Printable Schedule C Tax Form

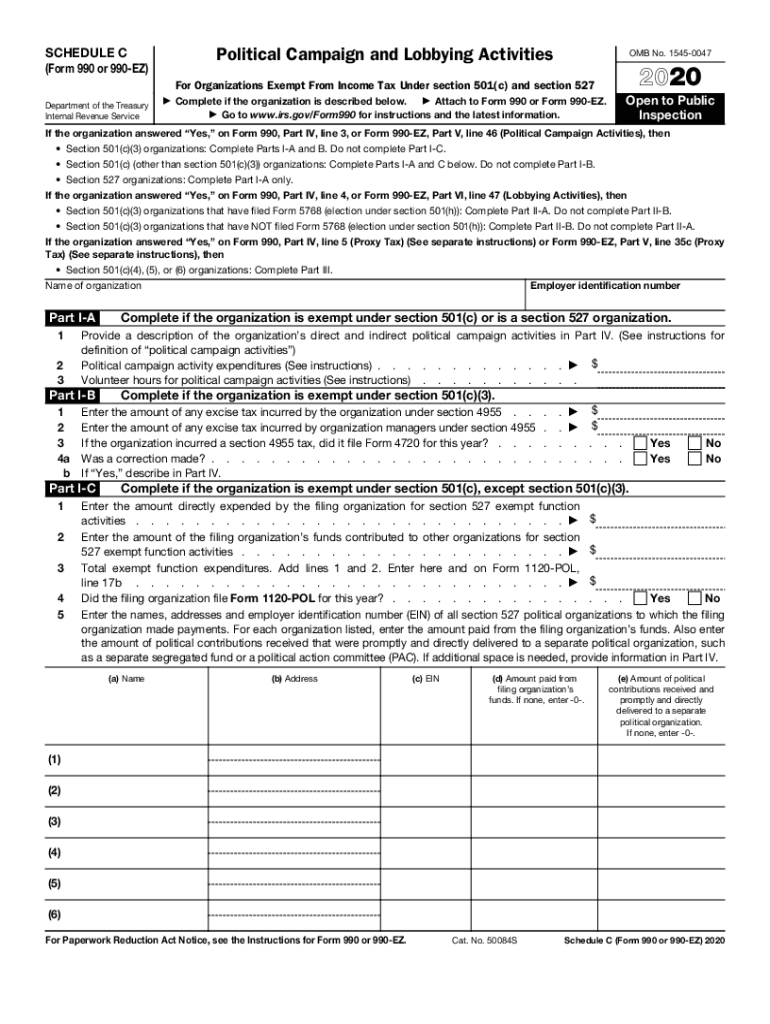

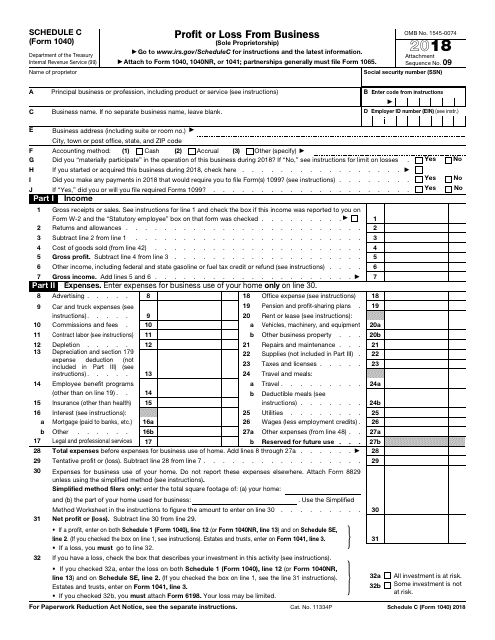

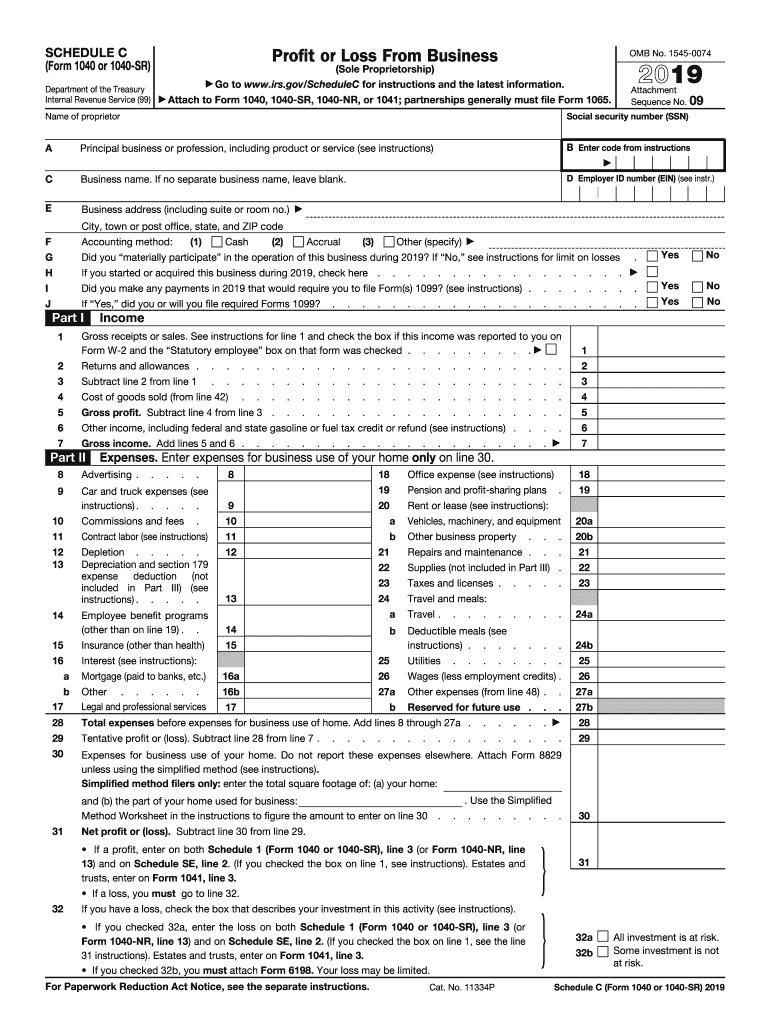

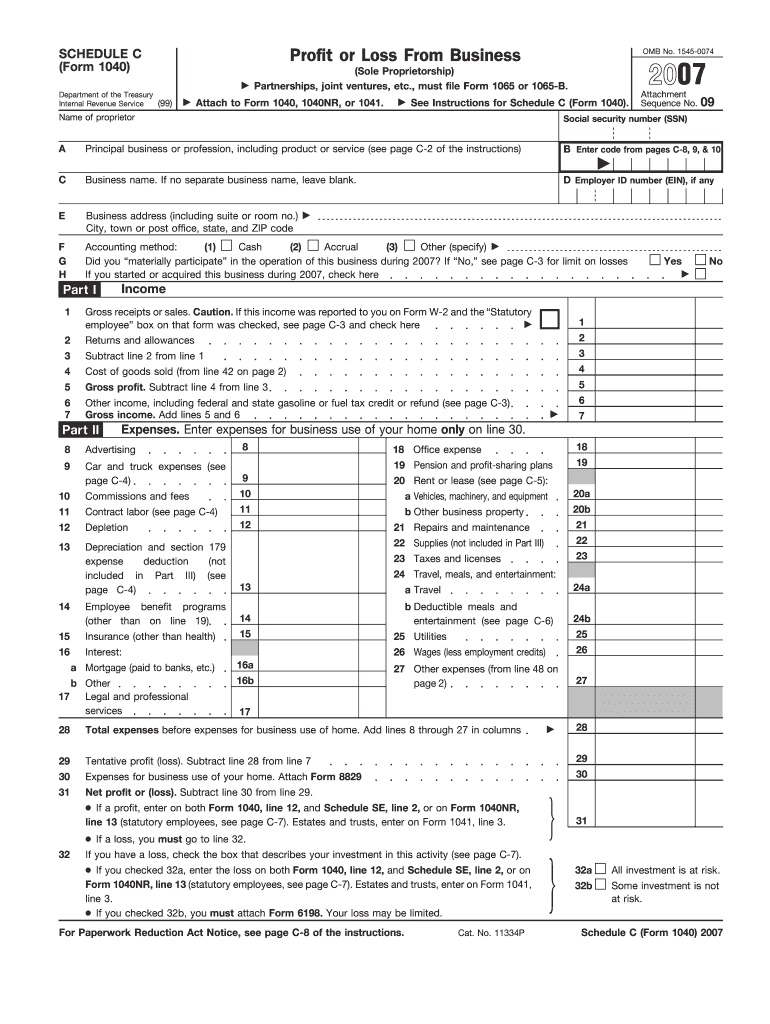

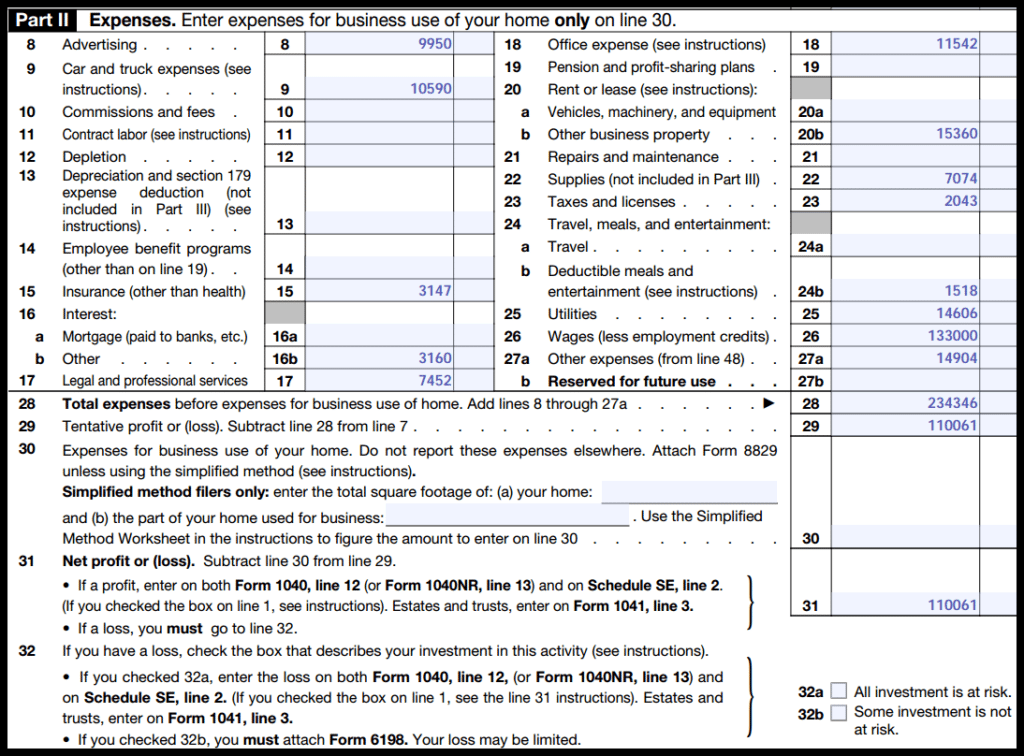

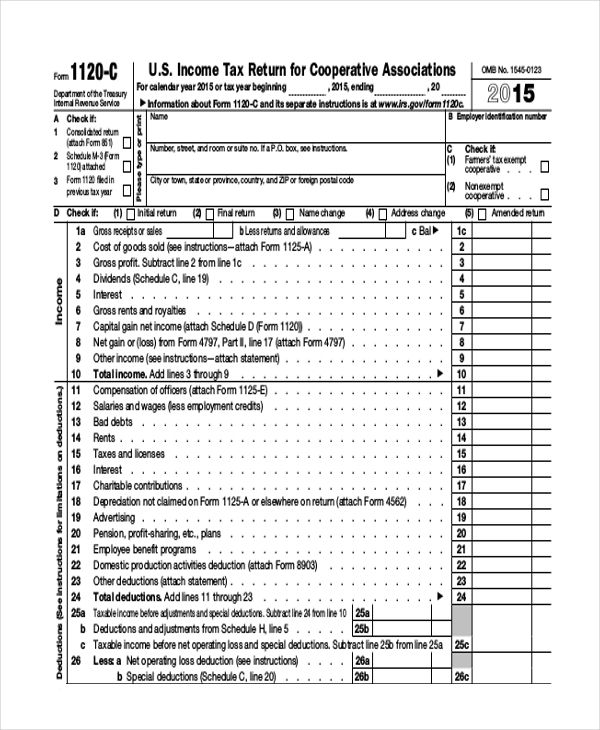

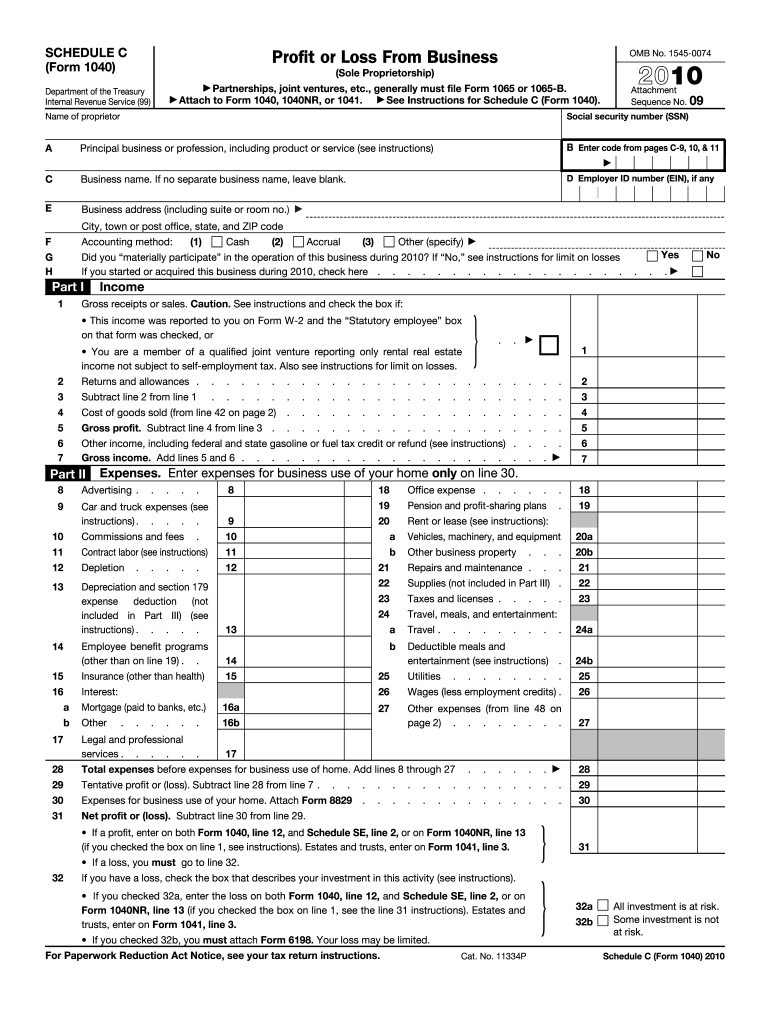

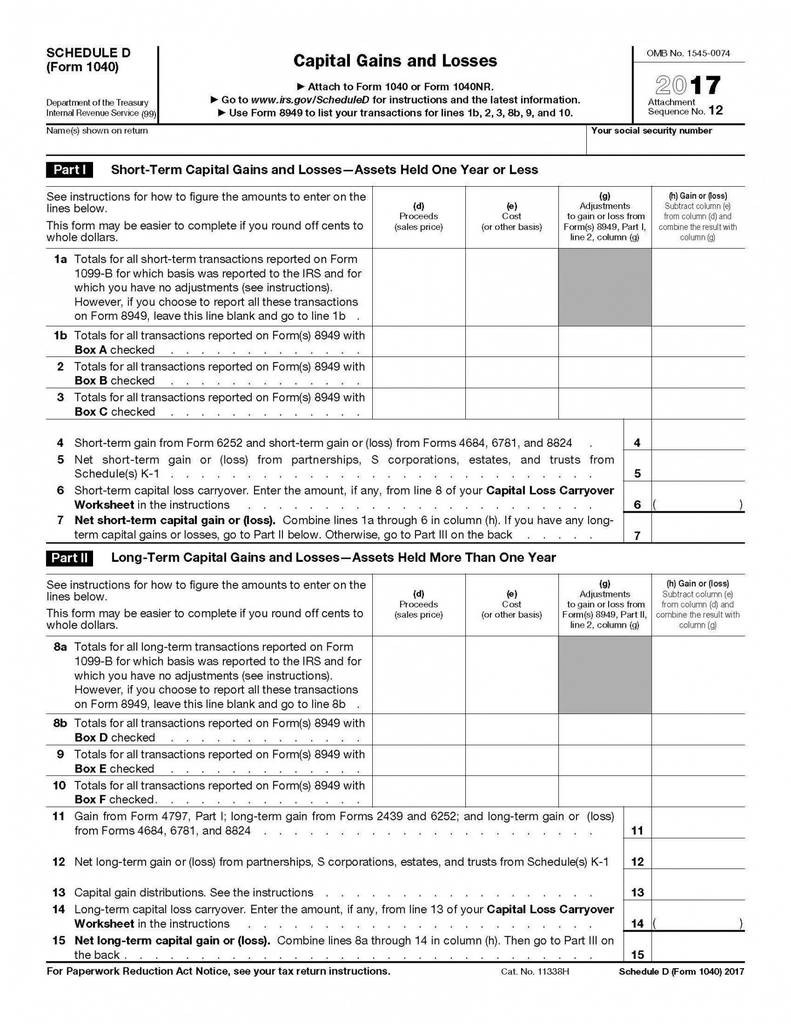

Printable Schedule C Tax Form - Web you don't need to apply. Web fill out form 1040 (schedule c) in minutes, not hours. The resulting profit or loss. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Complete, sign, print and send your tax documents easily with us legal forms. Individual tax return form 1040 instructions; It shows your income and how much taxes you owe. This form is for income earned in tax year 2022, with tax returns due. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web a form schedule c: Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Ad download or email schedule c & more fillable forms, register and subscribe now! Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Complete, sign, print and send your tax documents easily with us legal forms. Save your time spent on printing, signing, and scanning a paper copy of form 1040 (schedule c). Pdffiller.com has been visited by 1m+. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. The resulting profit or loss. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit. Web for the latest information about developments related to schedule c (form 990) and its instructions, such as legislation enacted after they were published, go to. Download blank or fill out online in pdf format. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web. Complete, sign, print and send your tax documents easily with us legal forms. This form is for income earned in tax year 2022, with tax returns due. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Pdffiller.com has been visited by 1m+. Web a form schedule c: There is no application or form to fill out; Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web schedule c is a sole proprietor tax form. Web here you will find an updated listing of all massachusetts department of revenue. Rebates will be sent automatically based on income tax returns for tax year 2021, including the. Web popular forms & instructions; Save your time spent on printing, signing, and scanning a paper copy of form 1040 (schedule c). Web a form schedule c: Web irs schedule c, profit or loss from business, is a tax form you file with your. It’s part of your individual tax. Web schedule c is a sole proprietor tax form. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. The resulting profit or loss. Web you don't need to apply. Rebates will be sent automatically based on income tax returns for tax year 2021, including the. Individual tax return form 1040 instructions; The resulting profit or loss. There is no application or form to fill out; Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web fill out form 1040 (schedule c) in minutes, not hours. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for. This form is for income earned in tax year 2022, with tax returns due. Complete, sign, print and send your tax documents easily with us legal forms. It shows your income and how much taxes you owe. Web fill out form 1040 (schedule c) in minutes, not hours. Web for the latest information about developments related to schedule c (form 990) and its instructions, such as legislation enacted after they were published, go to. Rebates will be sent automatically based on income tax returns for tax year 2021, including the. Web printable federal income tax schedule c. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web we last updated federal 1040 (schedule c) in december 2022 from the federal internal revenue service. Download blank or fill out online in pdf format. Web schedule c is a sole proprietor tax form. There is no application or form to fill out; It’s part of your individual tax. Web a form schedule c: Web popular forms & instructions; Save your time spent on printing, signing, and scanning a paper copy of form 1040 (schedule c). Web you don't need to apply. Web here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Web fill out form 1040 (schedule c) in minutes, not hours. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Rebates will be sent automatically based on income tax returns for tax year 2021, including the. Web popular forms & instructions; Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule. Web schedule c is a sole proprietor tax form. Save your time spent on printing, signing, and scanning a paper copy of form 1040 (schedule c). The resulting profit or loss. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Individual tax return form 1040 instructions; Schedule c is an addition. Complete, sign, print and send your tax documents easily with us legal forms. Pdffiller.com has been visited by 1m+ users in the past monthSchedule C Form 990 Or 990 EZ Political Campaign And Lobbying

Printable Schedule C Master of Documents

IRS 1040 Schedule C 2019 Fill and Sign Printable Template Online

Schedule C Tax Form Fill Out and Sign Printable PDF Template signNow

How to Complete Schedule C Profit and Loss From a Business

FREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

Irs form schedule c 2010 Fill out & sign online DocHub

2016 Schedule C Tax Form Lovely Qualified Dividends And —

Schedule c tax form fleetqust

Ad Download Or Email Schedule C & More Fillable Forms, Register And Subscribe Now!

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

Web Irs Schedule C, Profit Or Loss From Business, Is A Tax Form You File With Your Form 1040 To Report Income And Expenses For Your Business.

It Shows Your Income And How Much Taxes You Owe.

Related Post: