Probate Estate Accounting Template

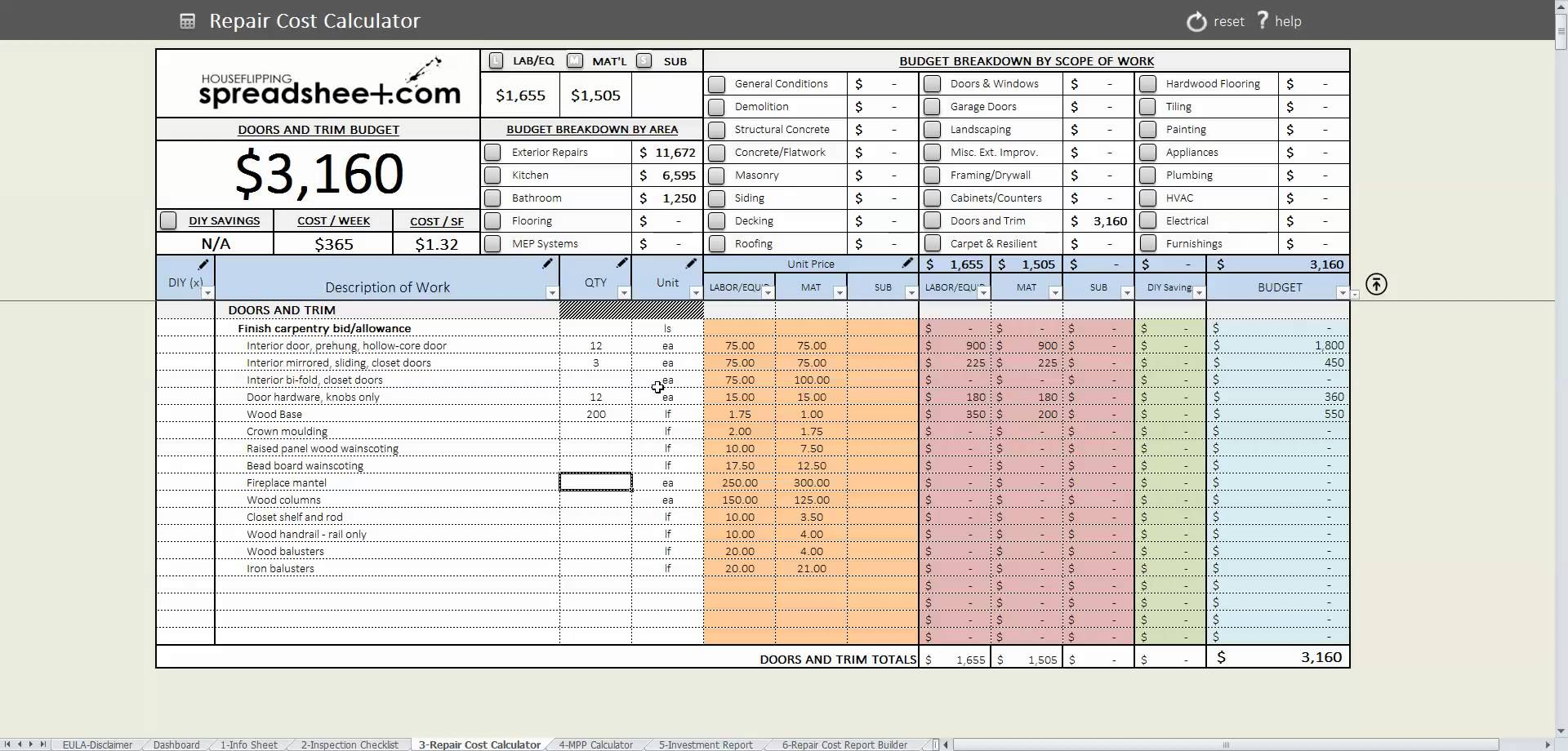

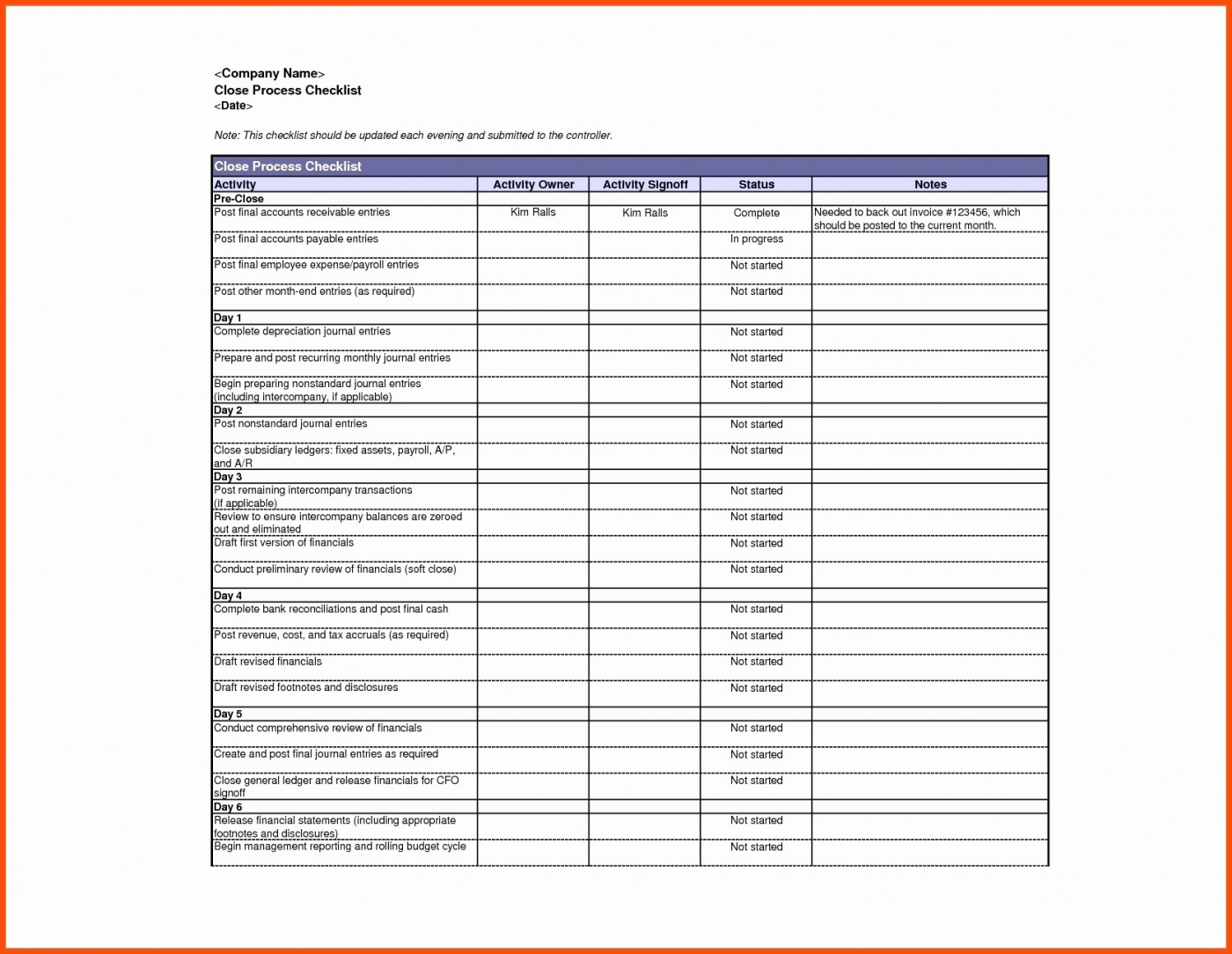

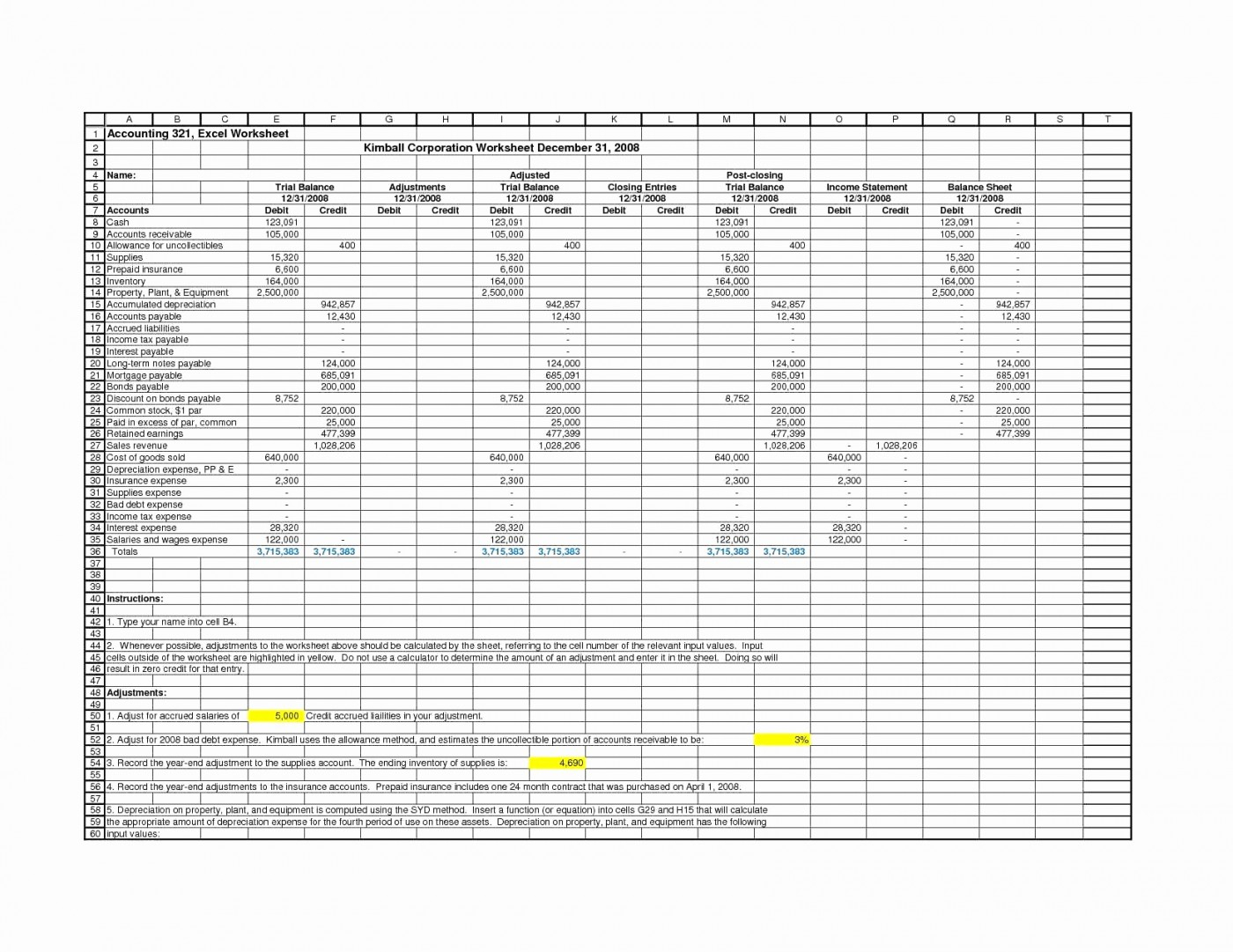

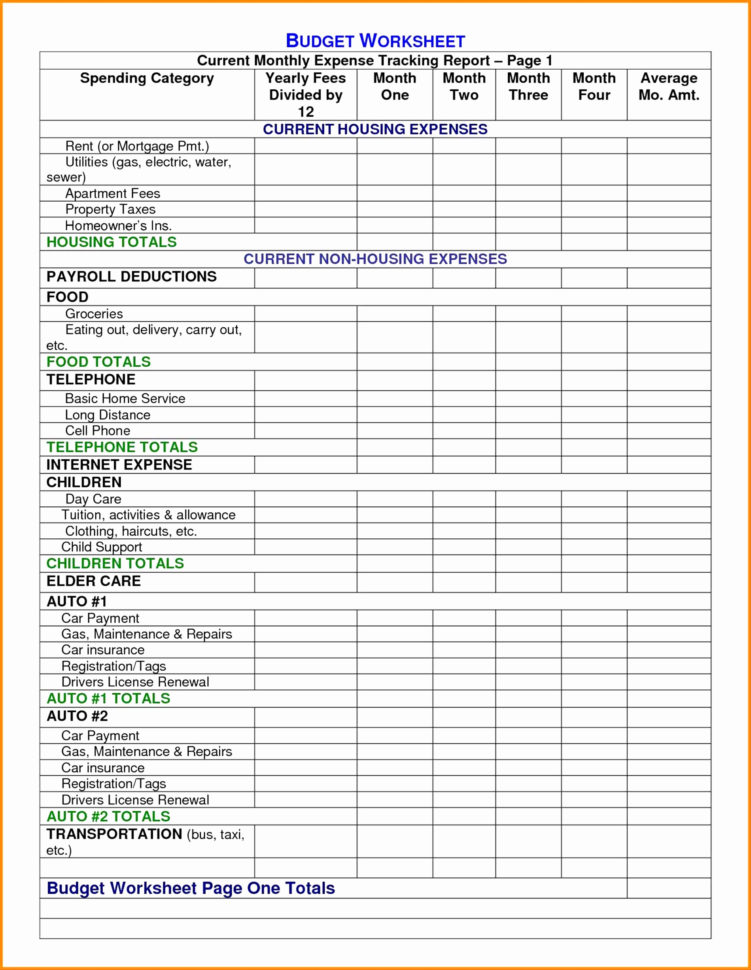

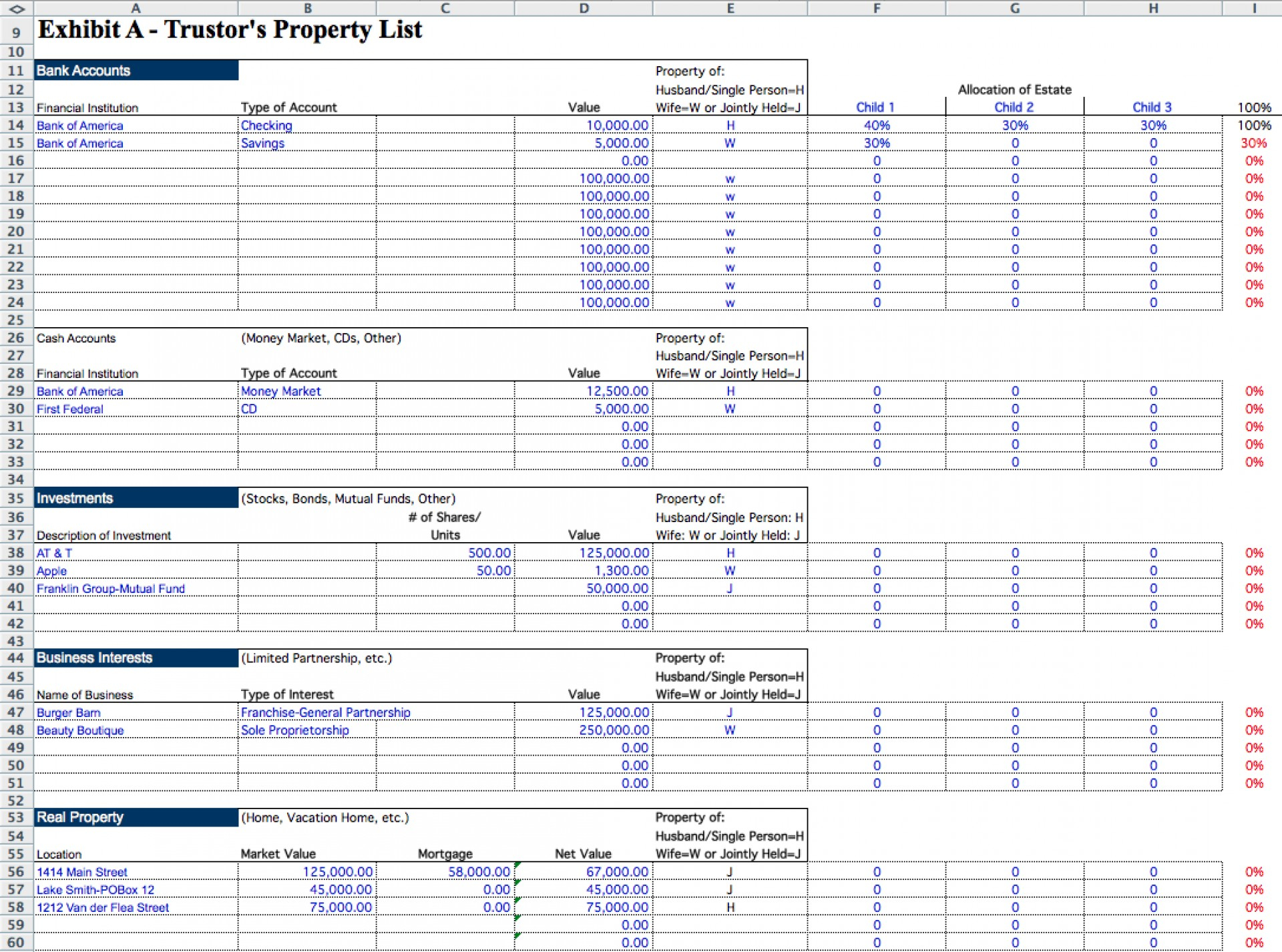

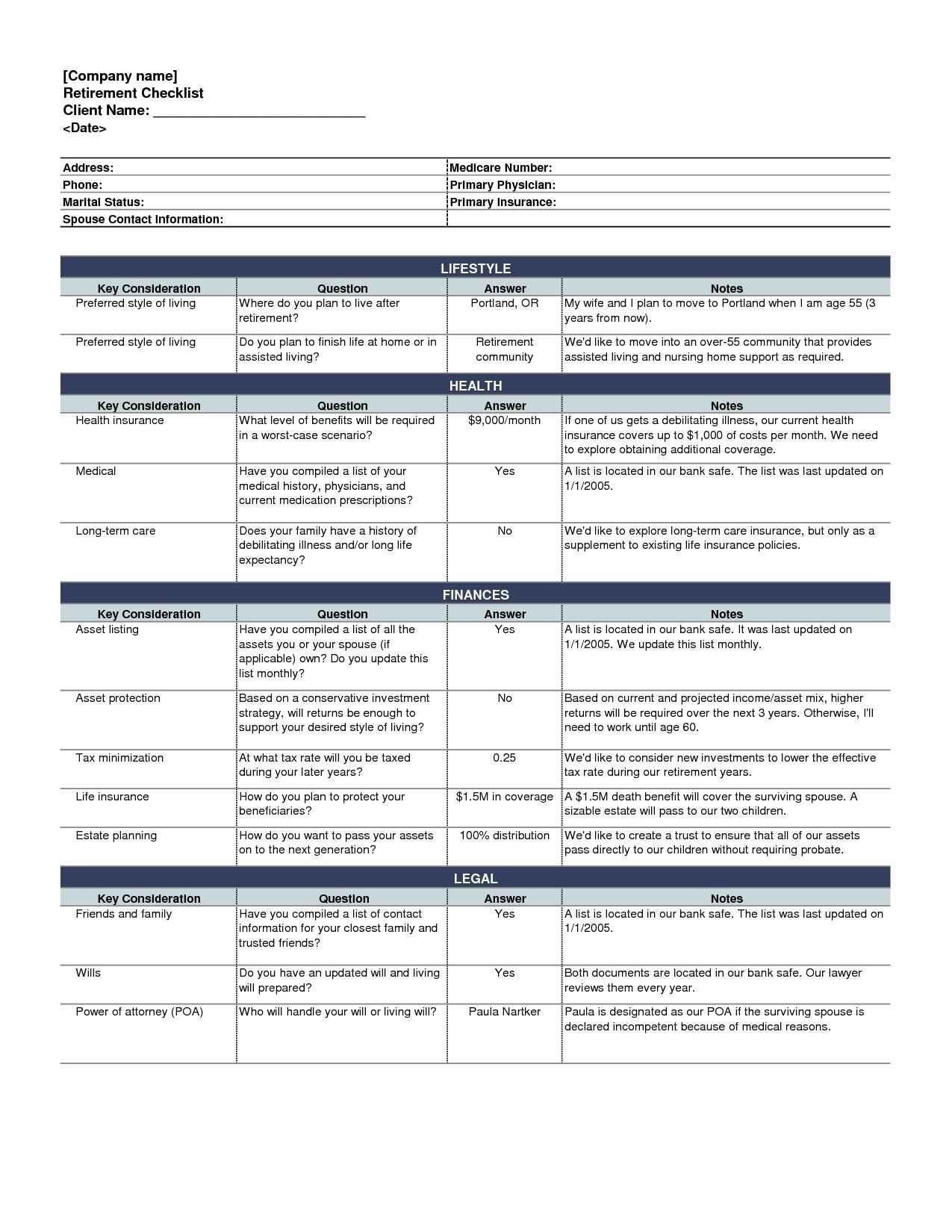

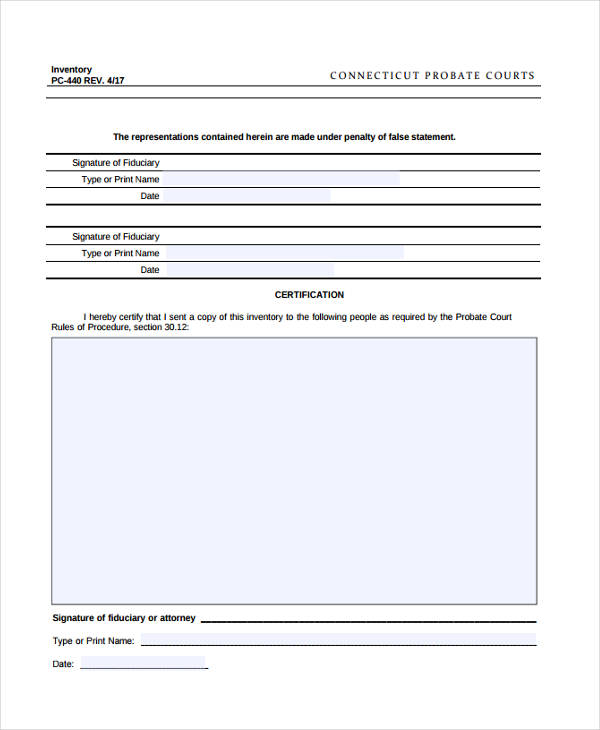

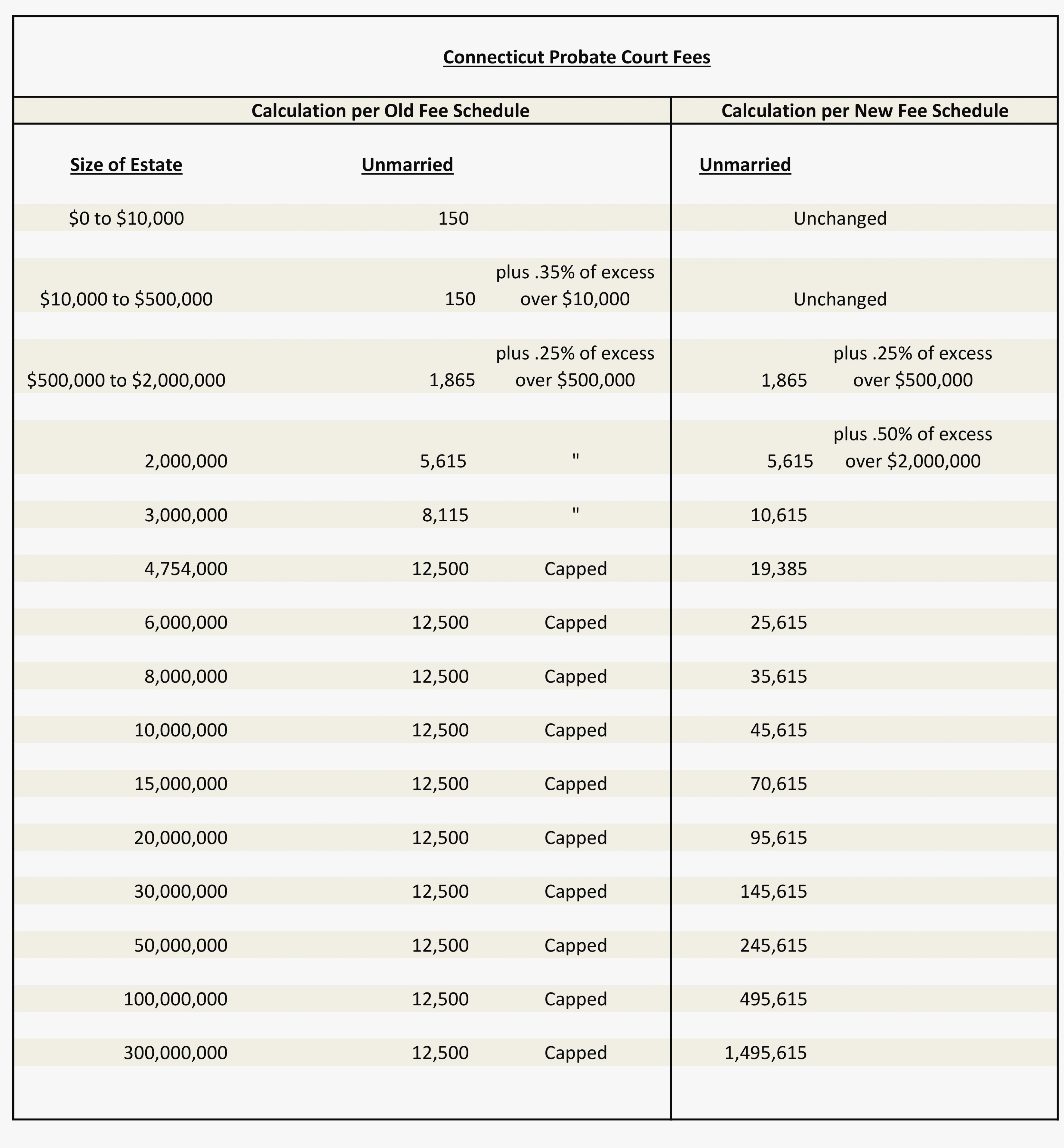

Probate Estate Accounting Template - Web in the probate court accounting case number: Basically, a probate accounting is a financial record of a probate estate, which has three phases: Ask the commissioner how many. General accounts must be filed with the commissioner of accounts. The court will enter an order directing the performance of your duties in your fiduciary role as a personal representative, guardian,. Web complete nj final accounting form for probate in several clicks by simply following the instructions below: Web the probate final accounting is the last step to close the estate and distribute assets to the estate heirs and pay the creditors who have filed legitimate claims. Web after updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Probate accounting consists of three essential components that dictate the administration and leadership of any estate or. Web when there are estate assets, but probate is not required as set forth above the rightful heirs/devisees may use an affidavit prescribed by law to collect estate assets. Beginning assets (from inventory or prior account) $ 101,259.54 2. Gains on asset sales (attach itemized list) $ 400.00 4. Web model estate account. Web after updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Probate accounting consists of three essential components that dictate the administration and leadership of any. Web lesson 2 accounting for estates and trusts completion of this lesson will enable you to: Finally an accounting software you want to use, easy, beautiful. Web the probate final accounting is the last step to close the estate and distribute assets to the estate heirs and pay the creditors who have filed legitimate claims. Web as the estate executor,. Web lesson 2 accounting for estates and trusts completion of this lesson will enable you to: Web model estate account. If you or anyone else is charging fees to the estate, the petition must also include a request for. Gains on asset sales (attach itemized list) $ 400.00 4. Receipts (attach itemized list) $ 8,946.87 3. Pick the template you want in the library of legal form samples. Basically, a probate accounting is a financial record of a probate estate, which has three phases: Web before the executor can finalize probate and close the estate, they must provide a final accounting that includes: Click here for our excel estate accounting sample with examples. Finally an accounting. This lists all the property that is in the estate, and establishes the starting. Finally an accounting software you want to use, easy, beautiful. Web up to 24% cash back legal documents ⌃ family and personal ⌃ estate planning ⌃ for executors and heirs make your free estate administration worksheet make document. Beginning assets (from inventory or prior account) $. An itemized list of the estate’s assets. Web after updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Web distribution with the probate registrar, but it is not required. (a) a breakdown of the estate principal; Web complete nj final accounting form for probate in several clicks by simply following. Probate fees $ 72.00 02/22/06 henry smith appraisal of jewelry and antiques 50.00. Web no matter what type of accounting you prepare, your accounting should contain: General accounts must be filed with the commissioner of accounts. Gains on asset sales (attach itemized list) $ 400.00 4. Web as the estate executor, it is your fiduciary duty to create a thorough. Basically, a probate accounting is a financial record of a probate estate, which has three phases: If you or anyone else is charging fees to the estate, the petition must also include a request for. Click here for our excel estate accounting sample with examples. Pick the template you want in the library of legal form samples. Probate fees $. An itemized list of the estate’s assets. Beginning assets (from inventory or prior account) $ 101,259.54 2. Finally an accounting software you want to use, easy, beautiful. Web lesson 2 accounting for estates and trusts completion of this lesson will enable you to: Web the probate final accounting is the last step to close the estate and distribute assets to. This lists all the property that is in the estate, and establishes the starting. General accounts must be filed with the commissioner of accounts. Web lesson 2 accounting for estates and trusts completion of this lesson will enable you to: Professionally prepared by local firm Receipts (attach itemized list) $ 8,946.87 3. Ad save time by managing bills & expenses, invoicing & easy reconciliation all in one app. As mentioned in the article closing an estate in a. Web the probate final accounting is the last step to close the estate and distribute assets to the estate heirs and pay the creditors who have filed legitimate claims. Identify the accountant’s role and describe gaap principles concerning fiduciary. Gains on asset sales (attach itemized list) $ 400.00 4. Web the probate accounting process. Web before the executor can finalize probate and close the estate, they must provide a final accounting that includes: Professionally prepared by local firm Receipts (attach itemized list) $ 8,946.87 3. Web no matter what type of accounting you prepare, your accounting should contain: Probate fees $ 72.00 02/22/06 henry smith appraisal of jewelry and antiques 50.00. Web complete nj final accounting form for probate in several clicks by simply following the instructions below: Web model estate account. (a) a breakdown of the estate principal; Web distribution with the probate registrar, but it is not required. Pick the template you want in the library of legal form samples. Get access to the largest online library of legal forms for any state. Finally an accounting software you want to use, easy, beautiful. Beginning assets (from inventory or prior account) $ 101,259.54 2. General accounts must be filed with the commissioner of accounts. Click here for our excel estate accounting sample with examples. Gains on asset sales (attach itemized list) $ 400.00 4. Probate accounting consists of three essential components that dictate the administration and leadership of any estate or. Web complete nj final accounting form for probate in several clicks by simply following the instructions below: Basically, a probate accounting is a financial record of a probate estate, which has three phases: Beginning assets (from inventory or prior account) $ 101,259.54 2. Web the probate final accounting is the last step to close the estate and distribute assets to the estate heirs and pay the creditors who have filed legitimate claims. Web no matter what type of accounting you prepare, your accounting should contain: Web in the probate court accounting case number: Ad get through uncontested probate without the headache. If you or anyone else is charging fees to the estate, the petition must also include a request for. (b) any realized gains or losses on. Web instructions for account for decedent’s estate i. Web model estate account. Professionally prepared by local firm Web before the executor can finalize probate and close the estate, they must provide a final accounting that includes:Probate Spreadsheet —

Executor Accounting Spreadsheet Inside 001 Probate Accounting Template

Probate Accounting Spreadsheet Google Spreadshee probate accounting

Probate Accounting Spreadsheet Google Spreadshee probate accounting

Estate Executor Spreadsheet —

Probate Accounting Spreadsheet Inside Spreadsheet For Estate Accounting

FREE 20+ Accounting Forms in PDF Ms Word Excel

Probate Spreadsheet Template Google Spreadshee probate spreadsheet

Probate Spreadsheet Template intended for 9 Unique Spreadsheet For

Probate Accounting Spreadsheet Google Spreadshee probate accounting

Get Access To The Largest Online Library Of Legal Forms For Any State.

This Lists All The Property That Is In The Estate, And Establishes The Starting.

Web When There Are Estate Assets, But Probate Is Not Required As Set Forth Above The Rightful Heirs/Devisees May Use An Affidavit Prescribed By Law To Collect Estate Assets.

Ask The Commissioner How Many.

Related Post: