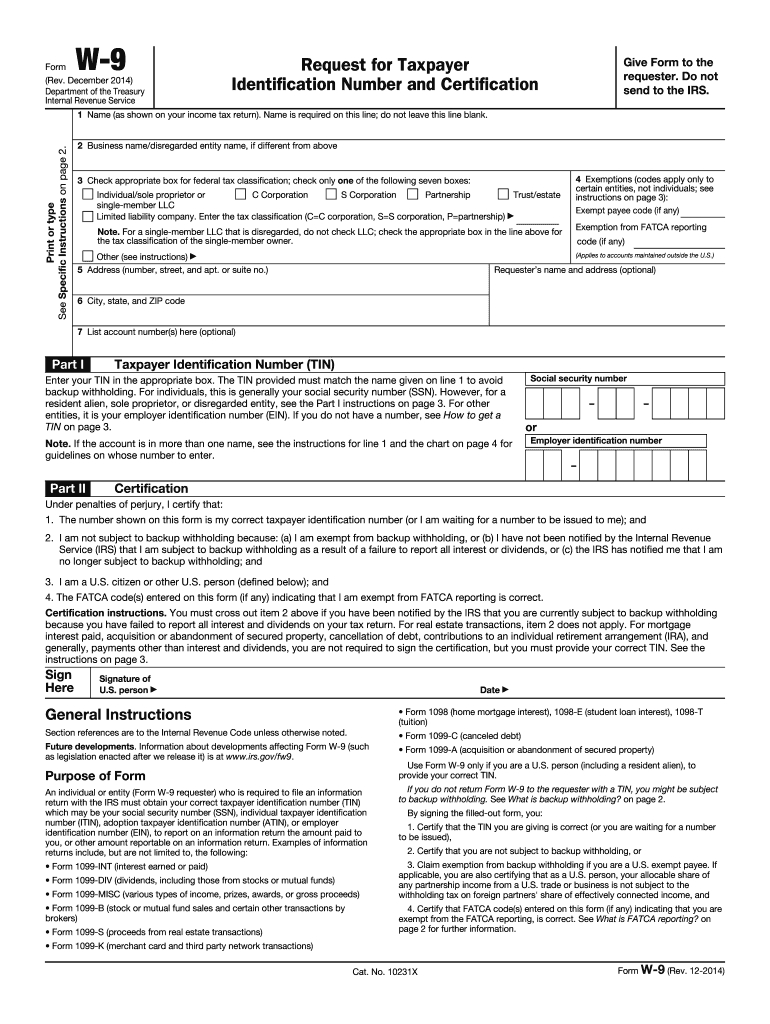

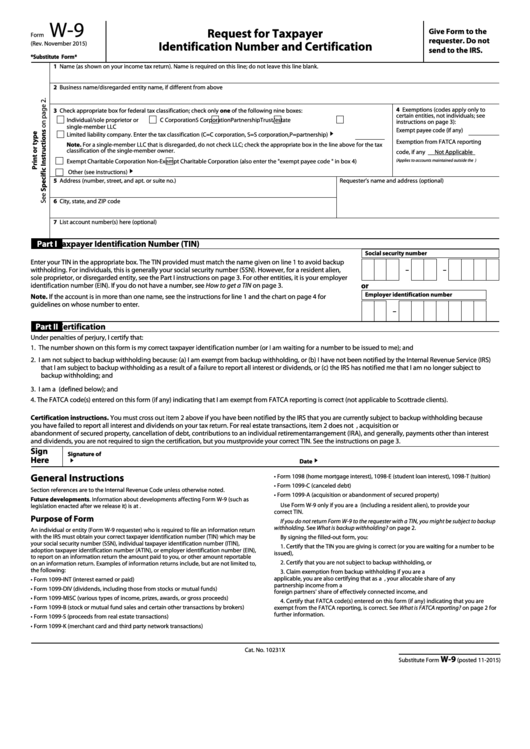

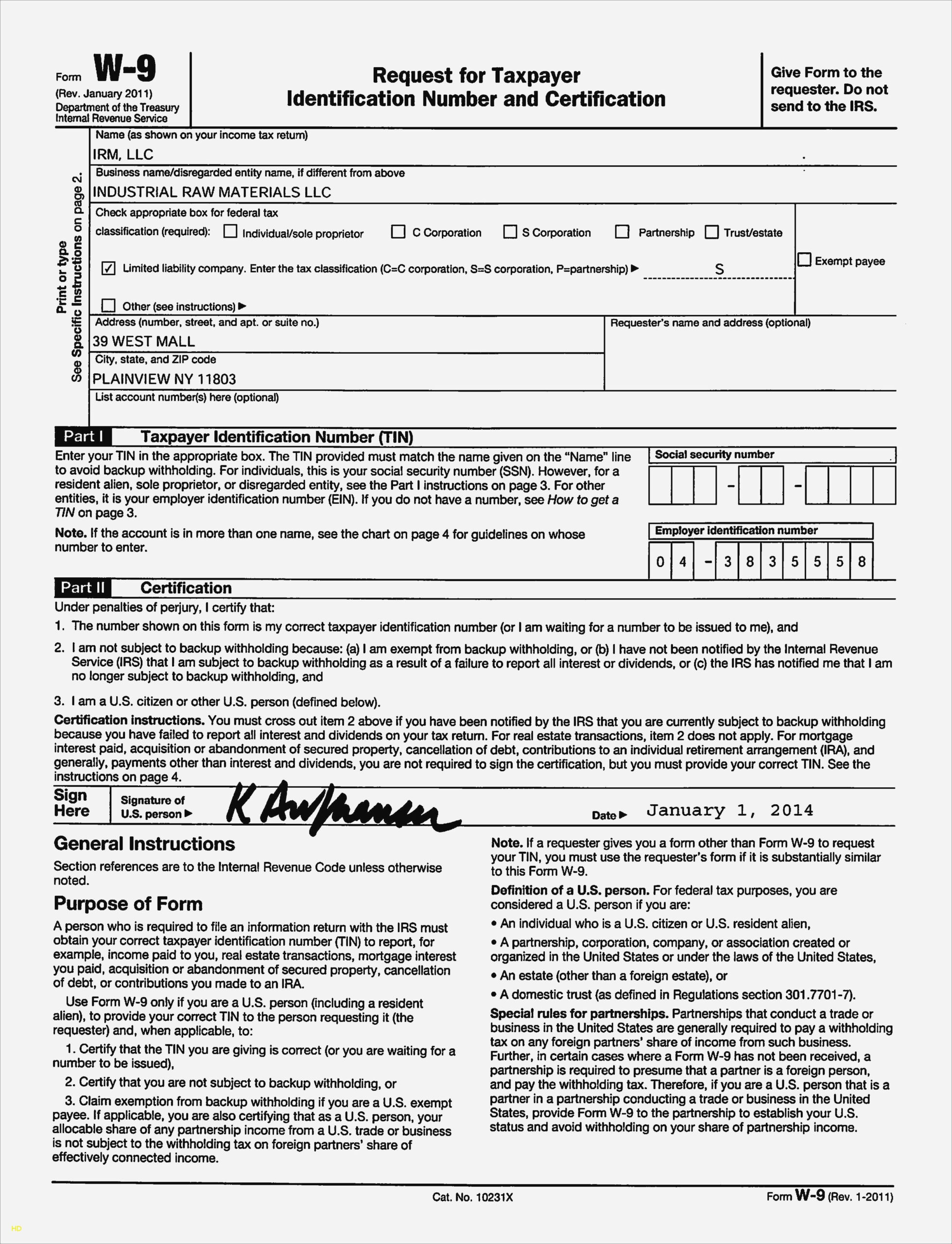

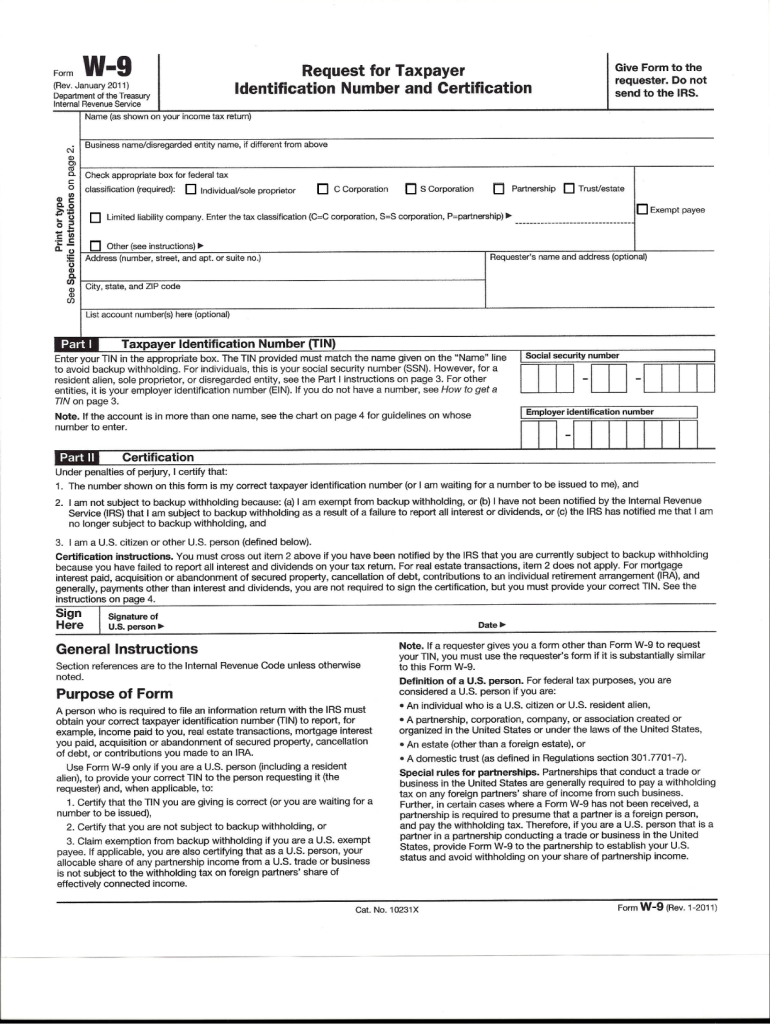

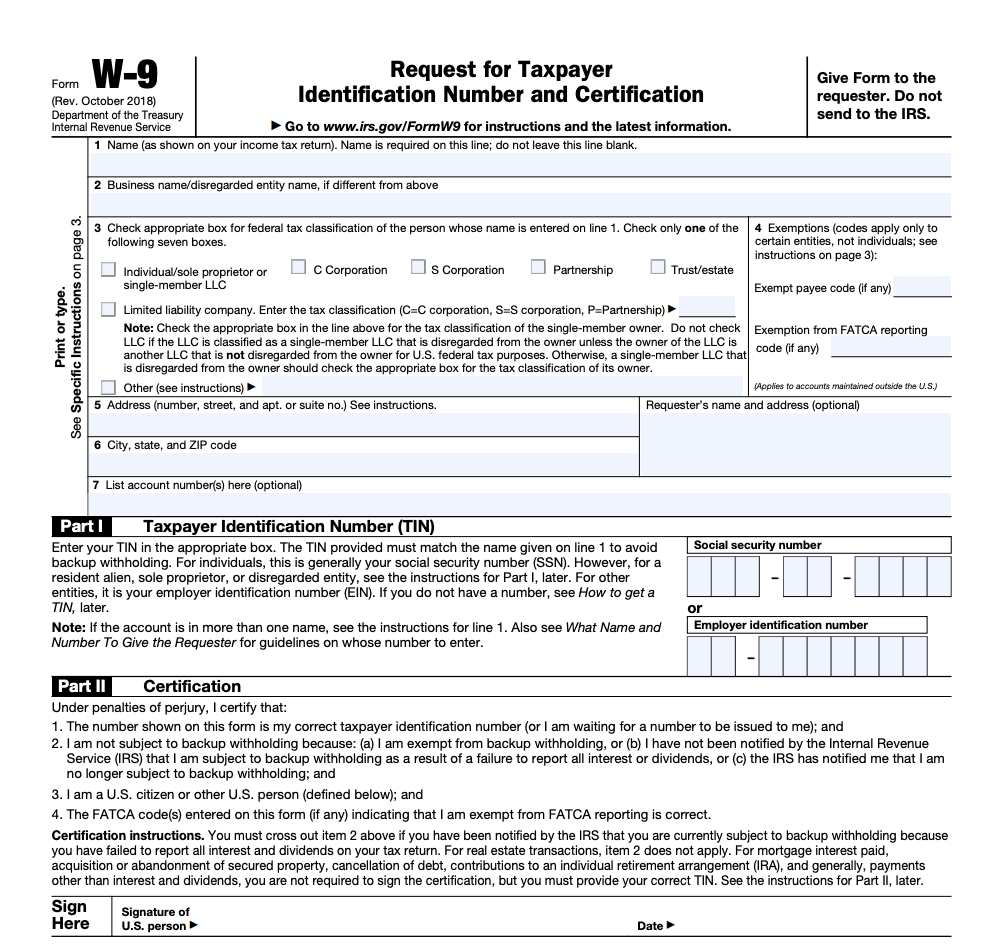

Printable Form W 9

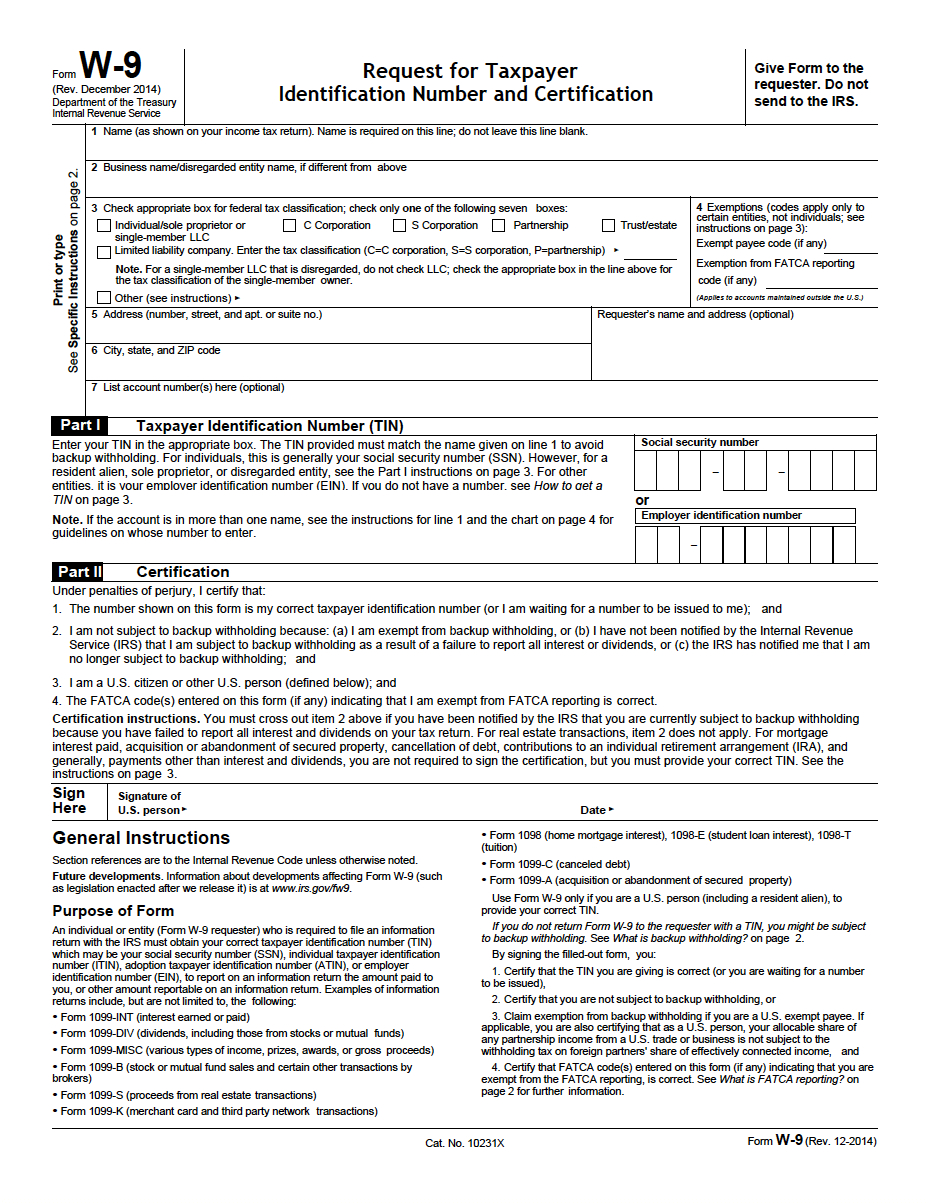

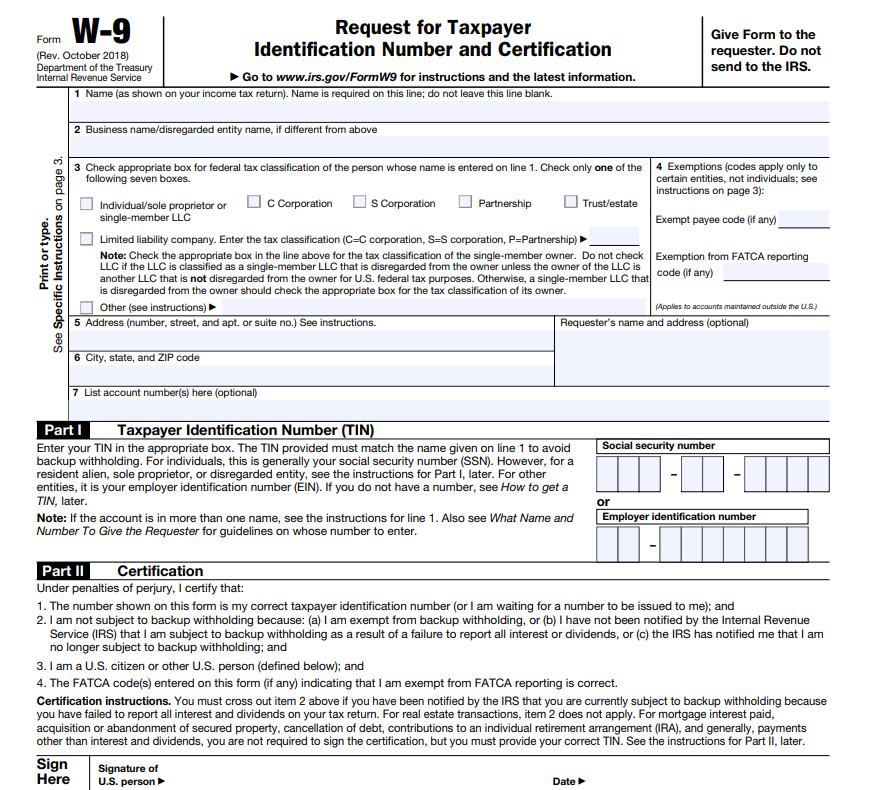

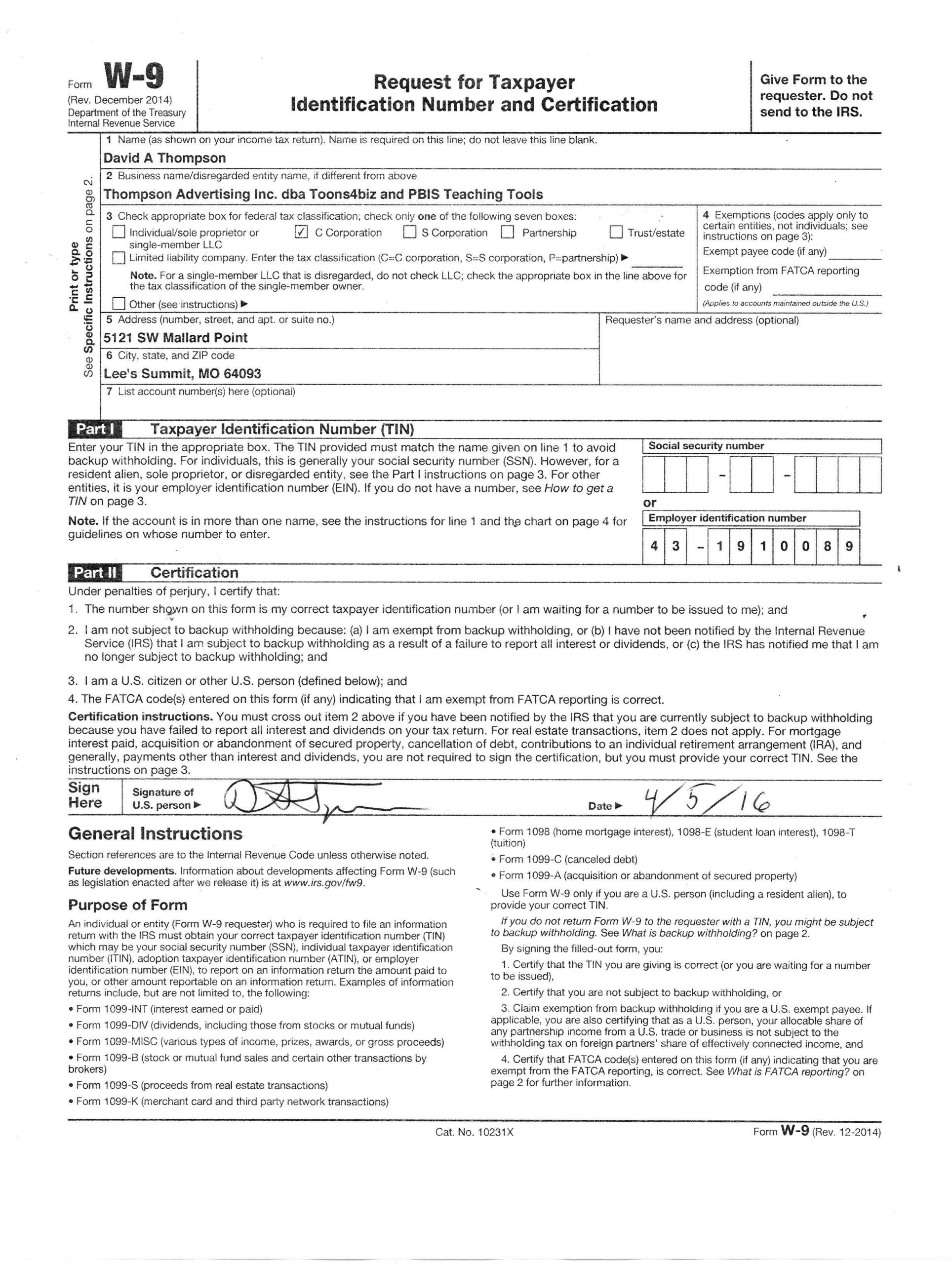

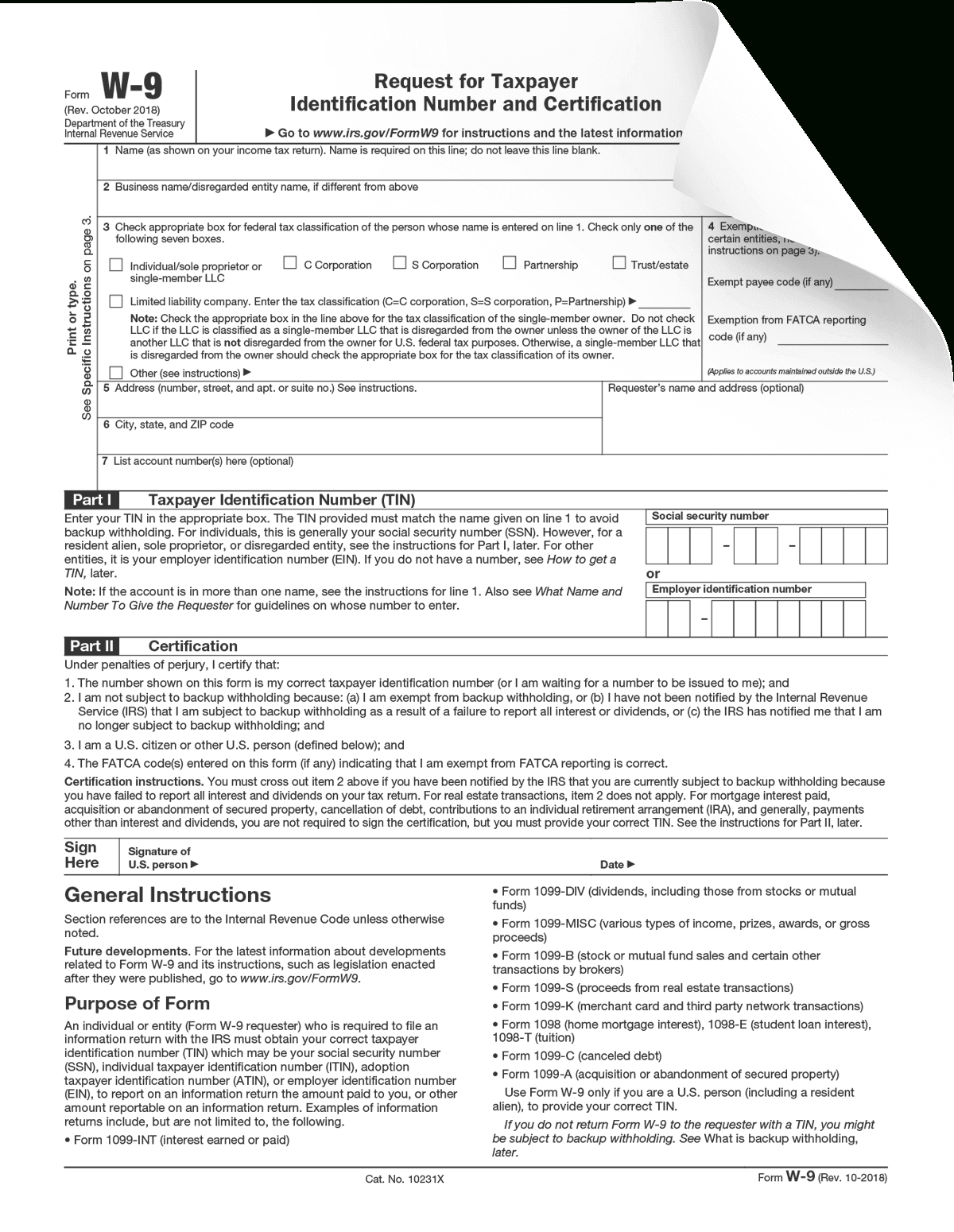

Printable Form W 9 - Request for taxpayer identification number and certification. Name is required on this line; The irs form w9 is a form that is requested from any company or individual that you have paid more than $600 in the past year. If you are a u.s. Fill in the required fields. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Do not leave this line blank. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. December 2014) department of the treasury internal revenue service. Print in capital letters inside the grey areas as shown in this example. December 2014) department of the treasury internal revenue service. October 2018) department of the treasury internal revenue service. Web the tips below can help you complete print w 9 form printable easily and quickly: The irs form w9 is a form that is requested from any company or individual that you have paid more than $600 in the past year.. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: The irs form w9 is a form that is requested from any company or individual that you have paid more than $600 in the past year. Request for taxpayer. Find out which product is right for you. December 2014) department of the treasury internal revenue service. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Name is required on this line; Web this form is used to provide the correct taxpayer identification. Find out which product is right for you. Web the tips below can help you complete print w 9 form printable easily and quickly: Print in capital letters inside the grey areas as shown in this example. Name is required on this line; October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago. Name is required on this line; Do not leave this line blank. Request for taxpayer identification number and certification. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Name (as shown on your income tax return). Name is required on this line; This form is for income earned in tax year 2022, with tax returns due in april 2023. Find out which product is right for you. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Web the tips. October 2018) department of the treasury internal revenue service. Request for taxpayer identification number and certification. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Web the tips below can help you complete print w 9 form printable. Name (as shown on your income tax return). This form is for income earned in tax year 2022, with tax returns due in april 2023. Fill in the required fields. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Web the tips below. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Find out which product is right for you. Print in capital letters inside the grey areas as shown in this example. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to.. Name is required on this line; Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Do not leave this line blank. The irs form w9 is a form that is requested from any company or individual that you have paid more than $600. Name (as shown on your income tax return). Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: Do not leave this line blank. Web the tips below can help you complete print w 9 form printable easily and quickly: Find out which product is right for you. Request for taxpayer identification number and certification. October 2018) department of the treasury internal revenue service. If you are a u.s. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Print in capital letters inside the grey areas as shown in this example. Fill in the required fields. The irs form w9 is a form that is requested from any company or individual that you have paid more than $600 in the past year. Name is required on this line; Request for taxpayer identification number and certification. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: This form is for income earned in tax year 2022, with tax returns due in april 2023. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. December 2014) department of the treasury internal revenue service. December 2014) department of the treasury internal revenue service. If you are a u.s. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and. Do not leave this line blank. The irs form w9 is a form that is requested from any company or individual that you have paid more than $600 in the past year. Person (including a resident alien), to provide your correct tin to the person requesting it (the requester) and, when applicable, to: October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification ago to. Request for taxpayer identification number and certification. Name is required on this line; Fill in the required fields. Find out which product is right for you. October 2018) department of the treasury internal revenue service. Request for taxpayer identification number and certification. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:W9 Form Printable 2017 Free Free Printable

Form W9 Do I REALLY Need It?

Free W9 Forms 2021 Printable Pdf Calendar Printables Free Blank

Irs W9 Form 2021 Printable Calendar Printable Free

Nys W9 Printable Forms For 2021 Calendar Template Printable

Blank Tax Forms W9 Calendar Template Printable

Fillable Form W9 Request For Taxpayer Identification Number And

Free W 9 Form Printable Calendar Printables Free Blank

W9 Template Fill Out and Sign Printable PDF Template signNow

Printable Tx W9 Form

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Print In Capital Letters Inside The Grey Areas As Shown In This Example.

Name (As Shown On Your Income Tax Return).

Web The Tips Below Can Help You Complete Print W 9 Form Printable Easily And Quickly:

Related Post: