Printable Sales Tax Chart

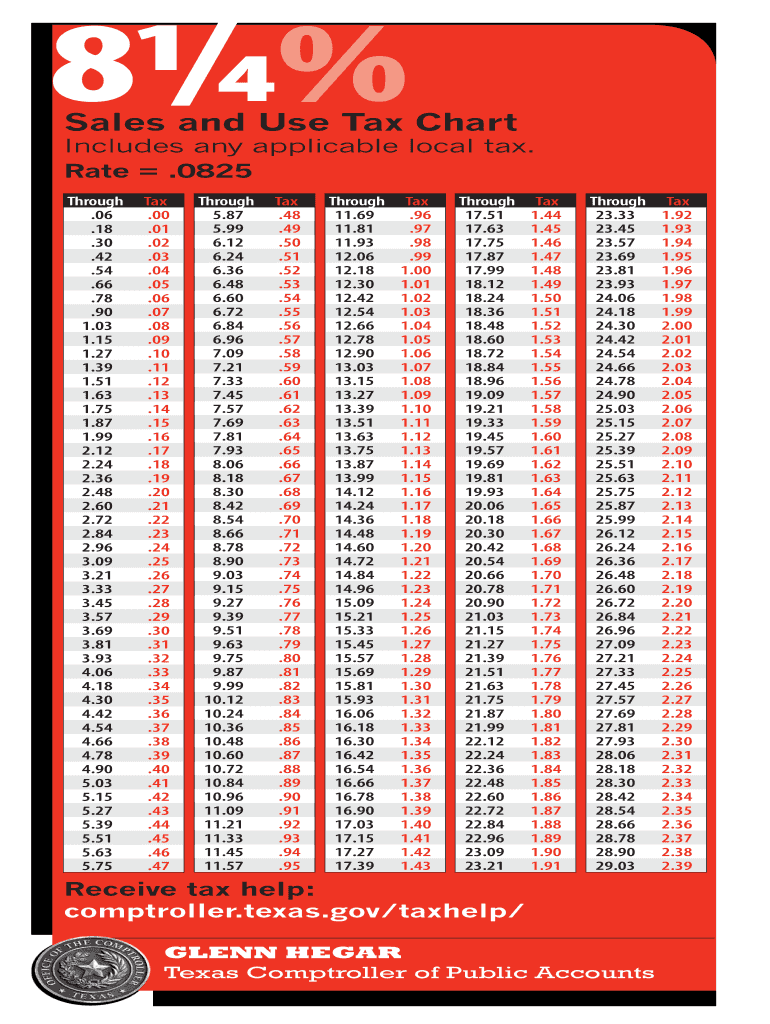

Printable Sales Tax Chart - For quick reference, this table includes the minimum and maximum local tax rates that occur within. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. There is no applicable special tax. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web sales tax chart get our configurable sales tax chart. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). City rates with local codes and total tax rates. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. Web sales tax chart get our configurable sales tax chart. For quick reference, this table includes the minimum and maximum local tax rates that occur within. Take control over your company's tax strategies and confidently manage with onesource®. City rates with local codes and total tax rates. Web county and transit sales and use tax rates for cities and towns. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. City rates with local codes and total tax rates. Price up to tax price up to tax price up to tax price up to tax price up to. Web county and transit sales and use tax rates for cities and towns. Web sales tax chart get our configurable sales tax chart. Download avalara rate tables each month or find rates with the sales tax rate calculator. Price up to tax price up to tax price up to tax price up to tax price up to tax price up. Web 51 rows this sales tax table (also known as a sales tax chart or sales. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web sales and use tax chart (continued) sales over $50 how to figure the tax example: The five states with the highest average local sales tax rates are. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. For quick reference, this table includes the minimum and maximum local tax rates that occur within. Web sales tax chart get our configurable sales tax chart. Sale is. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. Sale is $75.95 tax on. Web local sales and use tax rates.. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Web sales and use tax chart (continued) sales over $50 how to figure the tax example: For quick reference, this table includes the minimum and maximum local tax rates that occur within. Web sales tax chart get our configurable. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). Download select the states in which you do. There is no applicable special tax. Web 2023 texas sales tax table. For quick reference, this table includes the minimum and maximum local tax rates that occur within. Web sales tax chart get our configurable sales tax chart. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Web local sales tax rates. Web instead of using your. Download select the states in which you do. Web local sales tax rates. Use the sales tax rate locator to search for sales tax rates by address. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web 2023 texas sales tax table. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Web county and transit sales and use tax rates for cities and towns. Download select the states in which you do. Web sales and use tax chart (continued) sales over $50 how to figure the tax example: Web 51 rows this sales tax table (also known as a sales tax chart or sales. Web sales tax chart tennessee department of revenue sales tax chart sales from to combining local tax (2.75%) and state tax (7%) = total (9.75%). Take control over your company's tax strategies and confidently manage with onesource®. Simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax. Web local sales tax rates. There is no applicable special tax. Sale is $75.95 tax on. Web local sales and use tax rates. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web what is the maximum local sales tax rate in your area (even down to the zip code)? City rates with local codes and total tax rates. Web instead of using your actual expenses, you can use the 2022 optional state sales tax table and the 2022 optional local sales tax tables at the end of these instructions to. Download avalara rate tables each month or find rates with the sales tax rate calculator. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web the 8.6% sales tax rate in phoenix consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.3% phoenix tax. Use the sales tax rate locator to search for sales tax rates by address. There is no applicable special tax. Take control over your company's tax strategies and confidently manage with onesource®. Web what is the maximum local sales tax rate in your area (even down to the zip code)? Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web 2023 texas sales tax table. Web sales and use tax chart (continued) sales over $50 how to figure the tax example: Web local sales tax rates. Web county and transit sales and use tax rates for cities and towns. Web local sales and use tax rates. Download select the states in which you do. Download avalara rate tables each month or find rates with the sales tax rate calculator. Web 51 rows this sales tax table (also known as a sales tax chart or sales. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent),. Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Ad calculate sales, use, & excise tax, vat, & gst with our global tax determination software. Web sales tax chart get our configurable sales tax chart.California 9 Sales Tax Chart Printable Total up your items purchase

sales tax chart 8.25 Google Search Sales tax, Market day ideas

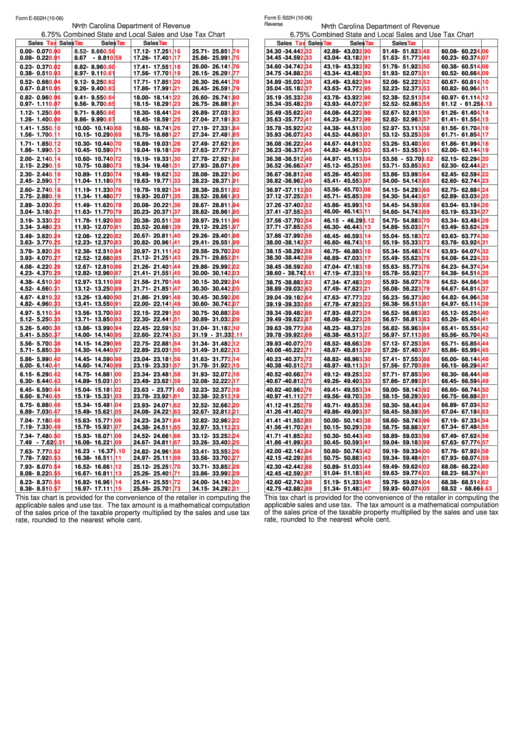

Form E502h 6.75 Combined State And Local Sales And Use Tax Chart

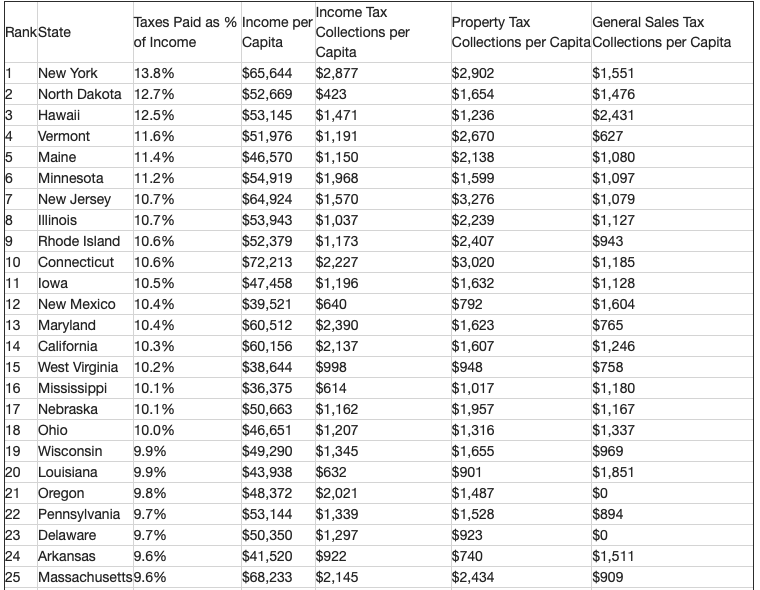

Taxidermy Local rates stuffed with fewer increases

7.25 Sales Tax Chart Printable Printable Word Searches

Florida Sales Tax Chart My XXX Hot Girl

REV227 PA Sales and Use Tax Credit Chart Free Download

20152022 Form TX 98292 Fill Online, Printable, Fillable, Blank

Free Printable Sales Tax Chart Printable World Holiday

The Amount Listed In The Sales Tax Table For Other States Click Here

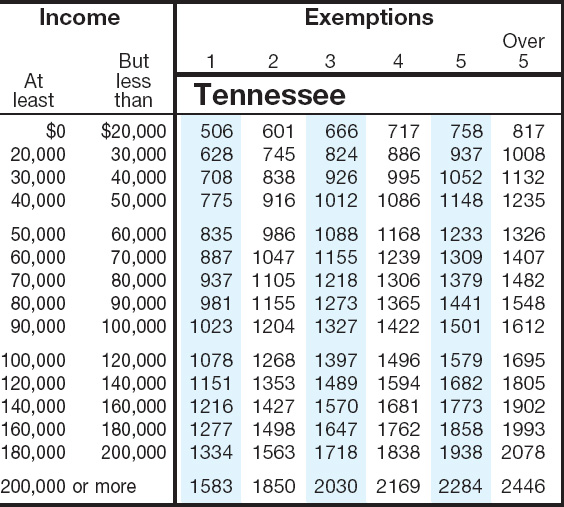

Web Sales Tax Chart Tennessee Department Of Revenue Sales Tax Chart Sales From To Combining Local Tax (2.75%) And State Tax (7%) = Total (9.75%).

For Quick Reference, This Table Includes The Minimum And Maximum Local Tax Rates That Occur Within.

Web The 8.6% Sales Tax Rate In Phoenix Consists Of 5.6% Arizona State Sales Tax, 0.7% Maricopa County Sales Tax And 2.3% Phoenix Tax.

Web Instead Of Using Your Actual Expenses, You Can Use The 2022 Optional State Sales Tax Table And The 2022 Optional Local Sales Tax Tables At The End Of These Instructions To.

Related Post: