Irs Form 1040 Printable

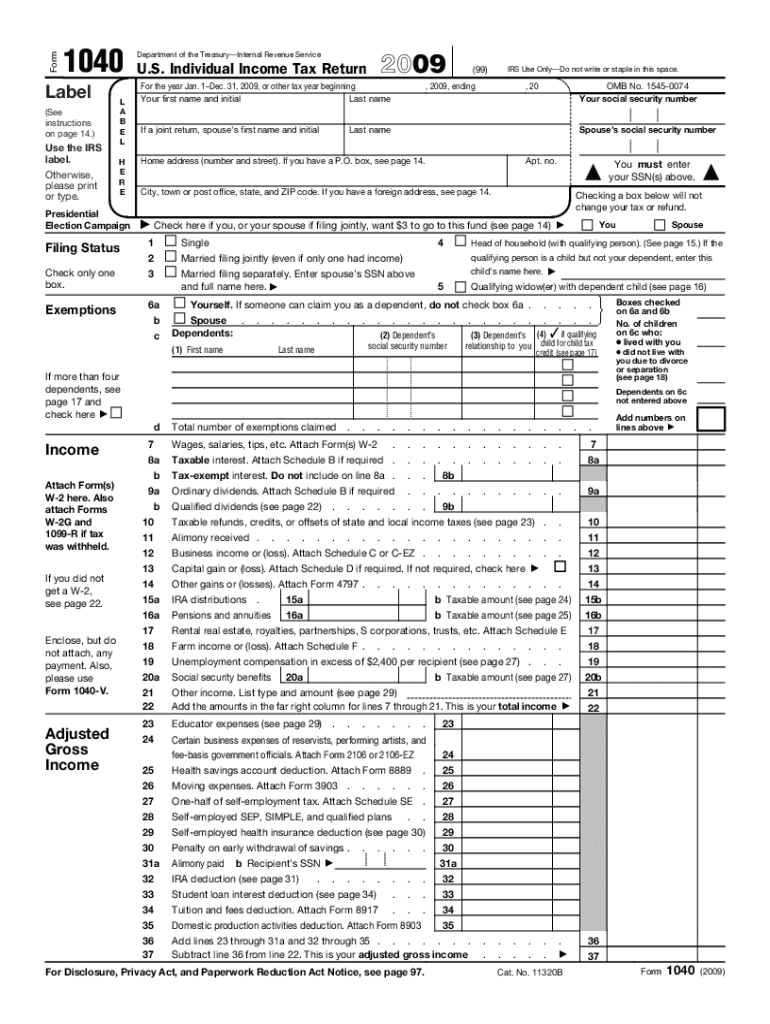

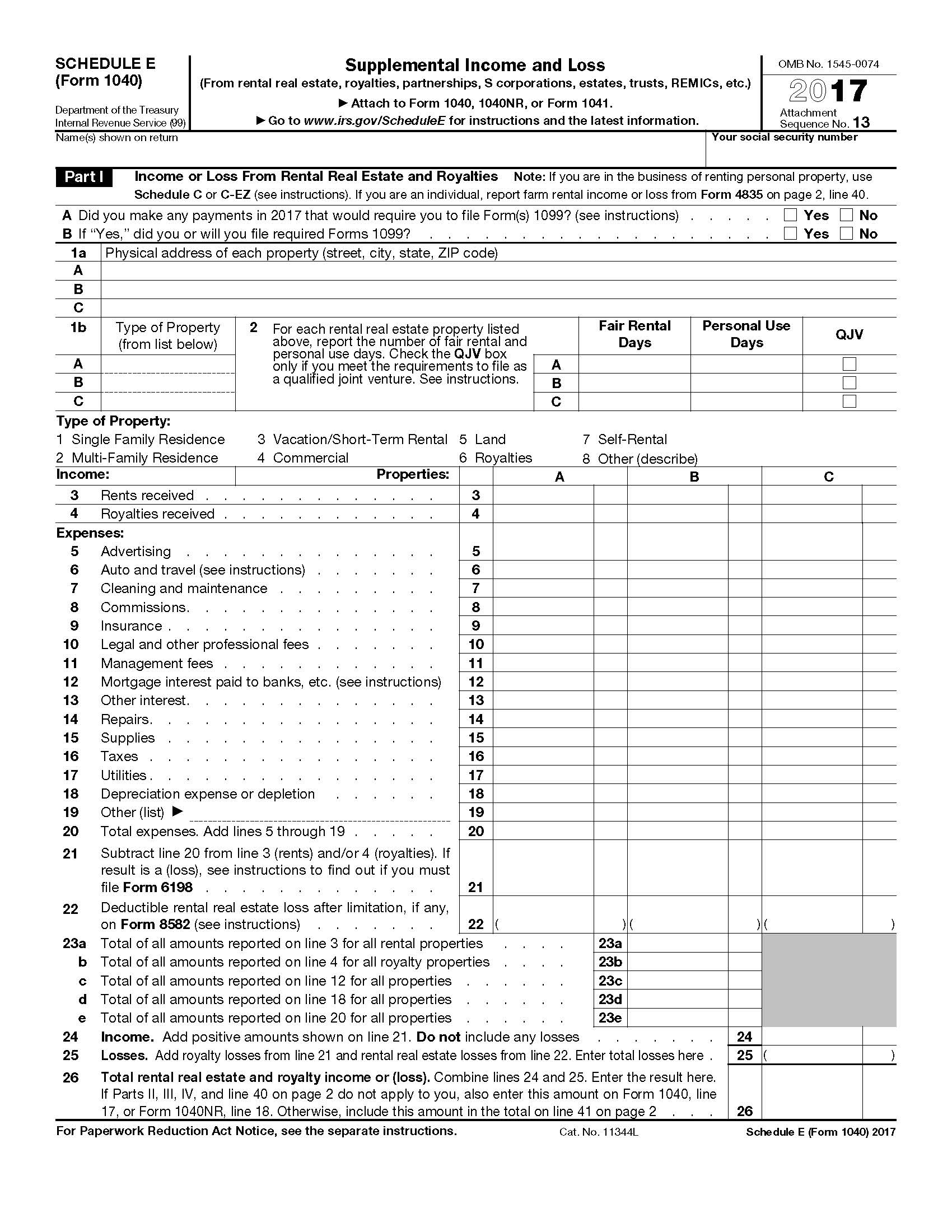

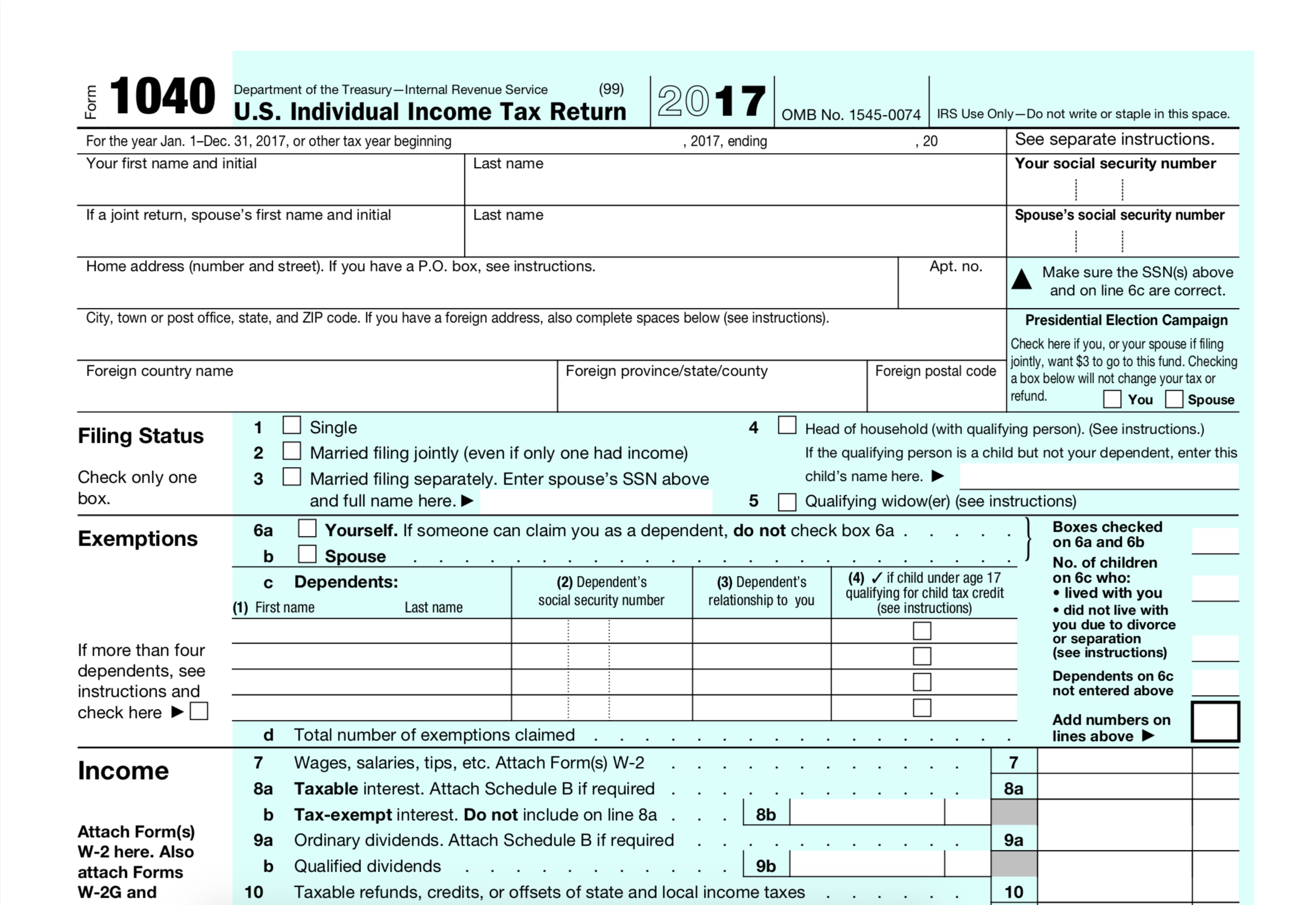

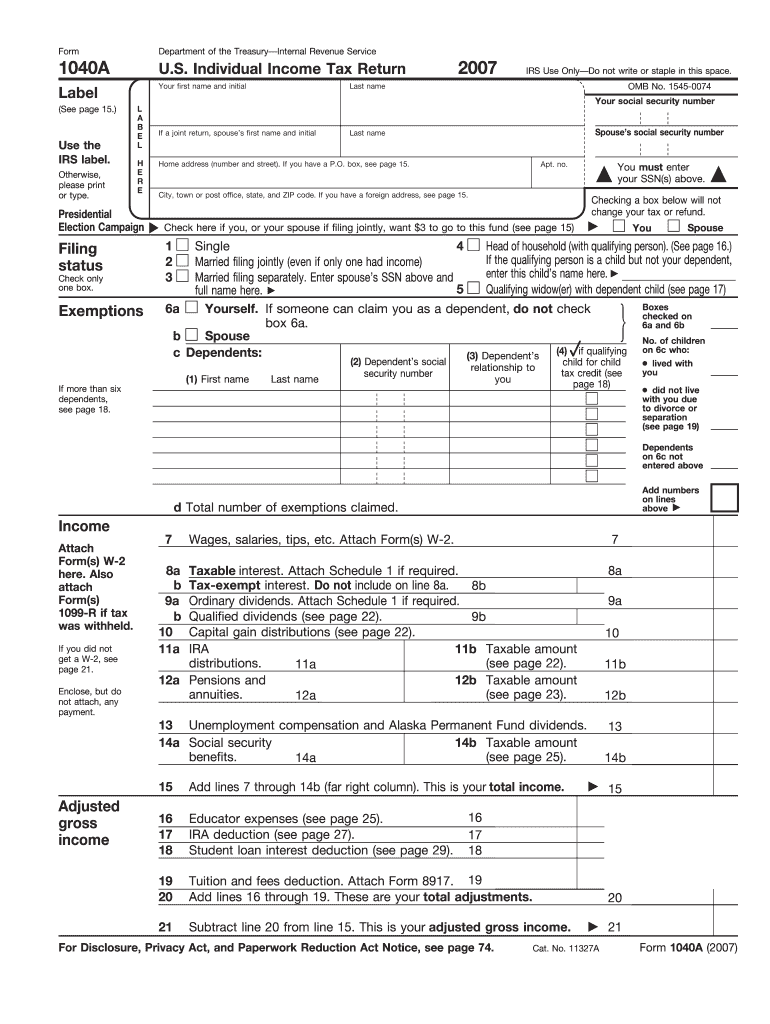

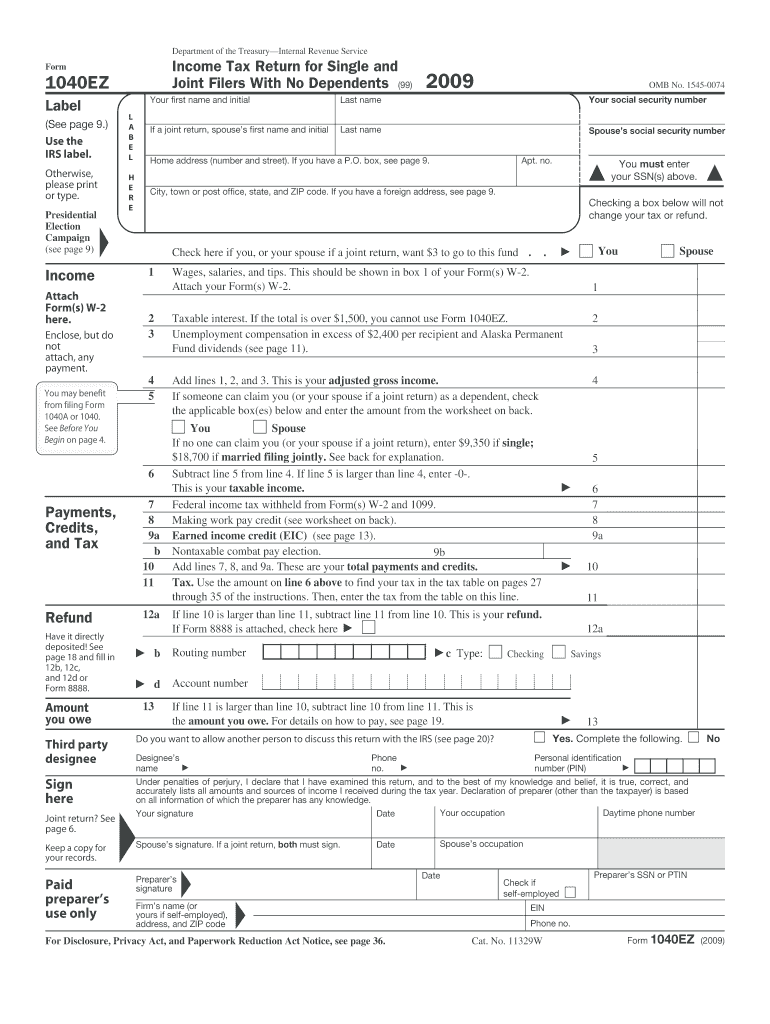

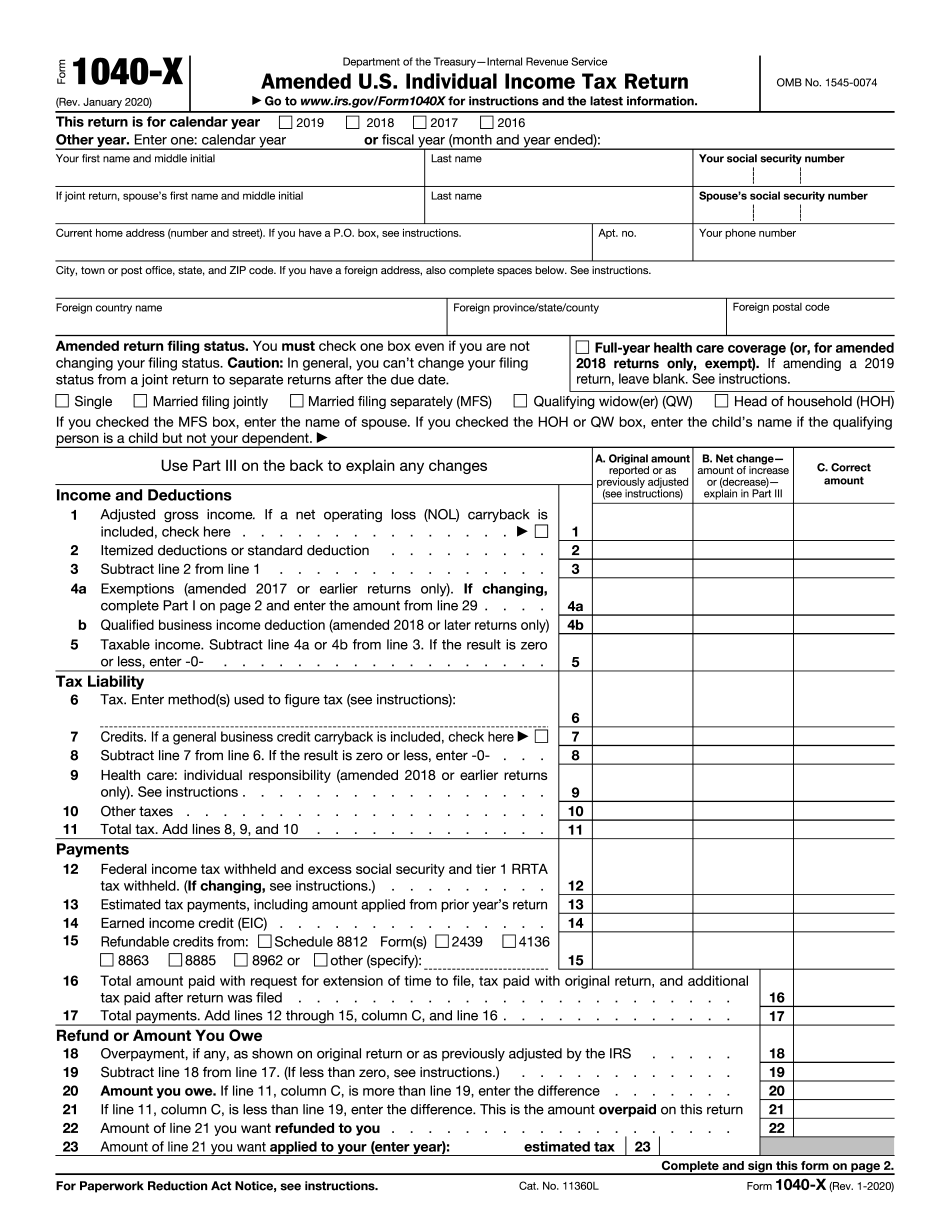

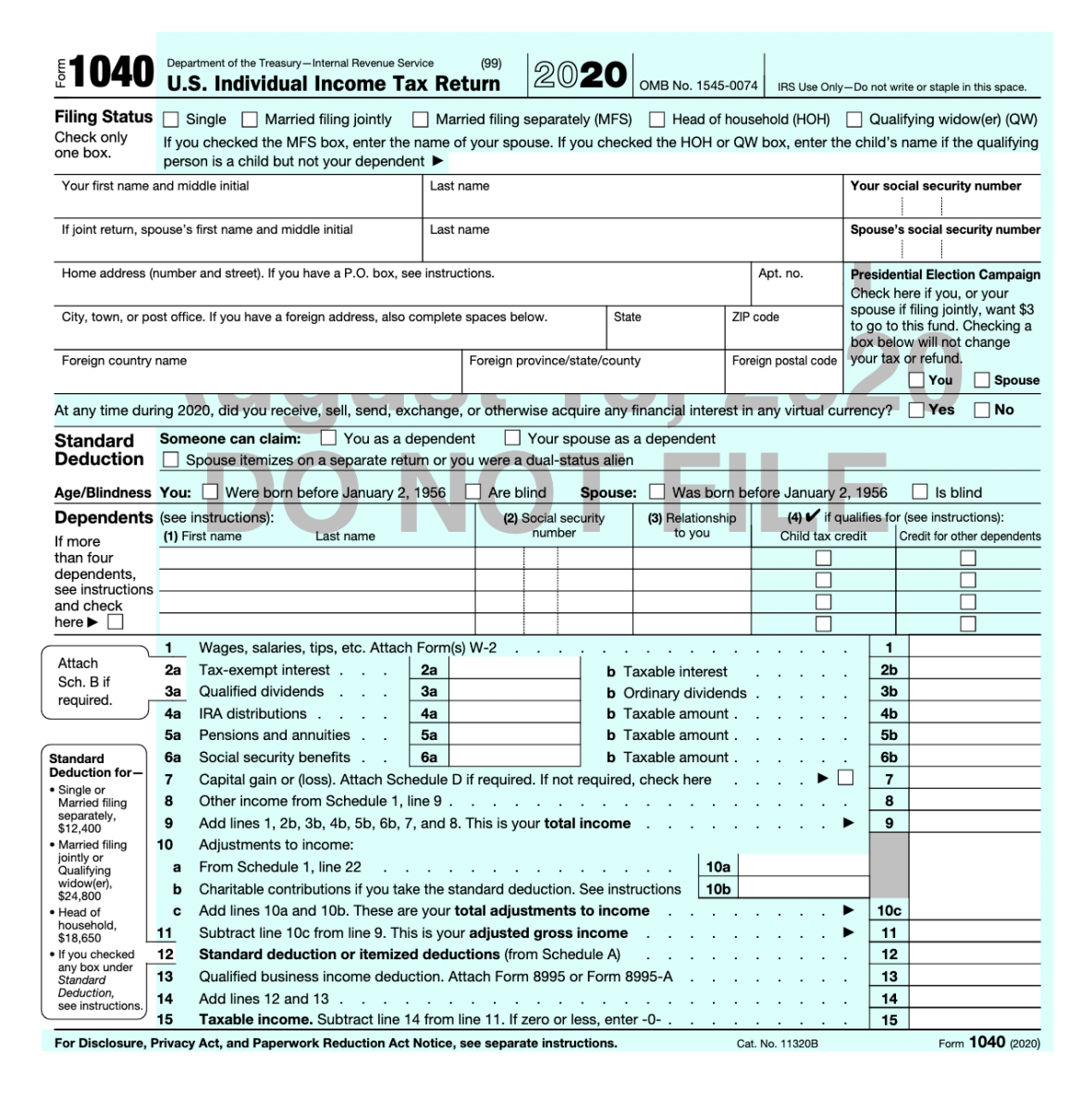

Irs Form 1040 Printable - Otherwise, continue to line 21. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. It has bigger print, less shading, and features. • married filing jointly, enter $32,000 •. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you, or your spouse if filing jointly, want $3. Ad free federal tax filing for simple and complex returns. Web form 1040 (2021) us individual income tax return for tax year 2021. Individual tax return form 1040 instructions; Subtract line 6 from line 5. Ad complete your 1040 form. The internal revenue service (irs) makes pdf templates of the 1040 form available for the 2022. Web use fill to complete blank online irs pdf forms for free. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Individual tax return form 1040 instructions; Annual income tax return filed by citizens or residents of the. Ad free federal tax filing for simple and complex returns. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Individual income tax return 2022 department of the treasury—internal revenue service. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Below is a general guide to what schedule. Request for taxpayer identification number (tin) and. Printable 2021 federal tax forms are listed. Individual income tax return 2022 department of the treasury—internal revenue service. Web none of your social security benefits are taxable. Web form 1040 (2021) us individual income tax return for tax year 2021. Married filing separate return qualifying widow(er) head of household your first name and initial last. Once completed you can sign your fillable form or send for signing. Ad discover helpful information and resources on taxes from aarp. Ad complete your 1040 form. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you,. More about the federal form 1040 we last updated. $520 for married couples who filed jointly with an. • married filing jointly, enter $32,000 •. Below is a general guide to what schedule (s) you will need to file. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you, or your spouse. $520 for married couples who filed jointly with an. Irs use only—do not write or staple in this. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Married filing separate return qualifying widow(er) head of household your first name and initial last. Individual tax return form 1040 instructions; Max refund is guaranteed and 100% accurate. More about the federal form 1040 we last updated. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Once completed you can sign your fillable form or send for signing. Subtract line 6 from line 5. Web use fill to complete blank online irs pdf forms for free. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. $520 for married couples who filed jointly with an. More about the federal form 1040 we last updated. Below is a general guide to what schedule (s) you will need to. Married filing separate return qualifying widow(er) head of household your first name and initial last. Fortunately, we’ve already taken the latest edition from the irs library. Below is a general guide to what schedule (s) you will need to file. Save time with our amazing tool. Web the most basic way to file the document is a printable blank 1040. Web get federal tax return forms and file by mail. This form is for income earned in tax. Fortunately, we’ve already taken the latest edition from the irs library. Once completed you can sign your fillable form or send for signing. Web if you want to fill out the 1040 form correctly, you should first get the 2022 1040 tax. Save time with our amazing tool. Web the most basic way to file the document is a printable blank 1040 form. It has bigger print, less shading, and features. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web use fill to complete blank online irs pdf forms for free. Web form 1040 (2021) us individual income tax return for tax year 2021. Ad complete your 1040 form. Individual tax return form 1040 instructions; Ad free federal tax filing for simple and complex returns. The internal revenue service (irs) makes pdf templates of the 1040 form available for the 2022. • married filing jointly, enter $32,000 •. Married filing separate return qualifying widow(er) head of household your first name and initial last. Individual income tax return 2022 department of the treasury—internal revenue service. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Annual income tax return filed by citizens or residents of the united states. Max refund is guaranteed and 100% accurate. Ad discover helpful information and resources on taxes from aarp. Web if you want to fill out the 1040 form correctly, you should first get the 2022 1040 tax form version. Web how much will i receive? Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Ad complete your 1040 form. Irs use only—do not write or staple in this. More about the federal form 1040 we last updated. Web zip code foreign country name foreign province/state/county foreign postal code presidential election campaign check here if you, or your spouse if filing jointly, want $3. This form is for income earned in tax. Web get federal tax return forms and file by mail. Individual tax return form 1040 instructions; Ad discover helpful information and resources on taxes from aarp. Request for taxpayer identification number (tin) and. Web how much will i receive? Married filing separate return qualifying widow(er) head of household your first name and initial last. It has bigger print, less shading, and features. Annual income tax return filed by citizens or residents of the united states. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Web 2022 ohio it 1040 individual income tax return sequence no.IRS 1040 2009 Fill and Sign Printable Template Online US Legal Forms

Irs 1040 Form / 1040 (2018) Internal Revenue Service Free Printable

What Does A 1040 Form Look Like Seven Questions To Ask At 1040 Form

Irs 1040 Form Example 1040 Ez Nr Form Example 1040 Form Printable

Irs Fillable Form 1040 / IRS 1040 Schedule 8812 2020 Fill out Tax

IRS 1040A 2007 Fill and Sign Printable Template Online US Legal Forms

Irs 1040 Form 2021 Irs schedule a is for figuring out the itemized

1040X Form Download A Template Or Complete Online 2021 Tax Forms 1040

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

What’s New On Form 1040 For 2020 Taxgirl

Fortunately, We’ve Already Taken The Latest Edition From The Irs Library.

Max Refund Is Guaranteed And 100% Accurate.

Ad Free Federal Tax Filing For Simple And Complex Returns.

$520 For Married Couples Who Filed Jointly With An.

Related Post: