Printable Tax Exempt Form

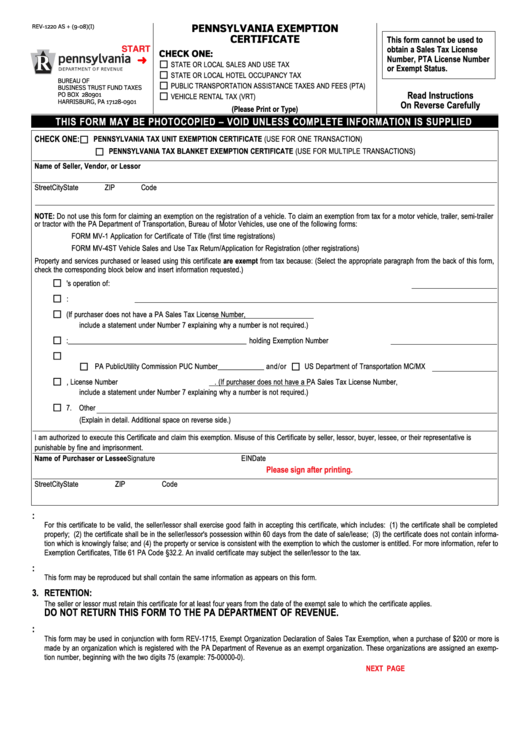

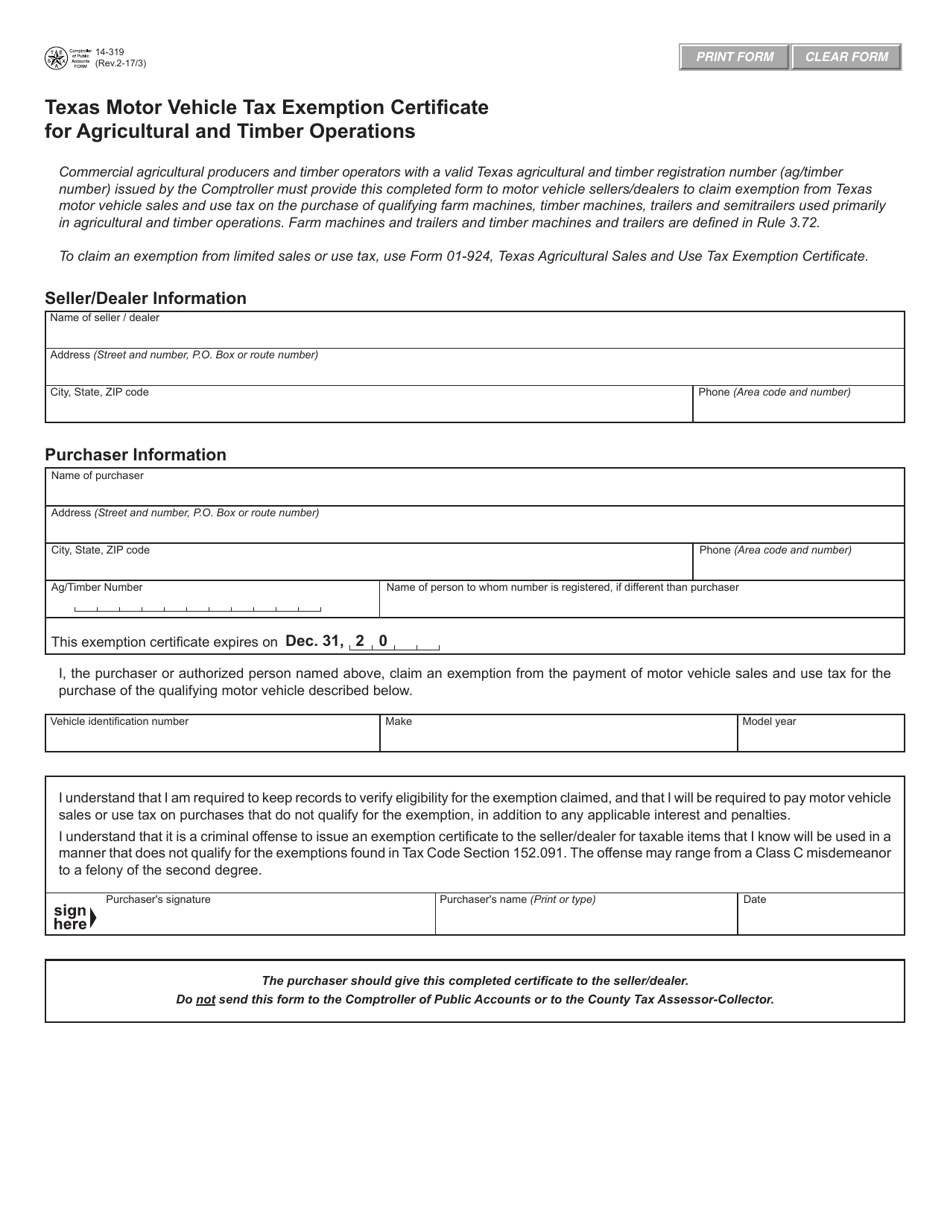

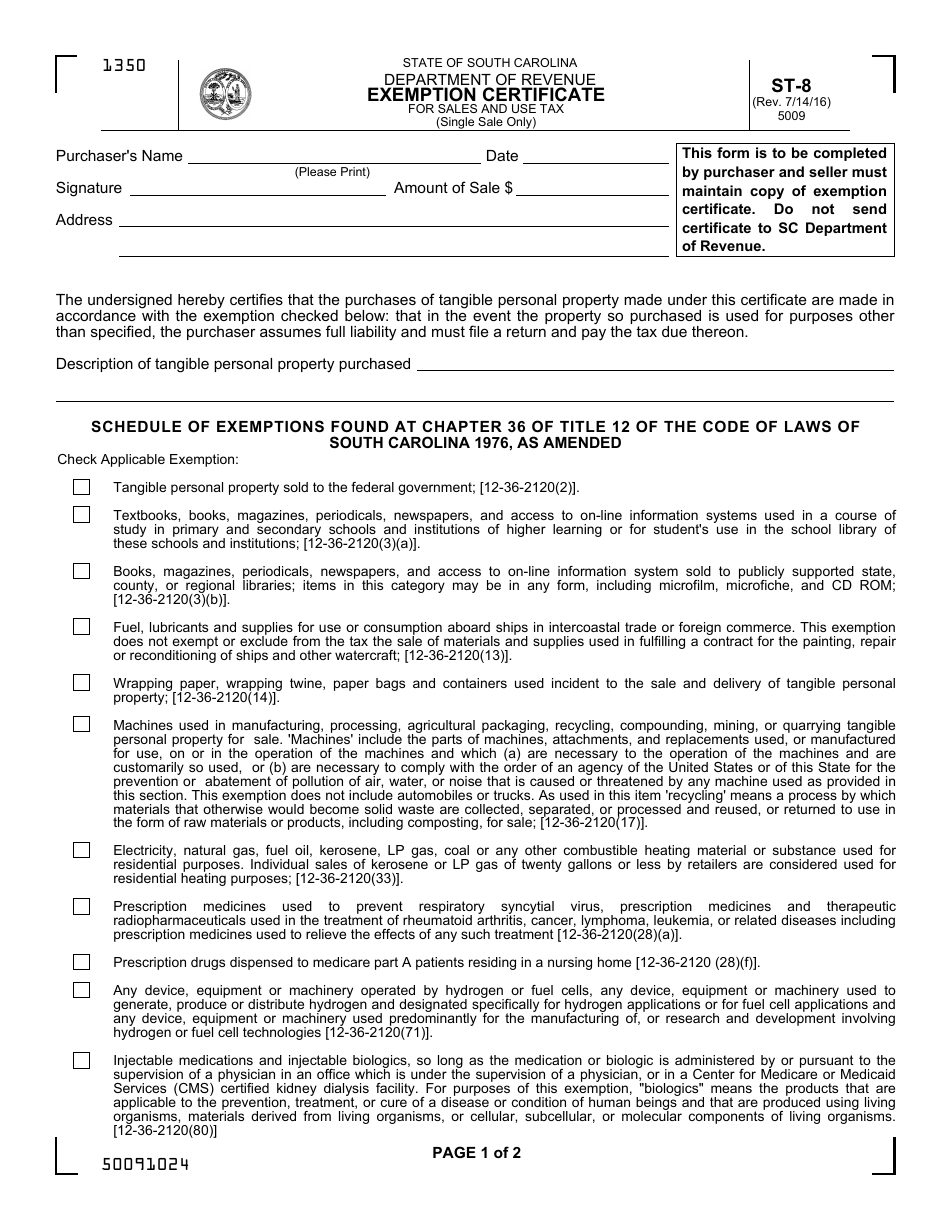

Printable Tax Exempt Form - The application must be submitted. $520 for married couples who filed jointly with an. This certificate is only for use by a purchaser who: Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. Web sales tax exemption documents. Under section 501(c)(3) of the internal. Web part 1 — exemptions related to production. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web united states tax exemption form. It is to be fi lled out completely by the purchaser and furnished to the vendor. The forms listed below are pdf files.. Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax. Form 990, return of organization exempt from income tax. It is to be fi lled out completely by the purchaser and furnished to the vendor. December 2017) department of the treasury internal revenue service. The purchaser hereby claims exception or exemption on all. Sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. The forms listed below are pdf files. Web purchases of tangible personal property for resale: Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described. Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax. It is to be fi lled out completely by the purchaser and furnished to the vendor. Pages 1 and 2 must be completed by the purchaser and given to the seller. Form 990, return of organization exempt from income tax. The purchaser hereby. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. December 2017) department of the treasury internal revenue. Web how much will i receive? Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. Under section 501(c)(3) of the internal. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe. By using this federal tax. United states tax exemption form. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Instructions for form 990 pdf. Web texas applications for tax exemption. Application for recognition of exemption. United states tax exemption form. Web texas applications for tax exemption. The application must be submitted. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web exempt organizations forms & instructions. Web united states tax exemption form. December 2017) department of the treasury internal revenue service. Web how much will i receive? Web part 1 — exemptions related to production. United states tax exemption form. Web united states tax exemption form. Only one form of exemption can. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. $520 for married couples who filed jointly with an. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web how much will i receive? They include graphics, fillable form fields, scripts and functionality that work best with the free adobe. Sales and use tax blanket exemption certificate. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax. $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021. Under section 501(c)(3) of the internal. Web sales tax exemption documents. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web texas applications for tax exemption. This certificate is only for use by a purchaser who: United states tax exemption form. Web applying for tax exempt status. Application for recognition of exemption. By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Web united states tax exemption form. Instructions for form 990 pdf. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Web applying for tax exempt status. United states tax exemption form. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and. Certificate of indian exemption for certain property or services. Only one form of exemption can. Web texas applications for tax exemption. Sales and use tax blanket exemption certificate. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Instructions for form 990 pdf. December 2017) department of the treasury internal revenue service. Retailers that are purchasing tangible personal property for resale purposes are exempt from sales or use tax. This certificate is only for use by a purchaser who: By using this federal tax exemption form sample, you will be able to claim exemption from taxes imposed by section 4251. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice). Pages 1 and 2 must be completed by the purchaser and given to the seller.Fillable Form Rev1220 Pennsylvania Exemption Certificate printable

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

California Farm Tax Exemption Form Fill Online, Printable, Fillable

Bupa Tax Exemption Form FREE 10+ Sample Tax Exemption Forms in PDF

Form ST8 Download Fillable PDF or Fill Online Exemption Certificate

Sd Tax Exempt Form Fill and Sign Printable Template Online US Legal

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

20172020 Form PA DoR REV1220 AS Fill Online, Printable, Fillable

St119 1 Fillable Form 20202022 Fill and Sign Printable Template

FREE 10+ Sample Tax Exemption Forms in PDF

Web I, The Purchaser Named Above, Claim An Exemption From Payment Of Sales And Use Taxes (For The Purchase Of Taxable Items Described Below Or On The Attached Order Or Invoice).

Web Sales Tax Exemption Documents.

Under Section 501(C)(3) Of The Internal.

Web Purchases Of Tangible Personal Property For Resale:

Related Post: