Response Letter To Irs Template

Response Letter To Irs Template - Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. They have a balance due. Ad get your irs response letter today. • you owe additional tax; It doesn’t need to be complicated, but it should. In addition to the documents the irs has requested, you should send a letter. Web full name of the person or business requesting the review of an irs penalty, known going forward as the requester ? The first opportunity for taxpayer advocate. We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. The irs mails letters or notices to taxpayers for a variety of reasons including if: Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. There is usually no need to call the irs. The letter specifies the tax form that. They. Ad get your irs response letter today. The first opportunity for taxpayer advocate. Or • the irs is requesting payment or needs additional. Web that letter and includes information that will help the taxes identify the source of the penalty and the causes why it should be savings. In addition to the documents the irs has requested, you should send. Web that letter and includes information that will help the taxes identify the source of the penalty and the causes why it should be savings. Different formats and samples are. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Web up to $3 cash back 1. Taxpayers don't need to reply to a notice unless specifically. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip. There is usually no need to call the irs. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. Web. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. In addition to the documents the irs has requested, you. November 4, 2020 | last updated: Or • the irs is requesting payment or needs additional. Web up to $3 cash back 1. Web the irs generally asks for a response within 30 days. We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. • you owe additional tax; There is usually no need to call the irs. Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. November 4, 2020 | last updated: If for any reason you cannot respond by the deadline, call the number included with the irs audit letter. We have covered a few types of irs notices here, including a notice of deficiency. Web full name of the person or business requesting the review of an irs penalty, known going forward as the requester ? The first opportunity for. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. The irs mails letters or notices to taxpayers for a variety of reasons including. Web remember, there are many different types of irs tax notices. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. Get free, competing quotes from leading irs tax issue experts. In addition to the documents the irs has requested, you should. The irs mails letters or notices to taxpayers for a variety of reasons including if: Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Web remember, there are many different types of irs tax notices. There is usually no need to call the irs. Web the irs generally asks for a response within 30 days. Ad get your irs response letter today. We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. • you are due a larger refund; The first opportunity for taxpayer advocate. It doesn’t need to be complicated, but it should. We have covered a few types of irs notices here, including a notice of deficiency. Web full name of the person or business requesting the review of an irs penalty, known going forward as the requester ? Web if you disagree with the irs’s proposal of tax and/or penalties, it’s important to respond to the irs in a clear and concise manner. Get a free irs tax issue consultation. November 4, 2020 | last updated: If for any reason you cannot respond by the deadline, call the number included with the irs audit letter. Web reply only if instructed to do so. • you owe additional tax; Web up to $3 cash back 1. They have a balance due. Web reply only if instructed to do so. Web remember, there are many different types of irs tax notices. Ad don't face the irs alone. Ad get your irs response letter today. • you owe additional tax; We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. Rra98 § 3705 requires all employees to identify themselves upon initially contacting a taxpayer or representative. Generally, the irs sends a letter if: Get a free irs tax issue consultation. Or • the irs is requesting payment or needs additional. The irs independent office of appeals seeks to. The irs mails letters or notices to taxpayers for a variety of reasons including if: Web up to $3 cash back 1. February 4, 2022 letter 4383 collection due process/equivalent hearing withdrawal acknowledgement view our. Different formats and samples are. The first opportunity for taxpayer advocate.IRS Audit Letter CP134B Sample 1

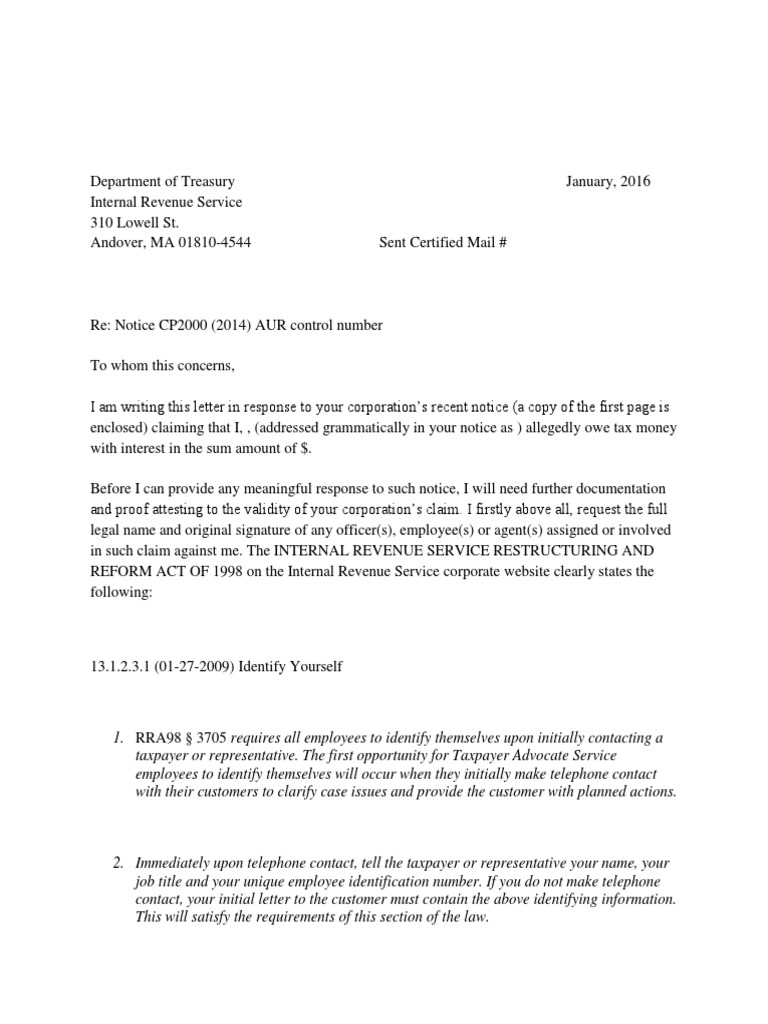

Irs Cp2000 Example Response Letter amulette

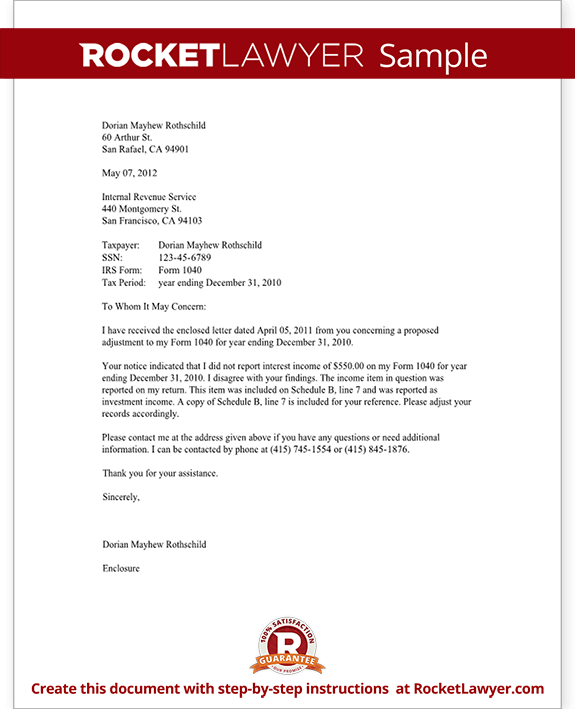

Irs Response Letter Template in 2022 Letter templates, Business

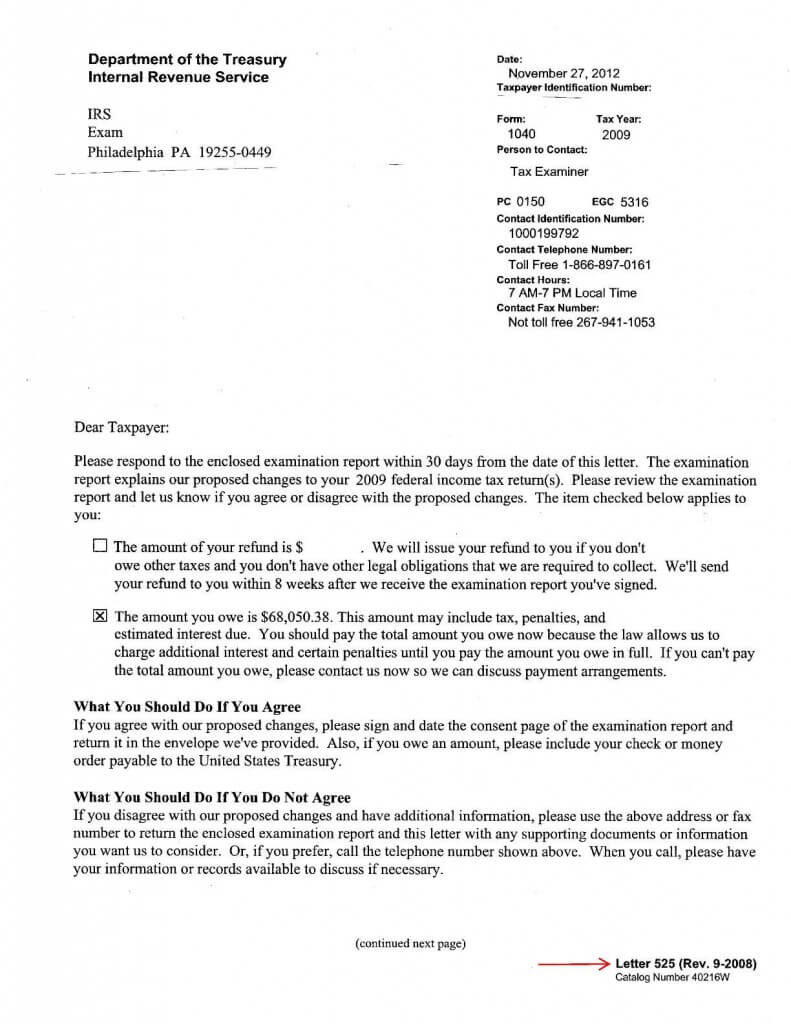

IRS Response Letter Template Federal Government Of The United States

Sample Letter To Irs Free Printable Documents

Cp2000 Response Letter Template Samples Letter Template Collection

Irs Response Letter Template 11+ Professional Templates Ideas

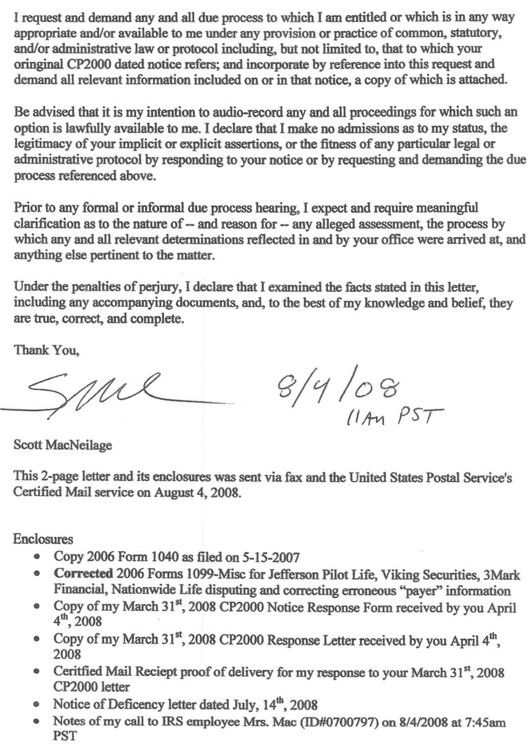

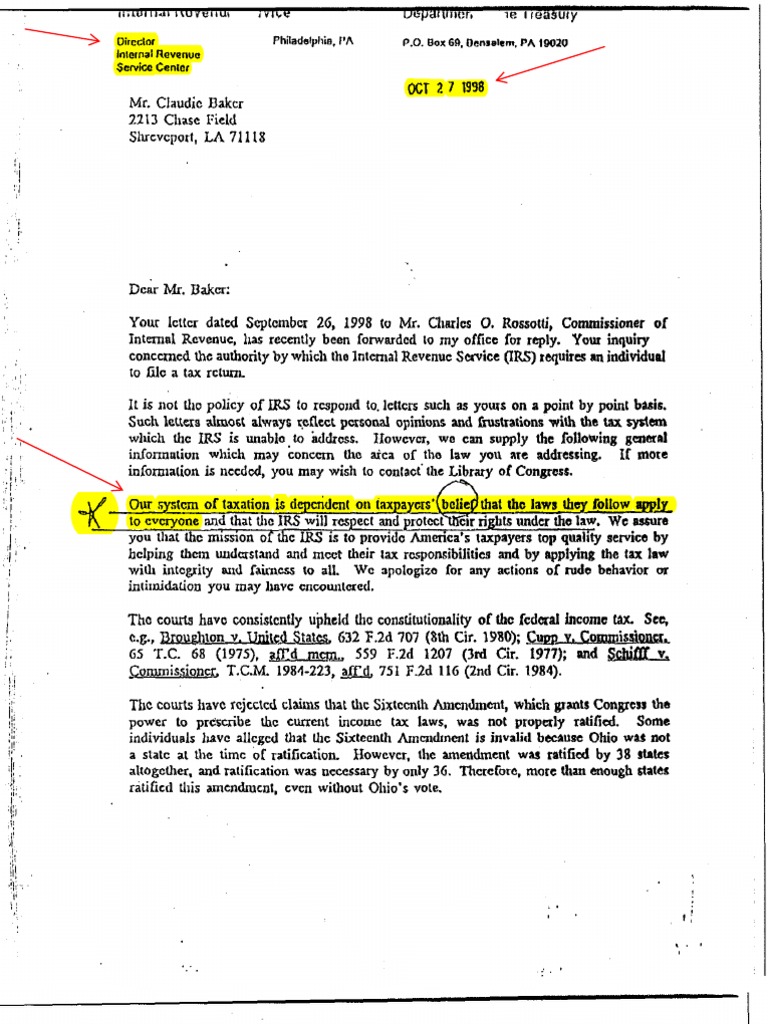

IRS response Letter Internal Revenue Service Ratification

Irs Cp2000 Example Response Letter amulette

Letter to the IRS IRS Response Letter Form (with Sample)

Web The Irs Generally Asks For A Response Within 30 Days.

Web That Letter And Includes Information That Will Help The Taxes Identify The Source Of The Penalty And The Causes Why It Should Be Savings.

If For Any Reason You Cannot Respond By The Deadline, Call The Number Included With The Irs Audit Letter.

Web You Should Reply As Indicated On Your Letter Or Notice That Could Include Mail, Fax, Or Digitally Through The Irs’ Documentation Upload Tool, When Available, By Using.

Related Post: