Printable Schedule C Form

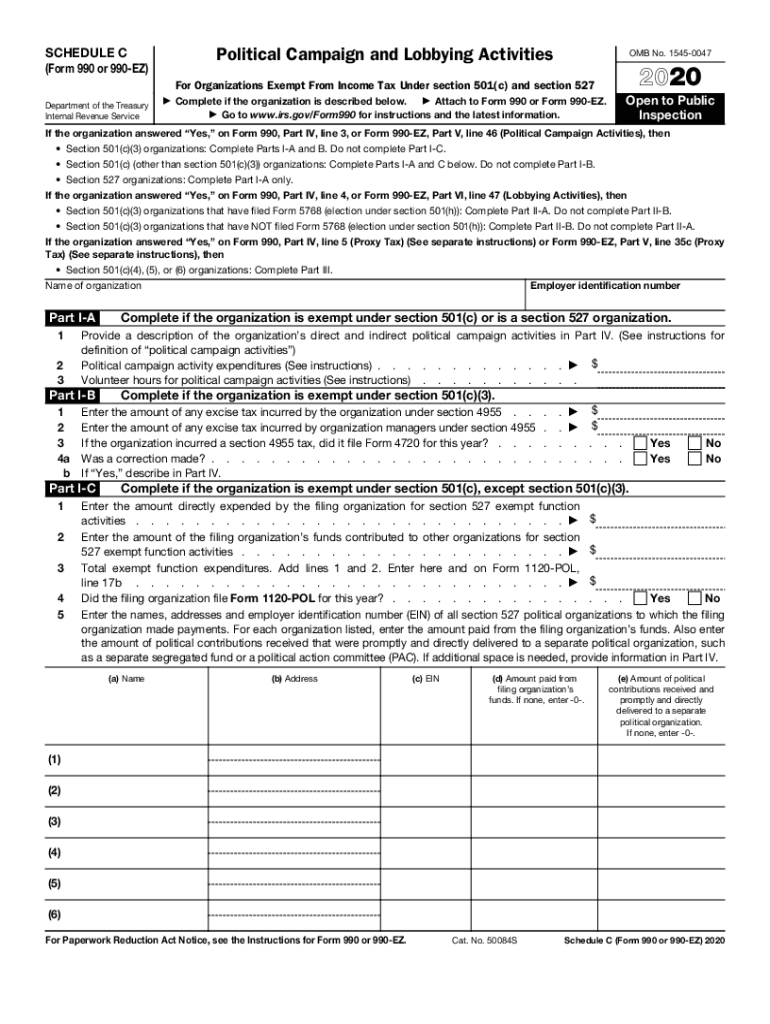

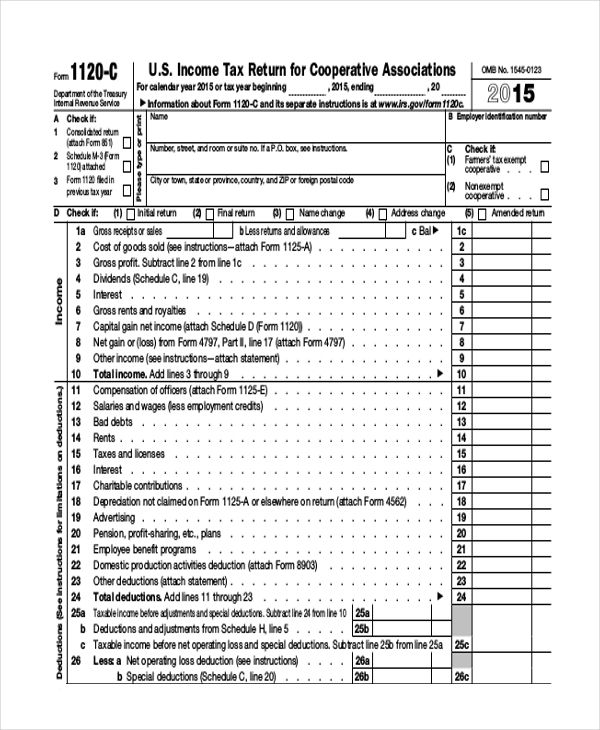

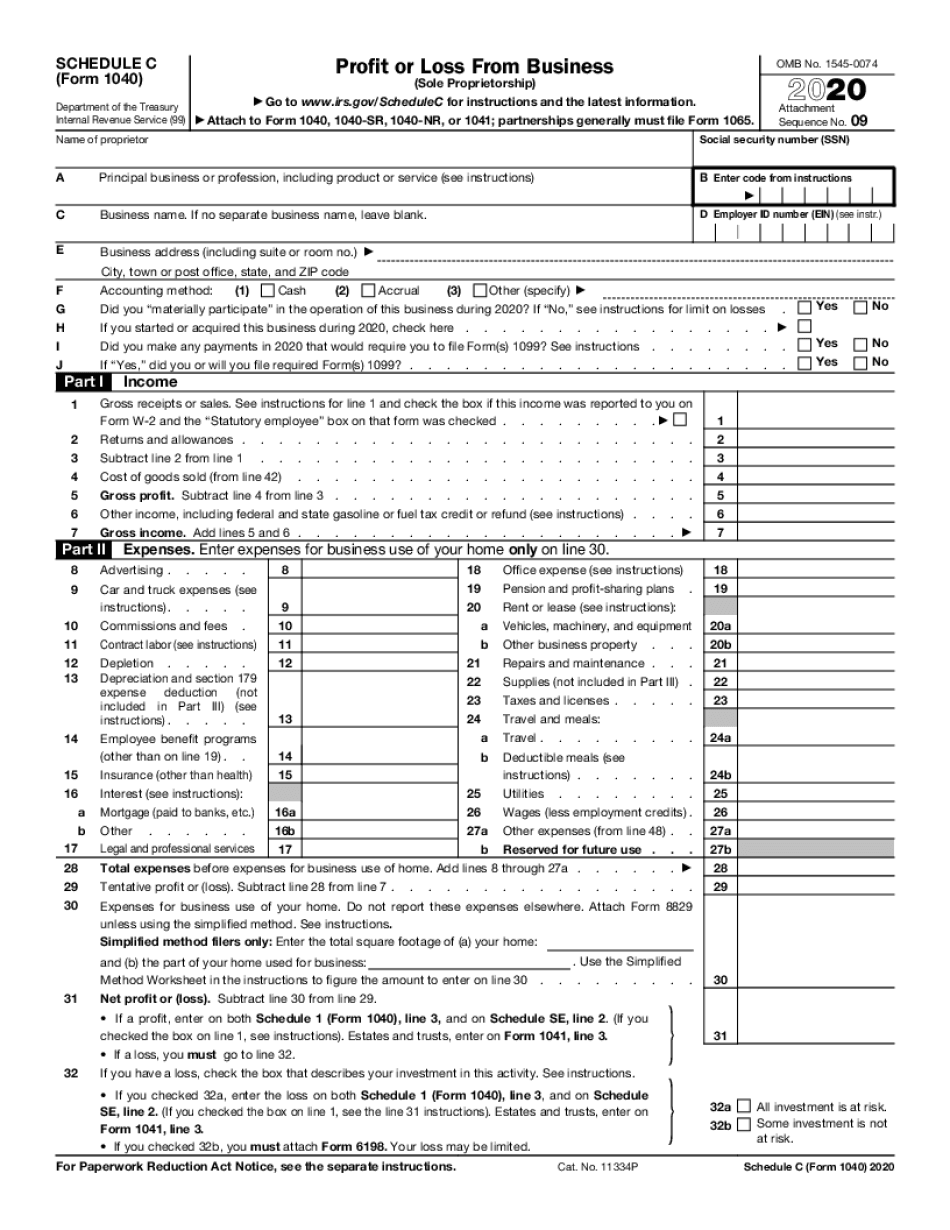

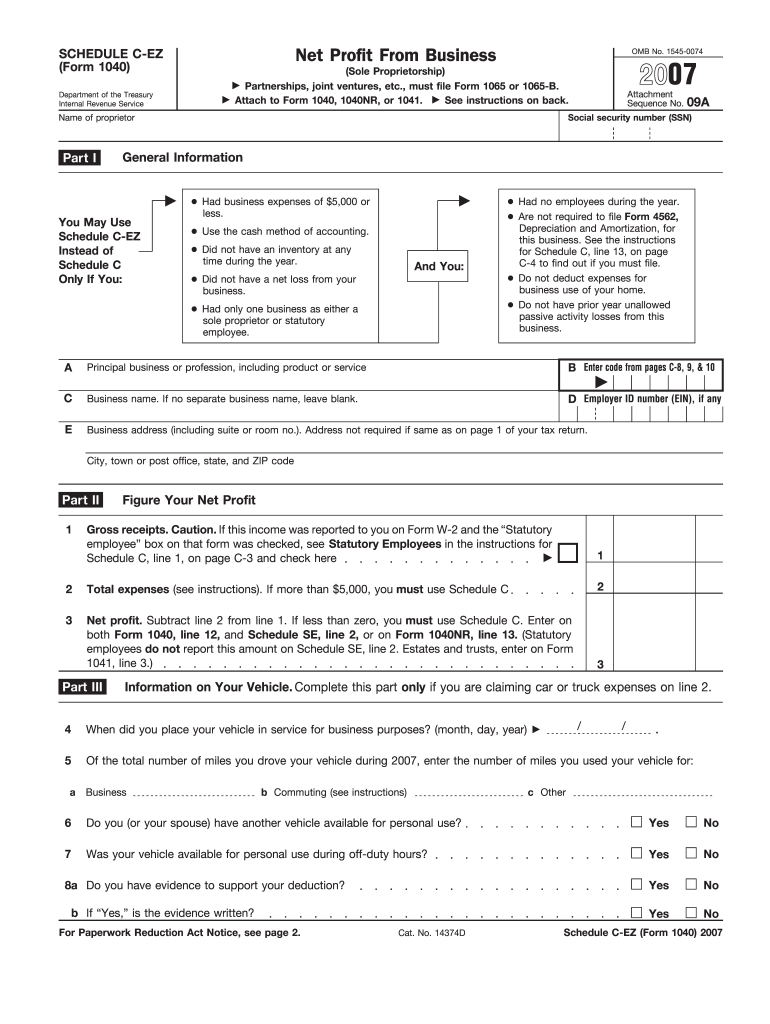

Printable Schedule C Form - The first section on schedule c asks whether you made any payments subject to filing a form 1099. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Track and field fans in europe can follow and watch the. File forms 1099 for all contractors. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. This form is for income earned in tax year 2022, with tax returns due. An activity qualifies as a business if your. Web documents needed for schedule c. Pdffiller.com has been visited by 1m+ users in the past month Web how much will i receive? Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web nbc sports is the exclusive rights' holder of the 2023 world athletics championships in the u.s. Web documents needed for schedule c. Web schedule c worksheet hickman & hickman, pllc. This form is for. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Pdffiller.com has been visited by 1m+ users in the past month You must file a 1099. This form is for income earned in tax year 2022, with tax returns due. Use. Web printable federal income tax schedule c. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web documents needed for. Web printable federal income tax schedule c. The first section on schedule c asks whether you made any payments subject to filing a form 1099. File forms 1099 for all contractors. Web nbc sports is the exclusive rights' holder of the 2023 world athletics championships in the u.s. Web schedule c (form 1040) 2015 profit or loss from business (sole. File forms 1099 for all contractors. Web documents needed for schedule c. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web how much will i receive? Web schedule c worksheet hickman & hickman, pllc. File forms 1099 for all contractors. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This form is for income earned in tax year 2022, with tax returns due. The first section on schedule c asks whether you made any payments subject to filing. Ad download or email schedule c & more fillable forms, register and subscribe now! Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. You must file a 1099. An activity qualifies as a business if your. $520 for married couples who filed jointly with an. $520 for married couples who filed jointly with an. You must file a 1099. Ad download or email schedule c & more fillable forms, register and subscribe now! Pdffiller.com has been visited by 1m+ users in the past month The first section on schedule c asks whether you made any payments subject to filing a form 1099. An activity qualifies as a business if your. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Track and field fans in europe can follow and watch the. Web use schedule c (form 1040) to report income or (loss) from a business you operated or. The first section on schedule c asks whether you made any payments subject to filing a form 1099. An activity qualifies as a business if your. File forms 1099 for all contractors. Web nbc sports is the exclusive rights' holder of the 2023 world athletics championships in the u.s. Web schedule c worksheet hickman & hickman, pllc. $520 for married couples who filed jointly with an. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Web printable federal income tax schedule c. Web nbc sports is the exclusive rights' holder of the 2023 world athletics championships in the u.s. File forms 1099 for all contractors. Web schedule c worksheet hickman & hickman, pllc. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Pdffiller.com has been visited by 1m+ users in the past month Web documents needed for schedule c. This form is for income earned in tax year 2022, with tax returns due. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. You must file a 1099. Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. Web how much will i receive? Track and field fans in europe can follow and watch the. Ad download or email schedule c & more fillable forms, register and subscribe now! Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your. The first section on schedule c asks whether you made any payments subject to filing a form 1099. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. You must file a 1099. Web printable federal income tax schedule c. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This form is for income earned in tax year 2022, with tax returns due. Ad download or email schedule c & more fillable forms, register and subscribe now! Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. Web how much will i receive? Web documents needed for schedule c.Schedule C Form 990 Or 990 EZ Political Campaign And Lobbying

How To Fill Out A Schedule C Form Fill Online, Printable, Fillable

Free Printable Schedule C Tax Form Printable Form 2022

FREE 9+ Sample Schedule C Forms in PDF MS Word

The Fastest Way To Convert PDF To Fillable Schedule C 1040 Form

printable schedule c ez 2007 form Fill out & sign online DocHub

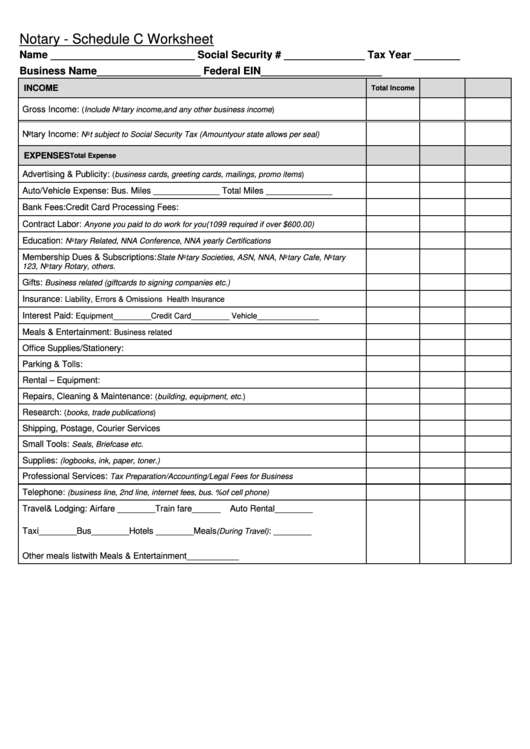

Schedule C Worksheet printable pdf download

FREE 9+ Sample Schedule C Forms in PDF MS Word

Who's required to fill out a Schedule C IRS form?

Schedule C Worksheet Fillable

Track And Field Fans In Europe Can Follow And Watch The.

$260 For Each Taxpayer With An Adjusted Gross Income Of $75,000 Or Less In 2021.

Pdffiller.com Has Been Visited By 1M+ Users In The Past Month

$520 For Married Couples Who Filed Jointly With An.

Related Post:

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)