Printable 1099 Form Independent Contractor

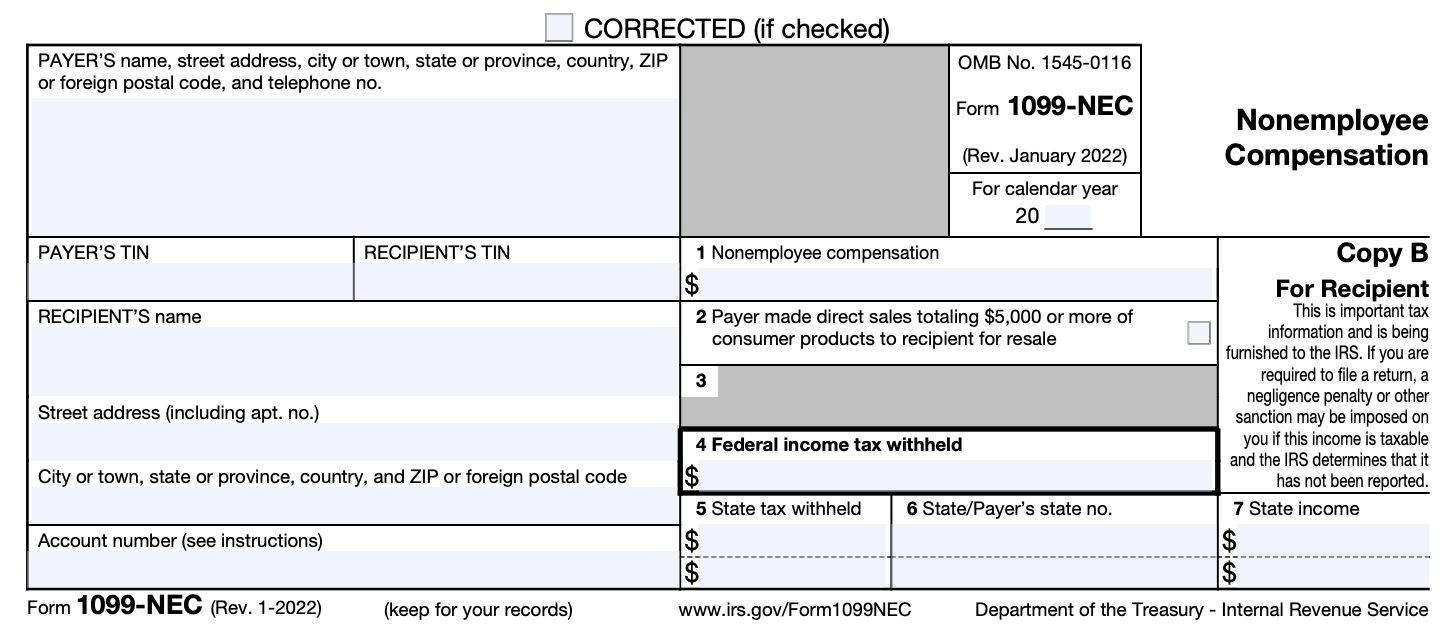

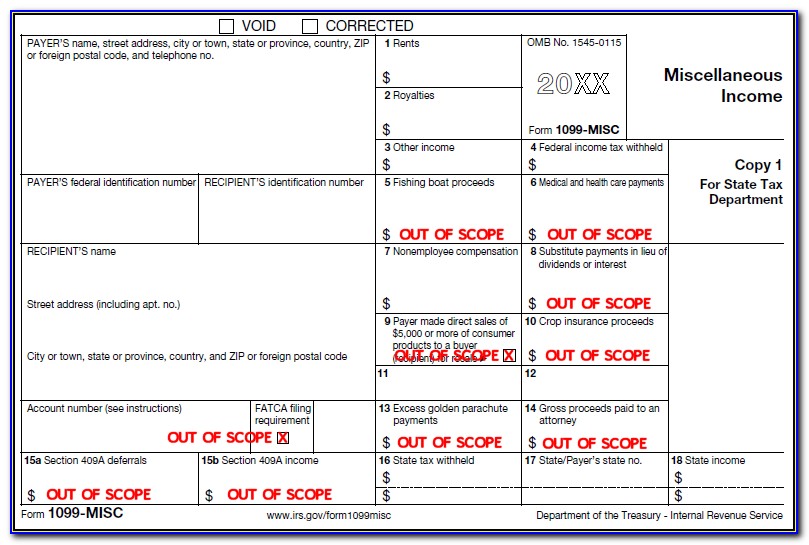

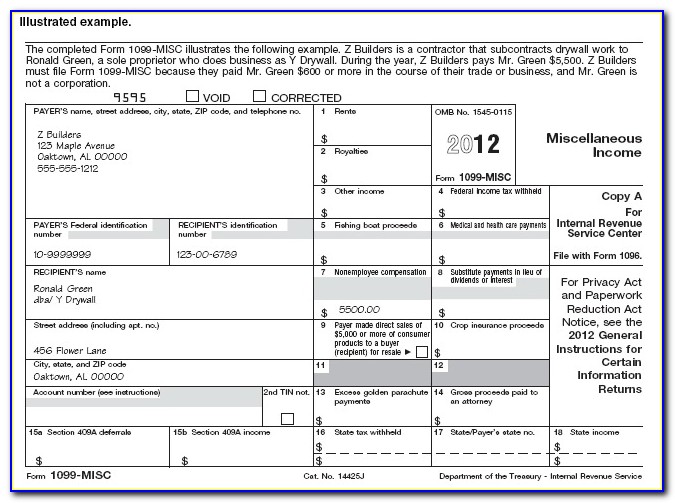

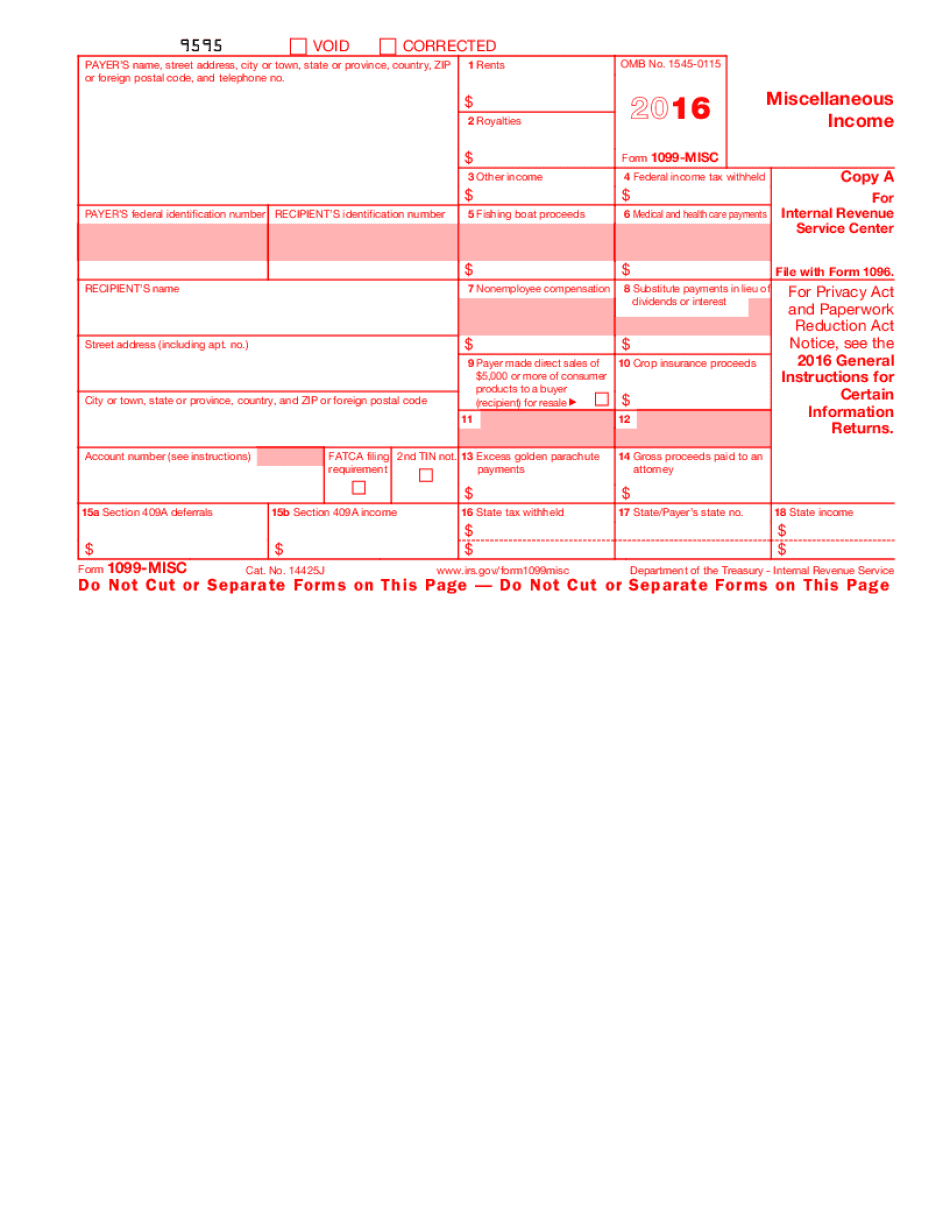

Printable 1099 Form Independent Contractor - Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web independent contractors guide to 1099 misc forms: Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Ad read customer reviews & find best sellers. Ad fast, easy & secure. Save time with our amazing tool (this last name is derived from the irs form 1099 which the. For your protection, this form may show only the last four digits of your. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. 1099 form is an information return form used to report the payments made in a calendar year to the irs. For your protection, this form may show only the last four digits of your. A person who contracts to perform services for others without having the legal status of an employee is an independent. Web independent contractors guide to 1099 misc forms: Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. This form can be used to request the correct name and taxpayer identification number, or tin, of. Web form 1099 is a tax information return that reports. Web form 1099 is a tax information return that reports income received outside of wages, salaries and tips. You must also complete form 8919 and attach it to. A person who contracts to perform services for others without having the legal status of an employee is an independent. Web what is a 1099 independent contractor? Ad manage your contractors with. Ad fast, easy & secure. Web independent contractors guide to 1099 misc forms: You received the form for working as an independent contractor for the. Complete your pay stub easily. Did you receive a 1099 misc form in the mail? You must also complete form 8919 and attach it to. There are three different versions, each with different purposes: Ad manage your contractors with confidence by using quickbooks® contractor payments software. 1099 form is an information return form used to report the payments made in a calendar year to the irs. Save time with our amazing tool (this last name is derived from the irs form 1099 which the. Did you receive a 1099 misc form in the mail? Web independent contractors guide to 1099 misc forms: Ad read customer reviews & find best sellers. Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. Web neither the client nor the contractor may assign this agreement without the express written consent of the other party. Ad manage your contractors with confidence by using quickbooks® contractor payments software. You received the form for working as an independent contractor for the. Web an independent contractor invoice is used by anyone independently working for themselves to request payment. Getting confused who is a 1099. Ad fast, easy & secure. This form can be used to request the correct name and taxpayer identification number, or tin, of. Save time with our amazing tool Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments. Ad manage your contractors with confidence by using quickbooks® contractor payments software. Getting confused who is a 1099. Web independent contractors are also known as consultants, freelancers, or 1099 contractors. Complete your pay stub easily. For your protection, this form may show only the last four digits of your. Web independent contractors are also known as consultants, freelancers, or 1099 contractors. (this last name is derived from the irs form 1099 which the. Web create a high quality document now! Getting confused who is a 1099. Web what is a 1099 independent contractor? You received the form for working as an independent contractor for the. You must also complete form 8919 and attach it to. Ad fast, easy & secure. Web what is a 1099 independent contractor? Ad read customer reviews & find best sellers. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Save time with our amazing tool Bring a colleague and save $100!. At least $10 in royalties or broker. Web you’ll issue a 1099 form. This form can be used to request the correct name and taxpayer identification number, or tin, of. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Web independent contractors guide to 1099 misc forms: An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Web create a high quality document now! Ad manage your contractors with confidence by using quickbooks® contractor payments software. Complete your pay stub easily. (this last name is derived from the irs form 1099 which the. 1099 form is an information return form used to report the payments made in a calendar year to the irs. For your protection, this form may show only the last four digits of your. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. 1099 form is an information return form used to report the payments made in a calendar year to the irs. An independent contractor agreement is a legal document between a contractor that performs a service for a client in. Did you receive a 1099 misc form in the mail? Getting confused who is a 1099. Complete your pay stub easily. Web independent contractors guide to 1099 misc forms: Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). You must also complete form 8919 and attach it to. Save time with our amazing tool Web what is a 1099 independent contractor? Web form 1099 is a tax information return that reports income received outside of wages, salaries and tips. This form can be used to request the correct name and taxpayer identification number, or tin, of. Web independent contractors are also known as consultants, freelancers, or 1099 contractors. At least $10 in royalties or broker.Printable 1099 Form Independent Contractor Printable Form, Templates

1099 tax form independent contractor printable 1099 forms independent

1099 Form Independent Contractor Pdf Independent Contractor Invoice

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

Printable 1099 Form Independent Contractor Master of

Free 1099 Forms For Independent Contractors Universal Network

1099 Form For Independent Contractors 2019 Form Resume Examples

1099 form independent contractor Fill Online, Printable, Fillable

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

Ad Manage Your Contractors With Confidence By Using Quickbooks® Contractor Payments Software.

Ad Read Customer Reviews & Find Best Sellers.

You Received The Form For Working As An Independent Contractor For The.

Web You’ll Issue A 1099 Form.

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)