Irs Mandated Wisp Template For Tax Professionals

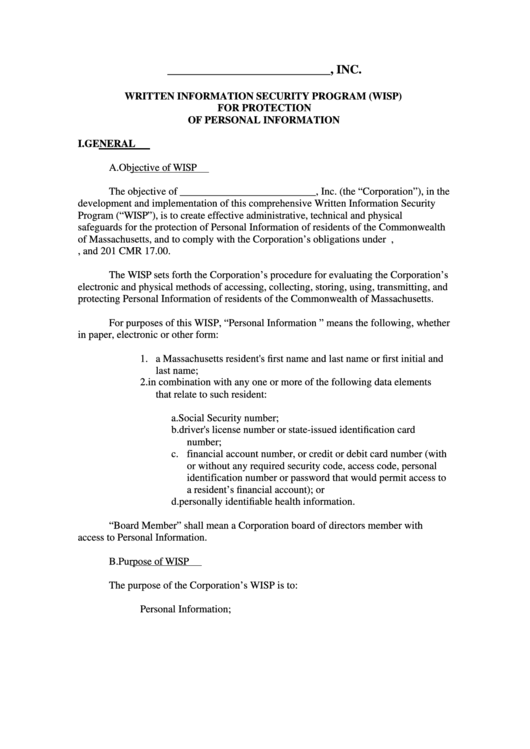

Irs Mandated Wisp Template For Tax Professionals - | natp and data security expert brad messner discuss the irs's newly released security. Written information security plan (wisp) for. Ad download our free written information security plan template for accountants. All tax and accounting firms should do the following:. Expert discussion on the irs’s wisp template and the importance of a data security plan by: Web creating and using a wisp template is a simple but important process for irs mandated tax professionals. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written. Web the irs also has a wisp template in publication 5708. First, create a document in an excel sheet or google sheets detailing. File a complaint pdf against an irs continuing education provider for failure to comply with irs ce provider. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Creating a written information security plan (wisp) for your tax & accounting practice. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. | natp and data security expert brad messner discuss. First, create a document in an excel sheet or google sheets detailing. | natp and data security expert brad messner discuss the irs's newly released security. Ad free shipping on qualified orders. Web tax preparers, protect your business with an irs wisp. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must. Web the irs also has a wisp template in publication 5708. Web find the local stakeholder liaison in your state for information about irs policies,. First, create a document in an excel sheet or google sheets detailing. Many say they were not aware. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers. We provide information about the policies, practices and procedures the irs. Web find the local stakeholder liaison in your state for information about irs policies,. Web wisp developing a wisp good wisp should identify the risks of data loss for the types of information handled by a company and focus on three areas: National association of tax professionals october 11,. Web find the local stakeholder liaison in your state for information about irs policies,. Web the irs is forcing all tax pros to have a wisp. | natp and data security expert brad messner discuss the irs's newly released security. This document was prepared by the security summit, a partnership. Web we ask this question during our security training programs. Web the irs also has a wisp template in publication 5708. Find deals and low prices on master tax guide 2021 at amazon.com Creating a written information security plan (wisp) for your tax & accounting practice. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. File. Creating a written information security plan (wisp) for your tax & accounting practice. Find deals and low prices on master tax guide 2021 at amazon.com Web the irs also has a wisp template in publication 5708. Expert discussion on the irs’s wisp template and the importance of a data security plan by: Web find the local stakeholder liaison in your. Publication 5708, creating a written information security plan for your tax & accounting. Web tax preparers, protect your business with an irs wisp. Web creating and using a wisp template is a simple but important process for irs mandated tax professionals. File a complaint pdf against an irs continuing education provider for failure to comply with irs ce provider. Many. First, create a document in an excel sheet or google sheets detailing. Free, easy returns on millions of items. Ad free shipping on qualified orders. File a complaint pdf against an irs continuing education provider for failure to comply with irs ce provider. This document was prepared by the security summit, a partnership. Expert discussion on the irs’s wisp template and the importance of a data security plan by: Web the irs also has a wisp template in publication 5708. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web find the local stakeholder liaison in your state for information about irs policies,.. Free, easy returns on millions of items. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. This document is for general distribution and is available to all. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Creating a written information security plan (wisp) for your tax & accounting practice. First, create a document in an excel sheet or google sheets detailing. National association of tax professionals october 11, 2022. This document was prepared by the security summit, a partnership. All tax and accounting firms should do the following:. Web find the local stakeholder liaison in your state for information about irs policies,. We provide information about the policies, practices and procedures the irs. Sign in to your account. Written information security plan (wisp) for. | natp and data security expert brad messner discuss the irs's newly released security. File a complaint pdf against an irs continuing education provider for failure to comply with irs ce provider. Web the valid schemas and business rules for 1042 provides information to software developers and/or transmittors about the release of schemas and business. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written. Ad free shipping on qualified orders. Find deals and low prices on master tax guide 2021 at amazon.com Easier than the irs one. Ad free shipping on qualified orders. Free, easy returns on millions of items. Sign in to your account. Web the irs also has a wisp template in publication 5708. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written. All tax and accounting firms should do the following:. First, create a document in an excel sheet or google sheets detailing. Easier than the irs one. File a complaint pdf against an irs continuing education provider for failure to comply with irs ce provider. Ad download our free written information security plan template for accountants. Web the valid schemas and business rules for 1042 provides information to software developers and/or transmittors about the release of schemas and business. Web find the local stakeholder liaison in your state for information about irs policies,. Web wisp developing a wisp good wisp should identify the risks of data loss for the types of information handled by a company and focus on three areas: Publication 5708, creating a written information security plan for your tax & accounting. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals.Irs Form W4V Printable / Form W 7 Application For Irs Individual

Irs Wisp Template

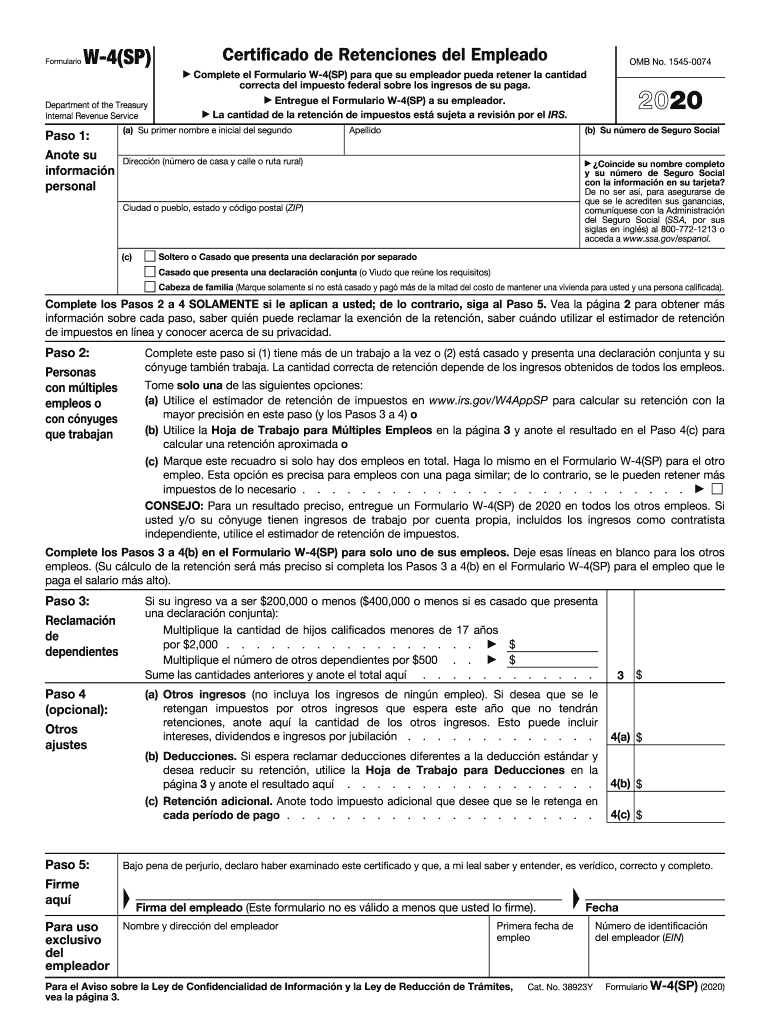

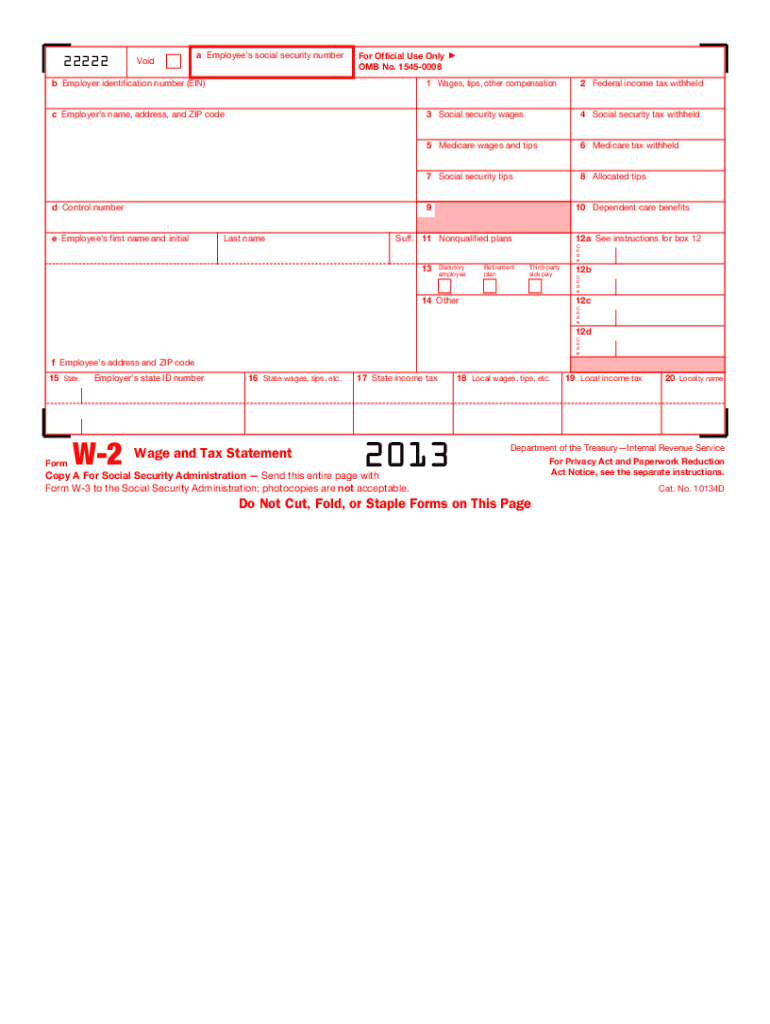

Irs Form W4s Download Fillable Pdf Or Fill Online Request For Federal A18

Irs Form W4V Printable IRS 1040 Schedule 1 2020 Fill out Tax

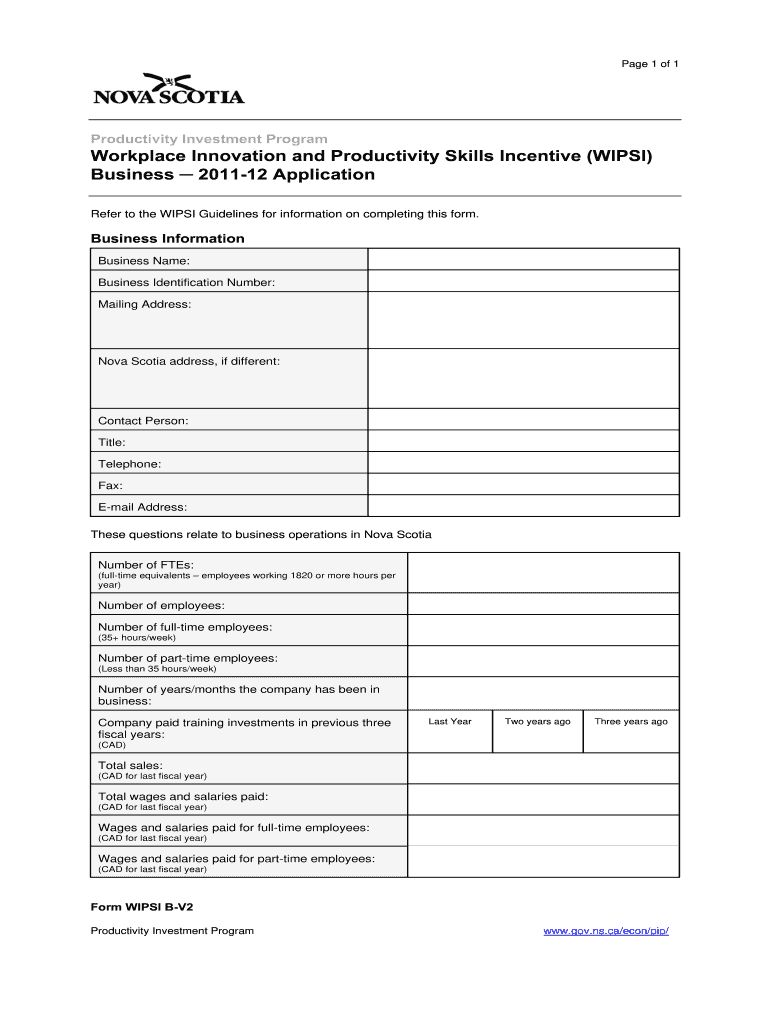

Wipsi Fill Out and Sign Printable PDF Template signNow

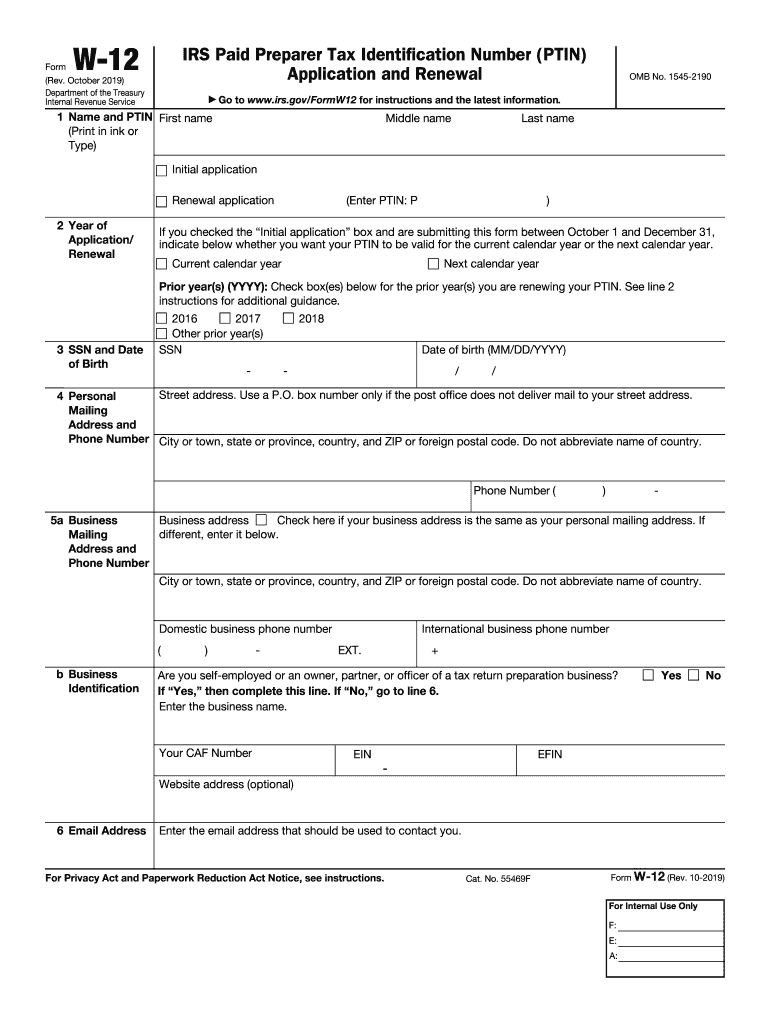

Form W12 IRS Paid Preparer Tax Identification Number (PTIN

Irs Wisp Template

IRS W2 2013 Fill and Sign Printable Template Online US Legal Forms

Irs Form W4V Printable Free Printable W 4 Form W4 2020 Form

Irs Wisp Template

Web Creating And Using A Wisp Template Is A Simple But Important Process For Irs Mandated Tax Professionals.

Web We Ask This Question During Our Security Training Programs And Find A Significant Number Of Firms Currently Do Not Have A Wisp.

Written Information Security Plan (Wisp) For.

And The Schedule A (Form.

Related Post: