Printable 1099 Nec

Printable 1099 Nec - Web copy a of this form is provided for informational purposes only. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. These are forms that report payments made to independent contractors. File copy a of this form with the irs by. As a small business owner, you may be familiar with 1099 forms. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Specify the date range for the forms then choose ok. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. 100% free federal tax filing. Give these forms to payees and report them to the. Specify the date range for the forms then choose ok. The official printed version of copy a of this irs form is. As a small business owner, you may be familiar with 1099 forms. Pdfquick.com has been visited by 10k+ users in the past month Give these forms to payees and report them to the. These are forms that report payments made to independent contractors. File copy a of this form with the irs by. Furnish copy b of this form to the recipient by january 31, 2022. The official printed version of copy a of this irs form is. Give these forms to payees and report them to the. The official printed version of copy a of this irs form is. Specify the date range for the forms then choose ok. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web 1099, 3921, or 5498 that you print from the irs website. Log. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Pdfquick.com has been visited by 10k+ users in the past month The official printed version of copy a of this irs form is. Log in to your pdfliner account. File copy a of this form. 100% free federal tax filing. Web copy a of this form is provided for informational purposes only. Web to get the form, either hit the fill this form button or do the steps below: Give these forms to payees and report them to the. Copy a appears in red, similar to the official irs form. Log in to your pdfliner account. The official printed version of copy a of this irs form is. Web 1099, 3921, or 5498 that you print from the irs website. Furnish copy b of this form to the recipient by january 31, 2022. Copy a appears in red, similar to the official irs form. Pdfquick.com has been visited by 10k+ users in the past month Copy a appears in red, similar to the official irs form. These are forms that report payments made to independent contractors. The official printed version of copy a of this irs form is. Log in to your pdfliner account. Specify the date range for the forms then choose ok. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. These are forms that report payments made to independent contractors. File copy a of this form with. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. As a small business owner, you may be familiar with 1099 forms. File copy a of this form with the irs by. Web report payments made of at least $600 in the course of a. Web 1099, 3921, or 5498 that you print from the irs website. As a small business owner, you may be familiar with 1099 forms. Web copy a of this form is provided for informational purposes only. Specify the date range for the forms then choose ok. Give these forms to payees and report them to the. Specify the date range for the forms then choose ok. File copy a of this form with the irs by. Log in to your pdfliner account. Give these forms to payees and report them to the. Furnish copy b of this form to the recipient by january 31, 2022. Web 1099, 3921, or 5498 that you print from the irs website. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Ad find deals on printable 1099 nec in office supplies on amazon. Copy a appears in red, similar to the official irs form. These are forms that report payments made to independent contractors. The official printed version of copy a of this irs form is. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web copy a of this form is provided for informational purposes only. Pdfquick.com has been visited by 10k+ users in the past month 100% free federal tax filing. Web to get the form, either hit the fill this form button or do the steps below: As a small business owner, you may be familiar with 1099 forms. Web 1099, 3921, or 5498 that you print from the irs website. Pdfquick.com has been visited by 10k+ users in the past month Log in to your pdfliner account. Furnish copy b of this form to the recipient by january 31, 2022. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. The official printed version of copy a of this irs form is. 100% free federal tax filing. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Ad find deals on printable 1099 nec in office supplies on amazon. Specify the date range for the forms then choose ok. As a small business owner, you may be familiar with 1099 forms. Give these forms to payees and report them to the. These are forms that report payments made to independent contractors.1099NEC Recipient Copy B Cut Sheet HRdirect

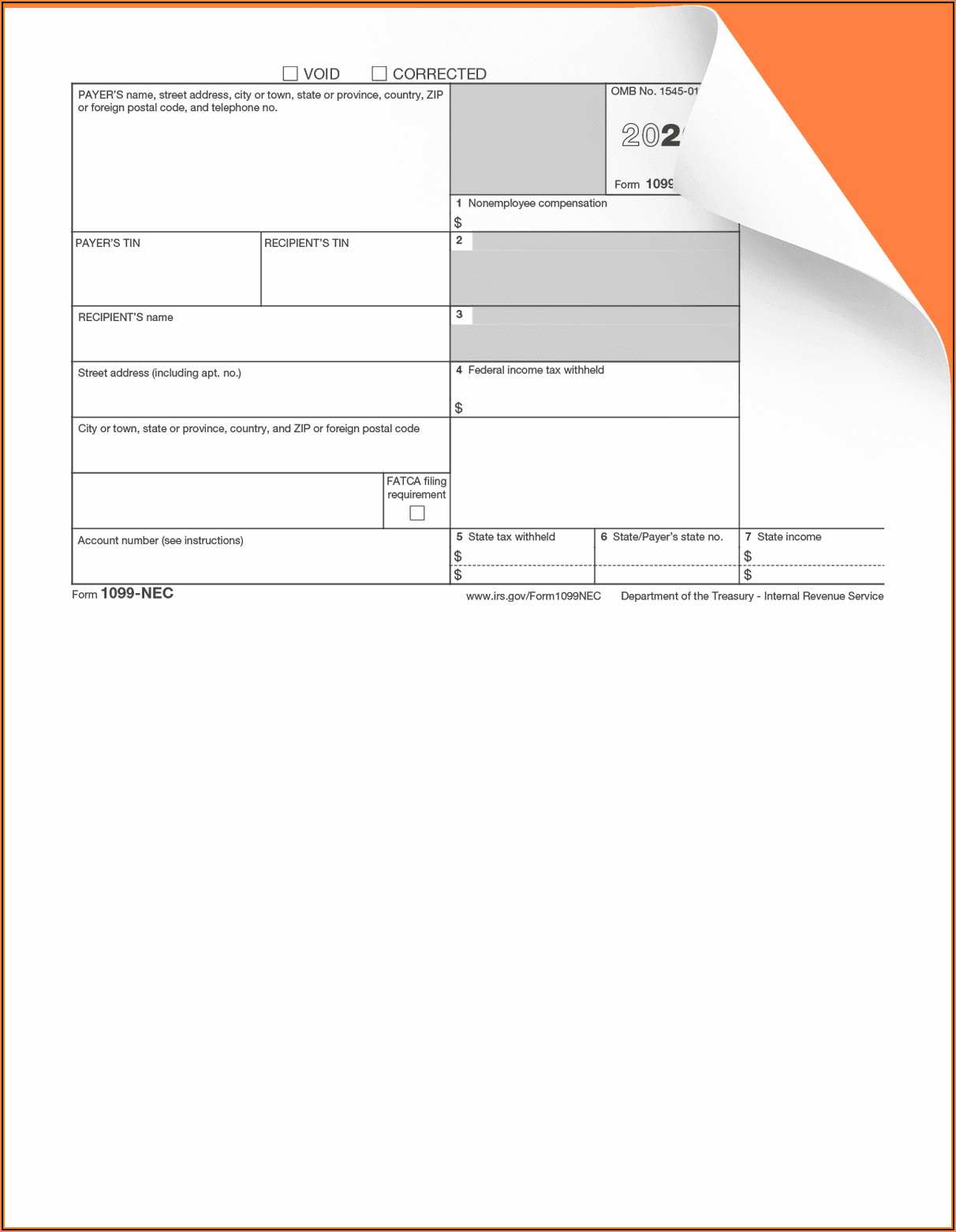

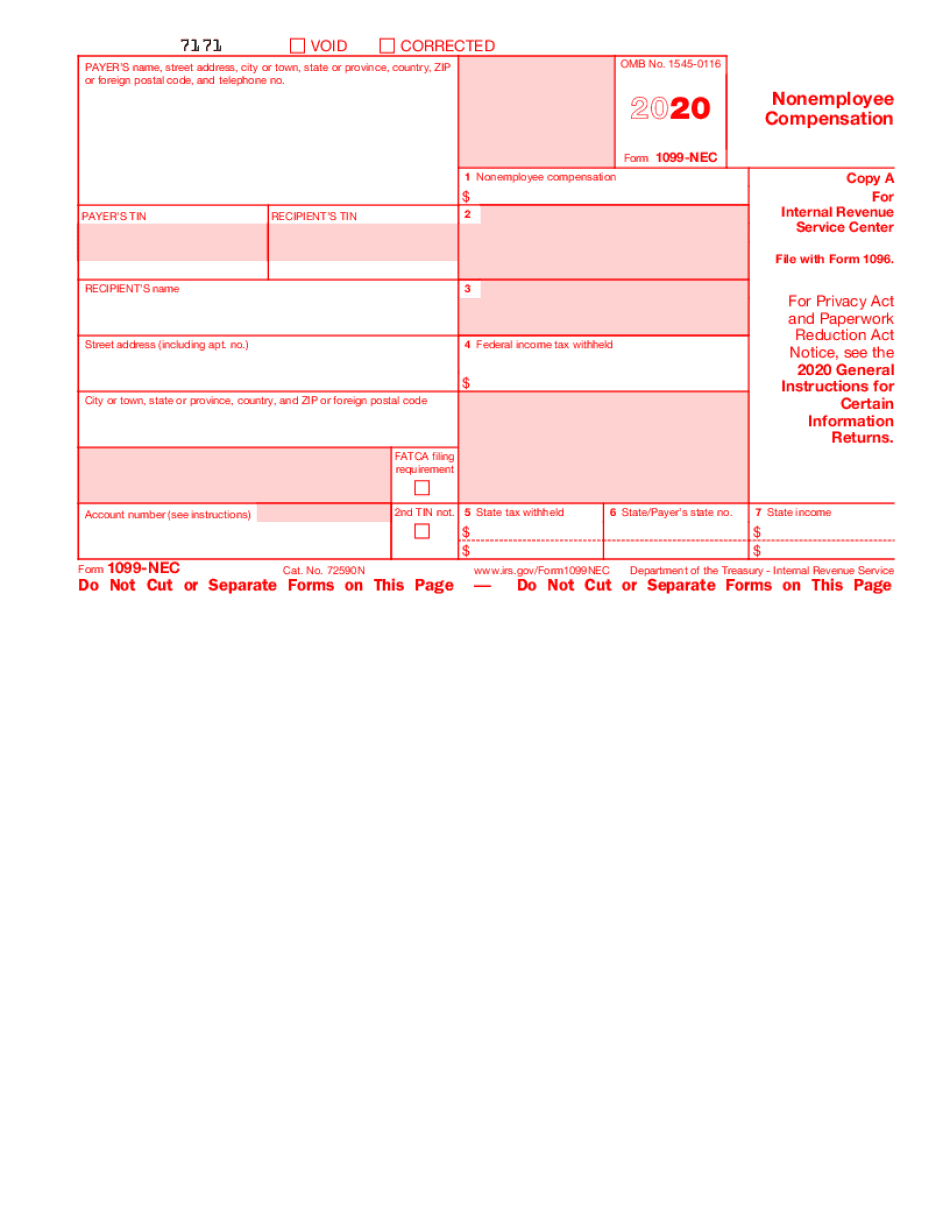

Form 1099NEC Nonemployee Compensation, Recipient Copy B

How to File Your Taxes if You Received a Form 1099NEC

Free 1099 Nec Fillable Form Printable Forms Free Online

Form1099NEC

Printable Blank 1099 Nec Form Printable World Holiday

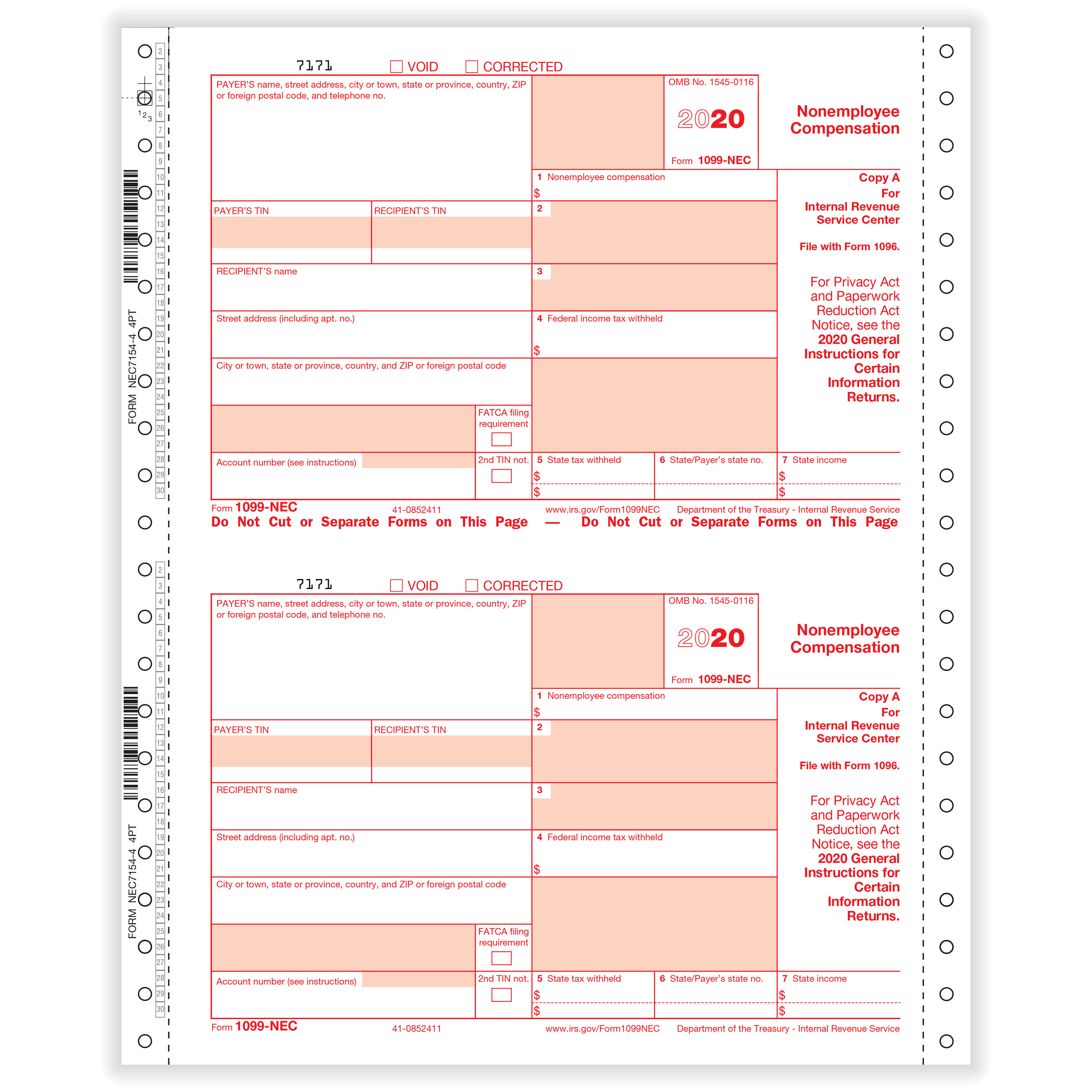

1099NEC Continuous 1" Wide 4Part Formstax

1099NEC Continuous 1" Wide 4Part Formstax

What the 1099NEC Coming Back Means for your Business Chortek

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Copy A Appears In Red, Similar To The Official Irs Form.

Web To Get The Form, Either Hit The Fill This Form Button Or Do The Steps Below:

Web Copy A Of This Form Is Provided For Informational Purposes Only.

File Copy A Of This Form With The Irs By.

Related Post: