S-Corp Bookkeeping Template

S-Corp Bookkeeping Template - S corp bookkeeping is an important part of running your corporation and maintaining your. Ad kickstart your s corporation in minutes. Register your s corp today We have unmatched experience in forming businesses online. Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Ad kickstart your s corporation in minutes. Web for loss and deduction items, which exceed a shareholder's stock basis, the shareholder is allowed to deduct the excess up to the shareholder's basis in loans personally made to. Learn how much payroll costs with adp® payroll services. Web we’ve collected 23 of the top bookkeeping templates for small business owners. Get 3 months free payroll! Web learn how to set up payroll for your s corp with our s corp payroll services. Register your s corp today Web what is the most important bookkeeping task for an s corp? You should learn how to. Get help with s corp payroll taxes with quickbooks’ tax penalty protection. We have unmatched experience in forming businesses online. Each template is free to download, printable, and fully customizable to meet. Free website with formation to get you started. We support thousands of small businesses with their financial needs to help set them up for. Web learn how to set up payroll for your s corp with our s corp payroll. Get 3 months free payroll! Get help with s corp payroll taxes with quickbooks’ tax penalty protection. Web bookkeeping records ‐ if you use a bookkeeping system other than xero, you can provide us with a year‐end income statement, balance sheet and statement of cash flows. Web for loss and deduction items, which exceed a shareholder's stock basis, the shareholder. We have unmatched experience in forming businesses online. Gusto.com has been visited by 10k+ users in the past month Web a bookkeeping business requires you to manage your expenses and income, prepare tax returns for clients and process payrolls. Free website with formation to get you started. Completing a tax organizer will help you avoid. We have unmatched experience in forming businesses online. Learn how much payroll costs with adp® payroll services. S corp bookkeeping is an important part of running your corporation and maintaining your. Ad kickstart your s corporation in minutes. Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits. Web we’ve collected 23 of the top bookkeeping templates for small business owners. Accounting for s corp 2. Learn how much payroll costs with adp® payroll services. Get help with s corp payroll taxes with quickbooks’ tax penalty protection. Web what is the most important bookkeeping task for an s corp? Gusto.com has been visited by 10k+ users in the past month Learn how much payroll costs with adp® payroll services. Track everything in one place. Free website with formation to get you started. Ad kickstart your s corporation in minutes. We support thousands of small businesses with their financial needs to help set them up for. Distributions paid to the shareholders account 4. Web a bookkeeping business requires you to manage your expenses and income, prepare tax returns for clients and process payrolls. Track everything in one place. Web for loss and deduction items, which exceed a shareholder's stock basis,. Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Get help with s corp payroll taxes with quickbooks’ tax penalty protection. Web a major bookkeeping task for an s corporation is the creation of the company's balance sheet. Web november 2, 2021 / by johanna raspolich. Get 3 months free payroll! We support thousands of small businesses with their financial needs to help set them up for. Explore the #1 accounting software for small businesses. Gusto.com has been visited by 10k+ users in the past month Get help with s corp payroll taxes with quickbooks’ tax penalty protection. Web we’ve collected 23 of the top bookkeeping templates for small business owners. Register your s corp today Web the following are the best free excel bookkeeping templates we could find for everyday use, including financial statements, bank reconciliation, and startup costs. Web what is the most important bookkeeping task for an s corp? Get 3 months free payroll! Ad kickstart your s corporation in minutes. Get help with s corp payroll taxes with quickbooks’ tax penalty protection. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. Web learn how to set up payroll for your s corp with our s corp payroll services. Learn how much payroll costs with adp® payroll services. S corp bookkeeping is an important part of running your corporation and maintaining your. Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Free website with formation to get you started. Web for loss and deduction items, which exceed a shareholder's stock basis, the shareholder is allowed to deduct the excess up to the shareholder's basis in loans personally made to. The balance sheet shows the company's allocation of assets,. Track everything in one place. Register your s corp today Ad process payroll faster & easier with adp® payroll. Gusto.com has been visited by 10k+ users in the past month We support thousands of small businesses with their financial needs to help set them up for. S corp bookkeeping is an important part of running your corporation and maintaining your. Distributions paid to the shareholders account 4. Web a bookkeeping business requires you to manage your expenses and income, prepare tax returns for clients and process payrolls. Each template is free to download, printable, and fully customizable to meet. Register your s corp today Accounting for s corp 2. Get 3 months free payroll! Ad kickstart your s corporation in minutes. Register your s corp today Web bookkeeping records ‐ if you use a bookkeeping system other than xero, you can provide us with a year‐end income statement, balance sheet and statement of cash flows. Web learn how to set up payroll for your s corp with our s corp payroll services. Free website with formation to get you started. Gusto.com has been visited by 10k+ users in the past month Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. Web for loss and deduction items, which exceed a shareholder's stock basis, the shareholder is allowed to deduct the excess up to the shareholder's basis in loans personally made to.Excel Accounting And Bookkeeping (Template Included) Bench For Excel

Sole Proprietorship vs SCorp Tax Spreadsheet for Publisher

Can you afford to be an S Corp? Bookkeeping business, Business tax

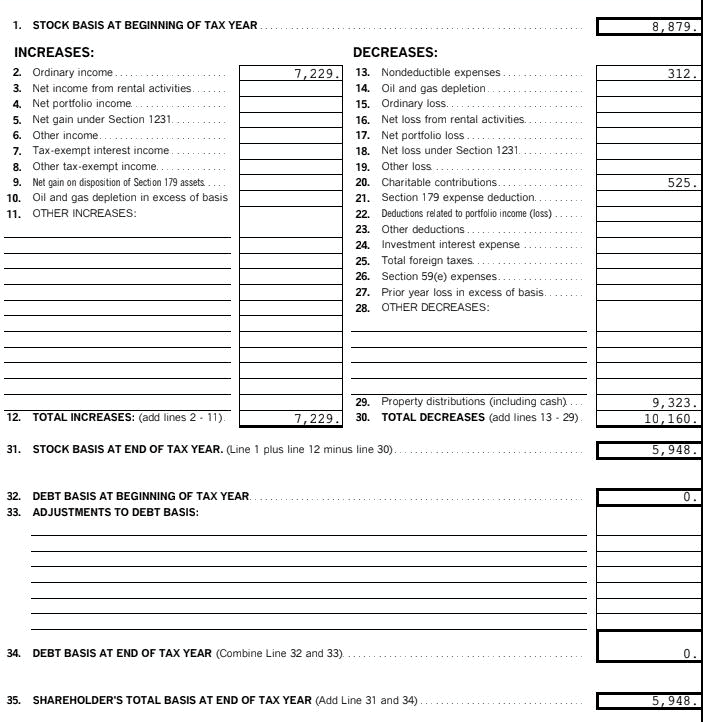

S Corp Basis Worksheet Studying Worksheets

Bookkeeping Templates For Small Business —

Free Statement Of Account Format In Excel MS Excel Templates

Ssurvivor Form 2553 Sample

Excel cashbook template Download and edit for your business

Scorp savings Singletrack Accounting

Pin on Side Hustle

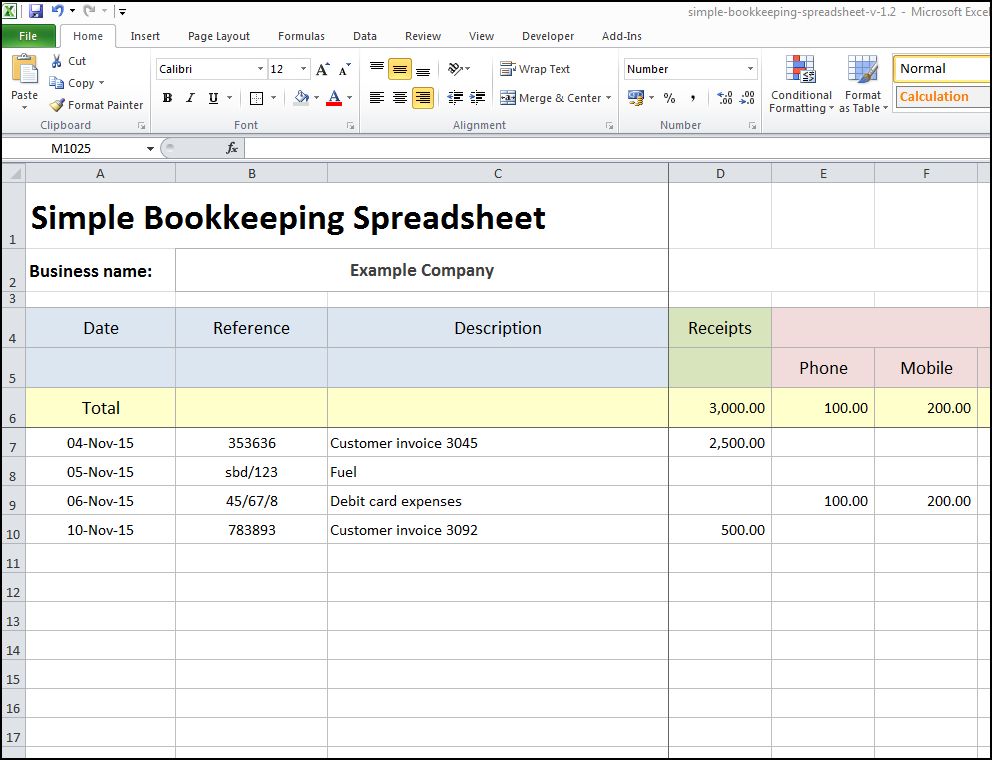

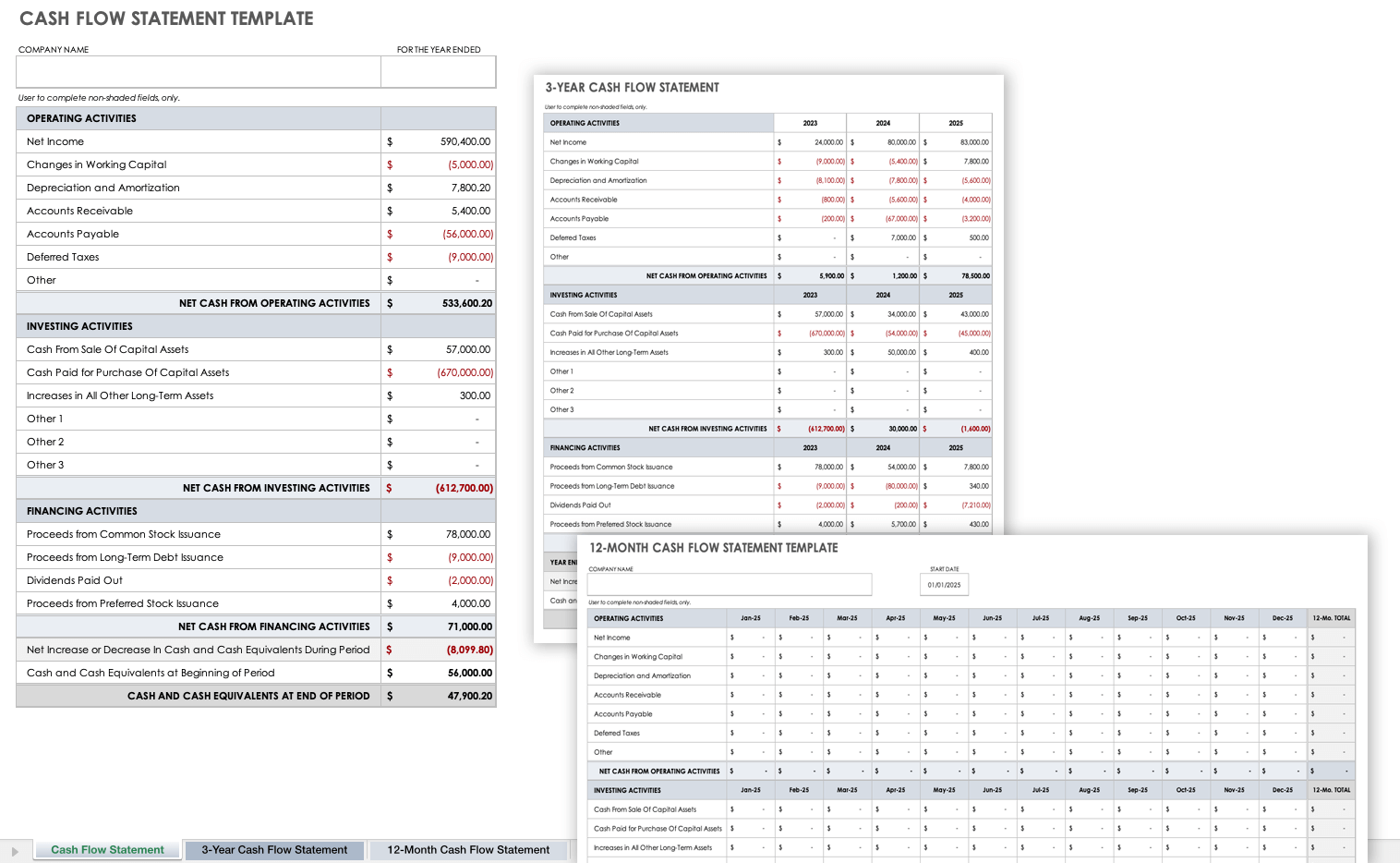

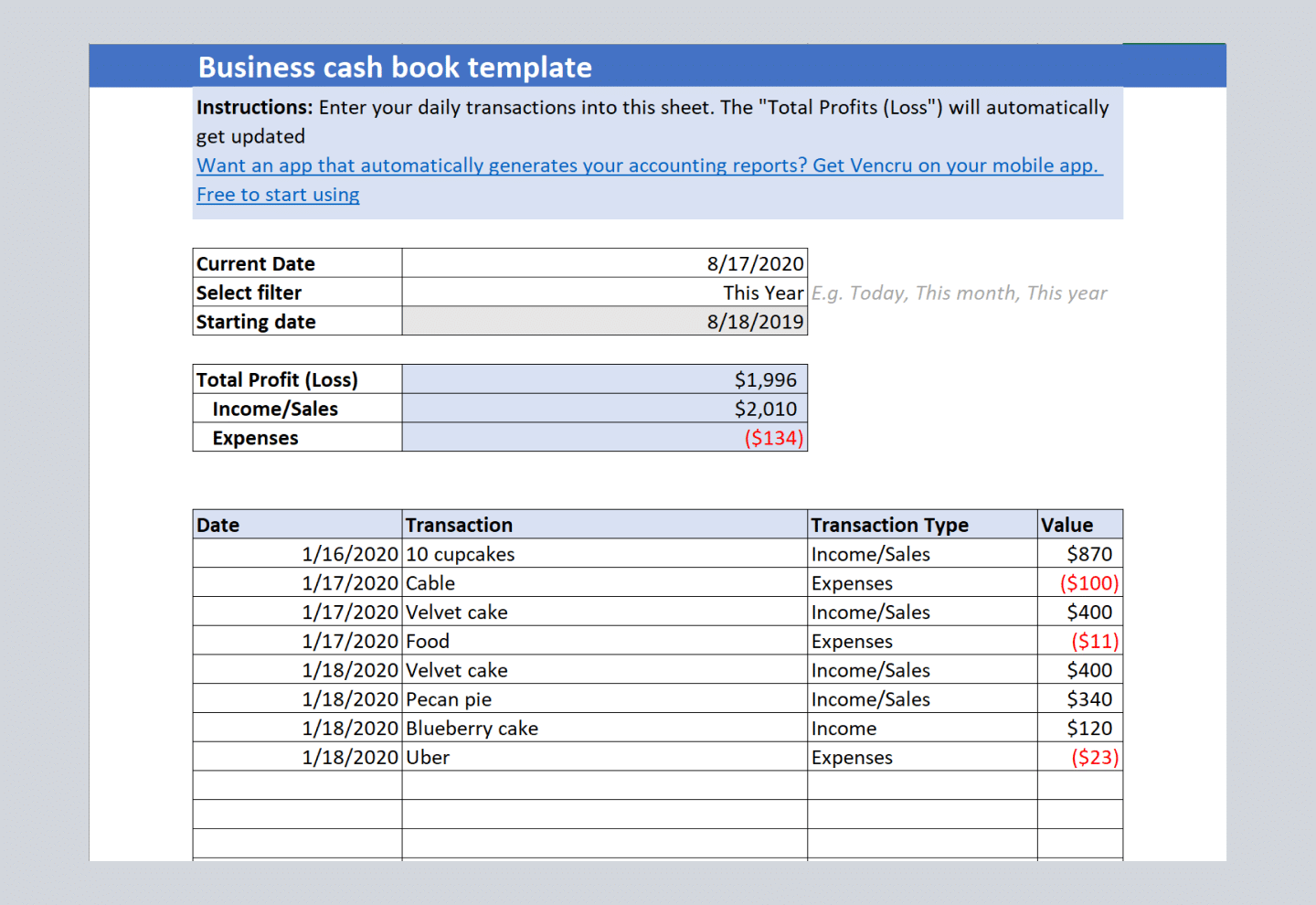

Web The Following Are The Best Free Excel Bookkeeping Templates We Could Find For Everyday Use, Including Financial Statements, Bank Reconciliation, And Startup Costs.

Track Everything In One Place.

We Have Unmatched Experience In Forming Businesses Online.

Completing A Tax Organizer Will Help You Avoid.

Related Post: