Printable State Tax Forms

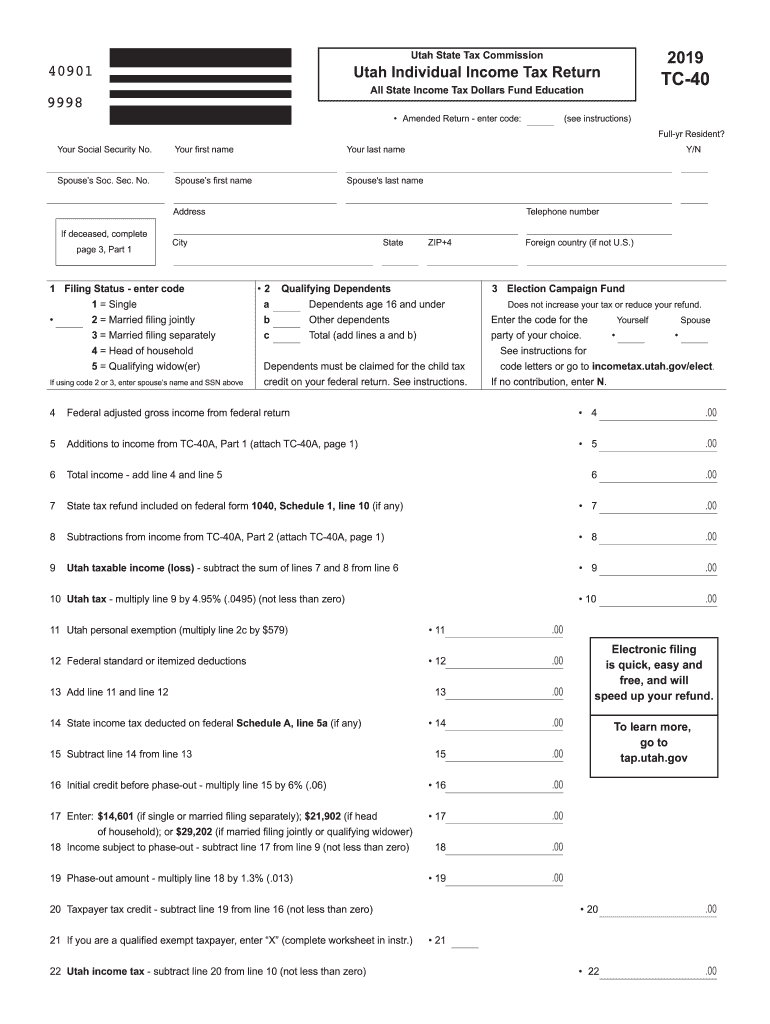

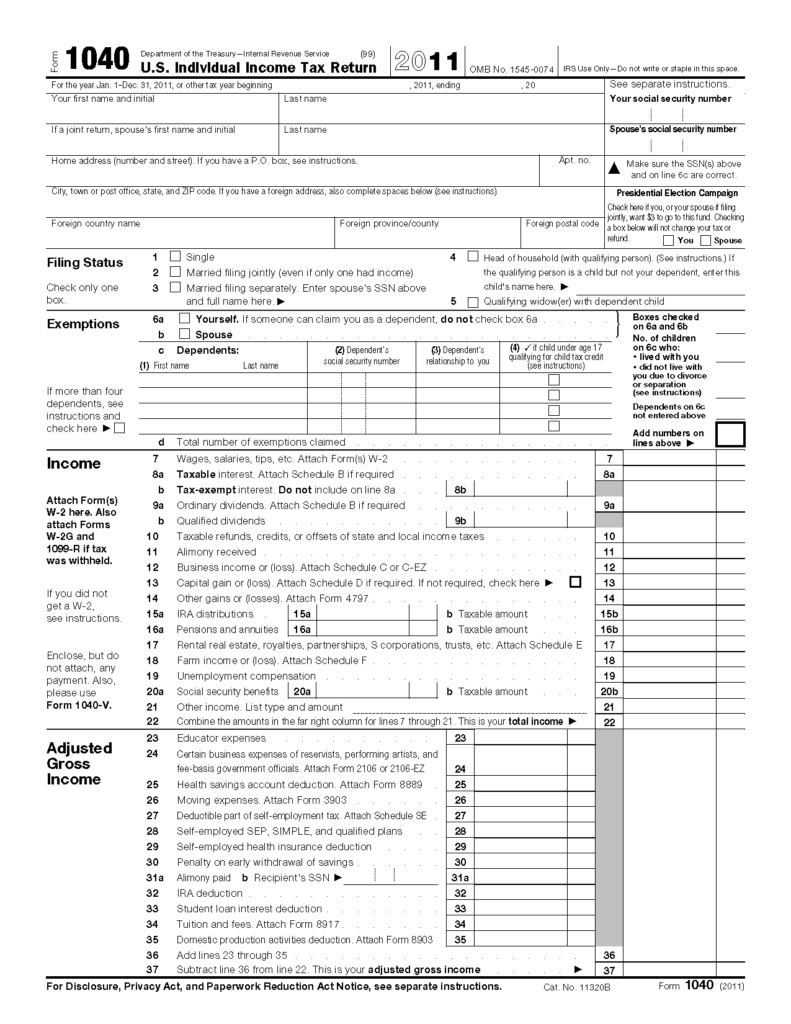

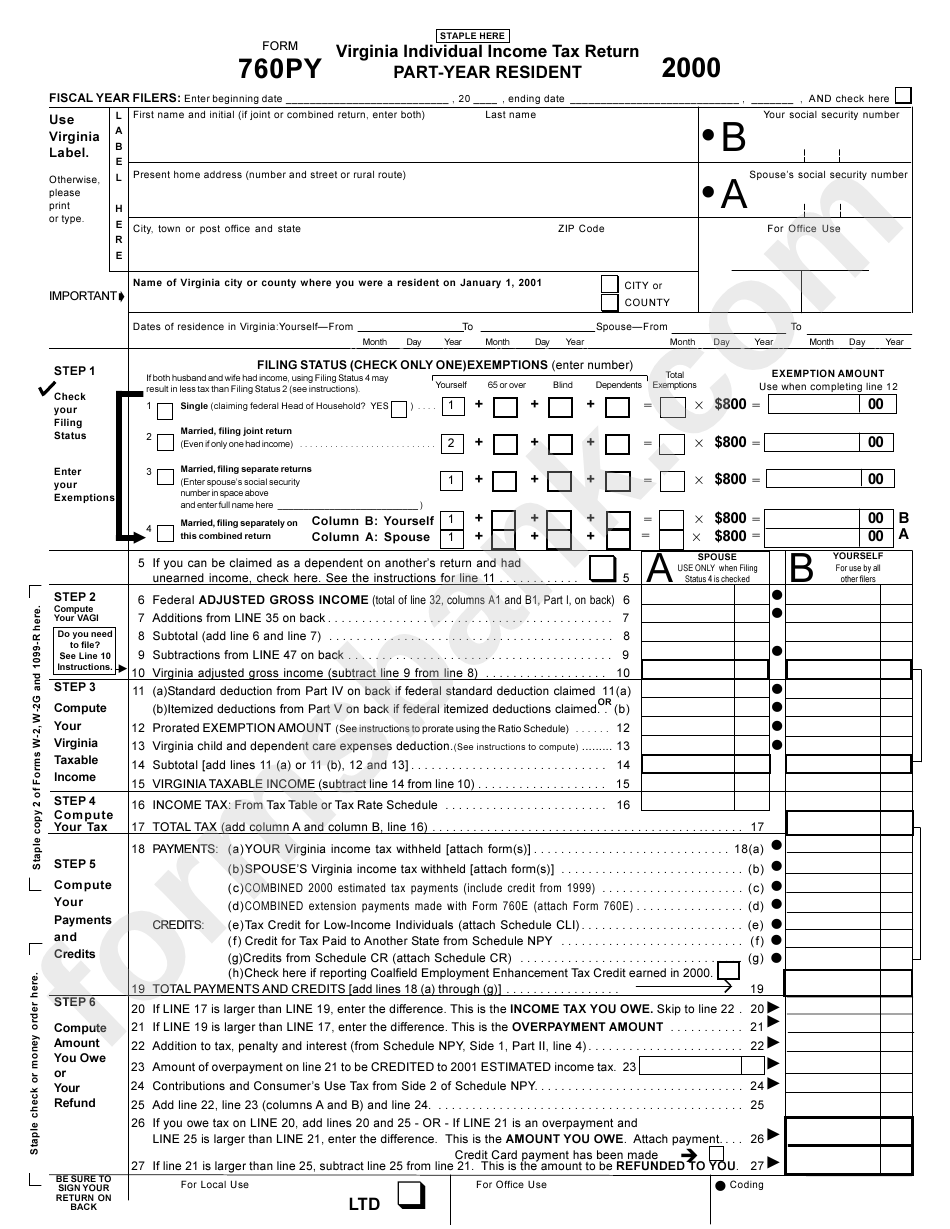

Printable State Tax Forms - You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web get federal tax return forms and file by mail. Web all massachusetts tax forms are in pdf format. Web state and city forms. The arizona income tax rate for tax year 2022 is progressive from a low of 2.59% to a high of 4.5%. You are making adjustments to income. Get information about your state’s tax forms by selecting the state below. Web 2021 california resident income tax return 540. Web helping you feel smarter and confident about your state taxes. Web city state zip code ohio county (first four letters) do not staple or paper clip. 10.tax liability after nonrefundable credits (line 8c minus line 9; Arizona corporate or partnership income tax payment voucher: Checking a box below will not change your tax or refund. Individual estimated tax payment booklet: Web tax forms and publications. You must use form 140 if any of the following apply: To read them, you'll need the free adobe acrobat reader. Web 2021 california resident income tax return 540. Web state tax forms and filing options. Web printable arizona state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31,. Web forms download 2022 individual income tax forms some internet browsers have a built in pdf viewer that may not be compatible with our forms. Web city state zip code ohio county (first four letters) do not staple or paper clip. To read them, you'll need the free adobe acrobat reader. Web you may have heard of the pact act,. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Each rebate is equal to the lesser of the amount of montana property taxes billed and paid on the principal residence or $675. Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released. Individual estimated tax payment booklet: Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and while there’s no deadline to apply for these benefits, veterans and their families will get the most out of those benefits if they file a pact act claim by. To translate a pdf or webpage's language, visit dor's translation page. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and while there’s no deadline to apply for these benefits, veterans and their families will get the most out of those benefits if they. Web these new laws provide property tax rebates to eligible taxpayers for tax years 2022 and 2023. 2106 employee business expenses instructions for form 2106 employee business expenses Your arizona taxable income is $50,000 or more, regardless of filing status. There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. You can pick. Web helping you feel smarter and confident about your state taxes. Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Individual tax return form 1040 instructions; Web forms download 2022 individual income tax forms some internet browsers have a built in pdf viewer that. State income tax form preparation begins with the completion of your federal tax forms. Web there is no application or form to fill out; Web personal income tax return filed by resident taxpayers. Income tax metropolitan commuter transportation mobility tax (mctmt) sales tax withholding tax corporation tax property. Check here if this is an amended return. Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Web printable 2022 state tax forms are grouped below along with their most commonly filed supporting schedules, worksheets, 2022 state tax tables, and instructions booklet for easy one page access. Web personal income tax return. Web you may have heard of the pact act, which expands va benefits and health care for veterans and servicemembers exposed to toxic substances while serving.and while there’s no deadline to apply for these benefits, veterans and their families will get the most out of those benefits if they file a pact act claim by august 14. Web corporate tax forms : Web state tax forms for 2022 and 2023 click on any state to view, download, or print state tax forms in pdf format. Arizona corporate or partnership income tax payment voucher: Enter month of year end: Web state tax forms and filing options. Web simplified income, payroll, sales and use tax information for you and your business Web personal income tax return filed by resident taxpayers. Check here if this is an amended return. Web get forms, instructions, and publications. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web there is no application or form to fill out; You can get minnesota tax forms either by mail or in person. Your first name initial last name suffix your ssn or itin. Individual estimated tax payment form: Individual estimated tax payment booklet: Web get federal tax return forms and file by mail. Each rebate is equal to the lesser of the amount of montana property taxes billed and paid on the principal residence or $675. The arizona income tax rate for tax year 2022 is progressive from a low of 2.59% to a high of 4.5%. To read them, you'll need the free adobe acrobat reader. To read them, you'll need the free adobe acrobat reader. Web popular forms & instructions; Checking a box below will not change your tax or refund. Our office hours are 9:30 a.m. Your first name initial last name suffix your ssn or itin. State income tax form preparation begins with the completion of your federal tax forms. 2106 employee business expenses instructions for form 2106 employee business expenses Your arizona taxable income is $50,000 or more, regardless of filing status. To translate a pdf or webpage's language, visit dor's translation page. Taxes don't have to be complicated. Individual estimated tax payment booklet: Web personal income tax return filed by resident taxpayers. Downloading from irs forms & publications page. The arizona income tax rate for tax year 2022 is progressive from a low of 2.59% to a high of 4.5%. You are making adjustments to income. We're here to help you understand tax laws, what notices you may have, and how to file and pay for taxes.Utah State Tax Forms Fill Out and Sign Printable PDF Template signNow

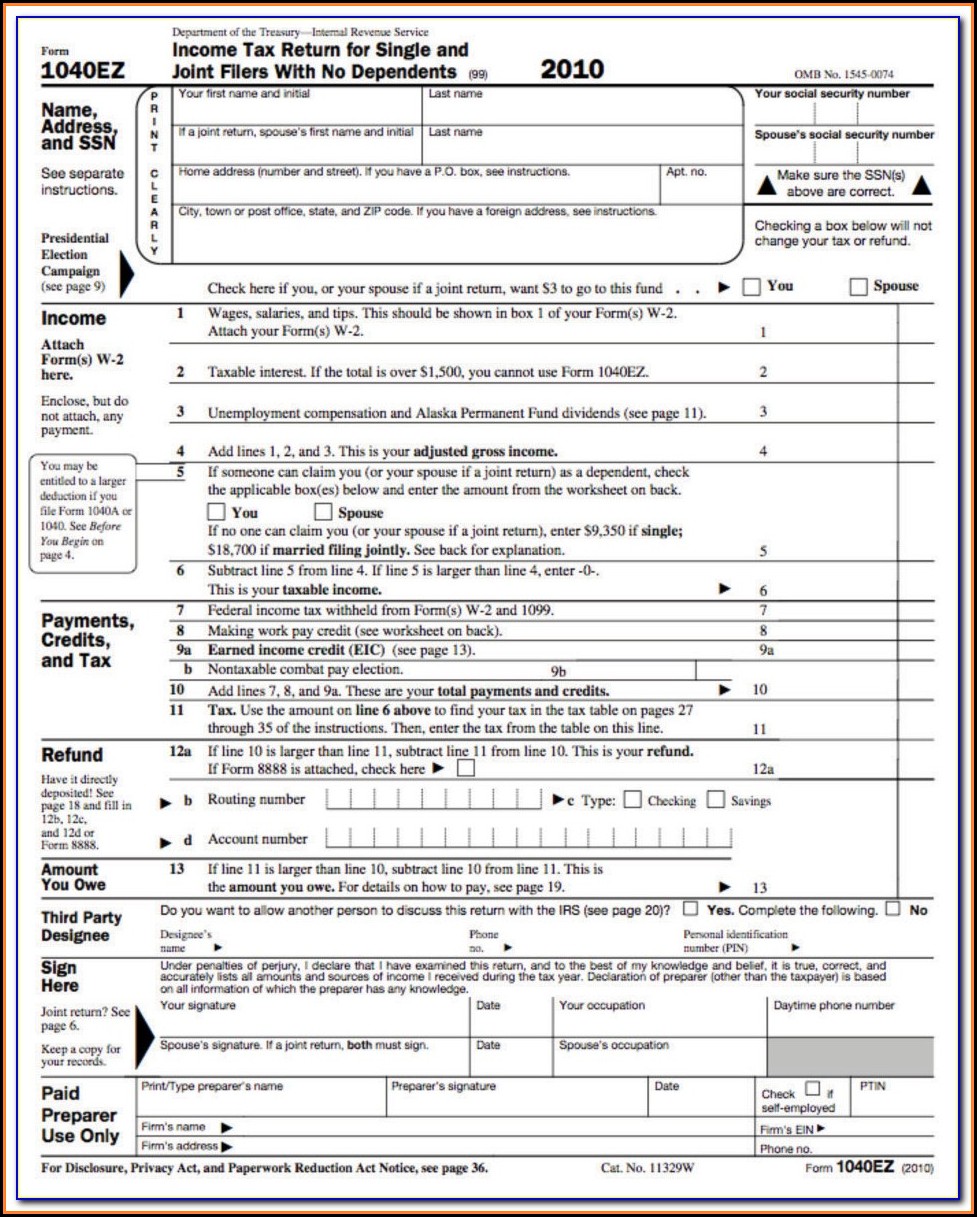

Printable Federal Tax Forms 1040ez Form Resume Examples e79Qn1gYkQ

Free Printable State Tax Forms Printable Templates

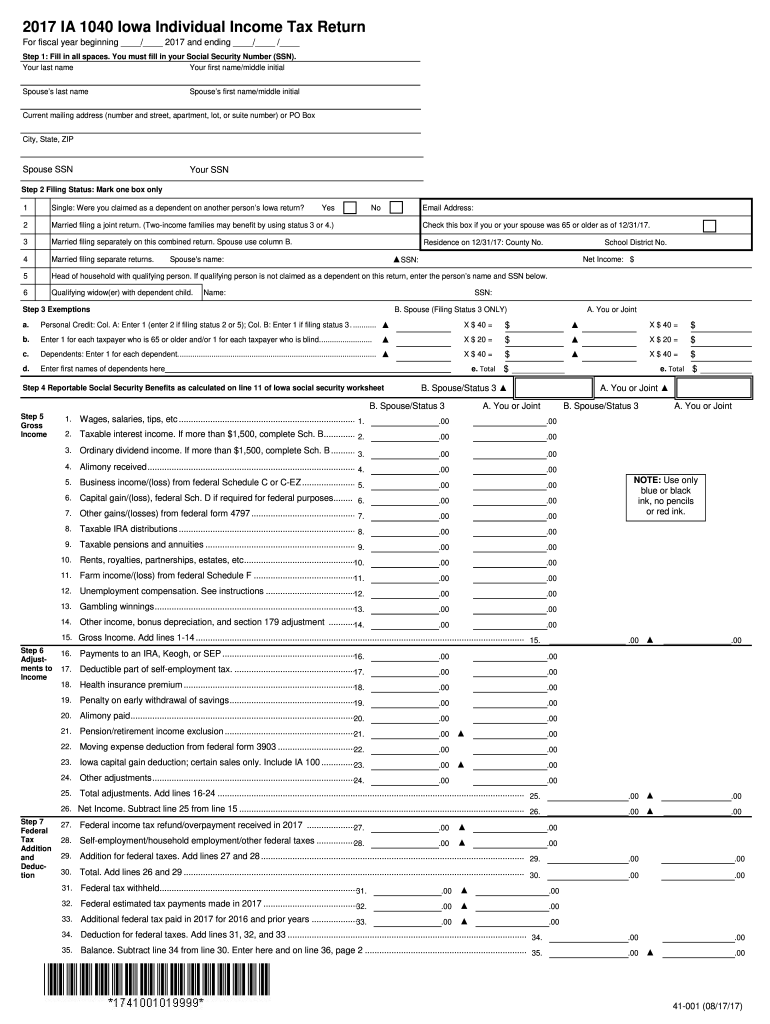

Iowa State Tax Form 1040 Fill Out and Sign Printable PDF

Free Printable State Tax Forms Printable Templates

Free Printable State Tax Return Forms Printable Forms Free Online

1040ez Arizona State Tax Form Universal Network

Free Printable State Tax Return Forms Printable Forms Free Online

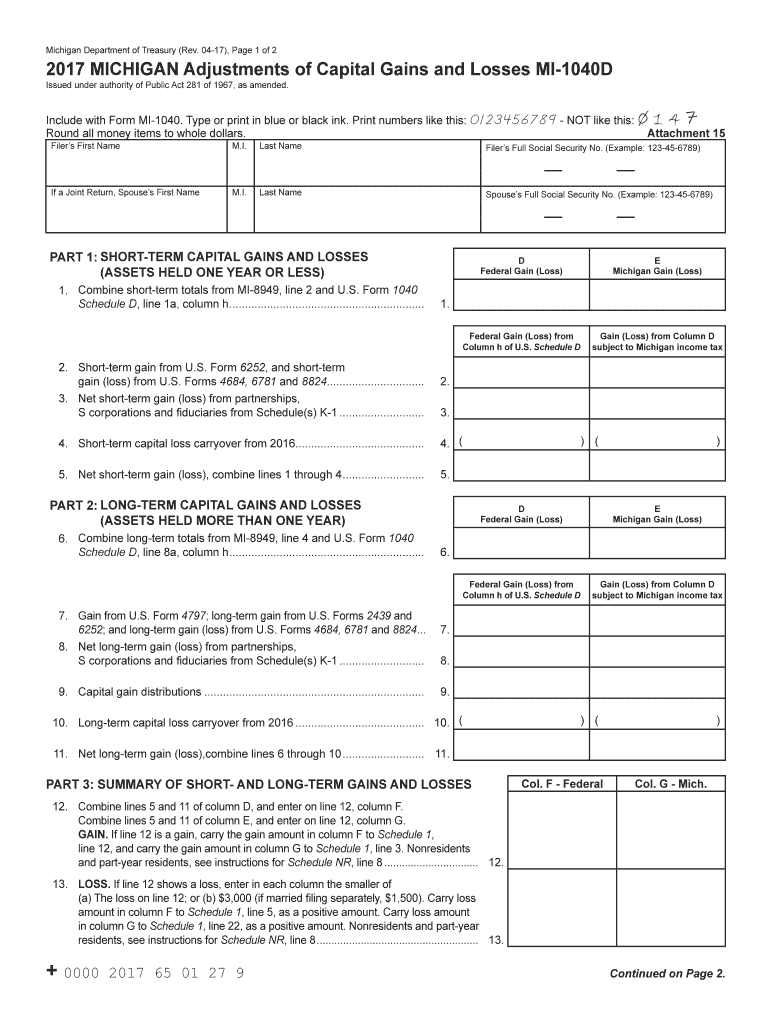

Mi 1040 Fill Out and Sign Printable PDF Template signNow

Free Printable State Tax Return Forms Printable Forms Free Online

Check Here If You, Or Your Spouse If Filing Jointly, Want $3 To Go To This Fund.

Individual Estimated Tax Payment Form:

Web Printable Arizona State Tax Forms For The 2022 Tax Year Will Be Based On Income Earned Between January 1, 2022 Through December 31, 2022.

Web There Is No Application Or Form To Fill Out;

Related Post: