Free Printable Tax Deduction Worksheet

Free Printable Tax Deduction Worksheet - The source information that is required for each tax. Download this income tax worksheet aka income tax organizer to maximize your deductions and minimize errors and omissions. Federal section>deductions>itemized deductions>medical and dental expenses if mfs and. Easily fill out pdf blank, edit, and sign them. Use other worksheets on the following pages as applicable. Web the best home office deduction worksheet for excel [free template] a free home office deduction worksheet to automate your tax savings by jesus. Tax deductions for calendar year 2 0 ___ ___ marketing. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web first of all, when you run your own business, the irs lets you write off the majority of your expenses. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Number of regular withholding allowances. Save or instantly send your ready. Adjustments to your income this following items can help reduce the amount of your income that is taxed, which can increase your tax refund, or lower the. Note that if you. Church employee income, see instructions for how to report your income and the definition of. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Gusto.com has been visited by 10k+ users in the past month Save or instantly send your ready. Use other worksheets on the following pages as applicable. Qualified business income deduction (section 199a deduction) line 16. If too little is withheld, you will generally owe tax when you file. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Use other worksheets on the following pages as applicable. This means that you get to deduct your expenses from your. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web for your personal deductions we have prepared forms for you to fill out. Church employee income, see instructions for how to report your income and the definition of. Web use worksheet a for regular withholding allowances. Web download our free 2022 small. Save or instantly send your ready. Number of regular withholding allowances. Web first of all, when you run your own business, the irs lets you write off the majority of your expenses. Web small business worksheet client: The source information that is required for each tax. Use other worksheets on the following pages as applicable. Turbotax® is here to help file your taxes with confidence and ease. Adjustments to your income this following items can help reduce the amount of your income that is taxed, which can increase your tax refund, or lower the. Ad filing taxes is fast and easy with turbotax® free edition. Church. If too little is withheld, you will generally owe tax when you file. This means that you get to deduct your expenses from your. See if you qualify today. Save or instantly send your ready. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3. Web the best home office deduction worksheet for excel [free template] a free home office deduction worksheet to automate your tax savings by jesus. Web standard deduction worksheet for dependents—line 12; Web use the following tax deduction checklist when filing your annual return: Download this income tax worksheet aka income tax organizer to maximize your deductions and minimize errors and. Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Gusto.com has been visited by 10k+ users in the past month Web small business worksheet client: Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter. Turbotax® is here to help file your taxes with confidence and ease. Web use worksheet a for regular withholding allowances. Ad finally an accounting software you want to use, easy, beautiful. Church employee income, see instructions for how to report your income and the definition of. Use other worksheets on the following pages as applicable. Turbotax® is here to help file your taxes with confidence and ease. See if you qualify today. Adjustments to your income this following items can help reduce the amount of your income that is taxed, which can increase your tax refund, or lower the. Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. If too little is withheld, you will generally owe tax when you file. Ad finally an accounting software you want to use, easy, beautiful. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Web use the following tax deduction checklist when filing your annual return: Generate clear dynamic statements and get your reports, the way you like them. Tax deductions for calendar year 2 0 ___ ___ marketing. Web first of all, when you run your own business, the irs lets you write off the majority of your expenses. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Gusto.com has been visited by 10k+ users in the past month The source information that is required for each tax. Federal section>deductions>itemized deductions>medical and dental expenses if mfs and. Easily fill out pdf blank, edit, and sign them. Web for your personal deductions we have prepared forms for you to fill out. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. This means that you get to deduct your expenses from your. Web standard deduction worksheet for dependents—line 12; Web use the following tax deduction checklist when filing your annual return: Download this income tax worksheet aka income tax organizer to maximize your deductions and minimize errors and omissions. Save or instantly send your ready. Generate clear dynamic statements and get your reports, the way you like them. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Gusto.com has been visited by 10k+ users in the past month Web small business worksheet client: Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Ad filing taxes is fast and easy with turbotax® free edition. See if you qualify today. Web here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Federal section>deductions>itemized deductions>medical and dental expenses if mfs and. Web use worksheet a for regular withholding allowances. Adjustments to your income this following items can help reduce the amount of your income that is taxed, which can increase your tax refund, or lower the. If too little is withheld, you will generally owe tax when you file. This means that you get to deduct your expenses from your.Tax De Trucker Tax Deduction Worksheet Great Linear —

Tax Deductions Tax Deductions Worksheet —

️Safe Worksheet Free Download Goodimg.co

Alabama Federal Tax Deduction Worksheet

Free Printable Tax Deduction Worksheets

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

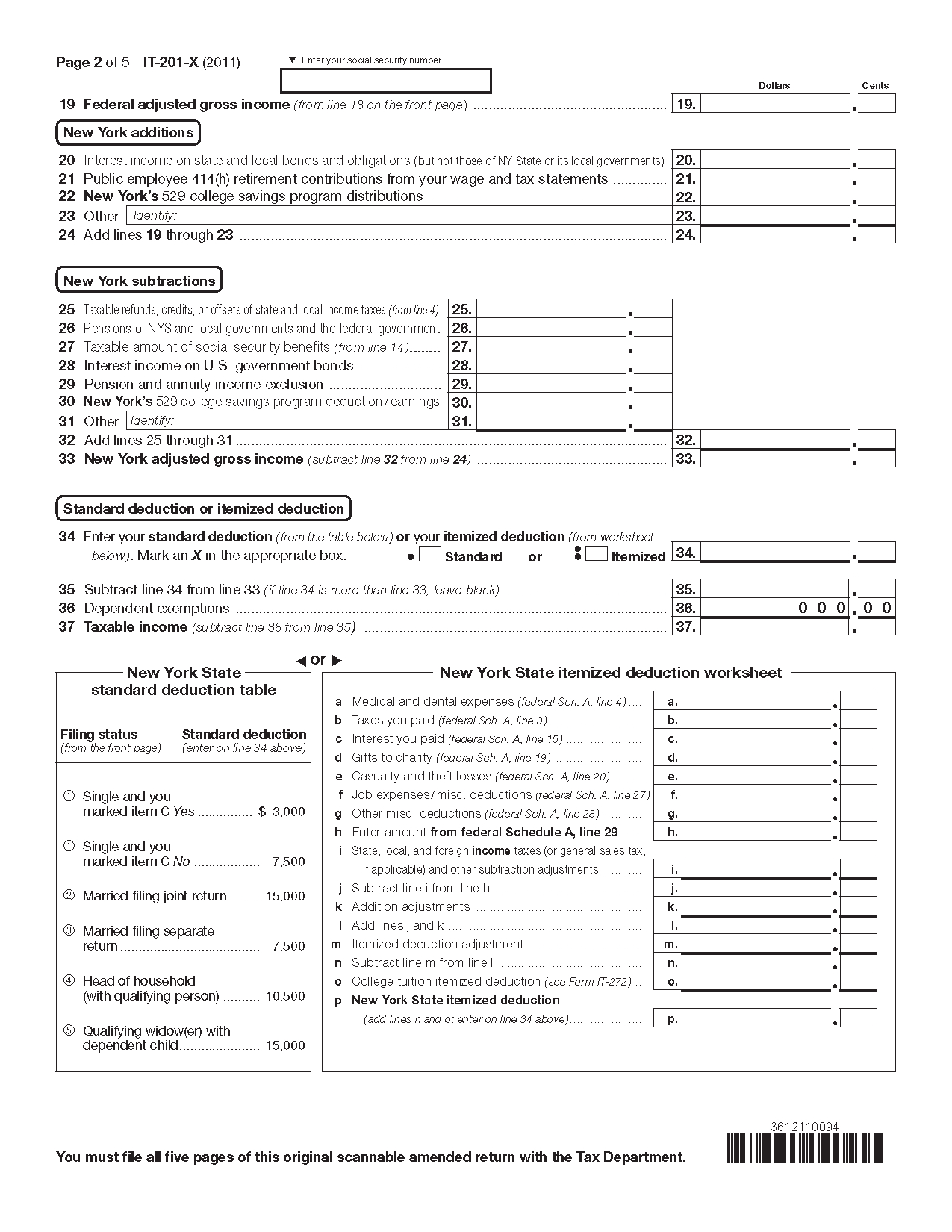

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

10 Business Tax Deductions Worksheet /

39 realtor tax deduction worksheet Worksheet Master

Small Business Tax Deductions Worksheets

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web Standard Deduction Worksheet For Dependents—Line 12;

Web First Of All, When You Run Your Own Business, The Irs Lets You Write Off The Majority Of Your Expenses.

Web Download These Income Tax Worksheets And Organizers To Maximize Your Deductions And Minimize Errors And Omissions.

Related Post: