Printable W2 And I9 Forms

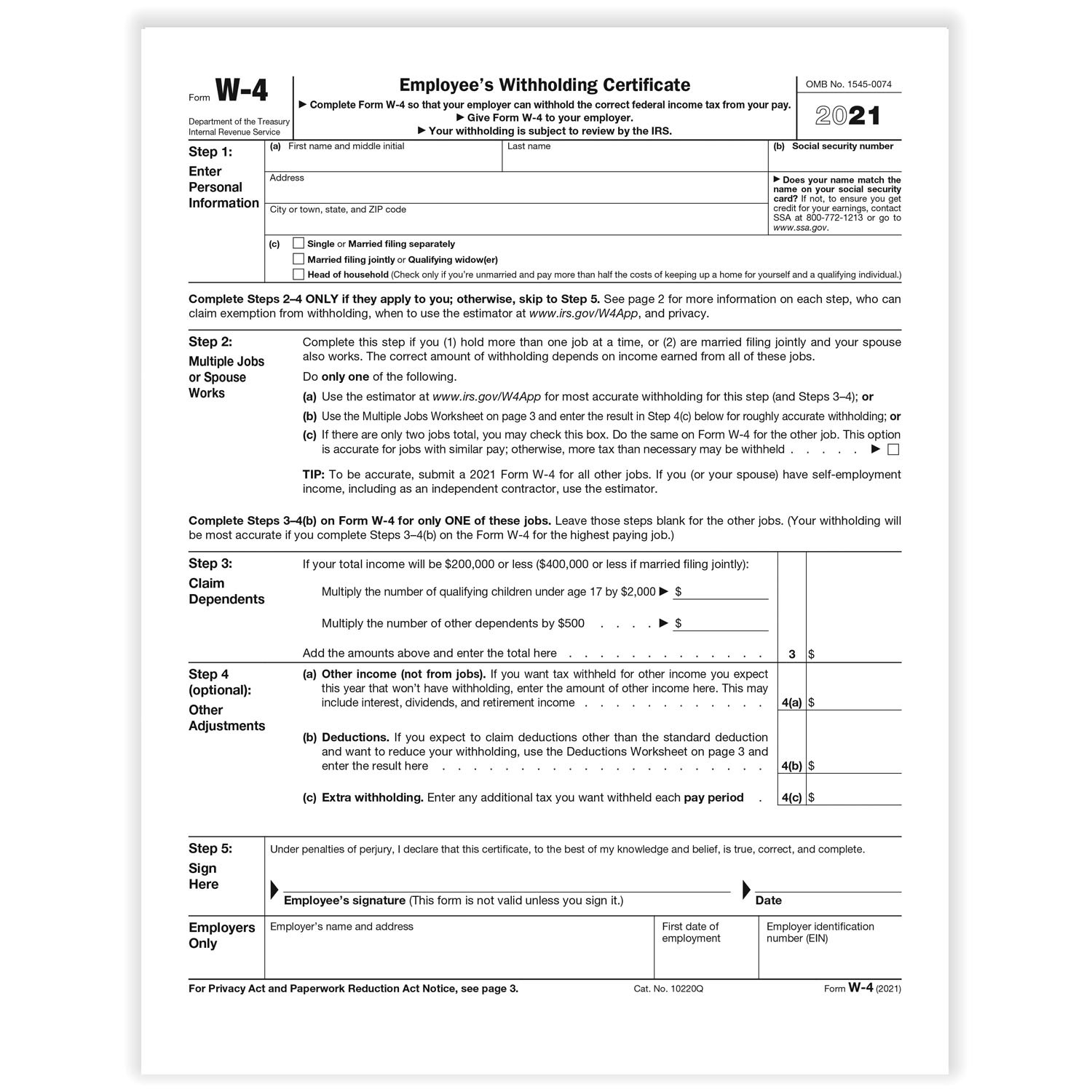

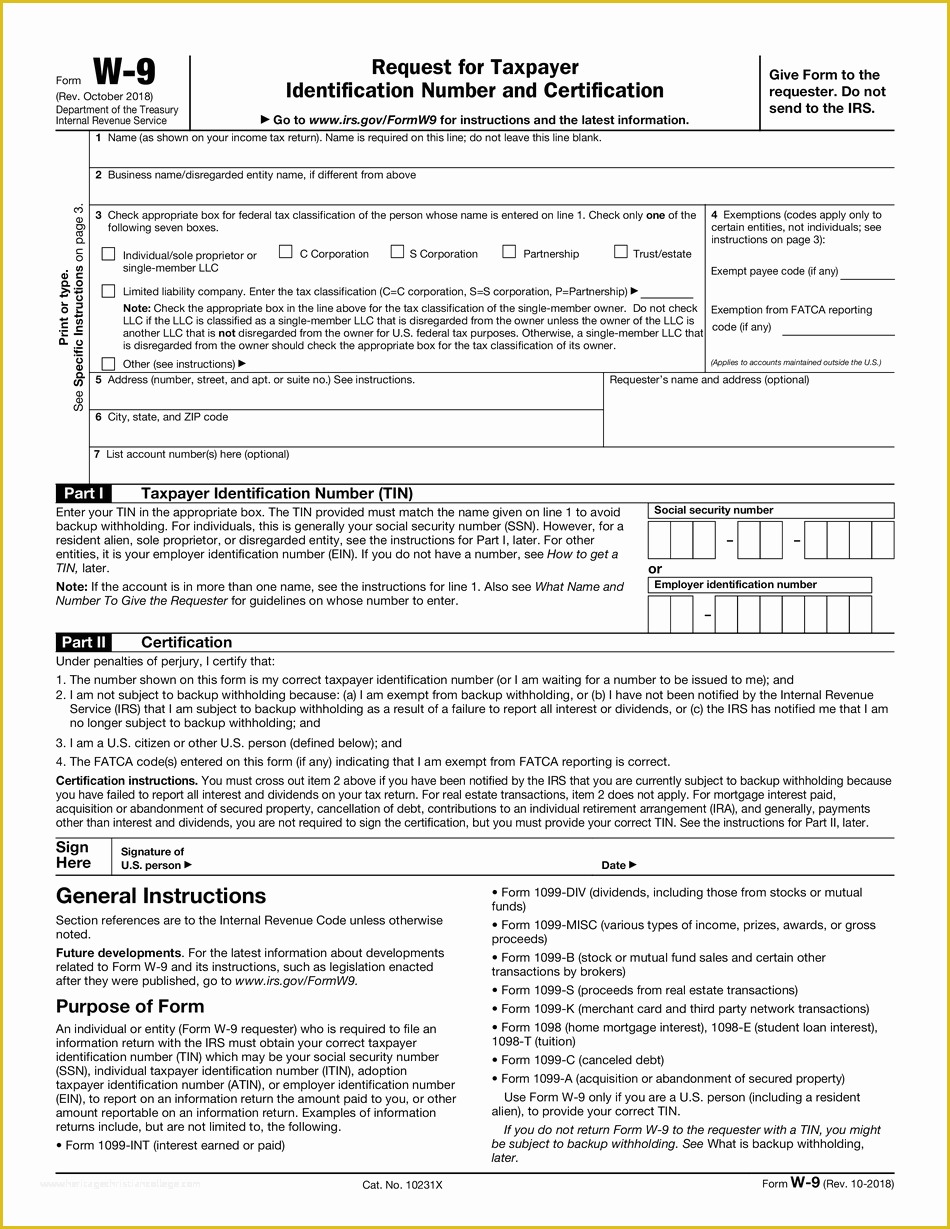

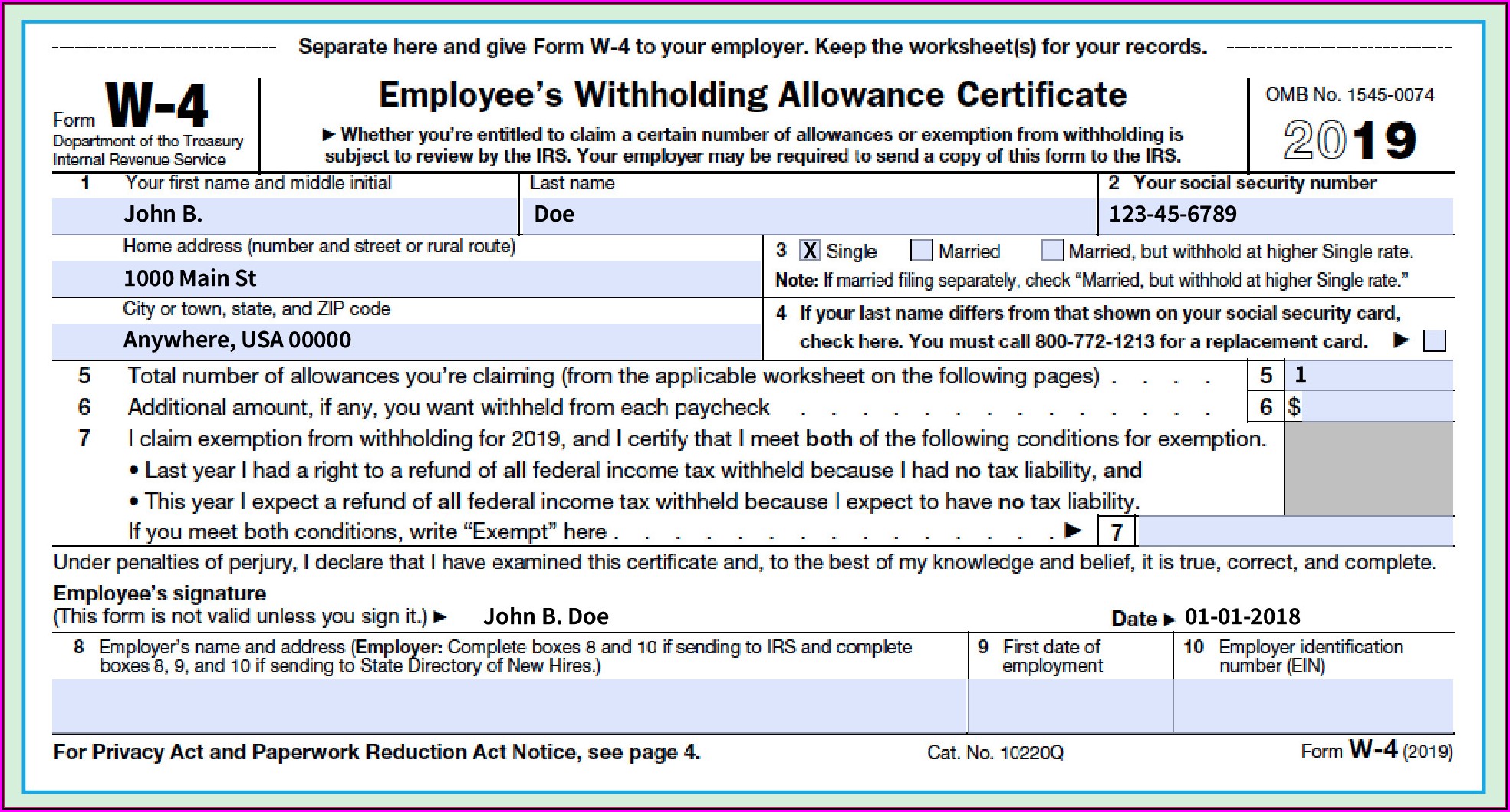

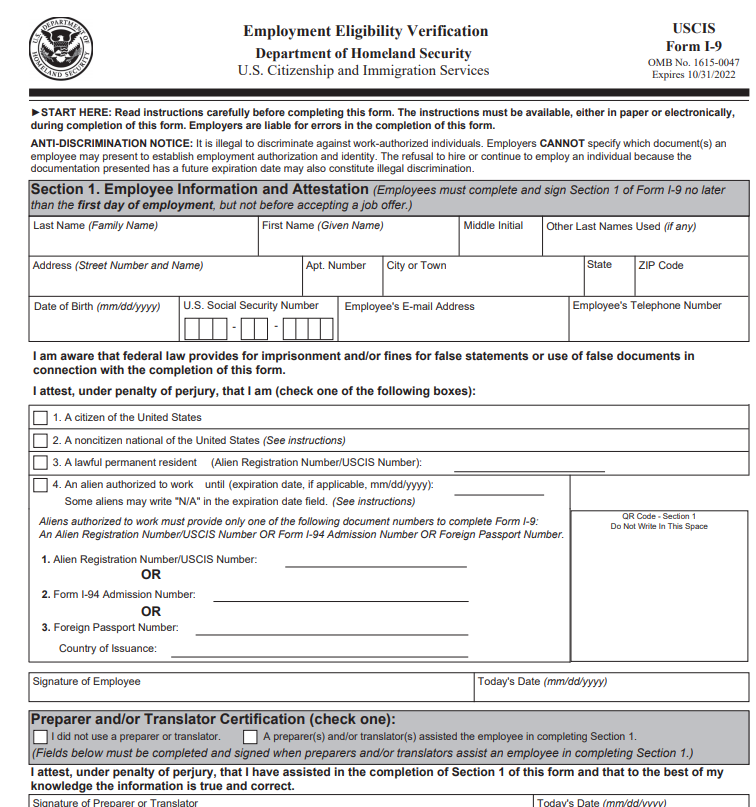

Printable W2 And I9 Forms - Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): December 2014) department of the treasury internal revenue service. Employers must ensure the form instructions are available to employees when completing this form. Name (as shown on your income tax return). Check out the relevant requirements for employment eligibility verification. Request for taxpayer identification number and certification. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. 6, 1986, in the u.s. Individual tax return form 1040 instructions; Save time with our amazing tool & try 24 hours free! Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Web popular forms & instructions; 6, 1986, in the u.s. Individual tax return form 1040 instructions; The purpose of this form is to document that each new employee (both citizen. The purpose of this form is to document that each new employee (both citizen and. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Save time with our amazing tool & try 24 hours free! Name (as shown on your income tax return). Request for taxpayer identification number and certification. Web on august 1, 2023, the u.s. What is the purpose of this form? Individual tax return form 1040 instructions; Ad complete your form w 2. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Name (as shown on your income tax return). Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Save time editing pdf documents online. December 2014) department of the treasury internal revenue service. Request for taxpayer identification number and certification. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. What is the purpose of this form? Web popular forms & instructions; Save time editing pdf documents online. Employers must ensure the form instructions are available to employees when completing. What is the purpose of this form? Check out the relevant requirements for employment eligibility verification. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web on august 1, 2023, the u.s. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year. Ad complete your form w 2. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Web on august 1, 2023, the u.s. Web popular forms & instructions; Web if your total income will be $200,000 or less ($400,000 or. Individual tax return form 1040 instructions; What is the purpose of this form? Request for taxpayer identification number and certification. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web on august 1, 2023, the u.s. 6, 1986, in the u.s. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Save time with. Check out the relevant requirements for employment eligibility verification. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. Do not leave this line blank. Individual tax return form 1040 instructions; Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Request for taxpayer identification number and certification. Name (as shown on your income tax return). Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): What is the purpose of this form? Save time with our amazing tool & try 24 hours free! The purpose of this form is to document that each new employee (both citizen and. Employers must ensure the form instructions are available to employees when completing this form. Web on august 1, 2023, the u.s. Name is required on this line; Save time editing pdf documents online. Individual tax return form 1040 instructions; You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. 6, 1986, in the u.s. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web popular forms & instructions; Ad complete your form w 2. December 2014) department of the treasury internal revenue service. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or. Check out the relevant requirements for employment eligibility verification. Do not leave this line blank. Name is required on this line; December 2014) department of the treasury internal revenue service. Check out the relevant requirements for employment eligibility verification. Request for taxpayer identification number and certification. 6, 1986, in the u.s. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. Employers must ensure the form instructions are available to employees when completing this form. Individual tax return form 1040 instructions; Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. What is the purpose of this form? Do not leave this line blank. The purpose of this form is to document that each new employee (both citizen and. Web popular forms & instructions; Save time with our amazing tool & try 24 hours free! Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or.W9 Form Layout Attending W9 Form Layout Can Be A Disaster If You

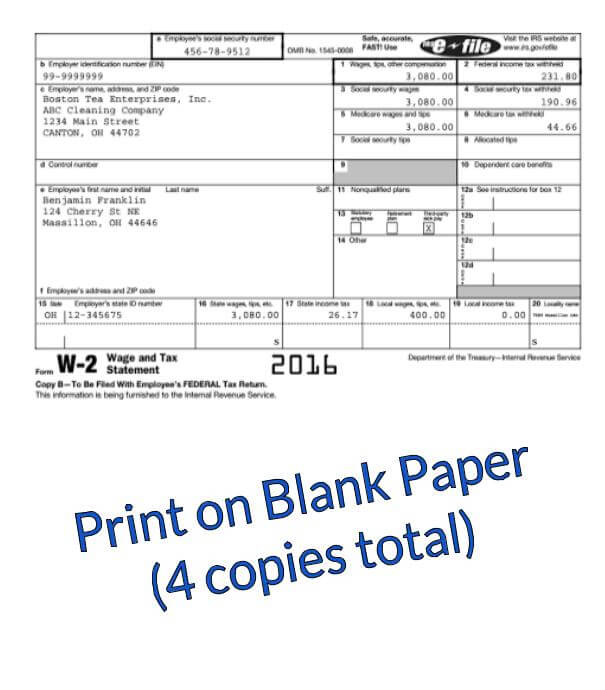

Templates Fillable Form W 2 Forms Free Without Watermarks Printable

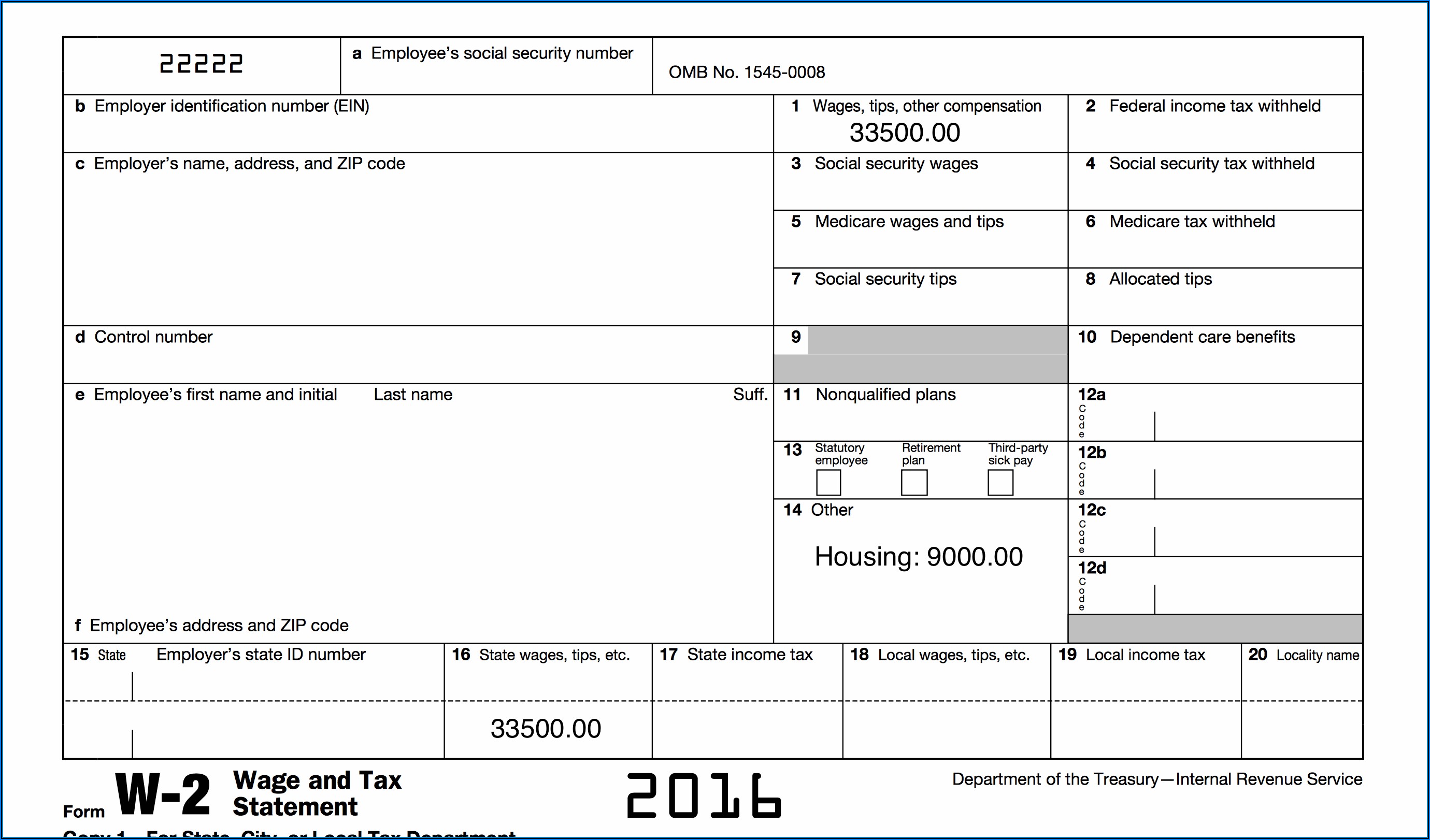

Free 2016 W2 Template Of 6 Adp Payroll Check Stub

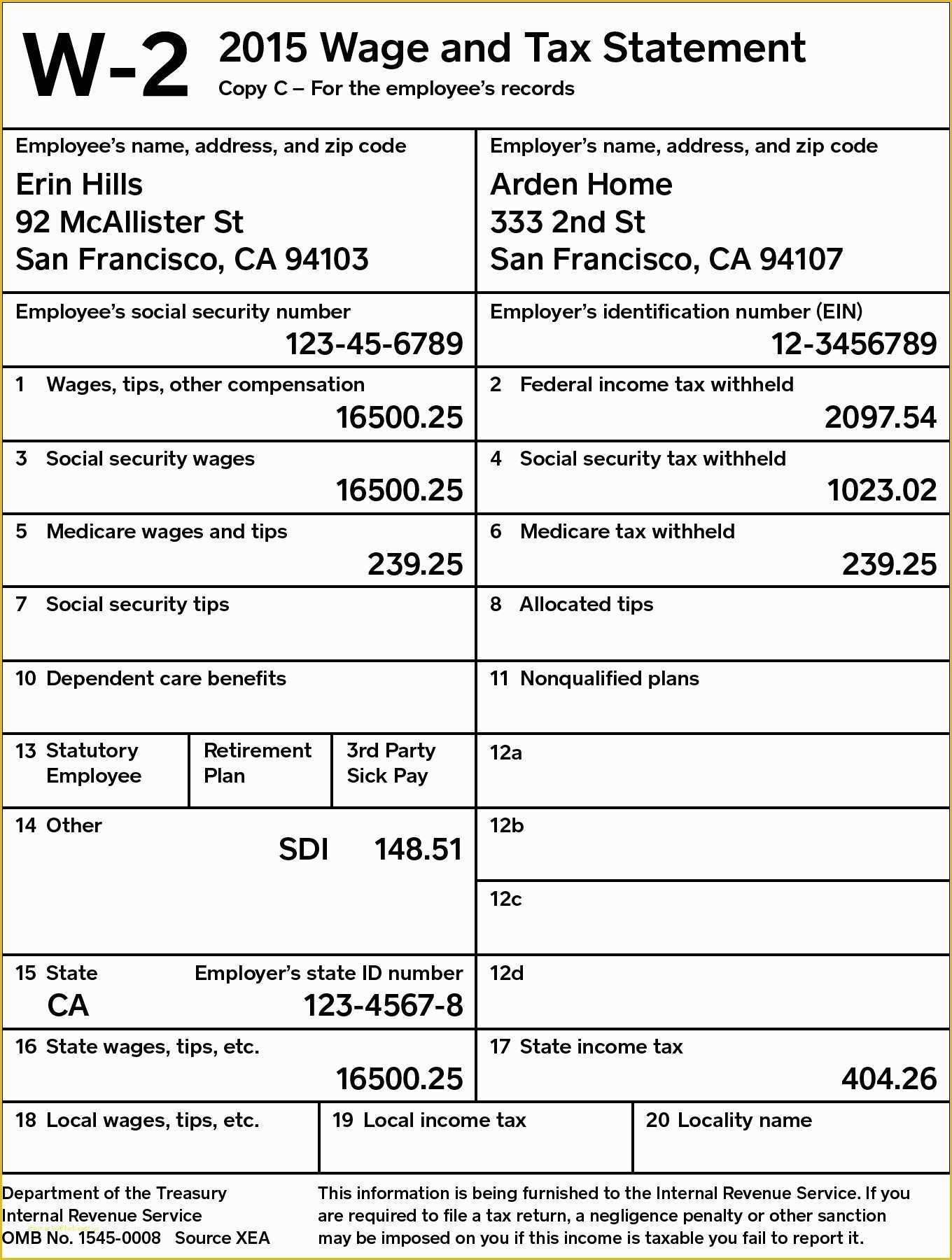

Fillable W2 Form 2019 Form Resume Examples pv9wPaoY7A

Alabama A4 Form 2021 Printable Printable Word Searches

Free W2 Template Of Irs W 9 form 2019 Blank W 9 Tax form In Pdf

Free Printable I 9 Form 2022 Printable Form, Templates and Letter

I9 Forms 2019 Printable Master of Documents

Fillable W2 Form 2019 Pdf Form Resume Examples djVaZpG2Jk

Employers Must Use New I9 Form by May 1 GDI Insurance Agency, Inc.

Save Time Editing Pdf Documents Online.

Name (As Shown On Your Income Tax Return).

Web On August 1, 2023, The U.s.

Ad Complete Your Form W 2.

Related Post: