Safe Simple Agreement For Future Equity Template

Safe Simple Agreement For Future Equity Template - Ad answer simple questions to make your legal documents. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. The safe investor receives the future shares when a priced round of investment or liquidity event occurs. Web the document titled 'safe (simple agreement for future equity)' is a legal instrument that outlines the terms and conditions for the issuance of shares of a company's capital. Web simple agreement for future equity (safe) this certifies that in exchange for the payment on or about [date of agreement] by the university of. Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. A safe agreement is a financial contract that is drawn up between startups and investors. Create your free legal agreements step by step. Web what is a safe (simple agreement for future equity) agreement? Safes are intended to provide a simpler mechanism for startups to seek initial funding other than Web updated february 22, 2023: Web what is a safe (simple agreement for future equity) agreement? All versions of the model form safe for llcs are available at jdform, including the: Web a simple agreement for future equity (safe) note is an innovative form. Web simple agreement for future equity (safe) this certifies that in exchange for the payment on or about [date of agreement] by the university of. Web what is a simple agreement for future equity (safe) template? Web the document titled 'safe (simple agreement for future equity)' is a legal instrument that outlines the terms and conditions for the issuance of. Ad answer simple questions to make your legal documents. Create your free legal agreements step by step. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. Personalized contracts in 5 minutes. Paul graham and ycombinator have recently created and publicly. Web a simple agreement for future equity term sheet lays out the relationship between the startup company and the investor and determines how the safe works. Web in recent years, a financing alternative called simple agreements for future equity (“safes”) has gained popularity and proven useful for emerging. Web a simple agreement for future equity (safe) is a financing contract. Ad answer simple questions to make your legal documents. All versions of the model form safe for llcs are available at jdform, including the: Web simple agreement for future equity (safe) this certifies that in exchange for the payment on or about [date of agreement] by the university of. Lawdepot.com has been visited by 100k+ users in the past month. Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. Latex templates for safe (simple agreement for future equity) term sheets. Web the document titled 'safe (simple agreement for future equity)' is a legal instrument that outlines the terms and conditions for. A safe way of raising capital practice group leader updated on december 14, 2022 reading time: Web a safe (simple agreement for future equity) is an agreement between an investor and a company that grants the investor rights for future equity in the company similar to a. 5 minutes follow us on linkedin. Web a simple agreement for future equity. All versions of the model form safe for llcs are available at jdform, including the: Ad answer simple questions to make your legal documents. Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. Lawdepot.com has been visited by 100k+ users in the past month. Latex templates for safe (simple agreement for future equity) term sheets. 5 minutes follow us on linkedin. Personalized contracts in 5 minutes. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. A safe agreement is a financial contract that is drawn up between startups and investors. Web a simple agreement for future equity term sheet lays out the relationship between the startup company and the investor and determines how the safe works. Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. One of the simplest (and cheapest) ways to invest. Web the simple agreement for future equity: A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. The safe investor receives the future shares when a priced round of investment or liquidity event occurs. Web what is a simple agreement for future equity (safe) template? Web simple agreement for future equity (safe) • the safe is a relatively recent addition to the seed financing toolkit, promoted by the leading startup accelerator, y combinator. Safes are intended to provide a simpler mechanism for startups to seek initial funding other than Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. Web updated february 22, 2023: Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. Web in recent years, a financing alternative called simple agreements for future equity (“safes”) has gained popularity and proven useful for emerging. Web a simple agreement for future equity (safe) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. One of the simplest (and cheapest) ways to invest in an. Web a simple agreement for future equity (safe) note is an innovative form of convertible security that enables small businesses and startups to raise capital while postponing. A safe agreement is a financial contract that is drawn up between startups and investors. Ad answer simple questions to make your legal documents. Web a simple agreement for future equity term sheet lays out the relationship between the startup company and the investor and determines how the safe works. Designed by lawyers for all states. Latex templates for safe (simple agreement for future equity) term sheets. Create your free legal agreements step by step. Web simple agreement for future equity (safe) this certifies that in exchange for the payment on or about [date of agreement] by the university of. A safe way of raising capital practice group leader updated on december 14, 2022 reading time: Lawdepot.com has been visited by 100k+ users in the past month Paul graham and ycombinator have recently created and publicly. Web in recent years, a financing alternative called simple agreements for future equity (“safes”) has gained popularity and proven useful for emerging. Web a simple agreement for future equity term sheet lays out the relationship between the startup company and the investor and determines how the safe works. The safe investor receives the future shares when a priced round of investment or liquidity event occurs. Latex templates for safe (simple agreement for future equity) term sheets. Create your free legal agreements step by step. A simple agreement for future equity (safe) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment. Designed by lawyers for all states. One of the simplest (and cheapest) ways to invest in an. Safes are intended to provide a simpler mechanism for startups to seek initial funding other than Web this simple agreement for future equity (this “agreement”), dated as of august 10, 2018, certifies that in exchange for the payment in instalments by. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment. Personalized contracts in 5 minutes. Web updated february 22, 2023:Equity For Services Agreement Template Gallery in 2021 Sweat equity

Equity Share Agreement Template Beautiful 20 Excellent Business Equity

Simple Agreement for Future Equity SAFE is Shown on the Photo Stock

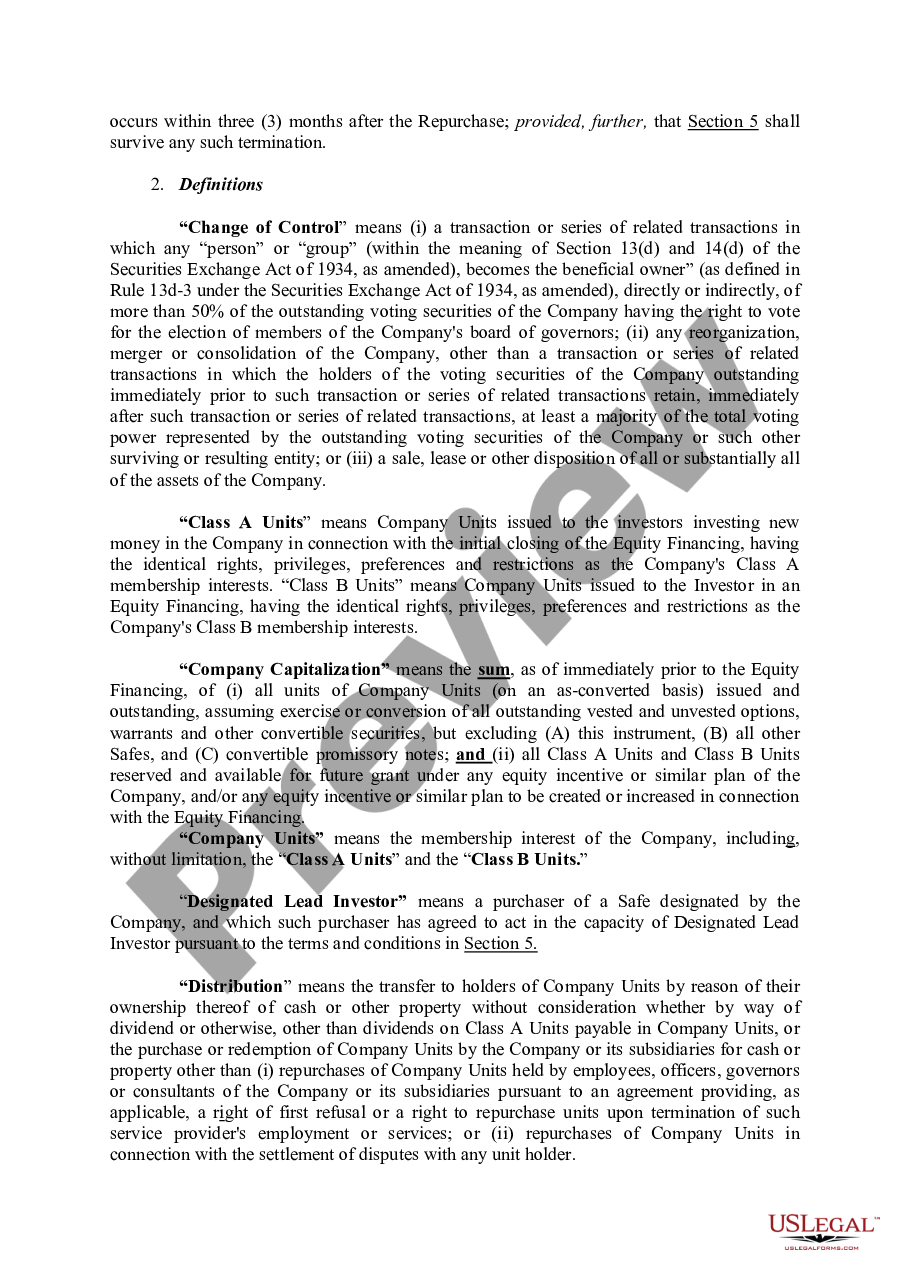

Maricopa Arizona Simple Agreement for Future Equity US Legal Forms

SAFE (simple agreement for future equity) Setup and Modify Eqvista

Conceptual Photo Showing Simple Agreement For Future Equity Safe Stock

Simple Agreement for Future Equity (SAFE) Free Template Sample

Equity Share Agreement Template Unique Free Holders Agreement Template

Free Simple Equity Agreement Template Google Docs, Word, Apple Pages

Simple Agreement For Future Equity Example

Web A Safe (Simple Agreement For Future Equity) Is An Agreement Between An Investor And A Company That Grants The Investor Rights For Future Equity In The Company Similar To A.

Web The Acronym Safe Stands For Simple Agreement For Future Equity. Conceived By Y Combinator, A Prominent Startup Accelerator, This Groundbreaking.

Web Simple Agreement For Future Equity (Safe) • The Safe Is A Relatively Recent Addition To The Seed Financing Toolkit, Promoted By The Leading Startup Accelerator, Y Combinator.

All Versions Of The Model Form Safe For Llcs Are Available At Jdform, Including The:

Related Post: