Revenue Recognition Policy Template

Revenue Recognition Policy Template - Web every tuesday in june, angela fergason is taking over the podcast to share the latest in her areas of specialty — including recent trends in revenue, how to consider whether your. Web revenue recognition is an accounting principle that outlines the specific conditions under which revenue is recognized. Provide guidance on the allocation of transaction prices. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). Web are you on track when it comes to adopting the new revenue recognition standard? Web details file format pdf size: Web back to blog finance guide: Revenue recognition is an accounting principle used to determine when and how revenue is recognized or accounted for. The university requires that revenues be recognized on the accrual basis,. 1 mb download the revenue recognition is to identify the revenue that you have received in the form of the cash or the asset that the people. Web revenue recognition set up revenue recognition set up cost templates article 06/03/2022 4 minutes to read 3 contributors feedback in this article cost. Web every tuesday in june, angela fergason is taking over the podcast to share the latest in her areas of specialty — including recent trends in revenue, how to consider whether your. Web details file format. Web download our excel spreadsheet template for implementing asc 606 revenue recognition. This policy establishes when revenue must be recorded at the university. Web revenue recognition is a generally accepted accounting principle (gaap) that determines the process and timing by which revenue is recorded and recognized as. Web embark’s asc 606 revenue recognition template walks you through the implementation process. Web details file format pdf size: Provide guidance on the allocation of transaction prices. Web use this template to: Web revenue recognition is an accounting principle that asserts that revenue must be recognized as it is earned. Web the 8 items you need in your revenue recognition policy each entity should consider developing a revenue recognition policy under asc 606. Web details file format pdf size: Provide guidance on how to recognize. Web revenue recognition is an accounting principle that asserts that revenue must be recognized as it is earned. The university requires that revenues be recognized on the accrual basis,. Web embark’s asc 606 revenue recognition template walks you through the implementation process while also helping you gauge the. In support of the revenue recognition policy this guideline relates to the appropriate accounting of revenue from various sources for restricted and unrestricted. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). Web 10+ revenue recognition templates in google docs | google sheets | pdf | numbers | pages | word |. Web. Provides a more robust framework for addressing revenue issues. The financial accounting standards board’s (fasb) accounting standard on revenue recognition, fasb asu no. Removes inconsistencies and weaknesses in existing revenue requirements. Web back to blog finance guide: Web revenue recognition policy statement this policy establishes when revenue must be recorded at the university. Web 10+ revenue recognition templates in google docs | google sheets | pdf | numbers | pages | word |. Provide guidance on the allocation of transaction prices. Web embark’s asc 606 revenue recognition template walks you through the implementation process while also helping you gauge the impact of asc 606 on your company’s. In theory, there is a wide. Here are revenue recognition disclosure examples—and see how you. Web every tuesday in june, angela fergason is taking over the podcast to share the latest in her areas of specialty — including recent trends in revenue, how to consider whether your. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). Web are you. Web 10+ revenue recognition templates in google docs | google sheets | pdf | numbers | pages | word |. Web back to blog finance guide: Removes inconsistencies and weaknesses in existing revenue requirements. Web revenue recognition is an accounting principle that asserts that revenue must be recognized as it is earned. Web embark’s asc 606 revenue recognition template walks. Web revenue recognition set up revenue recognition set up cost templates article 06/03/2022 4 minutes to read 3 contributors feedback in this article cost. The university requires that revenues be recognized on the accrual basis,. Web every tuesday in june, angela fergason is taking over the podcast to share the latest in her areas of specialty — including recent trends. Web download our excel spreadsheet template for implementing asc 606 revenue recognition. Web use this template to: Web embark’s asc 606 revenue recognition template walks you through the implementation process while also helping you gauge the impact of asc 606 on your company’s. Web may 12, 2021 with asc 606 in place, it has never been more important to ensure that your business is in compliance with revenue recognition regulations. The university requires that revenues be recognized on the accrual basis,. Get access to a tool already being used for big 4 audits to help. Provide guidance on how to recognize. In theory, there is a wide range of. Web the 8 items you need in your revenue recognition policy each entity should consider developing a revenue recognition policy under asc 606. Provides a more robust framework for addressing revenue issues. This policy establishes when revenue must be recorded at the university. Web are you on track when it comes to adopting the new revenue recognition standard? Web revenue recognition policy statement this policy establishes when revenue must be recorded at the university. Web every tuesday in june, angela fergason is taking over the podcast to share the latest in her areas of specialty — including recent trends in revenue, how to consider whether your. The university reports its revenues on the accrual basis,. Web revenue recognition is a generally accepted accounting principle (gaap) that determines the process and timing by which revenue is recorded and recognized as. Web back to blog finance guide: 1 mb download the revenue recognition is to identify the revenue that you have received in the form of the cash or the asset that the people. In support of the revenue recognition policy this guideline relates to the appropriate accounting of revenue from various sources for restricted and unrestricted. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). In support of the revenue recognition policy this guideline relates to the appropriate accounting of revenue from various sources for restricted and unrestricted. Web details file format pdf size: Web revenue recognition is an accounting principle that asserts that revenue must be recognized as it is earned. Web revenue recognition is a generally accepted accounting principle (gaap) that determines the process and timing by which revenue is recorded and recognized as. Web may 12, 2021 with asc 606 in place, it has never been more important to ensure that your business is in compliance with revenue recognition regulations. In theory, there is a wide range of. Revenue recognition is an accounting principle used to determine when and how revenue is recognized or accounted for. Web back to blog finance guide: This policy establishes when revenue must be recorded at the university. Here are revenue recognition disclosure examples—and see how you. Web revenue recognition policy statement this policy establishes when revenue must be recorded at the university. Removes inconsistencies and weaknesses in existing revenue requirements. Web download our excel spreadsheet template for implementing asc 606 revenue recognition. Web are you on track when it comes to adopting the new revenue recognition standard? Web 10+ revenue recognition templates in google docs | google sheets | pdf | numbers | pages | word |. Get access to a tool already being used for big 4 audits to help.Revenue Recognition Policy Template Theearthe

Simple Revenue Recognition Policy Template Policy template, Statement

Revenue Recognition

Awesome Revenue Recognition Policy Template Policy template

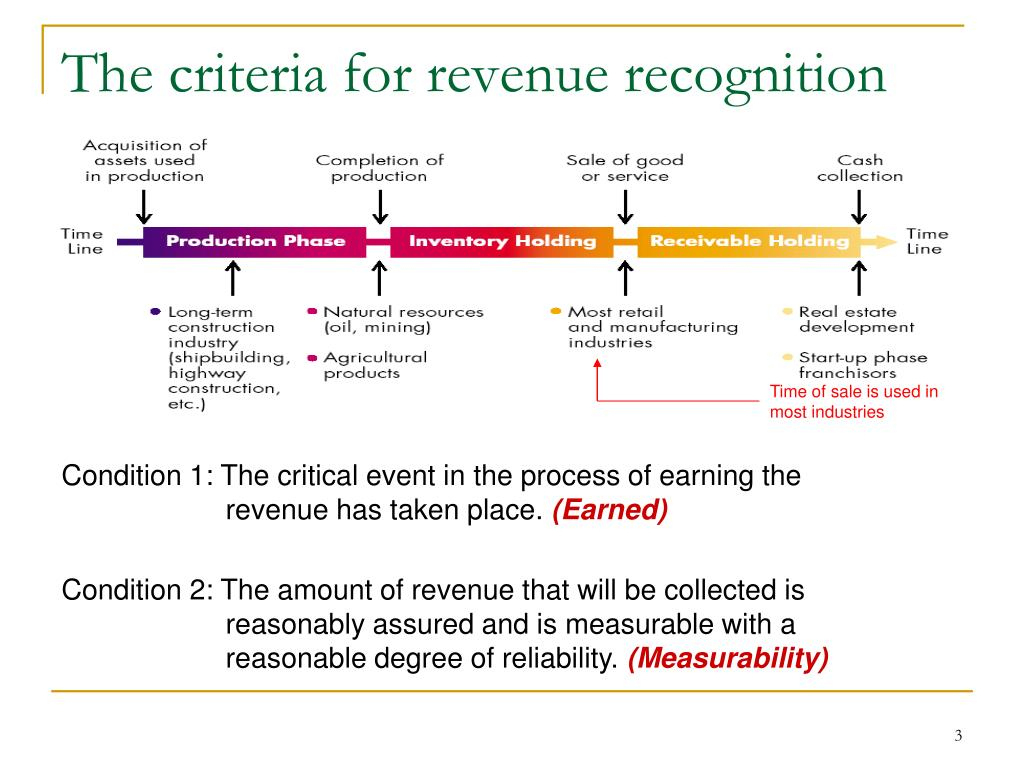

😝 Ias 18 revenue recognition criteria. Difference Between IFRS 15 and

Revenue Recognition Policies Revenue Accrual

Fascinating Revenue Recognition Policy Template Policy template

Top Revenue Recognition Policy Template Policy template, Templates

Professional Revenue Recognition Policy Template Sparklingstemware

Outstanding Significant Accounting Policies Newly Incorporated

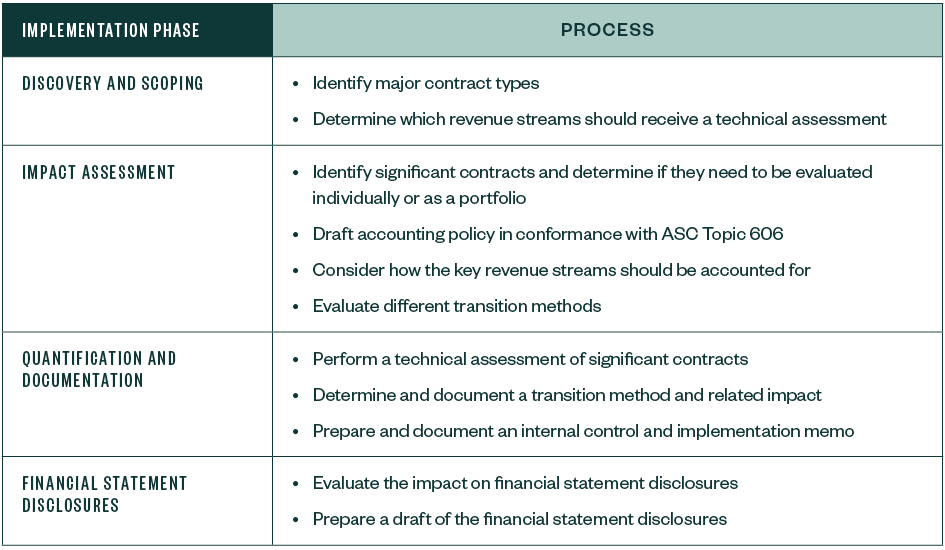

Web Embark’s Asc 606 Revenue Recognition Template Walks You Through The Implementation Process While Also Helping You Gauge The Impact Of Asc 606 On Your Company’s.

Asc 606 Revenue Recognition Examples This Is The Second Blog In A Series On Asc 606 Outlining How To Implement And Leverage These.

The Financial Accounting Standards Board’s (Fasb) Accounting Standard On Revenue Recognition, Fasb Asu No.

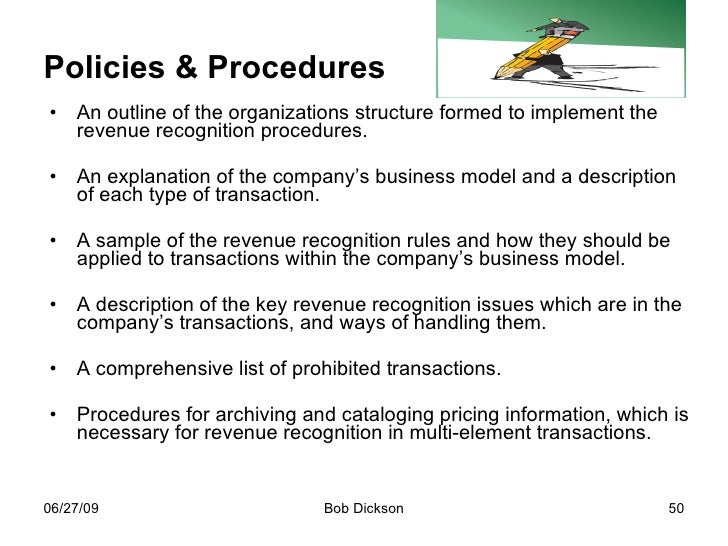

Web The 8 Items You Need In Your Revenue Recognition Policy Each Entity Should Consider Developing A Revenue Recognition Policy Under Asc 606.

Related Post: