Irs Mandated Wisp Template

Irs Mandated Wisp Template - Web internal revenue service works with state tax agencies and the tax industry to fight these 21st century identity thieves. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. All tax and accounting firms should do the following:. Web download wisp template on ptin renewals this year, the irs is requiring: Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Identify, protect, detect, respond and recover. Many say they were not aware. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. Web its focus is on five principles: A wisp template designed specifically for irs compliance ensures that you address the necessary requirements set forth by the irs. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web download wisp template on ptin renewals this year, the irs is requiring: Web washington — the irs, state tax. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. A wisp template designed specifically for irs compliance ensures that you address the necessary requirements set forth by the irs. Web sample template written information security plan (wisp) added detail for consideration when creating your wisp define the wisp objectives, purpose,. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web creating and using a wisp template is a simple but important process for irs mandated tax professionals. Web internal revenue service works with state tax agencies and the tax industry to fight these 21st century identity thieves. Identify, protect, detect,. All tax and accounting firms should do the following:. Identify, protect, detect, respond and recover. Ad download our free written information security plan template for accountants. Written information security plan (wisp) for. The irs requires written information security plans to protect data. Web creating and using a wisp template is a simple but important process for irs mandated tax professionals. A wisp template designed specifically for irs compliance ensures that you address the necessary requirements set forth by the irs. Web the irs is not giving practitioners a break, though. Web washington — the irs, state tax agencies and the nation’s tax. Web our guide, what to do in the event of a tax data breach, gives you practical steps you can include in your wisp, such as contacting the irs and fbi and offering. Web on august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written information security plan, or wisp.. All tax and accounting firms should do the following:. “as a paid tax return preparer, i am aware of my legal obligation to have. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Web the special plan, called a written information security. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web on august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written information security plan, or wisp. Web a wisp is a written information security plan that is required for certain. Web click the data security plan template link to download it to your computer. Web our guide, what to do in the event of a tax data breach, gives you practical steps you can include in your wisp, such as contacting the irs and fbi and offering. The sample plan is available on irs.gov. Web we ask this question during. Web download wisp template on ptin renewals this year, the irs is requiring: Written security plans are required to be in place for anyone with a ptin. Identify, protect, detect, respond and recover. First, create a document in an excel sheet or google sheets detailing. Web we ask this question during our security training programs and find a significant number. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. All tax and accounting firms should do the following:. Web click the data security plan template link to download it to your computer. Web its focus is on five principles: First, create a document in an excel sheet or google sheets detailing. The sample plan is available on irs.gov. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Written security plans are required to be in place for anyone with a ptin. A wisp template designed specifically for irs compliance ensures that you address the necessary requirements set forth by the irs. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. Web internal revenue service works with state tax agencies and the tax industry to fight these 21st century identity thieves. Ad download our free written information security plan template for accountants. Written information security plan (wisp) for. Web the irs is not giving practitioners a break, though. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. You will need to use an editor such as microsoft word or equivalent to open and edit the file. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web creating and using a wisp template is a simple but important process for irs mandated tax professionals. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. The irs requires written information security plans to protect data. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. “as a paid tax return preparer, i am aware of my legal obligation to have. A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web its focus is on five principles: Web our guide, what to do in the event of a tax data breach, gives you practical steps you can include in your wisp, such as contacting the irs and fbi and offering. Many say they were not aware. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Ad download our free written information security plan template for accountants. Web we ask this question during our security training programs and find a significant number of firms currently do not have a wisp. All tax and accounting firms should do the following:. Web click the data security plan template link to download it to your computer. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. The irs requires written information security plans to protect data. Web download wisp template on ptin renewals this year, the irs is requiring: A wisp template designed specifically for irs compliance ensures that you address the necessary requirements set forth by the irs.Irs Wisp Template

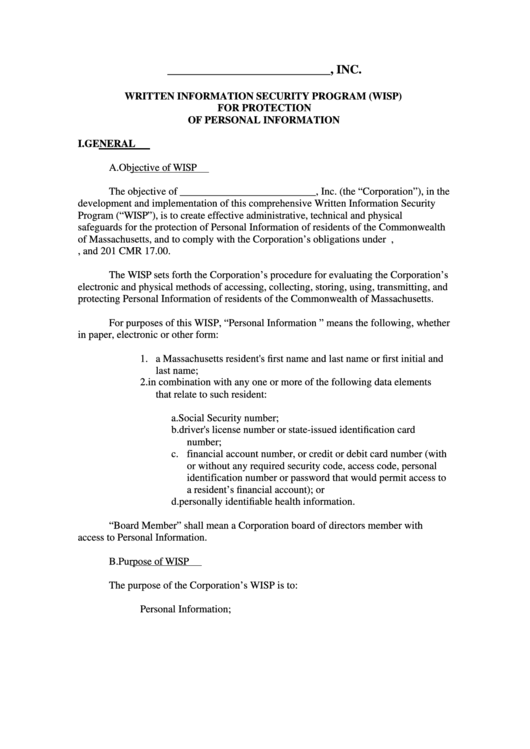

Written Information Security Program (WISP) Security Waypoint

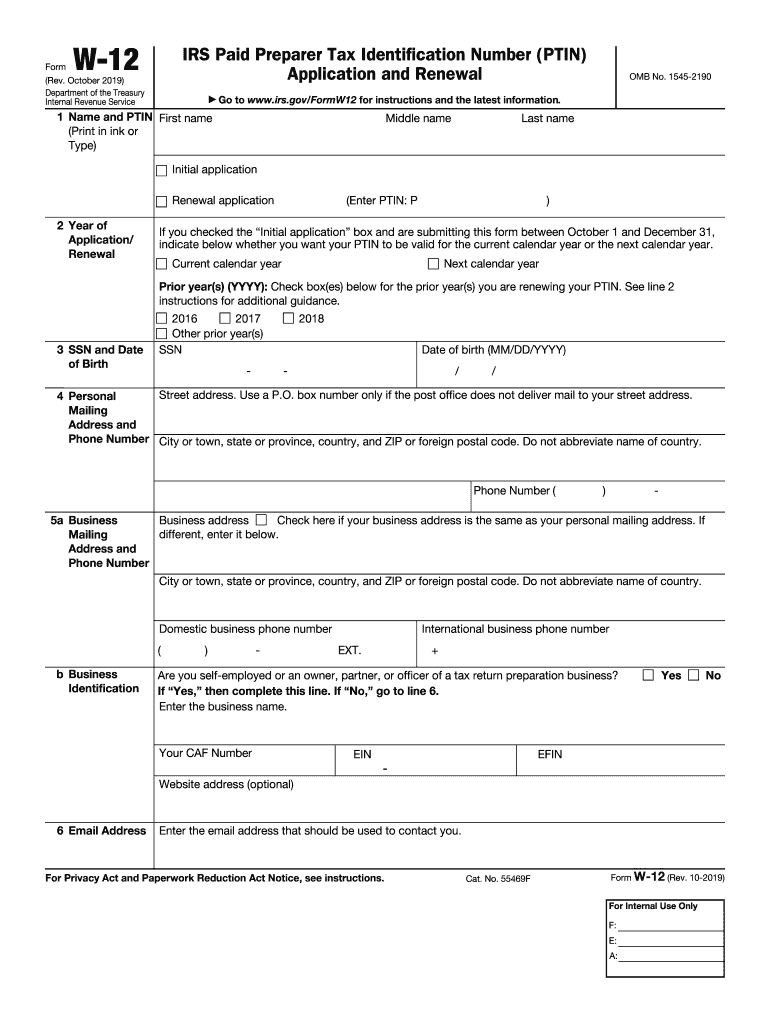

2019 Form IRS W12 Fill Online, Printable, Fillable, Blank pdfFiller

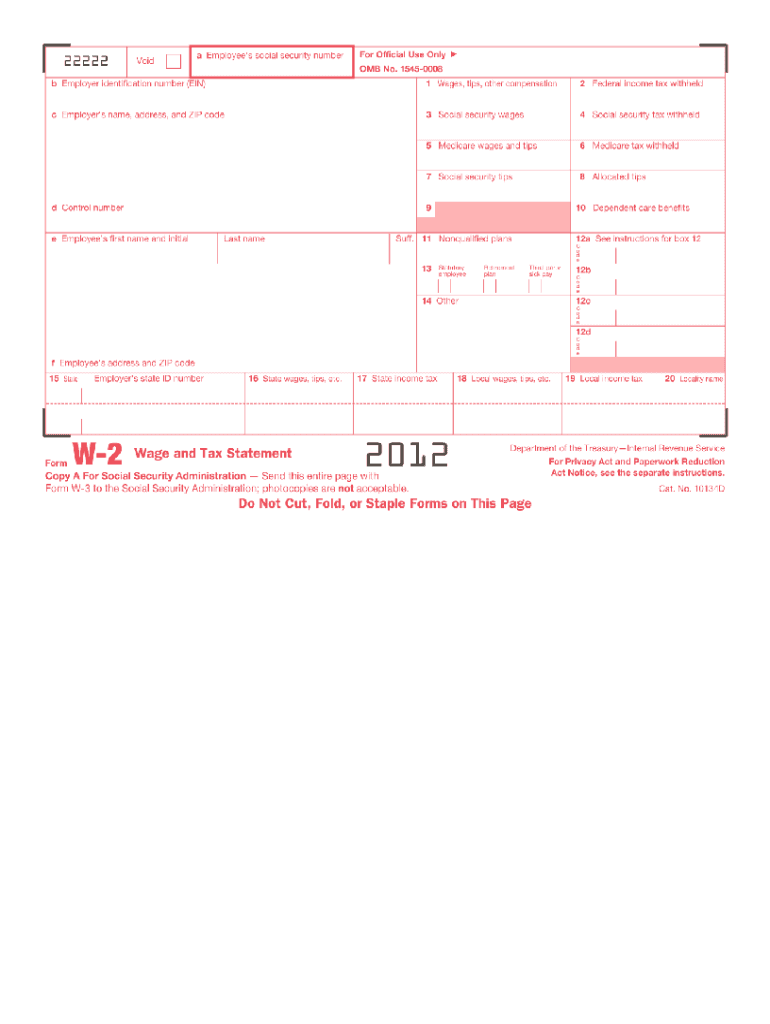

W 2 Form 2012 Printable Printable Word Searches

Massachusetts Written Information Security Program (WISP) Template

Irs Wisp Template

Written Information Security Program (WISP) Security Waypoint

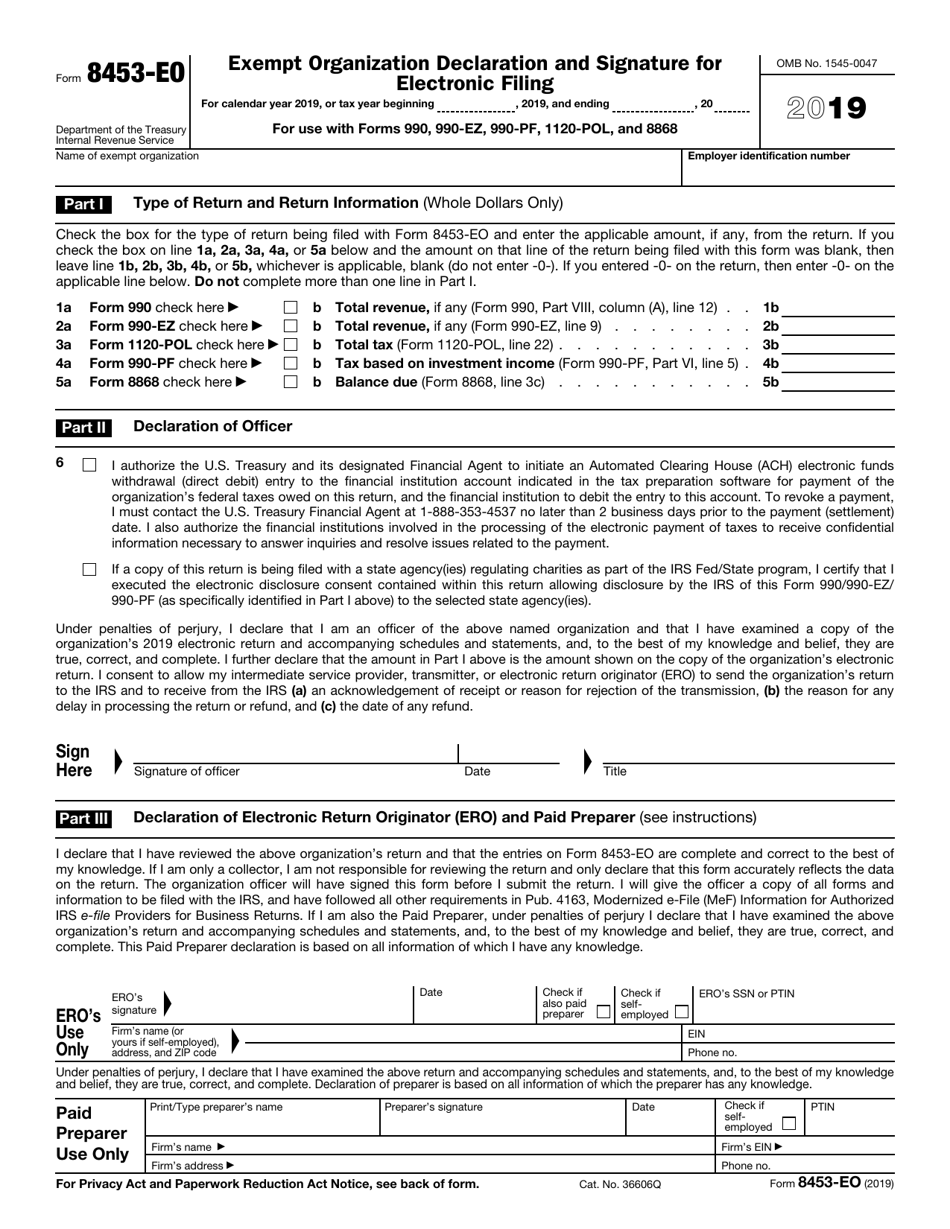

IRS Form 8453E0 Download Fillable PDF or Fill Online Exempt

Irs Form W4V Printable Free Printable W 4 Form W4 2020 Form

Irs Wisp Template

Web Our Free Information Security Plan Template, Which You Can Download For Free By Filling Out The Form, Covers Topics That Range From:

Web Internal Revenue Service Works With State Tax Agencies And The Tax Industry To Fight These 21St Century Identity Thieves.

You Will Need To Use An Editor Such As Microsoft Word Or Equivalent To Open And Edit The File.

Web On August 9Th, 2022 The Irs And Security Summit Have Issued New Requirements That All Tax Preparers Must Have A Written Information Security Plan, Or Wisp.

Related Post: