one).45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Free Printable Promissory Note For Personal Loan Free Printable

Addictionary

Free Promissory Note Template Of Blank Promissory Note Template 12 Free

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

7+ Blank Promissory Note Free Sample, Example, Format Download!

Free Blank Printable Real Estate Promissory Note (WORD)

FREE 22+ Promissory Note Samples in Google Docs MS Word Apple Pages

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

You Can Also Type Your Full Name And Select A.

There Shall Be Property To Secure This Note Described As:.

Web The Difference Is Whether There Is Collateral.

Enter All The Required Information In The Appropriate Fields On The Blank Form.

Related Post:

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-01.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-40.jpg?w=395)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-26.jpg)